The United States is entering an exponential debt spiral.

Welcome to the Monetary Event Horizon.

A Thread ⚡️🧵👇

Welcome to the Monetary Event Horizon.

A Thread ⚡️🧵👇

A little over a month ago, deja vu struck Congress as they underwent their ritual debt ceiling brinkmanship.

This time, the players fought over what concessions could be made as the U.S. approached the deadline of $31.4T in total debt outstanding while Yellen warned of severe austerity measures that the Treasury would have to undertake in order to avoid default.

As usual, the game was played with the typical jawboning and accusatory statements so often held by our politicians- but the conclusion was one we had not seen before.

On Saturday, June 3rd, President Joe Biden signed an agreement that lifted the debt ceiling completely for two years, and eliminated spending caps after 2025, allowing unlimited government spending.

The debt limit issue would be revisited in 2025.

The debt limit issue would be revisited in 2025.

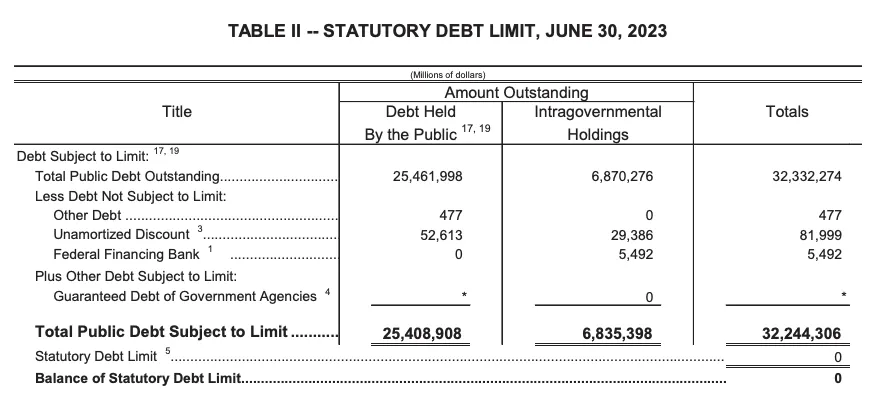

On the Treasury’s own reports, they list the statutory debt limit as ZERO.

I guess they didn’t have enough room to put “Infinity” down. https://t.co/sOh091mI5Ftwitter.com/i/web/status/1…

I guess they didn’t have enough room to put “Infinity” down. https://t.co/sOh091mI5Ftwitter.com/i/web/status/1…

Now, the debt level is increasing faster. And this time, it’s occurring without a crisis to spur massive government borrowing. twitter.com/i/web/status/1…

This removal of even the faintest whiff of fiscal constraint has truly allowed the Treasury to plunge deeper into the debt black hole-

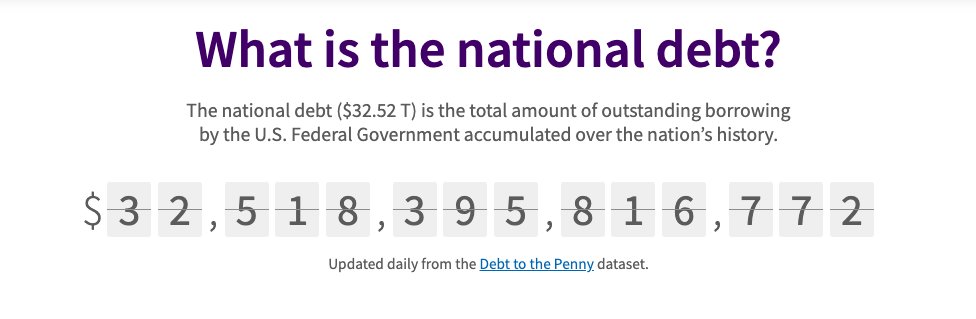

in a shocking turn of events, the national debt has increased by over $1.1 TRILLION in 41 days! https://t.co/Q2AHCrD9YItwitter.com/i/web/status/1…

in a shocking turn of events, the national debt has increased by over $1.1 TRILLION in 41 days! https://t.co/Q2AHCrD9YItwitter.com/i/web/status/1…

It now stands at a staggering $32.51 Trillion- a rate of $27B a DAY. twitter.com/i/web/status/1…

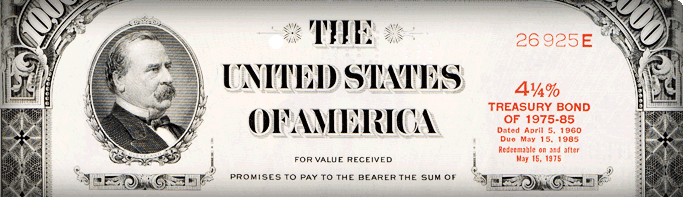

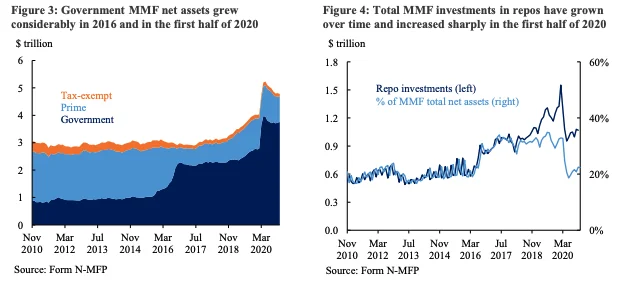

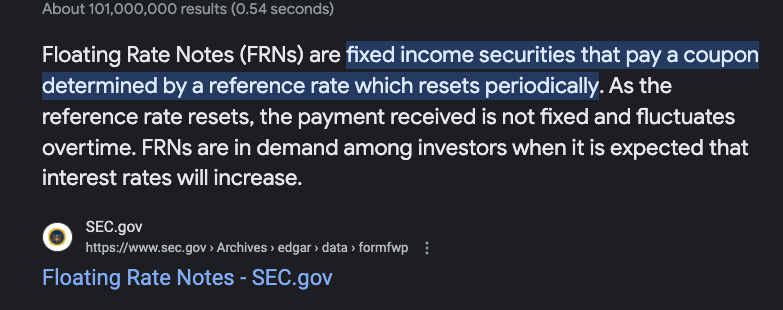

This was funded by a mix of Treasury notes, bills, and bonds, and a small amount of something called FRNs- floating rate notes.

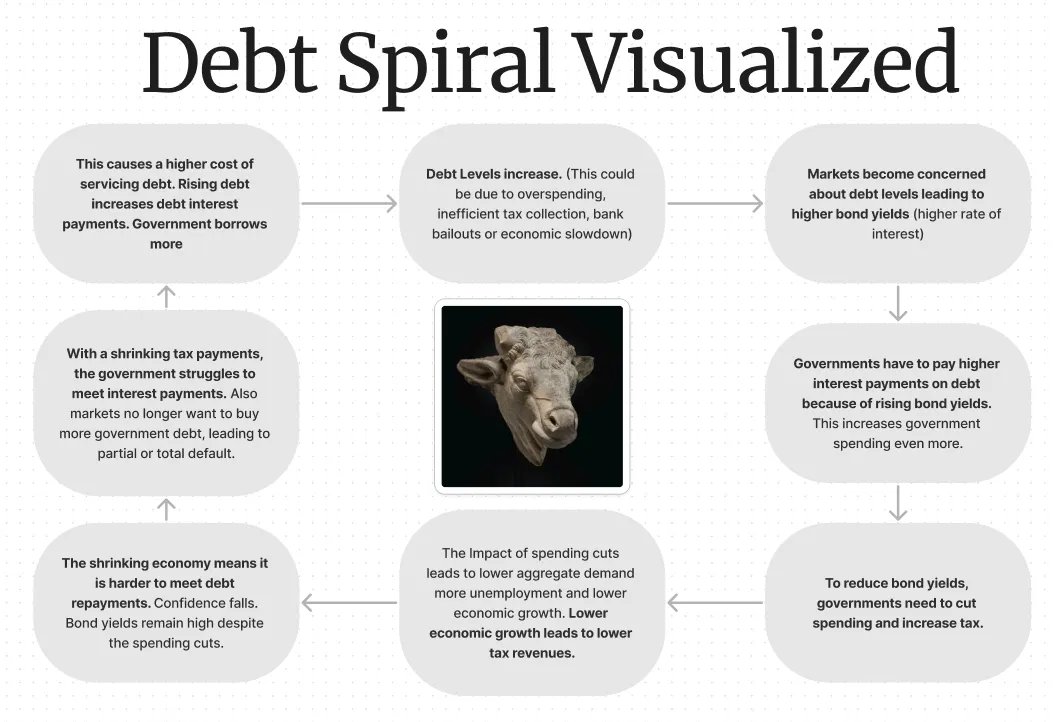

This recent tsunami of new Treasury issuances could be indicative that the United States is entering what is called a debt spiral.

A debt spiral occurs when an entity, such as a person, business or country finds itself needing to borrow money in order to fulfill its existing… twitter.com/i/web/status/1…

A debt spiral occurs when an entity, such as a person, business or country finds itself needing to borrow money in order to fulfill its existing… twitter.com/i/web/status/1…

This is what the United States is entering. At $32T of Federal debt, that means if rates stay at 5% the U.S. will eventually have to pay $1.6T a year in interest alone to service the debt. That doesn’t even include principal payments.

https://t.co/Dbogjn7fTe

twitter.com/i/web/status/1…

https://t.co/Dbogjn7fTe

https://twitter.com/ThHappyHawaiian/status/1679571972034904064?s=20

twitter.com/i/web/status/1…

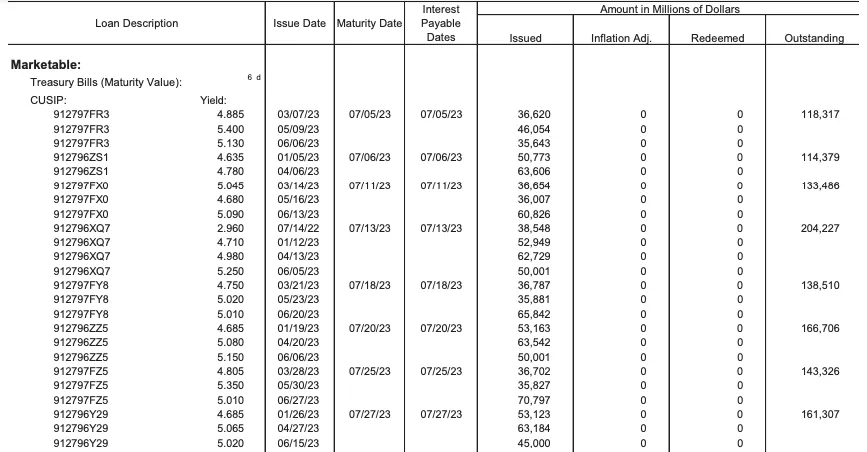

For example, let’s take a look at just the shortest-term debt securities that are maturing this month.

Per the Treasury’s monthly report, around $1.17T in bills will mature in July. All of this debt was recently issued and thus the rate step change won’t be too severe, but will… https://t.co/1butvq8nvZtwitter.com/i/web/status/1…

Per the Treasury’s monthly report, around $1.17T in bills will mature in July. All of this debt was recently issued and thus the rate step change won’t be too severe, but will… https://t.co/1butvq8nvZtwitter.com/i/web/status/1…

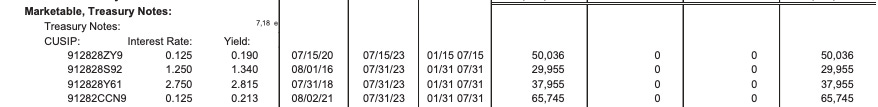

In terms of notes, approximately $183B will have to be refinanced as these instruments mature.

The amount of TIPs maturing is almost immaterial at $53B. Similar with Floating Rate Notes, of which $82B mature this month.

The amount of TIPs maturing is almost immaterial at $53B. Similar with Floating Rate Notes, of which $82B mature this month.

As these debt securities mature, the Treasury pays them off by issuing new ones, “rolling the debt” forward similar to how options or future traders roll contracts week to week or month to month.

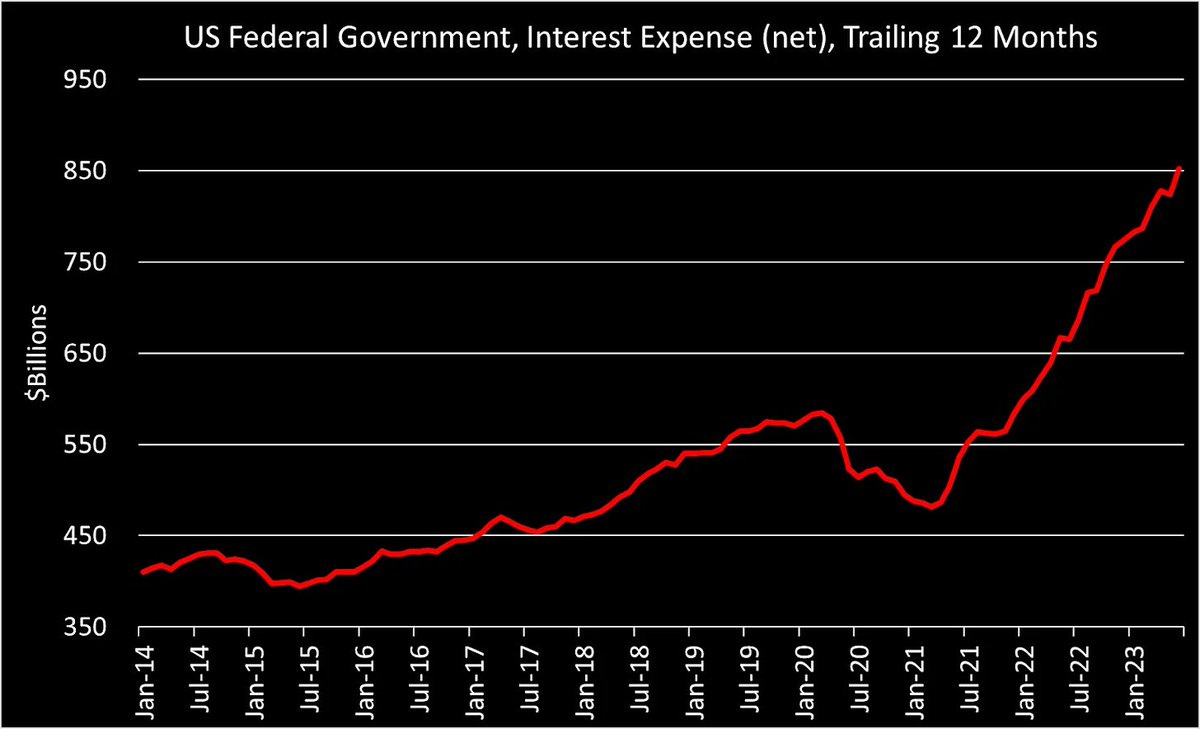

The issue is, all these securities are refinanced at higher rates and thus cause more interest expense to incur across the balance sheet. This is fueling a massive rise in interest expense paid by the United States.

As the interest rate rises, the amount of debt issued must rise in tandem. Which means the total interest paid rises even more, and thus more debt, in a devastating feedback loop.

What worsens the situation is that this process is non-linear, not only logically from the… twitter.com/i/web/status/1…

What worsens the situation is that this process is non-linear, not only logically from the… twitter.com/i/web/status/1…

H/t @ThHappyHawaiian -

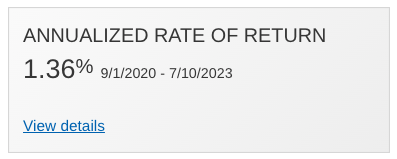

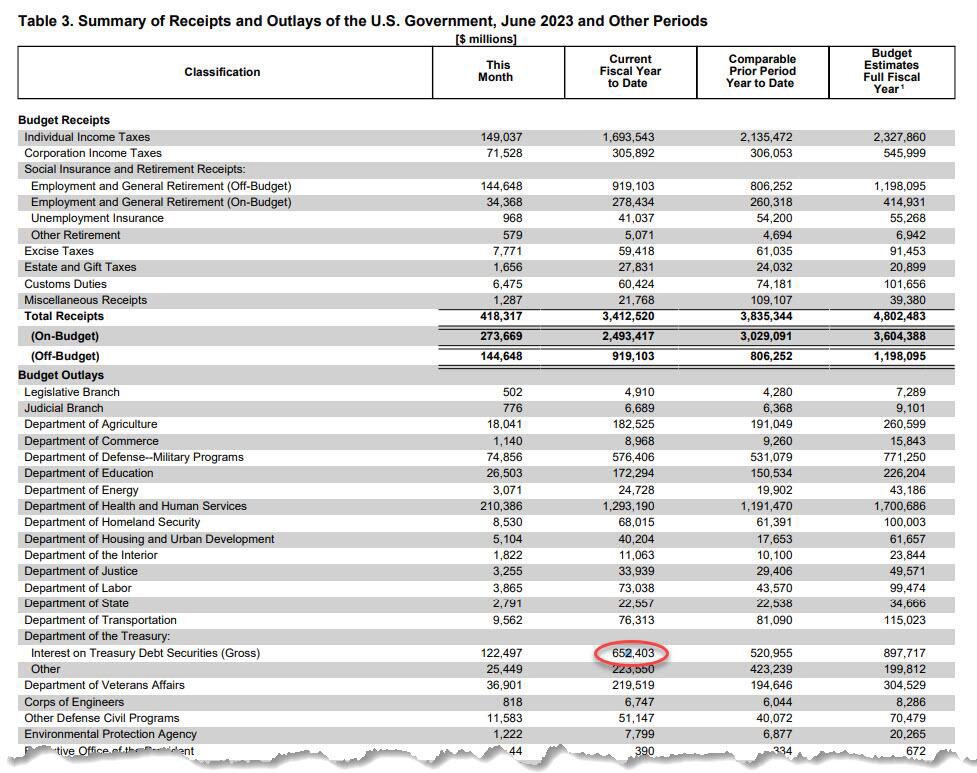

"In June, the interest expense paid for the last twelve months hit $852B- a 28% compounded annual growth rate."

If this keeps growing at this rate, we will be paying $1.78T in interest alone in 2025.

And $2.28T in 2026. twitter.com/i/web/status/1…

"In June, the interest expense paid for the last twelve months hit $852B- a 28% compounded annual growth rate."

If this keeps growing at this rate, we will be paying $1.78T in interest alone in 2025.

And $2.28T in 2026. twitter.com/i/web/status/1…

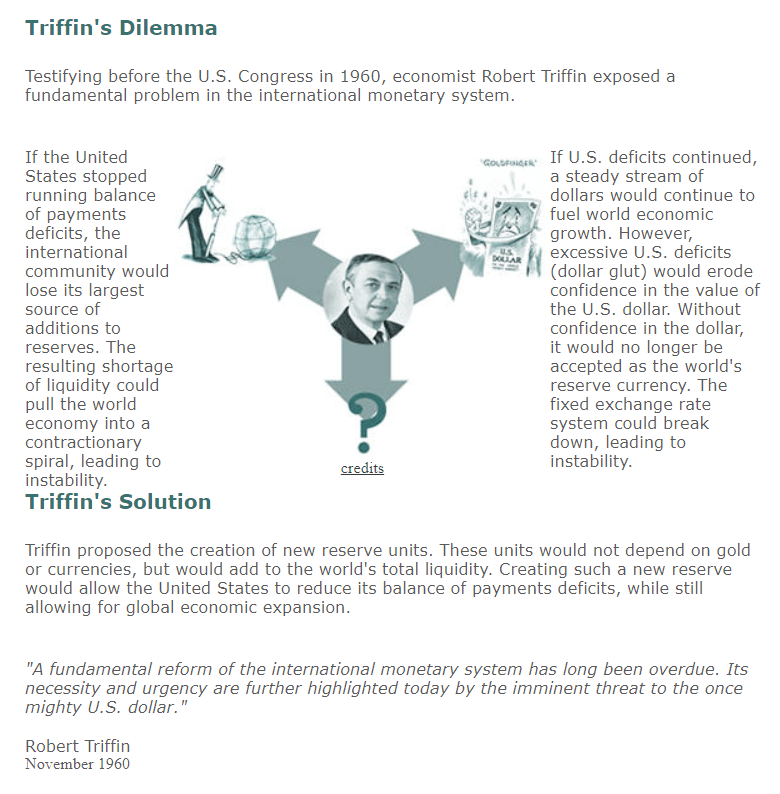

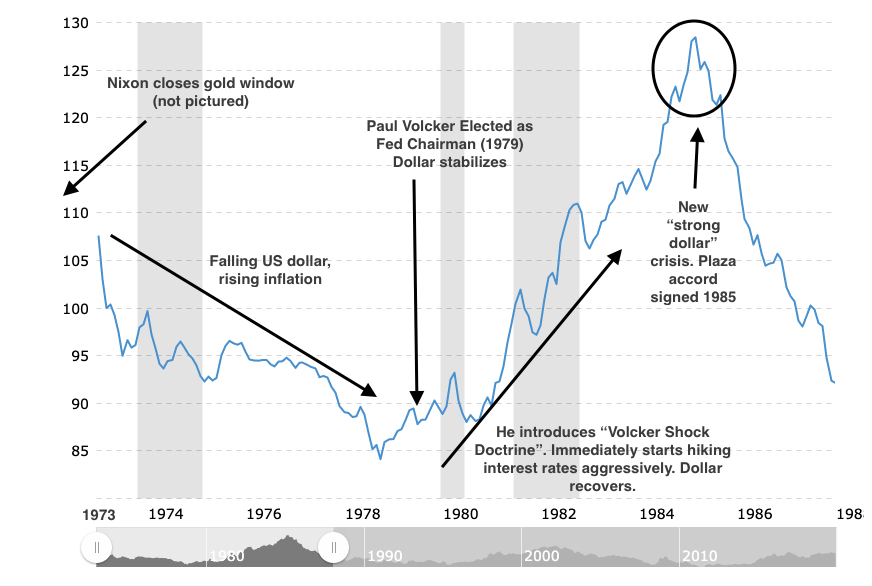

@ThHappyHawaiian The problem the central planners face is that of a true dilemma. If they raise rates to fight inflation, they’re only accelerating the debt spiral.

@ThHappyHawaiian However, if they lower rates and begin QE, this will in time cause more inflation, which will by default increase Treasury expenditures as the prices of labor, infrastructure, healthcare and military equipment rises.

@ThHappyHawaiian Which will increase the amount of debt the Treasury must issue. Which will push us further into the debt spiral.

I have termed this the Peruvian Bull Debt Paradox. The higher they raise rates, the closer and larger the next QE tsunami will become.

I have termed this the Peruvian Bull Debt Paradox. The higher they raise rates, the closer and larger the next QE tsunami will become.

https://twitter.com/peruvian_bull/status/1578028375880634374?s=20

@ThHappyHawaiian The U.S. is already paying record amounts in interest expense- and the Fed hasn't even finished its hiking cycle.

What happens if "higher for longer" proves to be true, and more of the $32T debt load gets refinanced at 5%??

What happens if "higher for longer" proves to be true, and more of the $32T debt load gets refinanced at 5%??

https://twitter.com/WallStreetSilv/status/1679565697590886402?s=20

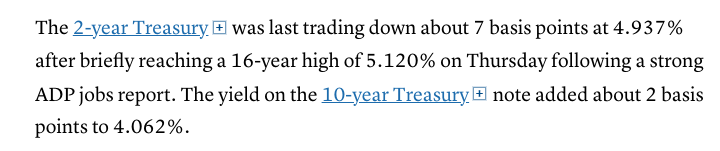

@ThHappyHawaiian The markets are sniffing this out. Last week, the 10-year Treasury broke 4%, a key resistance level seen in February 2023 before the bank failures of SVB and FRB, and September 2007.

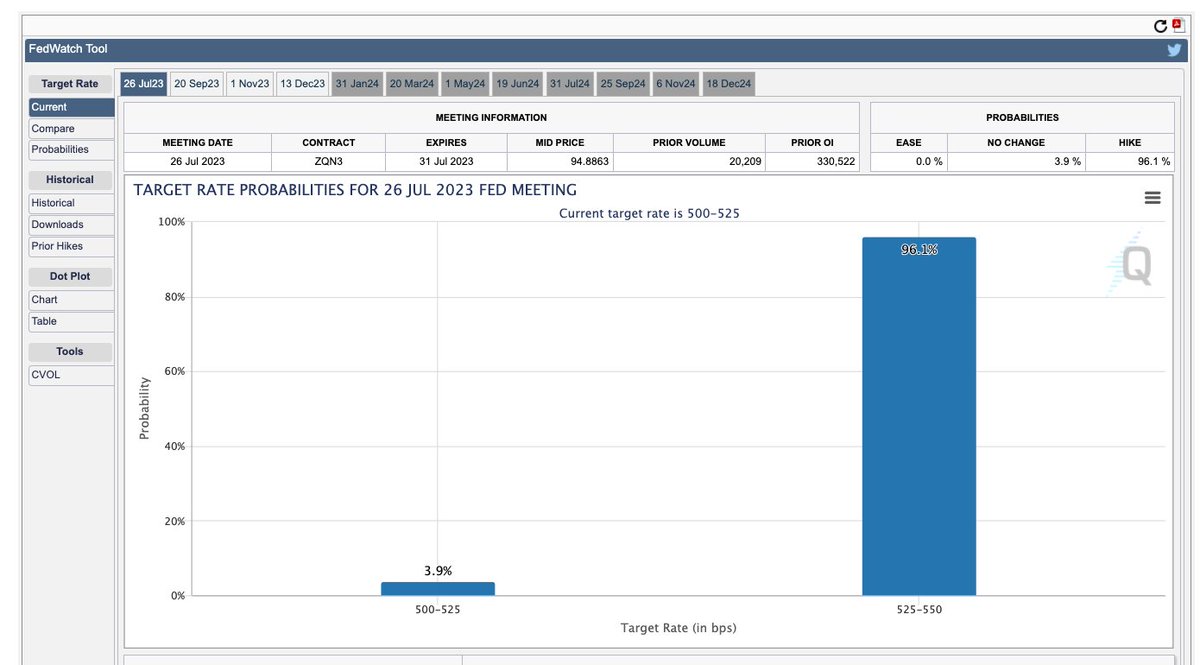

@ThHappyHawaiian Traders remained undeterred and continued to anticipate further interest rate hikes- Fed futures point to a 96% chance that the central bank will raise by a quarter point later this month according to CME Group’s FedWatch tool.

@ThHappyHawaiian Oh, and this year so far, there has been $652 BILLION in interest expense incurred.

It's only JULY.

(h/t @WallStreetSilv )

It's only JULY.

(h/t @WallStreetSilv )

@ThHappyHawaiian @WallStreetSilv The only escape from this conundrum is severe fiscal austerity. That means slashing military, infrastructure, and social security while hiking tax rates and eliminating loopholes, especially for corporations and wealthy benefactors who profit from the current lopsided tax code.

@ThHappyHawaiian @WallStreetSilv This is politically untenable. So our leaders will continue to lead us across the warped spacetime and closer to the Singularity. twitter.com/i/web/status/1…

@ThHappyHawaiian @WallStreetSilv The Fed has trapped the Treasury in a black hole of its own design. Crushed by the financial gravity of the debt, the government is contracting inwards towards default.

Determined to stave off deflationary collapse, Yellen and Powell will work hand in glove to create more money… https://t.co/yWigi0x3Rptwitter.com/i/web/status/1…

Determined to stave off deflationary collapse, Yellen and Powell will work hand in glove to create more money… https://t.co/yWigi0x3Rptwitter.com/i/web/status/1…

@ThHappyHawaiian @WallStreetSilv The Congressional Budget Office estimates in 4 years there will be $38T of Federal debt outstanding.

The Debt Clock predicts that actually if debt keeps growing at current rates, there will be $43T of debt outstanding.

That’s just by 2027.

The Debt Clock predicts that actually if debt keeps growing at current rates, there will be $43T of debt outstanding.

That’s just by 2027.

https://twitter.com/peruvian_bull/status/1678471838412972032?s=20

@ThHappyHawaiian @WallStreetSilv The wave of debt issuance will grow to be exponential. There isn’t enough demand, so the Fed will step in and print the difference, unleashing feedback loops long forgotten by the economic elites who rule our country.

@ThHappyHawaiian @WallStreetSilv This will only worsen the crisis and increase the growth rate of the money supply, causing inflation and dragging us deeper into the wormhole.

What they do not understand is that we’re not approaching the event horizon.

We’re already past it.

//END https://t.co/hbmuSTBVHMtwitter.com/i/web/status/1…

What they do not understand is that we’re not approaching the event horizon.

We’re already past it.

//END https://t.co/hbmuSTBVHMtwitter.com/i/web/status/1…

@ThHappyHawaiian @WallStreetSilv If you liked this thread, please follow me here on Twitter @peruvian_bull ! This thread is an excerpt of a post I made on Substack, you can find the post and subscribe here:

peruvianbull.substack.com/p/the-monetary…

peruvianbull.substack.com/p/the-monetary…

@ThHappyHawaiian @WallStreetSilv I also have a book, the Dollar Endgame that is available for sale here if you would like a copy-

amazon.com/Dollar-Endgame…

amazon.com/Dollar-Endgame…

@ThHappyHawaiian @WallStreetSilv Thanks for reading, and I"ll see you next time ⚡️

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter