Been actively trading ES for a while now, transitioning from crude oil options. It's not just because ICT uses them for teaching, but as a full-time student in India, the timings of index futures align perfectly with my schedule

Thread on “INDEX FUTURES LUNCH HOUR”

Thread on “INDEX FUTURES LUNCH HOUR”

Just a heads up, this thread is not well-organized as it's my first attempt. Keeping it concise, I'll touch on key points without extensively annotated charts. Rest assured, I'll gather more data and soon share a well-organized thread on Notion. Stay tuned! Lesgoo

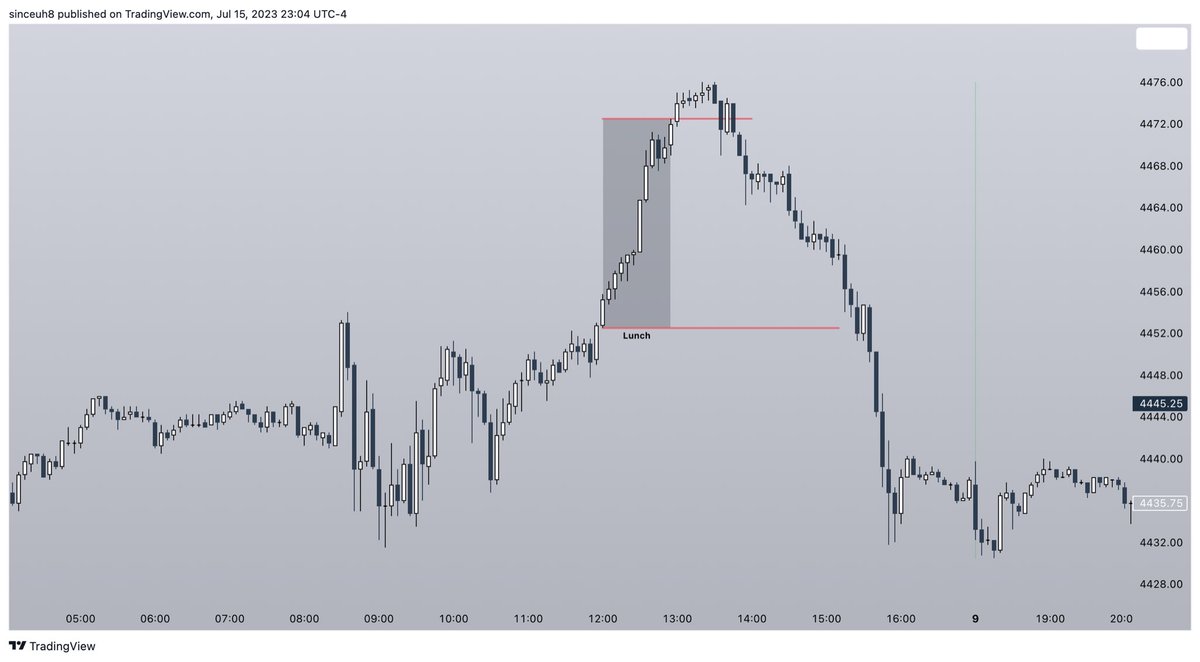

Lunch hour for index is 12 pm - 1 pm EST

The lunch hour range offers valuable insights into what to expect during the afternoon session. While that's a topic of its own, let's currently focus on the highs and lows formed during this period

The lunch hour range offers valuable insights into what to expect during the afternoon session. While that's a topic of its own, let's currently focus on the highs and lows formed during this period

The lunch hour Highs/Lows sweep sets the stage for two possible scenarios in the PM session:

1. Continuation of the AM trend.

2. Reversal from the AM trend.

1. Continuation of the AM trend.

2. Reversal from the AM trend.

First let’s talk about the continuation of AM trend

Let’s hear what ICT taught about this in ICT Mentorship Core Content - Month 10 -

Index Futures - Index Trade Setups

Link :

Let’s hear what ICT taught about this in ICT Mentorship Core Content - Month 10 -

Index Futures - Index Trade Setups

Link :

1: Continuation on Buy-side 📈 :

Based on my observations and taking into consideration what ICT has taught : when the low of the day forms and we experience a trending AM session, to ensure continued upward momentum in the PM session, we look for price to sweep the lunch lows

Based on my observations and taking into consideration what ICT has taught : when the low of the day forms and we experience a trending AM session, to ensure continued upward momentum in the PM session, we look for price to sweep the lunch lows

Continuation on sell-side 📉 :

Just the opposite of what we spoke about continuation on Buy-side : when the high of the day forms and we experience a declining AM session, to ensure continued downward momentum in the PM session, we look for price to sweep the lunch highs

Just the opposite of what we spoke about continuation on Buy-side : when the high of the day forms and we experience a declining AM session, to ensure continued downward momentum in the PM session, we look for price to sweep the lunch highs

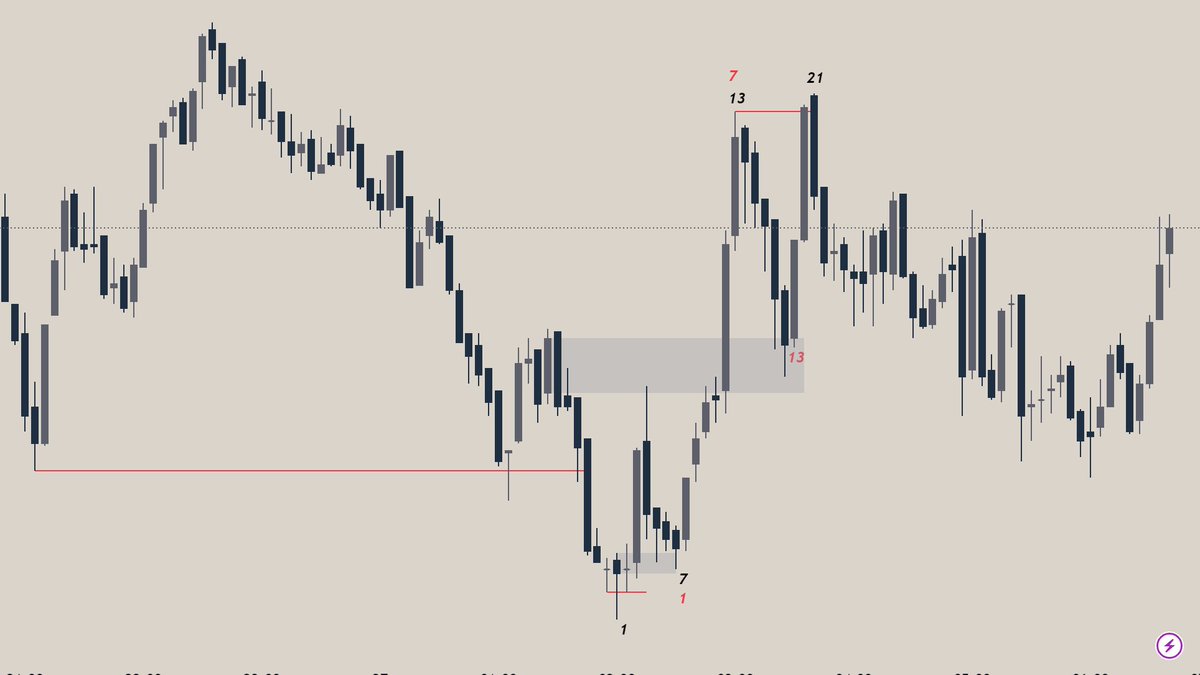

2. Reversal from the AM trend : MMSM

When the price hits HTF Resistance ( Premium arrays & BSL ) we expect a reversal. Especially during the morning session, if the price touches this level, it should reverse. Our goal is to see the lunch hour's highs swept

When the price hits HTF Resistance ( Premium arrays & BSL ) we expect a reversal. Especially during the morning session, if the price touches this level, it should reverse. Our goal is to see the lunch hour's highs swept

Reversal from the AM trend : MMBM

When the price hits HTF Support( Discount arrays & SSL ) we expect a reversal. Especially during the morning session, if the price touches this level, it should reverse. Our goal is to see the lunch hour's lows surpassed.

When the price hits HTF Support( Discount arrays & SSL ) we expect a reversal. Especially during the morning session, if the price touches this level, it should reverse. Our goal is to see the lunch hour's lows surpassed.

I'm eager to hear your observations! Please feel free to point out any mistakes or suggest improvements. Wishing everyone a wonderful day! 🙏❤️

• • •

Missing some Tweet in this thread? You can try to

force a refresh