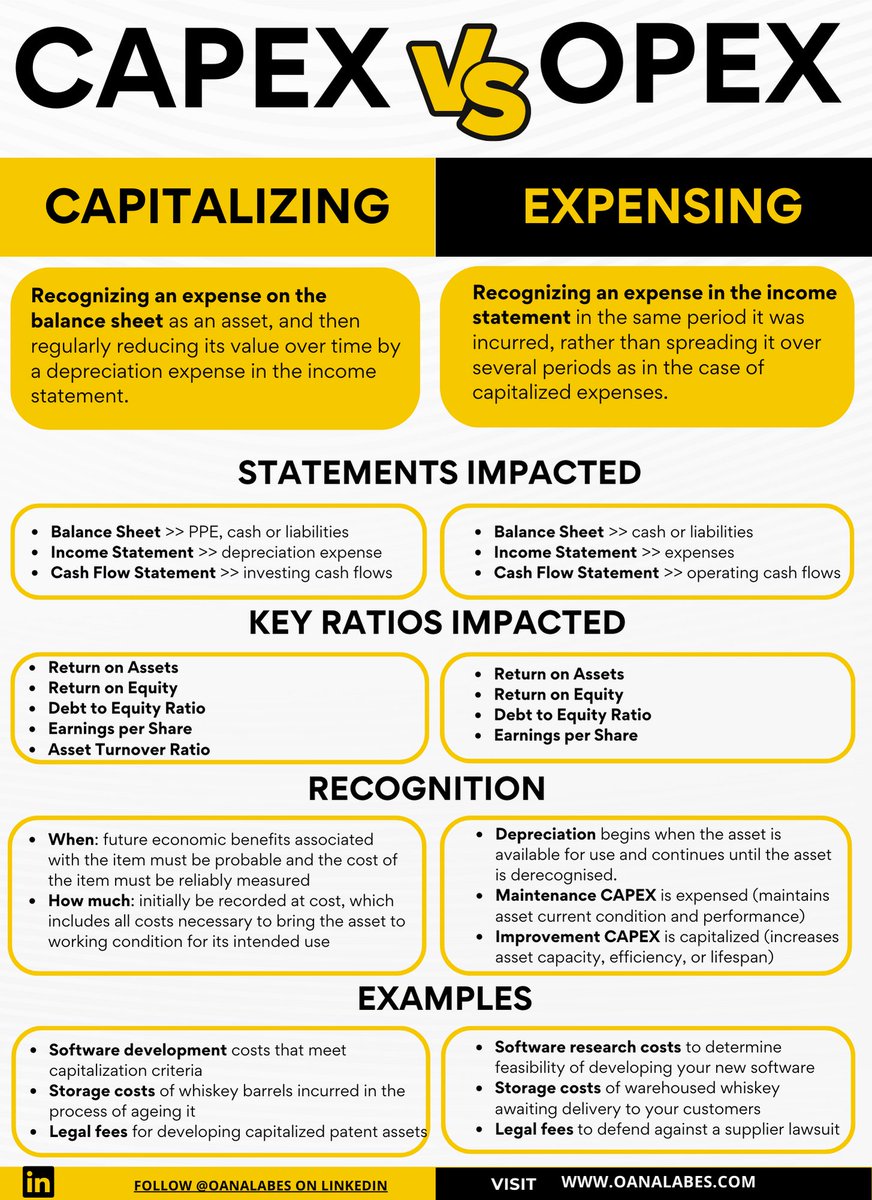

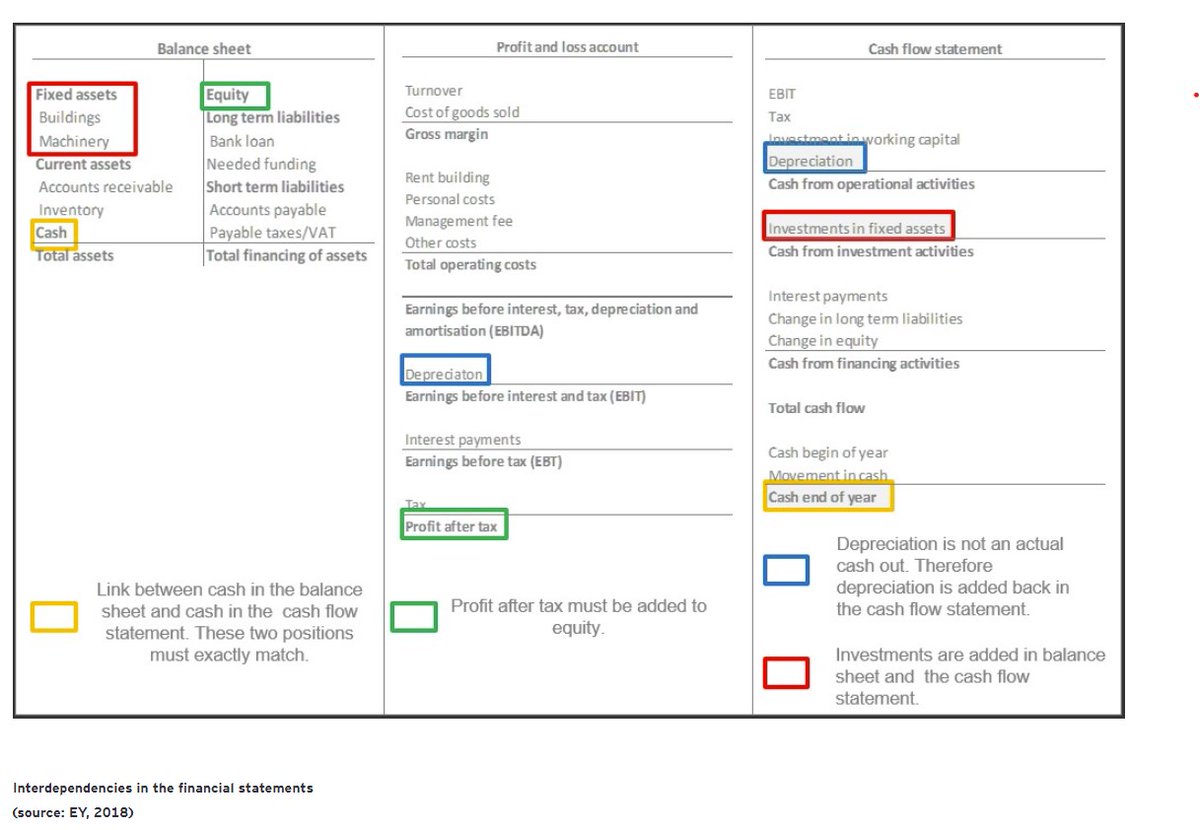

Capitalizing = recognizing a cost on the balance sheet as an asset, and then regularly reducing the value of that asset by a depreciation expense on the income statement.

Statements impacted:

⚫Balance Sheet >> increased non-current asset balance

⚫Income Statement >> reduced profitability from increased depreciation expense

⚫Cash Flow Statement >>increased investing cash flows, and reduced ending cash balance or increased financing cash flows

⚫Balance Sheet >> increased non-current asset balance

⚫Income Statement >> reduced profitability from increased depreciation expense

⚫Cash Flow Statement >>increased investing cash flows, and reduced ending cash balance or increased financing cash flows

Key ratios impacted:

