The IEA just released its Critical Mineral Market Review 2023.

The report provides valuable insights into the large and rapidly growing Critical Minerals Market.

A MUST-READ for metals investors.

Here's a thread on the most important things I learned from the report ... 🧵

The report provides valuable insights into the large and rapidly growing Critical Minerals Market.

A MUST-READ for metals investors.

Here's a thread on the most important things I learned from the report ... 🧵

1/ Why You Should Care About Critical Minerals

• Green energy tech is propelling demand growth of critical minerals

• Critical Minerals market size has doubled over past 5yrs to $320B

• Success of green movement hinges on critical mineral supply

• Geopolitical importance

• Green energy tech is propelling demand growth of critical minerals

• Critical Minerals market size has doubled over past 5yrs to $320B

• Success of green movement hinges on critical mineral supply

• Geopolitical importance

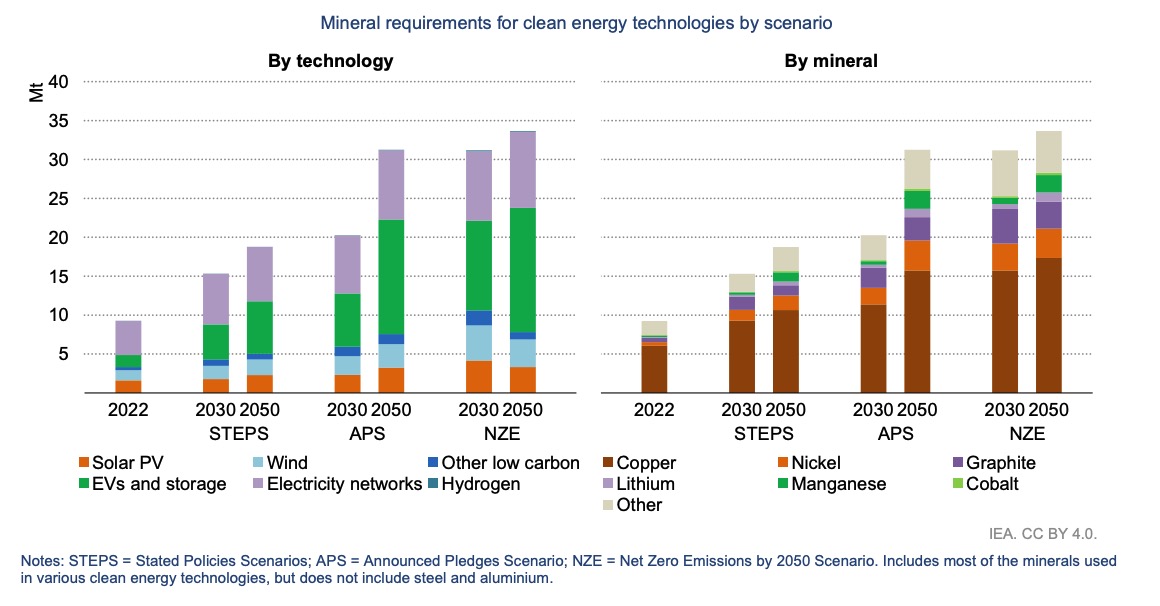

2/ Clean Energy Driving Demand Growth

Renewable energy technologies like Solar PV, Wind, and EVs are driving Critical Mineral Demand.

Check out the YoY demand growth expectations:

• Solar PV: +30%

• Wind: +70%

• EVs: +30%

Renewable energy technologies like Solar PV, Wind, and EVs are driving Critical Mineral Demand.

Check out the YoY demand growth expectations:

• Solar PV: +30%

• Wind: +70%

• EVs: +30%

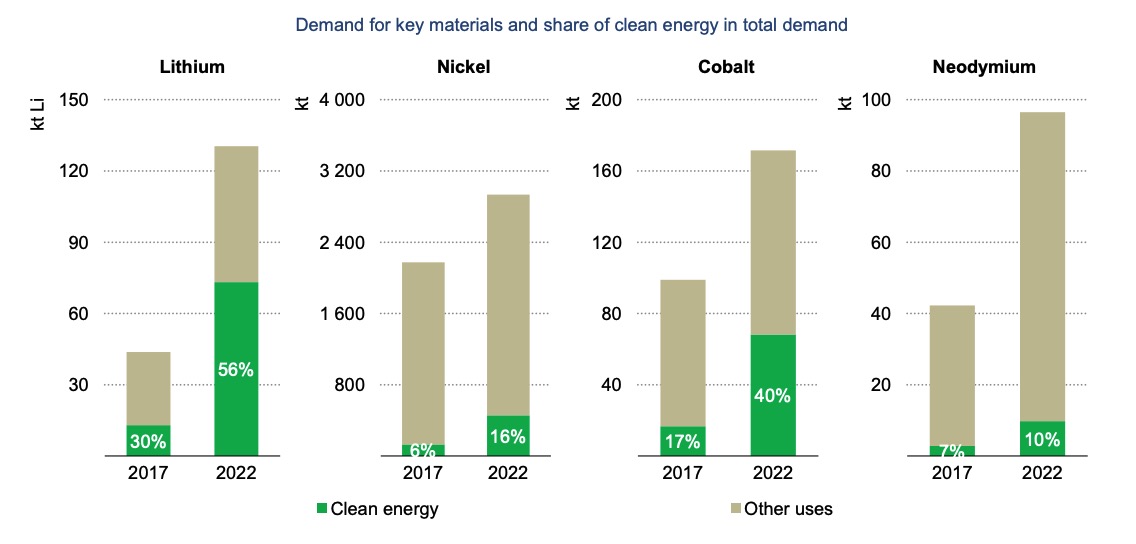

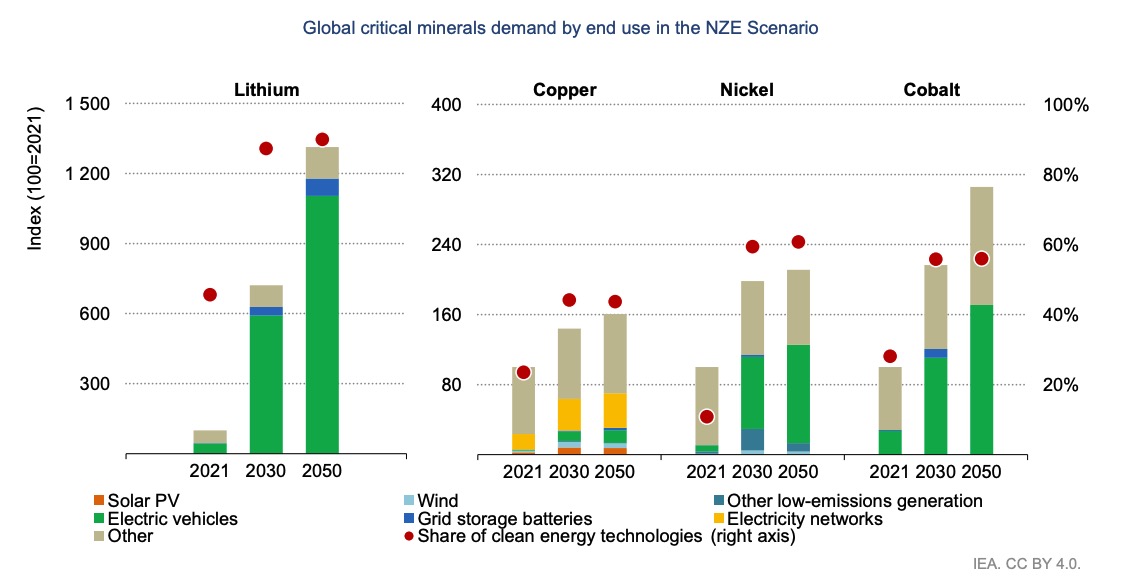

3/ Green Energy Shifts Demand For Key Minerals

One interesting aspect of green energy is that it creates more demand on top of a metal's existing demand function.

For example, in 2017, only 30% of lithium demand went to clean energy.

By 2022, it was 56%.

Other metals 👇

One interesting aspect of green energy is that it creates more demand on top of a metal's existing demand function.

For example, in 2017, only 30% of lithium demand went to clean energy.

By 2022, it was 56%.

Other metals 👇

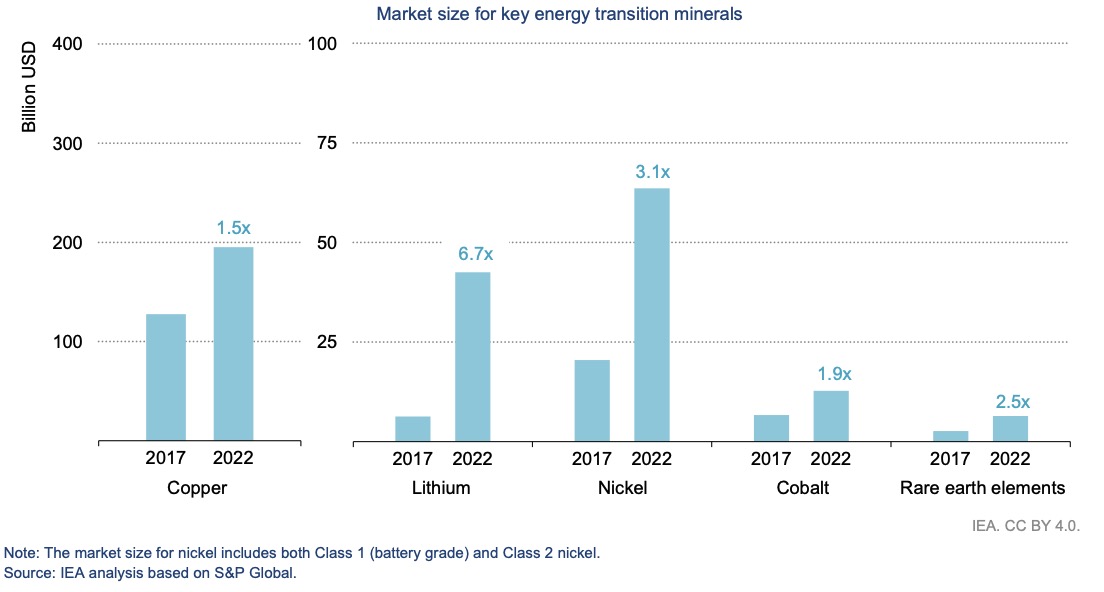

4/ Clean Energy Expands Mineral Markets

The market size for energy transition minerals doubled over the past five years (2017-2022):

• Copper: 1.5x

• Lithium: 6.5x

• Nickel: 3.1x

• Cobalt: 1.9x

• Rare Earths (REEs): 2.5x

This is just the beginning.

The market size for energy transition minerals doubled over the past five years (2017-2022):

• Copper: 1.5x

• Lithium: 6.5x

• Nickel: 3.1x

• Cobalt: 1.9x

• Rare Earths (REEs): 2.5x

This is just the beginning.

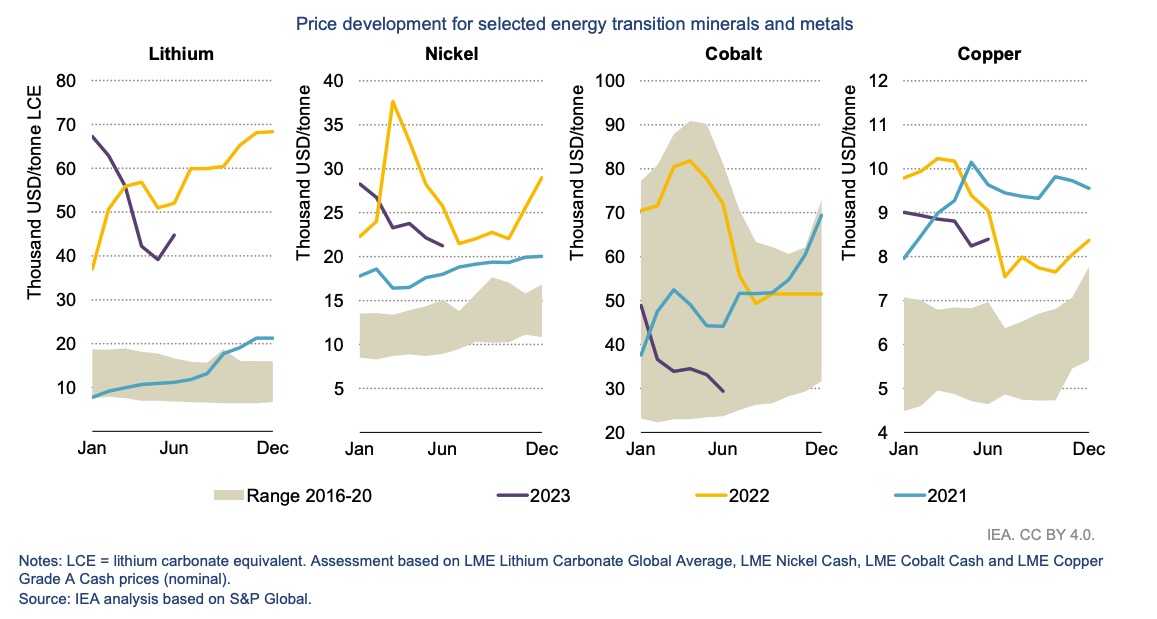

5/ Metals Prices: Higher For Longer

Metals prices went ballistic in 2021-2022. This year, they're pulling back hard, and mining stocks are down 50-80%+.

However, thanks to energy transition demand, metals prices should stay higher for longer.

New normals > prior ranges.

Metals prices went ballistic in 2021-2022. This year, they're pulling back hard, and mining stocks are down 50-80%+.

However, thanks to energy transition demand, metals prices should stay higher for longer.

New normals > prior ranges.

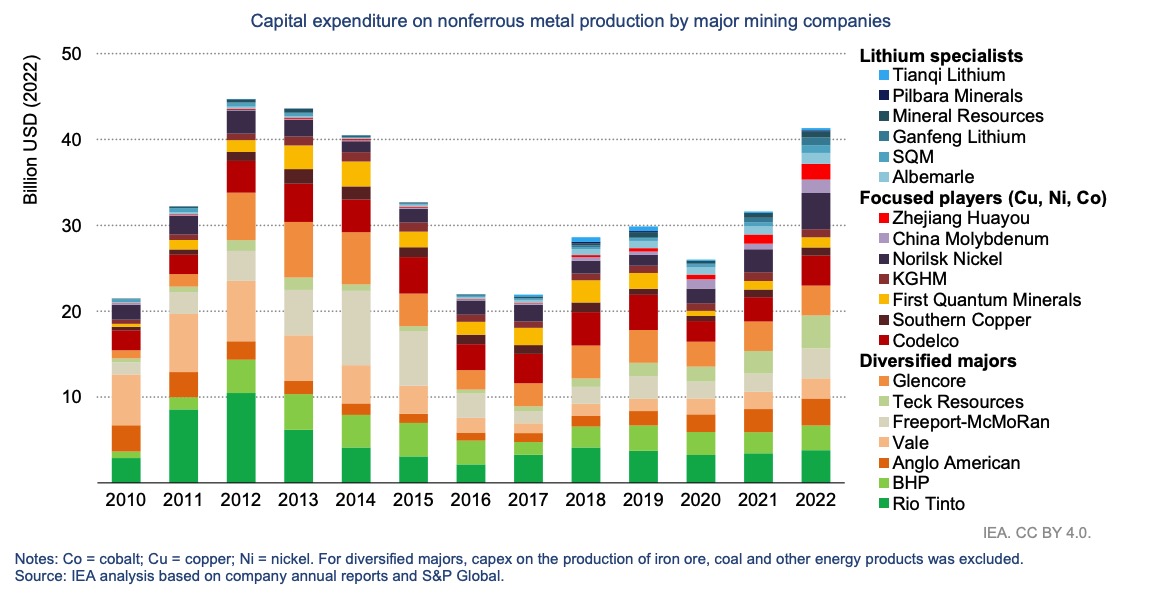

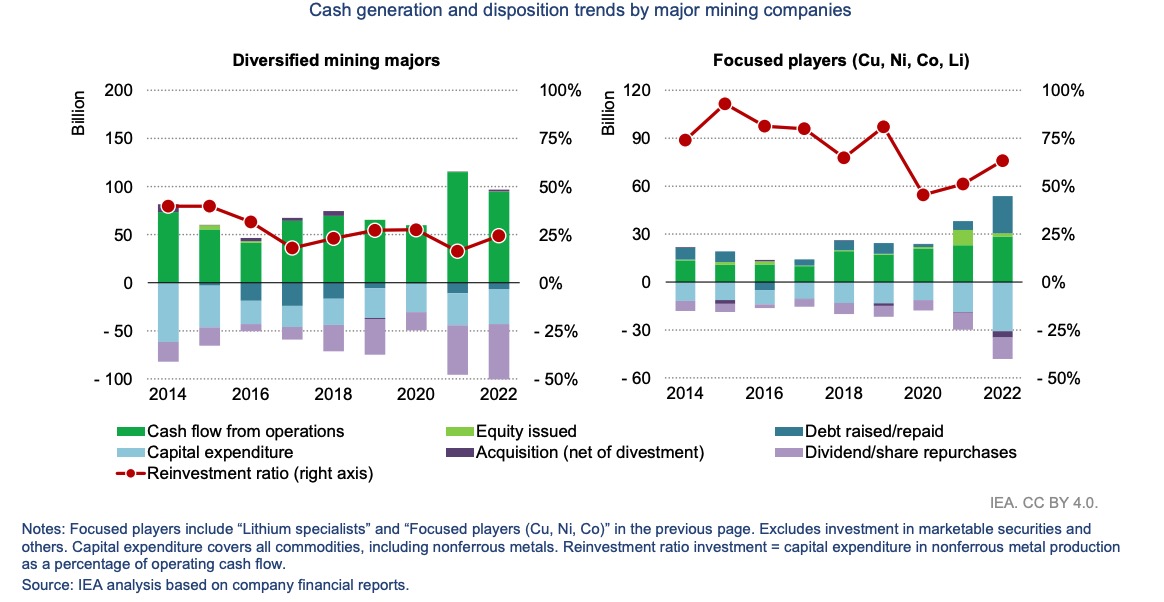

6/ Capital Is Starting To Flow Into Metals

Critical Mineral Mining Investment rose by 30% in 2022.

The investments spread across:

• Diversified majors (like $GLEN, $TECK, $BHP)

• Focused players ($CODELCO, $SCCO)

• Lithium ($SQM, $PLS)

This is a good sign!

Critical Mineral Mining Investment rose by 30% in 2022.

The investments spread across:

• Diversified majors (like $GLEN, $TECK, $BHP)

• Focused players ($CODELCO, $SCCO)

• Lithium ($SQM, $PLS)

This is a good sign!

7/ Mining Majors Still More Conservative

Diversified Majors still have PTSD from the past metals cycle.

They're reinvesting at a ~25% rate, which most of the reinvestment coming from cash from operations (versus debt/equity).

Majors still favor dividends/buybacks over capex.

Diversified Majors still have PTSD from the past metals cycle.

They're reinvesting at a ~25% rate, which most of the reinvestment coming from cash from operations (versus debt/equity).

Majors still favor dividends/buybacks over capex.

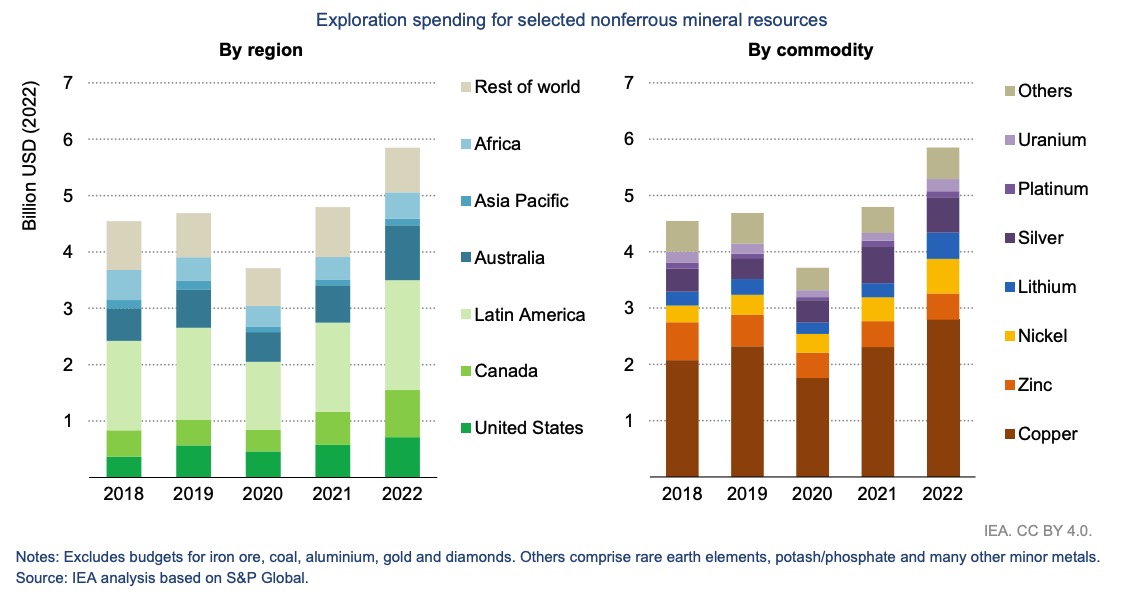

8/ Exploration Budgets Trending Higher

Exploration budgets increased by ~$1B from 2021 and ended at ~$6B in 2022.

~$3B of that exploration was spent on #Copper.

Unfortunately, increased exploration has yielded little (if any) major discoveries at high grades.

Exploration budgets increased by ~$1B from 2021 and ended at ~$6B in 2022.

~$3B of that exploration was spent on #Copper.

Unfortunately, increased exploration has yielded little (if any) major discoveries at high grades.

9/ Copper Dominates M&A Activity

M&A activity is down to ~$22B in 2022 versus ~$37B in 2021.

$20B of the $22B M&A in 2022 went to #copper deals.

In other words, the big players know what's coming in copper, and they see the impending supply/demand crunch.

M&A activity is down to ~$22B in 2022 versus ~$37B in 2021.

$20B of the $22B M&A in 2022 went to #copper deals.

In other words, the big players know what's coming in copper, and they see the impending supply/demand crunch.

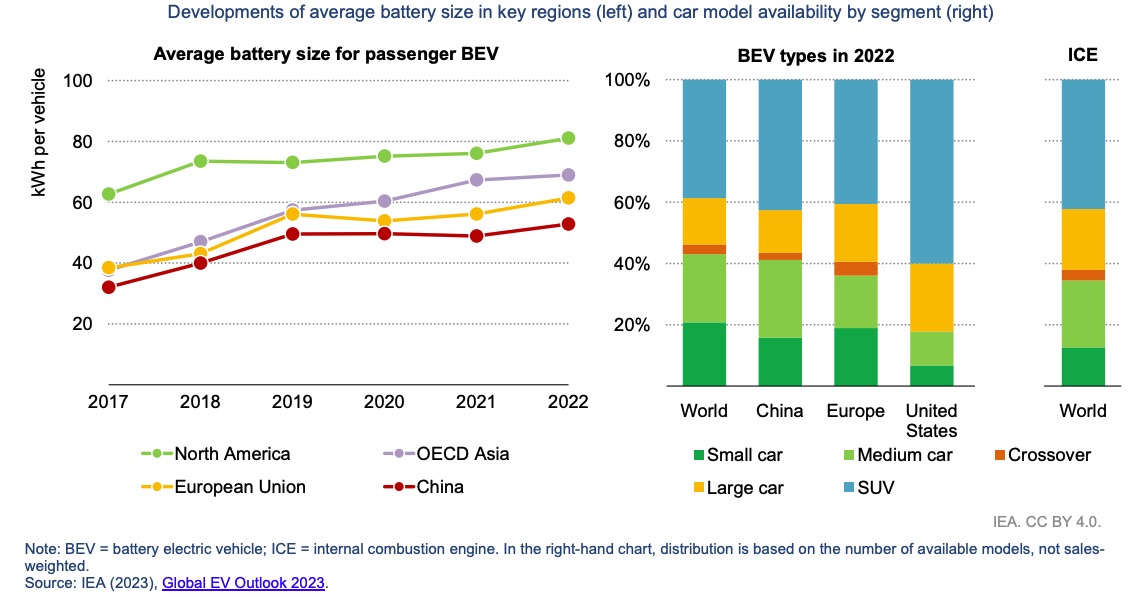

10/ Consumers Want Bigger EVs

Consumers want larger EVs, which require larger EV batteries.

This consumer preference increases metals requirement in both the EV and the EV battery.

People want EV SUVs.

Consumers want larger EVs, which require larger EV batteries.

This consumer preference increases metals requirement in both the EV and the EV battery.

People want EV SUVs.

11/ EV Manufacturers Are Securing Upstream Supply

We're seeing a large increase in EV manufacturer JVs and long-term offtake agreements.

Whether it's $TSLA trying to buy $SGML or Stellantis investing in copper mines.

The signal: Metals are scarce, we want to secure them.

We're seeing a large increase in EV manufacturer JVs and long-term offtake agreements.

Whether it's $TSLA trying to buy $SGML or Stellantis investing in copper mines.

The signal: Metals are scarce, we want to secure them.

12/ Production Trends For Copper & Lithium

We saw a 4% growth in mined copper production in 2022 and a 3% expected increase for 2023.

Refined #copper production also increased by 3%.

Lithium production increased by 38% with an expected 32% production increase in 2023.

We saw a 4% growth in mined copper production in 2022 and a 3% expected increase for 2023.

Refined #copper production also increased by 3%.

Lithium production increased by 38% with an expected 32% production increase in 2023.

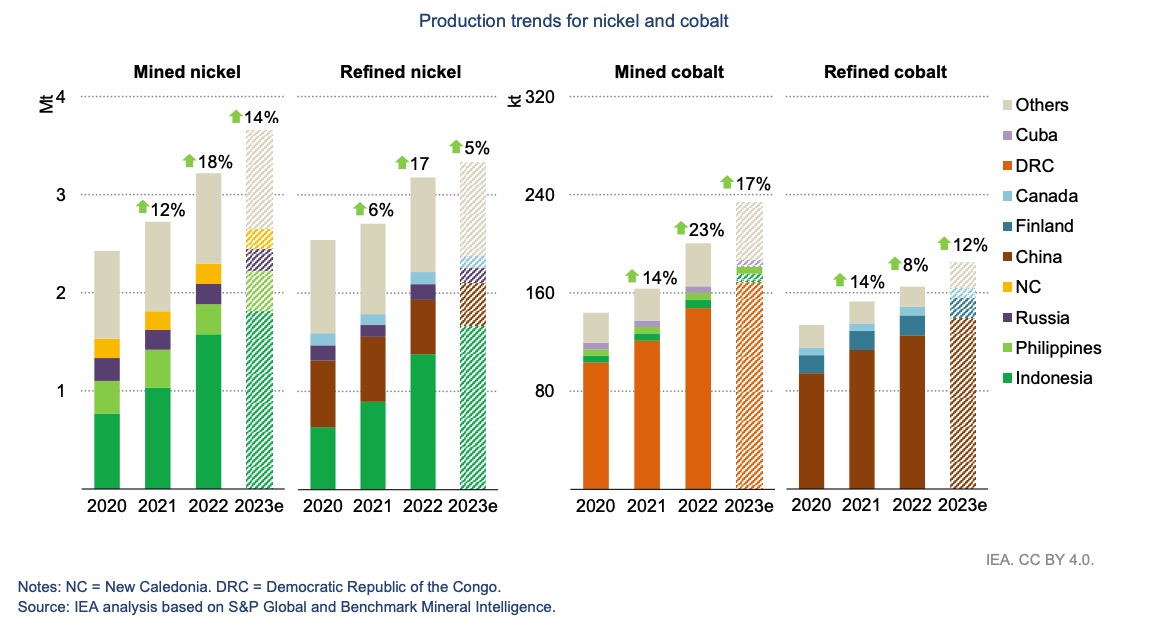

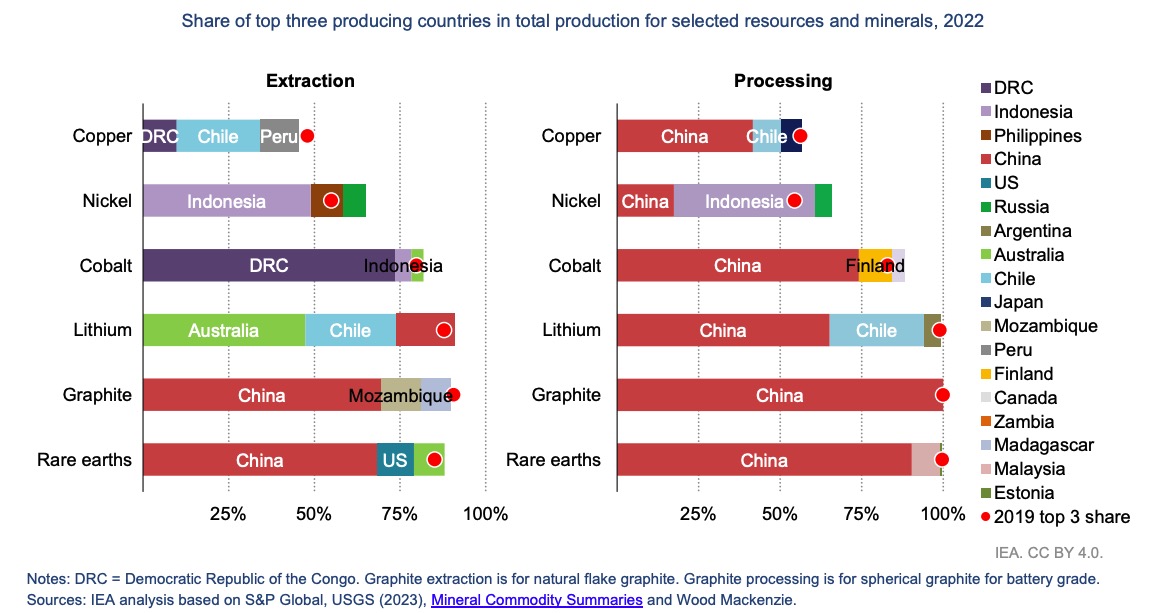

13/ Production Trends For Nickel & Cobalt

Mined #nickel increased by 18% in 2022 with a 14% increase expected in 2023.

Mined #cobalt increased by 23% in 2022 and is expected to increase by 17% in 2023.

Indonesia is now the world's leading nickel producer.

DRC leads cobalt.

Mined #nickel increased by 18% in 2022 with a 14% increase expected in 2023.

Mined #cobalt increased by 23% in 2022 and is expected to increase by 17% in 2023.

Indonesia is now the world's leading nickel producer.

DRC leads cobalt.

14/ Production Trends For Graphite & Rare Earths

Natural graphite production increased by 11% in 2022.

Mined Magnet REE production increased by 11% in 2022.

China is the global leader in both graphite and REE production.

This WILL become a geopolitical issue.

Natural graphite production increased by 11% in 2022.

Mined Magnet REE production increased by 11% in 2022.

China is the global leader in both graphite and REE production.

This WILL become a geopolitical issue.

15/ Critical Mineral Demand Set To Explode

If we get anywhere close to Net Zero by 2050, critical mineral demand will explode higher than we can imagine.

The obvious reality is that supply cannot keep up with demand growth due to:

• Grades

• ESG

• Permitting

• Water

If we get anywhere close to Net Zero by 2050, critical mineral demand will explode higher than we can imagine.

The obvious reality is that supply cannot keep up with demand growth due to:

• Grades

• ESG

• Permitting

• Water

16/ Anticipated Primary Production By 2030

Look at the gaps between "Anticipated Supply" and "Net Zero Emissions."

It is not even close for #Copper, #Lithium, #Nickel, and #Cobalt.

Only problem w/ Lithium is that there's so much gov't spending there = more competitive

Look at the gaps between "Anticipated Supply" and "Net Zero Emissions."

It is not even close for #Copper, #Lithium, #Nickel, and #Cobalt.

Only problem w/ Lithium is that there's so much gov't spending there = more competitive

17/ We Need To Diversify Processing & Extraction

We're entering Metallic Nationalism where countries stockpile valuable resources to produce higher value finished goods.

China dominates Graphite/REE production and nearly ALL Critical Mineral Processing.

Could get wild.

We're entering Metallic Nationalism where countries stockpile valuable resources to produce higher value finished goods.

China dominates Graphite/REE production and nearly ALL Critical Mineral Processing.

Could get wild.

18/ Where To Learn More

Interested in learning more?

There are a few ways you can learn more about Critical Minerals/Metals.

• Follow me on Twitter!

• Listen to my podcast:

• Read the original report: https://t.co/WG5iu9Gejdtinyurl.com/5n6d6hcc

tinyurl.com/43eda5fk

Interested in learning more?

There are a few ways you can learn more about Critical Minerals/Metals.

• Follow me on Twitter!

• Listen to my podcast:

• Read the original report: https://t.co/WG5iu9Gejdtinyurl.com/5n6d6hcc

tinyurl.com/43eda5fk

19/ Conclusion

I hope you enjoyed this thread on the IEA Critical Minerals Review 2023.

Here are the key points:

• Clean energy requires tons of Critical Minerals

• Supply cannot match demand growth

• China dominates production/processing

• REE demand will explode

I hope you enjoyed this thread on the IEA Critical Minerals Review 2023.

Here are the key points:

• Clean energy requires tons of Critical Minerals

• Supply cannot match demand growth

• China dominates production/processing

• REE demand will explode

• • •

Missing some Tweet in this thread? You can try to

force a refresh