Strategic Finance Coaching, Financial Planning & Business Intelligence | Join 400,000+ reading on socials and newsletter | MBA | CPA | Entrepreneur

4 subscribers

How to get URL link on X (Twitter) App

Where capital is sourced and deployed.

Where capital is sourced and deployed.

Because CEOs focus on earnings instead of cash flow strategy.

Because CEOs focus on earnings instead of cash flow strategy.

2. Investing Cash Flow (ICF)

2. Investing Cash Flow (ICF)

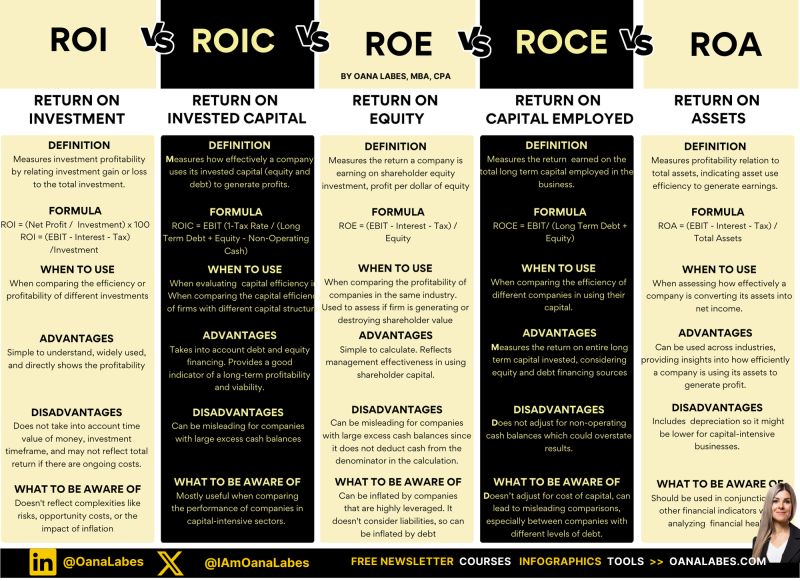

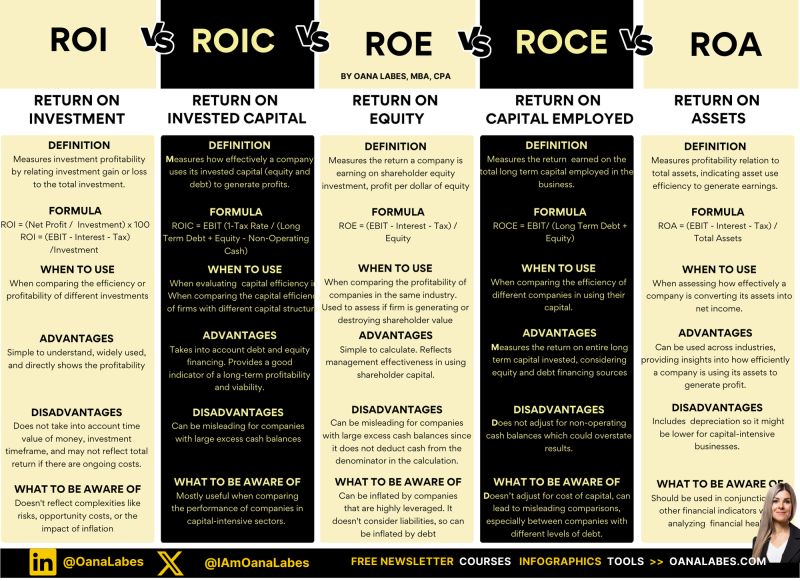

Formula: ROI = (Net Profit / Cost of Investment) * 100%

Formula: ROI = (Net Profit / Cost of Investment) * 100%

But complexity isn't strategy.

But complexity isn't strategy.

2. Investing Cash Flow (ICF)

2. Investing Cash Flow (ICF)

Here's how I'd fix that in 7 days:

Here's how I'd fix that in 7 days:

Capital spending drains liquidity

Capital spending drains liquidity

Operating Cash flows into your company from 3 main sources:

Operating Cash flows into your company from 3 main sources:

1️⃣ Capital Sourcing:

1️⃣ Capital Sourcing:

➡️ Start with PESTEL Analysis

➡️ Start with PESTEL Analysis

I spent thousands of hours in Excel and built lots of complex models.

I spent thousands of hours in Excel and built lots of complex models.

🎯NOPAT and EBIT are frequently used to evaluate a company's profitability.

🎯NOPAT and EBIT are frequently used to evaluate a company's profitability.

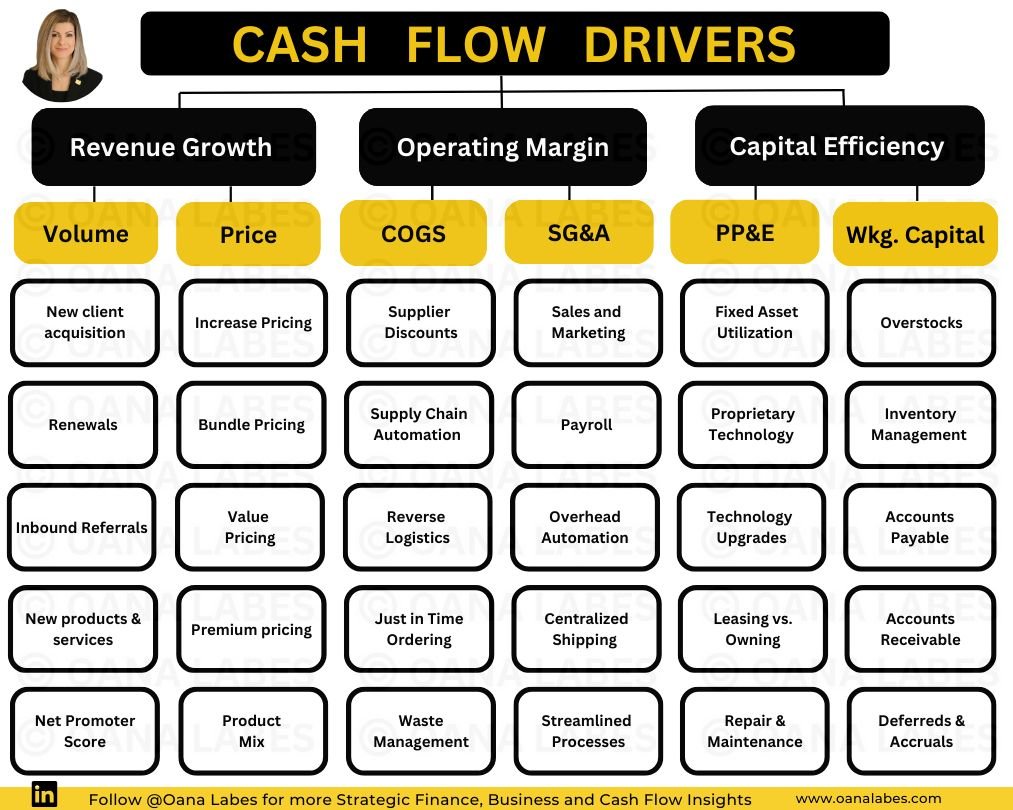

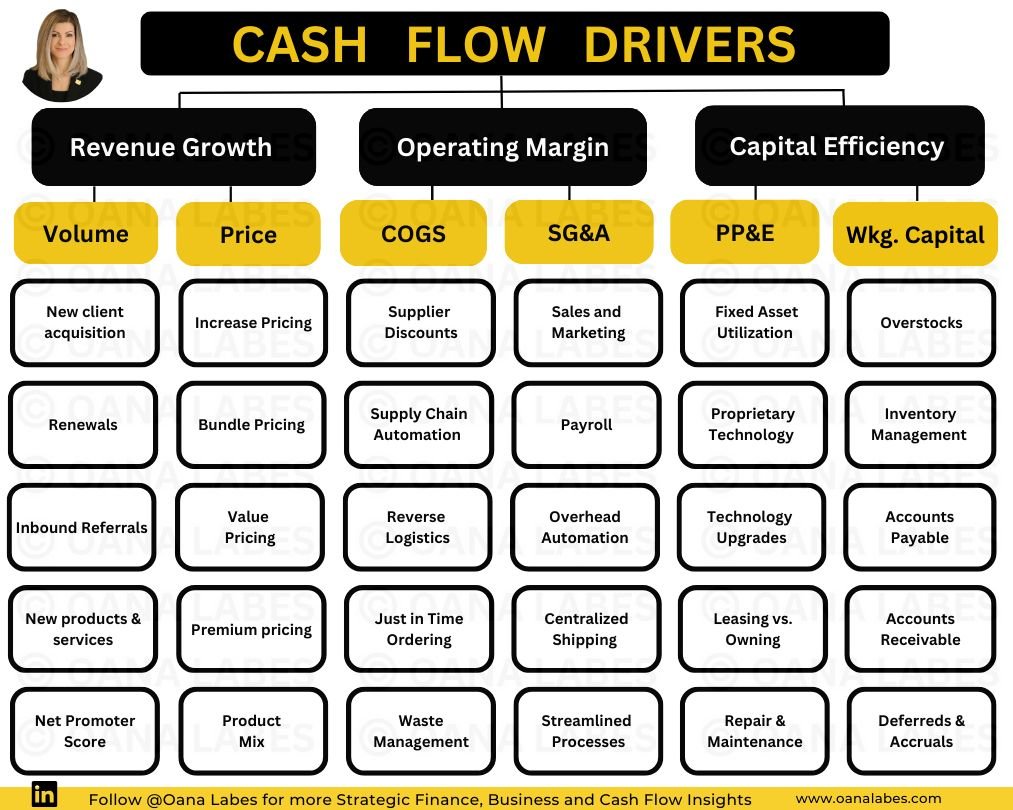

Most business problems fall into one of 3 main areas:

Most business problems fall into one of 3 main areas:

Accounting and Finance are not the same.

Accounting and Finance are not the same.