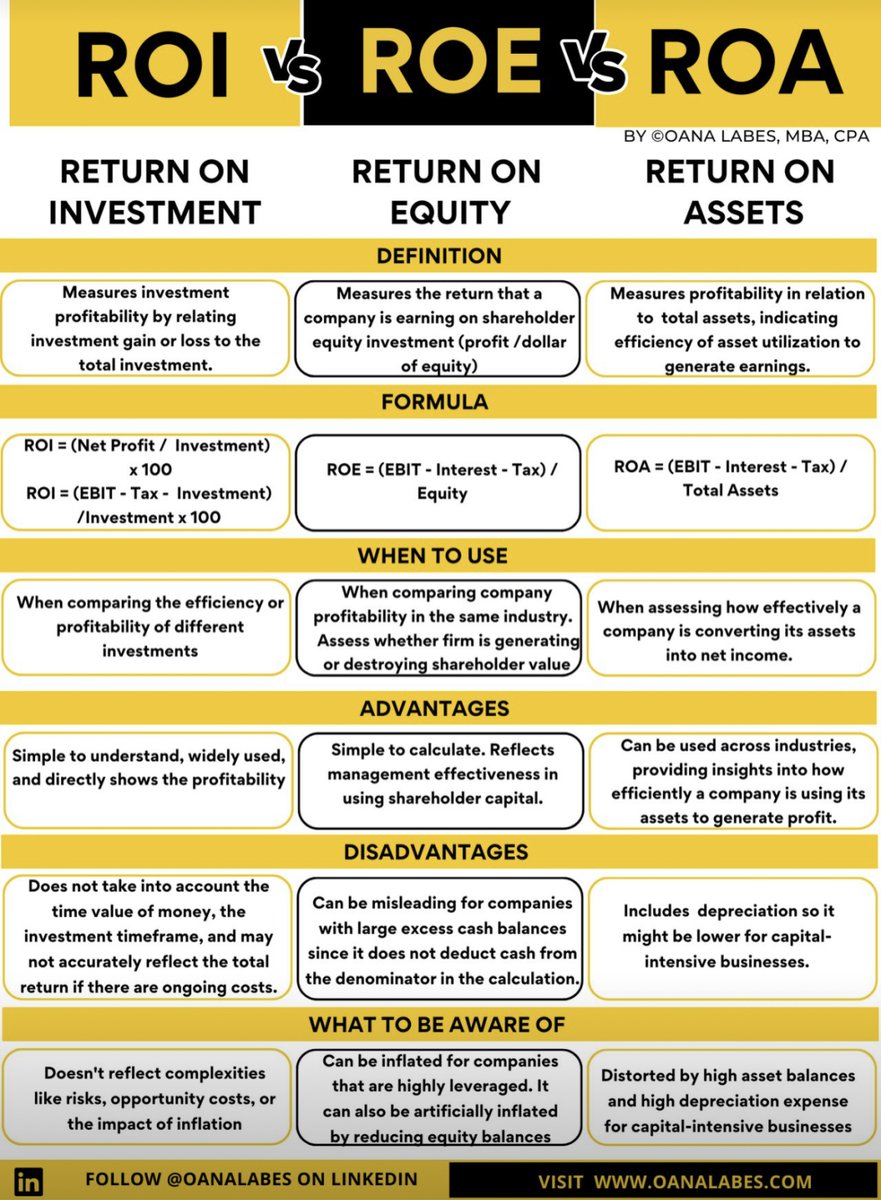

⚫Return on Assets

⚫Return on Equity

⚫Debt to Equity Ratio

⚫Asset Turnover Ratio

⚫Earnings per Share

⚫Return on Assets

⚫Return on Equity

⚫Debt to Equity Ratio

⚫Asset Turnover Ratio

⚫Earnings per Share

Examples:

➡️ software development costs that meet capitalization criteria

➡️ storage costs of whiskey barrels incurred in the process of ageing it

➡️ legal fees for developing your capitalized patent assets

➡️ software development costs that meet capitalization criteria

➡️ storage costs of whiskey barrels incurred in the process of ageing it

➡️ legal fees for developing your capitalized patent assets

Expensing = recognizing an expense on the income statement in the same period it was incurred, rather than spreading it over several periods as in the case of capitalized expenses.

Statements impacted:

⚫Income Statement >> reduced profitability from higher total expenses

⚫Balance Sheet >> reduced cash balance or increased liabilities

⚫Cash Flow Statement >> reduced operating cash flows

⚫Income Statement >> reduced profitability from higher total expenses

⚫Balance Sheet >> reduced cash balance or increased liabilities

⚫Cash Flow Statement >> reduced operating cash flows

Key ratios impacted:

⚫Return on Assets

⚫Return on Equity

⚫Debt to Equity Ratio

⚫Earnings per Share

⚫Interest Coverage Ratio

⚫Return on Assets

⚫Return on Equity

⚫Debt to Equity Ratio

⚫Earnings per Share

⚫Interest Coverage Ratio

Examples:

➡️ research costs to determine feasibility of developing your new software

➡️ storage costs of warehoused whiskey awaiting delivery to your customers

➡️ legal fees to defend against a supplier lawsuit

➡️ research costs to determine feasibility of developing your new software

➡️ storage costs of warehoused whiskey awaiting delivery to your customers

➡️ legal fees to defend against a supplier lawsuit

Key questions to answer:

•When to recognize: when future economic benefits associated with the item are probable and the cost of the item must be reliably measured

•When to recognize: when future economic benefits associated with the item are probable and the cost of the item must be reliably measured

•How much to recognize: initially must be recorded at cost, which includes all costs necessary to bring the asset to working condition for its intended use

•When to start depreciation: when the asset is available for use and continues until the asset is derecognized.

•When to start depreciation: when the asset is available for use and continues until the asset is derecognized.

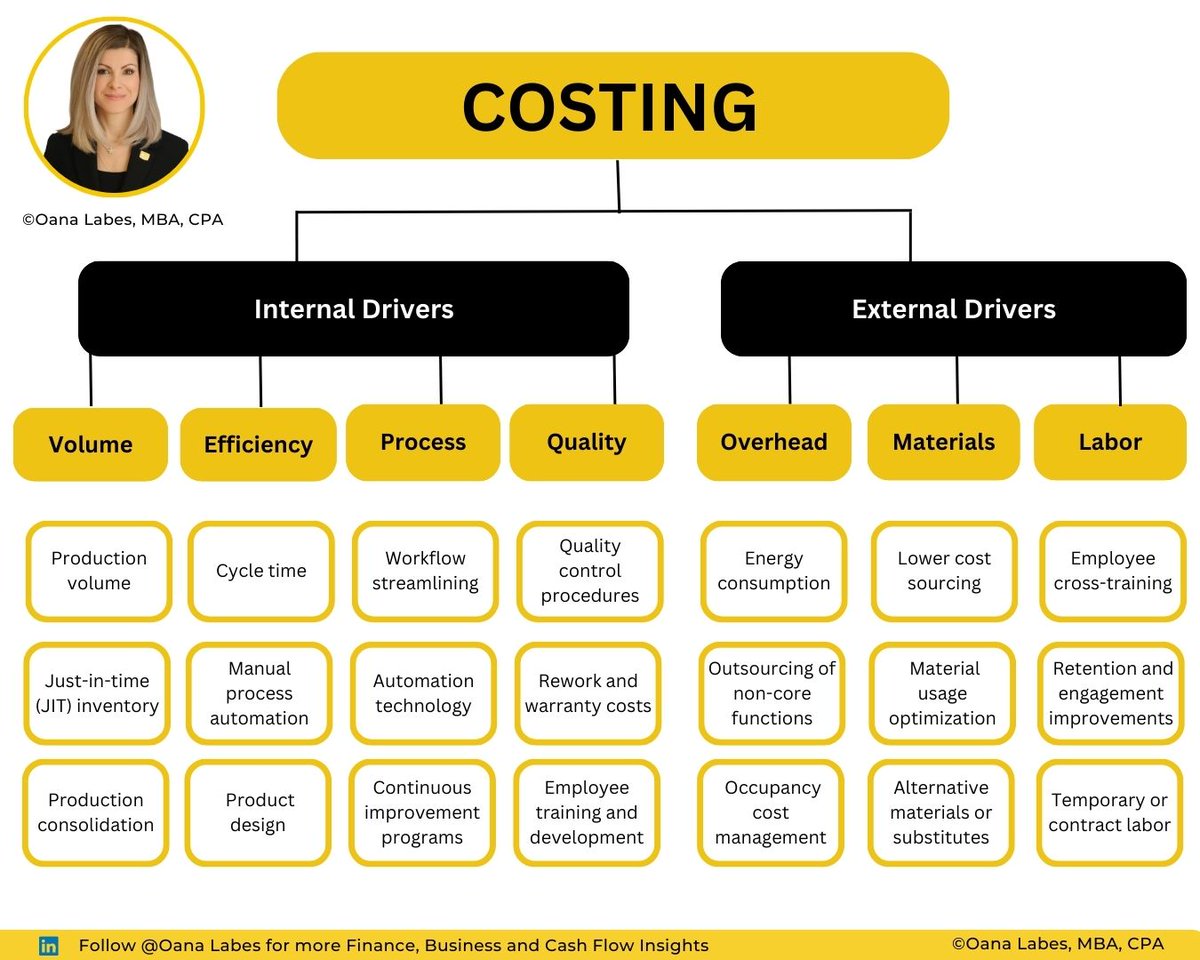

•What about maintenance CAPEX:L it is expensed (maintains asset current condition and performance)

•What about improvement CAPEX: it is capitalized (increases asset capacity, efficiency, or lifespan)

•What about improvement CAPEX: it is capitalized (increases asset capacity, efficiency, or lifespan)

What about Tax

o expensing costs reduces the business taxable income, and lowers the tax payment for that year

o capitalizing costs spreads the tax benefit over the useful life of the asset with only the annual tax depreciation expense available to reduce annual taxable income.

o expensing costs reduces the business taxable income, and lowers the tax payment for that year

o capitalizing costs spreads the tax benefit over the useful life of the asset with only the annual tax depreciation expense available to reduce annual taxable income.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter