Throughout 2023, @fraxfinance maintained peg stability and bootstrapped a widely successful liquid staking product.

What's next for the innovative protocol?

Our resident fraximalist @0xpibblez breaks it down 🧵

What's next for the innovative protocol?

Our resident fraximalist @0xpibblez breaks it down 🧵

1/

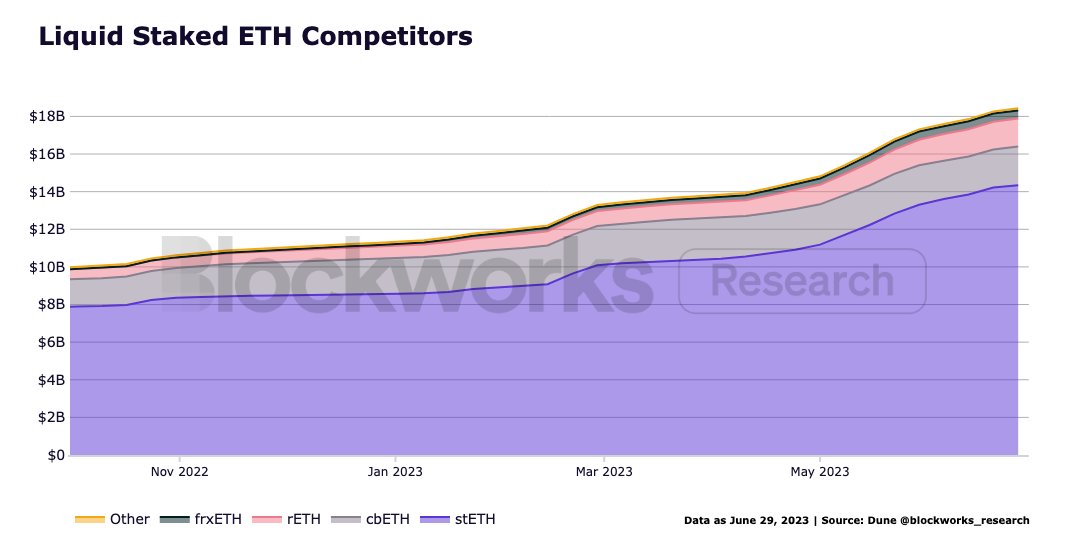

frxETH comprises 2.4% ($435M) of all liquid staked ETH, and has provided 30D avg staking rewards of 5%

Its next stop? Maybe flipping Rocket Pool 👀

frxETH comprises 2.4% ($435M) of all liquid staked ETH, and has provided 30D avg staking rewards of 5%

Its next stop? Maybe flipping Rocket Pool 👀

2/

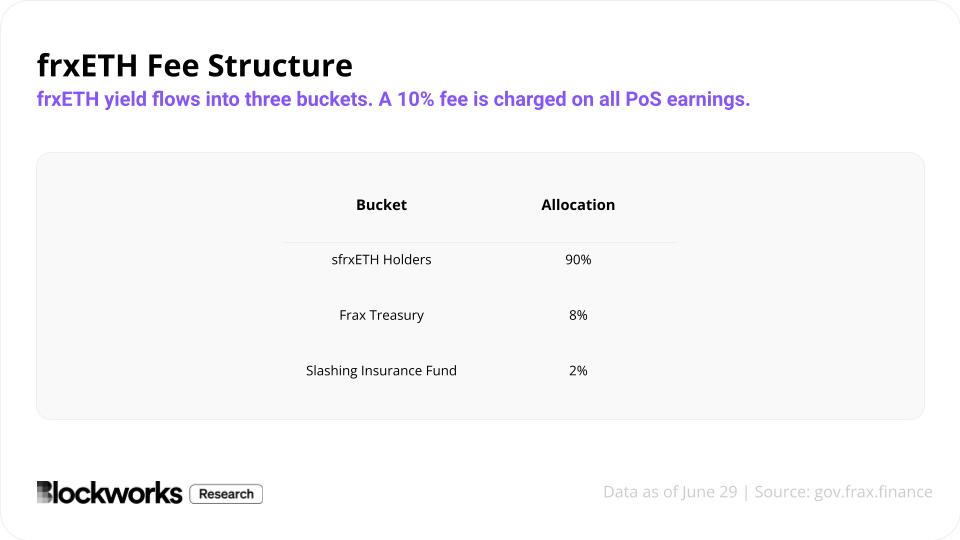

Frax benefits by charging a 10% fee on all staking rewards, divided as outlined below.

At 2.4% market share, Frax is raking in ~$2M to its treasury annually, but as frxETH grows, this revenue figure can go much higher.

Frax benefits by charging a 10% fee on all staking rewards, divided as outlined below.

At 2.4% market share, Frax is raking in ~$2M to its treasury annually, but as frxETH grows, this revenue figure can go much higher.

3/

FXS will benefit from protocol revenue via token buybacks.

However, since the USDC depeg in March, the protocol is currently redirecting all profits towards the collateral ratio (CR) for its FRAX stablecoin, with a goal to raise it to 100%.

The CR currently sits at 94.5%.

FXS will benefit from protocol revenue via token buybacks.

However, since the USDC depeg in March, the protocol is currently redirecting all profits towards the collateral ratio (CR) for its FRAX stablecoin, with a goal to raise it to 100%.

The CR currently sits at 94.5%.

4/

Earlier this month, Frax revealed details about frxETH V2, which aims to prioritize performant node runners, enhance capital efficiency, and boost decentralization.

Node operators will be able to collateralize with as little as 4 ETH to borrow 28 ETH and spin up a validator.

Earlier this month, Frax revealed details about frxETH V2, which aims to prioritize performant node runners, enhance capital efficiency, and boost decentralization.

Node operators will be able to collateralize with as little as 4 ETH to borrow 28 ETH and spin up a validator.

5/

Further, the protocol unveiled its upcoming rollup, which will utilize frxETH for gas, and burn frxETH and distribute it to veFXS holders as the network grows.

It is still early to judge the merit of a Frax-specific L2, but sequencer revenue could be substantial.

Further, the protocol unveiled its upcoming rollup, which will utilize frxETH for gas, and burn frxETH and distribute it to veFXS holders as the network grows.

It is still early to judge the merit of a Frax-specific L2, but sequencer revenue could be substantial.

6/

To safeguard the protocol, Frax will soon release its new governance module, frxGov.

It will utilize a dual contract model to completely decentralize the protocol, with checks and balances to safeguard operations and the treasury.

To safeguard the protocol, Frax will soon release its new governance module, frxGov.

It will utilize a dual contract model to completely decentralize the protocol, with checks and balances to safeguard operations and the treasury.

7/

Frax continues to focus on cash flow, and a path for value accrual is clear.

For further details on all things Frax, be sure to subscribe and read our latest Q2 report.

app.blockworksresearch.com/research/frax-…

Frax continues to focus on cash flow, and a path for value accrual is clear.

For further details on all things Frax, be sure to subscribe and read our latest Q2 report.

app.blockworksresearch.com/research/frax-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter