How to get URL link on X (Twitter) App

When you can trade on Mondays :

When you can trade on Mondays :

Just a heads up, this thread is not well-organized as it's my first attempt. Keeping it concise, I'll touch on key points without extensively annotated charts. Rest assured, I'll gather more data and soon share a well-organized thread on Notion. Stay tuned! Lesgoo

Just a heads up, this thread is not well-organized as it's my first attempt. Keeping it concise, I'll touch on key points without extensively annotated charts. Rest assured, I'll gather more data and soon share a well-organized thread on Notion. Stay tuned! Lesgoo

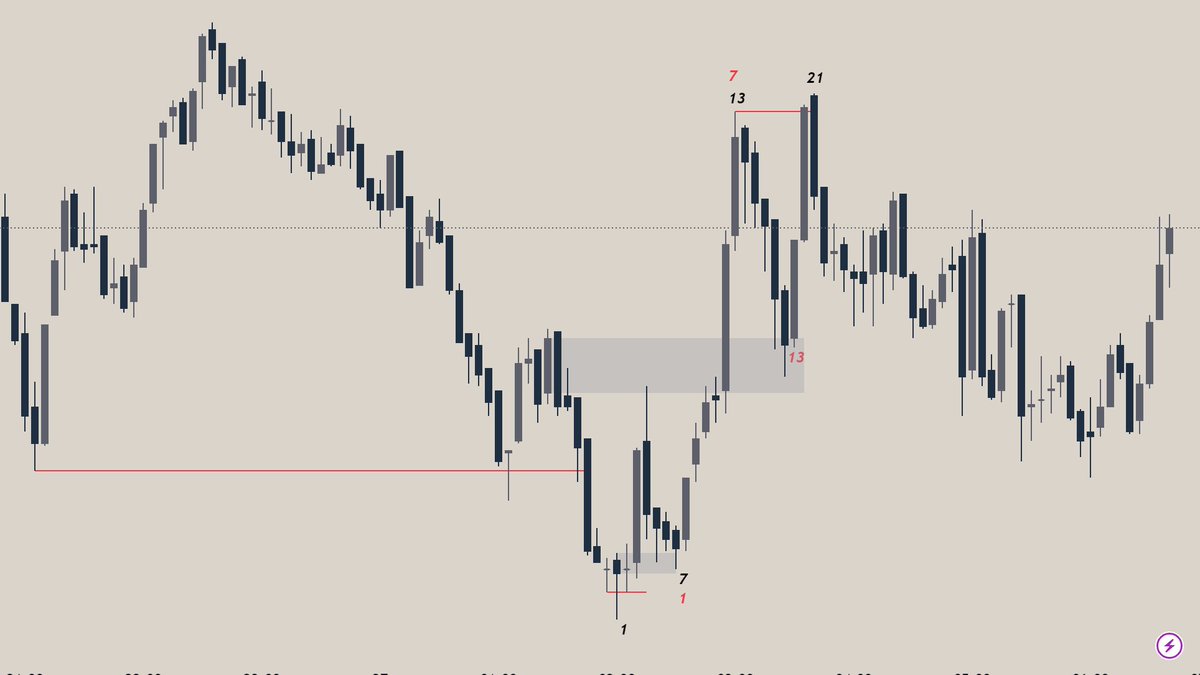

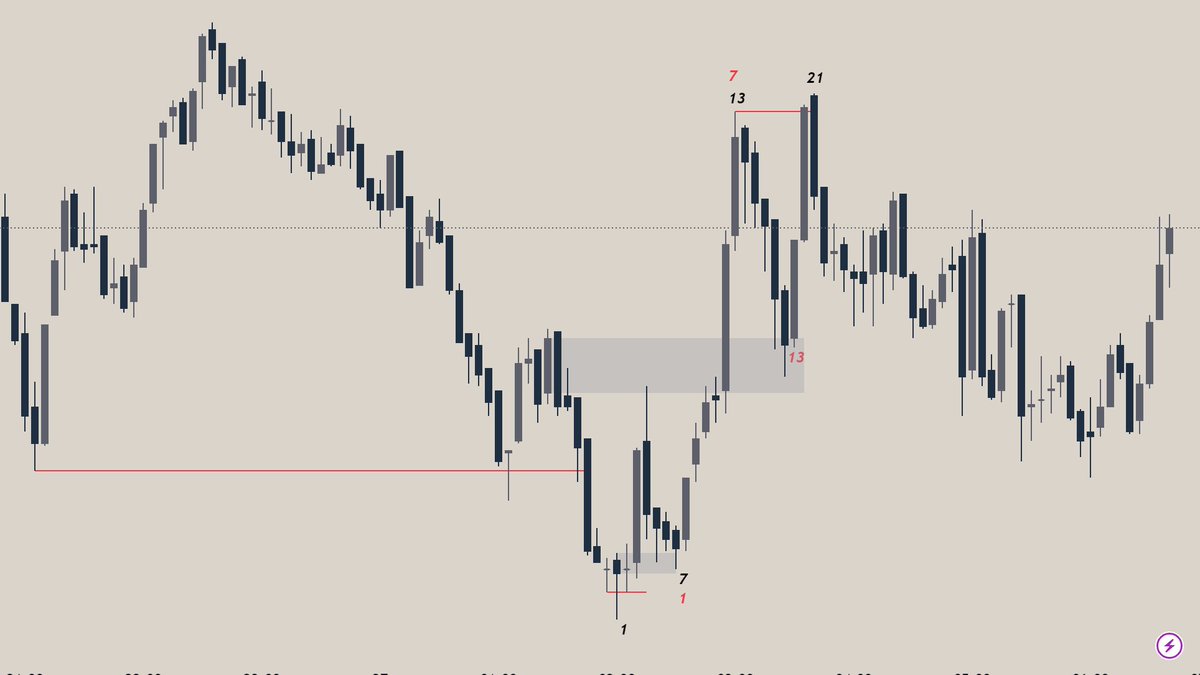

when ICT says when there are 2 fvgs, there are 2 ways to enter. 1st way being , enter at the first fvg and stop loss under that candle low. 2nd way being wait for the price to trade through the second fvg and enter when price comes to the first.

when ICT says when there are 2 fvgs, there are 2 ways to enter. 1st way being , enter at the first fvg and stop loss under that candle low. 2nd way being wait for the price to trade through the second fvg and enter when price comes to the first.