GMX v2 is just around the corner.

Here's everything you need to position yourself in 5 min or less.

1️⃣ GMX: Overview

2️⃣ GMX v2: How they plan to onboard 100x more traders than v1

3️⃣ GMX: Price Action

4️⃣ Smart money plays: @loch_chain exclusive 👀

Here's everything you need to position yourself in 5 min or less.

1️⃣ GMX: Overview

2️⃣ GMX v2: How they plan to onboard 100x more traders than v1

3️⃣ GMX: Price Action

4️⃣ Smart money plays: @loch_chain exclusive 👀

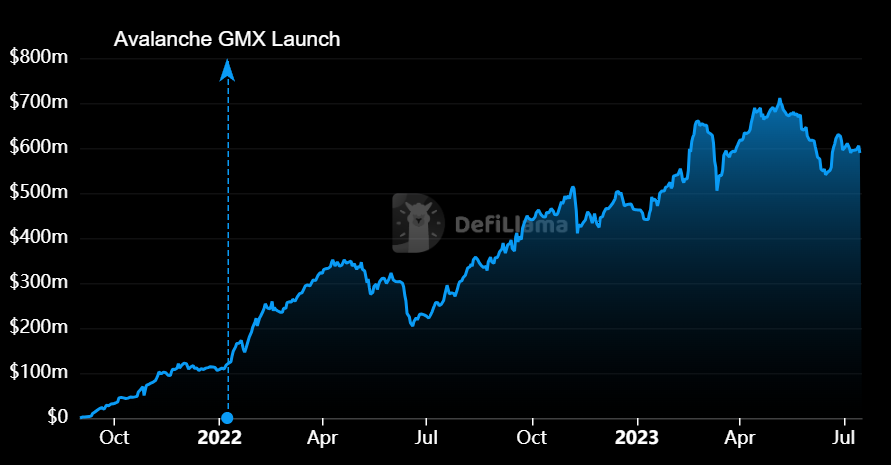

1️⃣ GMX The Derivatives King.

@GMX_IO v1 achieved remarkable success.

Undeniably, GMX has played a pivotal role in shaping the current form of the DeFi industry.

With GMX, traders can access decentralized derivatives and enjoy up to 50x leverage on major crypto assets.

@GMX_IO v1 achieved remarkable success.

Undeniably, GMX has played a pivotal role in shaping the current form of the DeFi industry.

With GMX, traders can access decentralized derivatives and enjoy up to 50x leverage on major crypto assets.

Its success stems from the $GLP liquidity model, enabling no-price-impact trading and exceptional tokenomics.

$GLP is a basket of assets with 50% stables and serves as a counterparty for all GMX trades.

At its all-time high, $GLP accounted for 50% of TVL on @arbitrum!

$GLP is a basket of assets with 50% stables and serves as a counterparty for all GMX trades.

At its all-time high, $GLP accounted for 50% of TVL on @arbitrum!

2️⃣ Enter GMX v2.

It's currently active on testnet. Mainnet in a few weeks.

Features:

1. New liquidity model (farewell $GLP)

2. Synthetic Assets

3. Revamped fee structure

It's currently active on testnet. Mainnet in a few weeks.

Features:

1. New liquidity model (farewell $GLP)

2. Synthetic Assets

3. Revamped fee structure

Every market within GMX can consist of multiple isolated pools.

Each pool comprises three elements:

• Index token

• Long token

• Short token

This innovation allows for permissionless listings, which was not previously possible with $GLP.

Each pool comprises three elements:

• Index token

• Long token

• Short token

This innovation allows for permissionless listings, which was not previously possible with $GLP.

For example, during the testnet phase, they introduced the trading of $SOL.

The SOL-USD market contains the ETH-USDC pool:

• Index token: SOL

• Long token: ETH

• Short token: USDC

The SOL-USD market contains the ETH-USDC pool:

• Index token: SOL

• Long token: ETH

• Short token: USDC

Moreover, GMX v2 will incorporate @chainlink feeds.

This integration will enhance the platform's functionality, providing users with access to reliable and real-time data.

It will also enable low-latency trading on the platform.

This integration will enhance the platform's functionality, providing users with access to reliable and real-time data.

It will also enable low-latency trading on the platform.

GMX v2 has introduced several modifications to the fee model compared to the previous structure:

• Reducing open/close fees from 0.1% to 0.05%

• Adjusting funding fees to favor the less dominant side

• Implementing price impact considerations

• Reducing open/close fees from 0.1% to 0.05%

• Adjusting funding fees to favor the less dominant side

• Implementing price impact considerations

GMX v2's DAO has an active community proposal:

1: 10% protocol fees to GMX stakers & LPs, sub-allocation for Chainlink oracles

2: Or maintain current fees, 1.2% reduction for GMX stakers to fund Chainlink oracles.

(h/t) #GMX #DAO #Governancemessari.io/governor/propo…

1: 10% protocol fees to GMX stakers & LPs, sub-allocation for Chainlink oracles

2: Or maintain current fees, 1.2% reduction for GMX stakers to fund Chainlink oracles.

(h/t) #GMX #DAO #Governancemessari.io/governor/propo…

3️⃣ GMX - Price Action

$GMX, CTs' favorite token, boasts an impressive track record:

• Growth rate: 500%+

• ATH: $91

• Current price: $60

• Current MC: $535M

$GMX, CTs' favorite token, boasts an impressive track record:

• Growth rate: 500%+

• ATH: $91

• Current price: $60

• Current MC: $535M

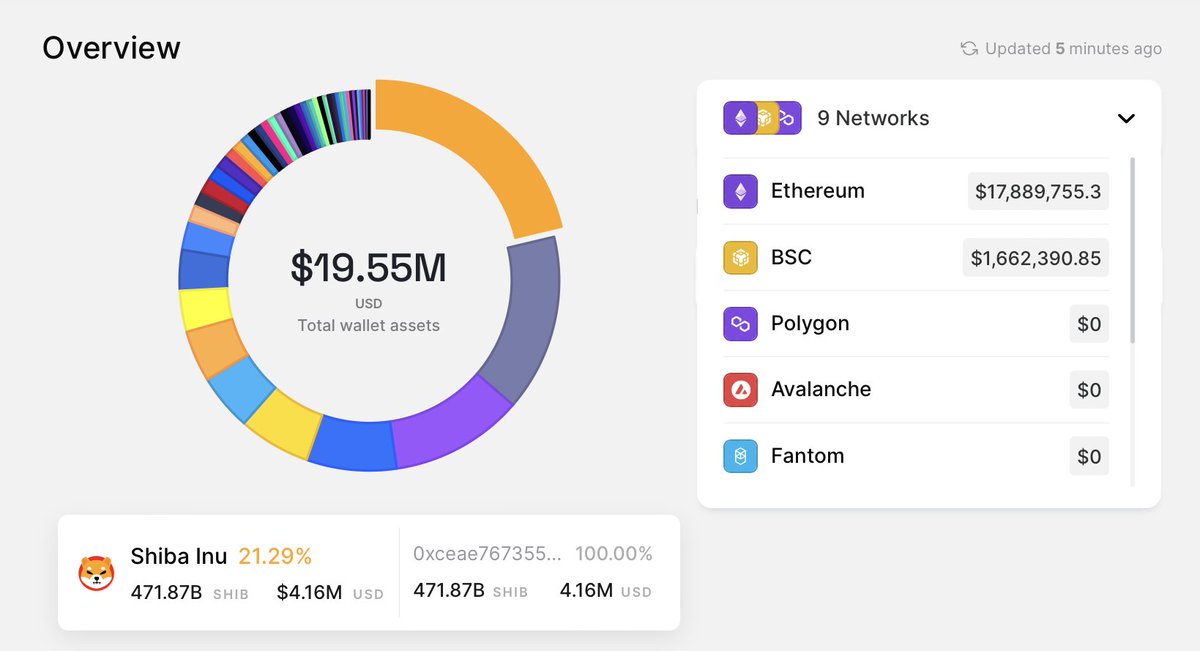

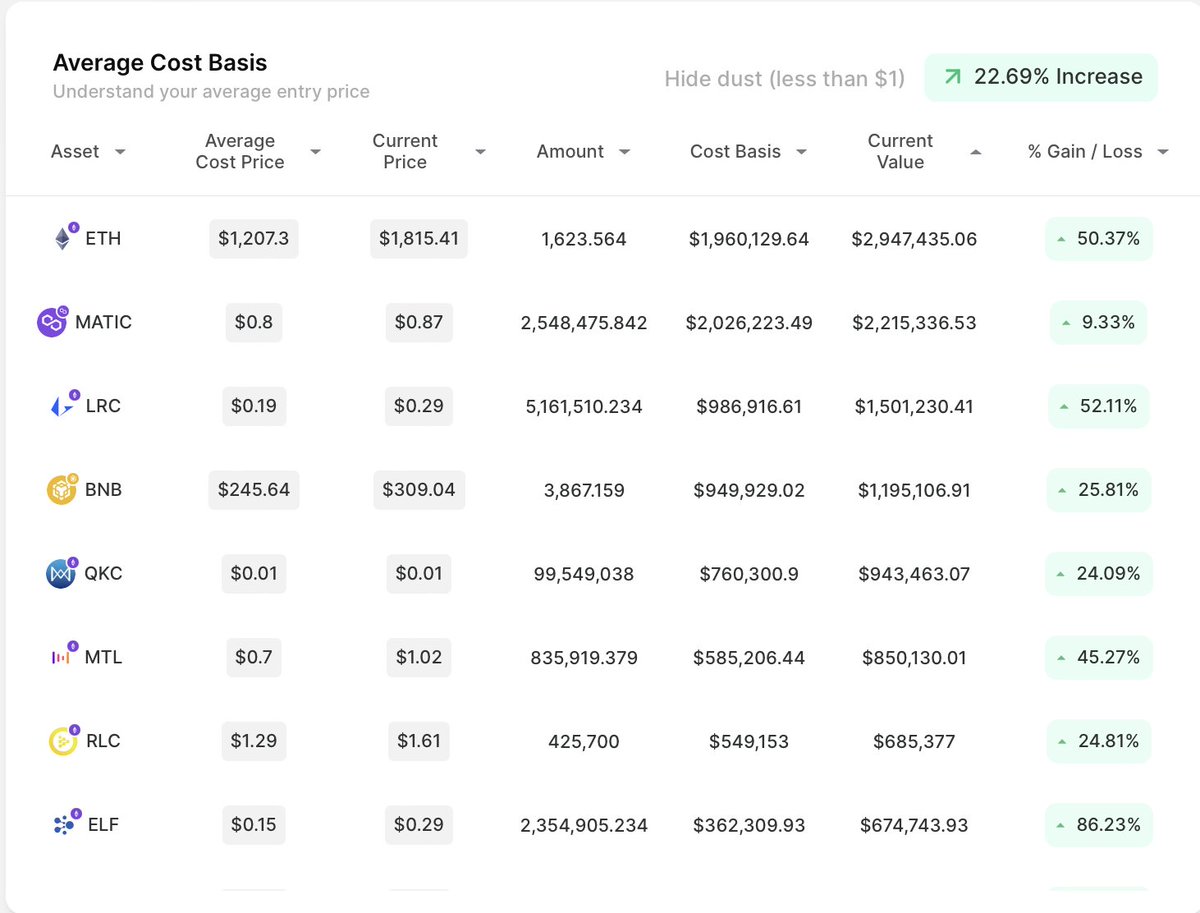

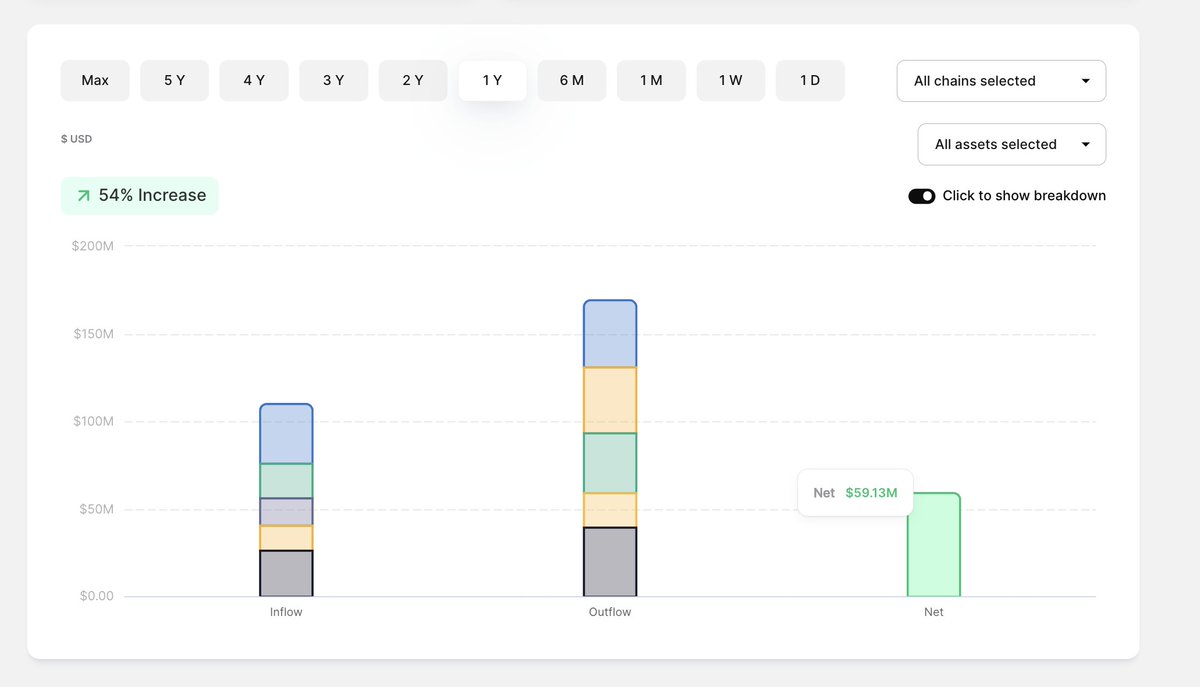

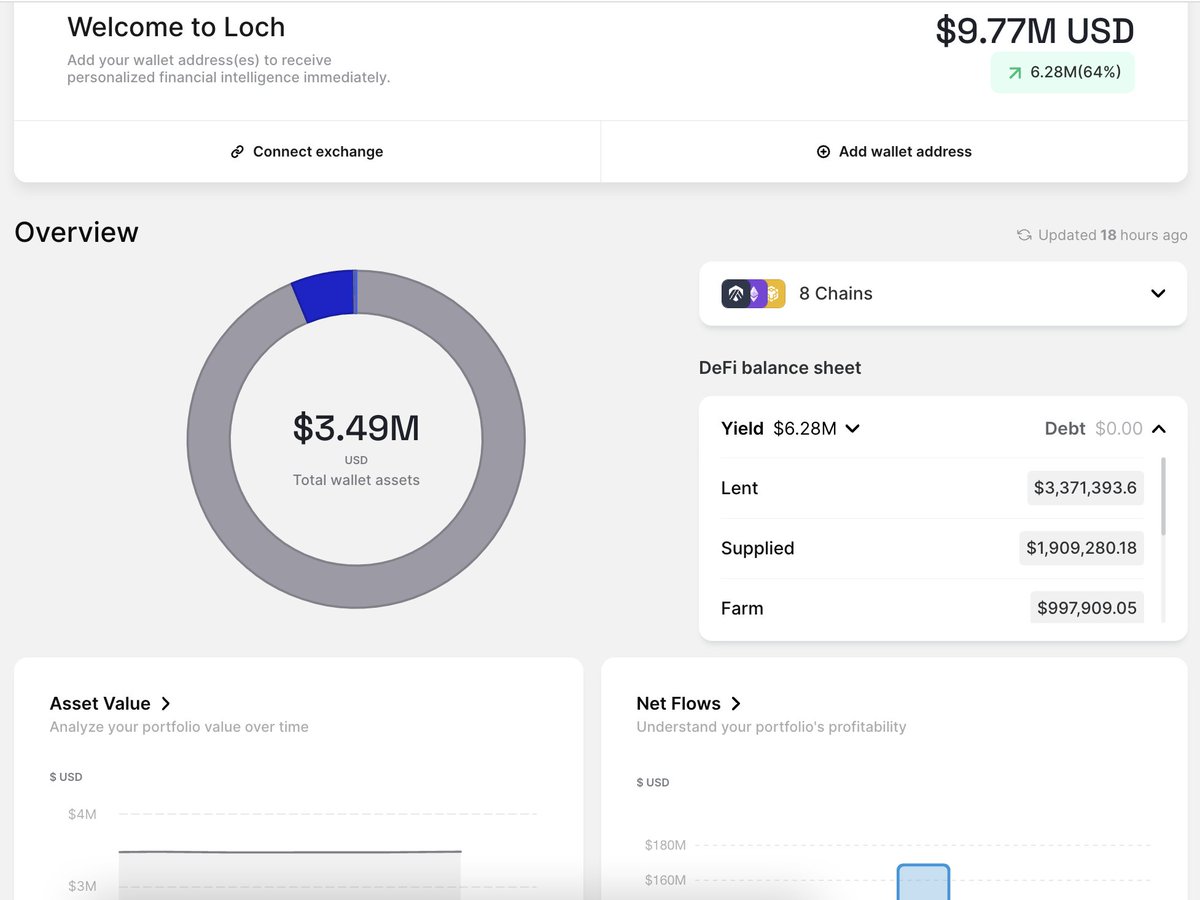

4️⃣ Smart Money Plays

@CryptoHayes, @Rewkang and other chads have consistently praised GMX since its inception.

$GMX not only appreciated in price, it is stakable to earn a handsome APR throughout the bear market.

@CryptoHayes, @Rewkang and other chads have consistently praised GMX since its inception.

$GMX not only appreciated in price, it is stakable to earn a handsome APR throughout the bear market.

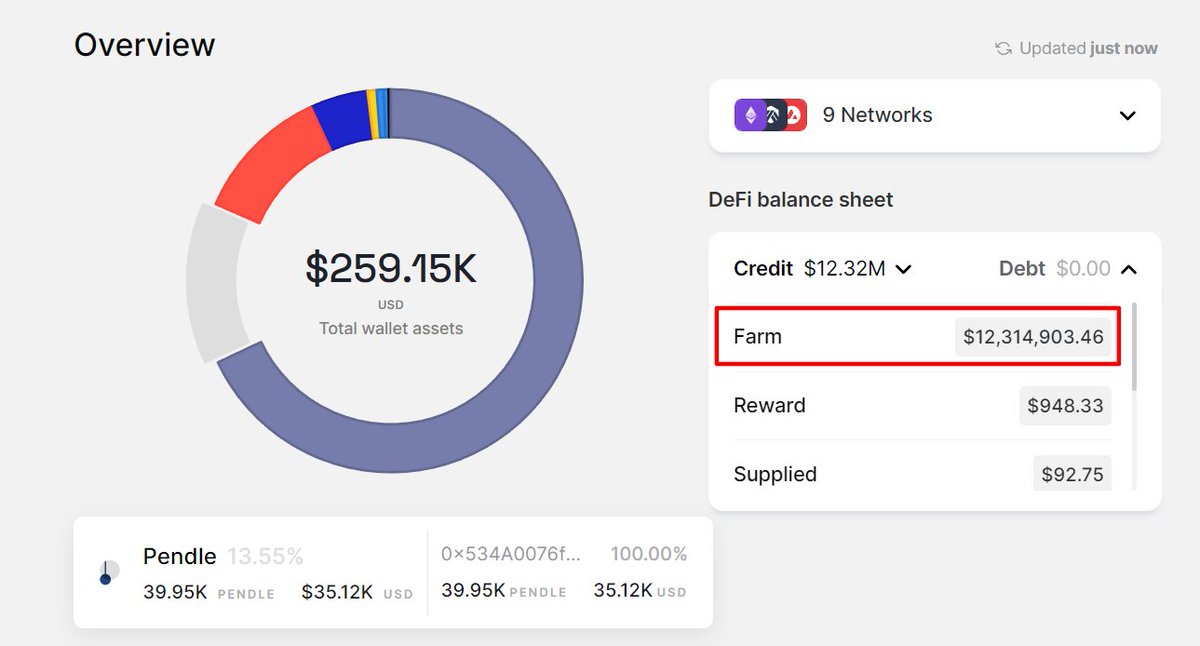

1. @CryptoHayes - 0x534

The former CEO of BitMex first accumulated 200,580 $GMX at $28.5 and has staked ever since.

Other major holdings on his public wallet:

$PENDLE - $35K

$BOND - $30K

The former CEO of BitMex first accumulated 200,580 $GMX at $28.5 and has staked ever since.

Other major holdings on his public wallet:

$PENDLE - $35K

$BOND - $30K

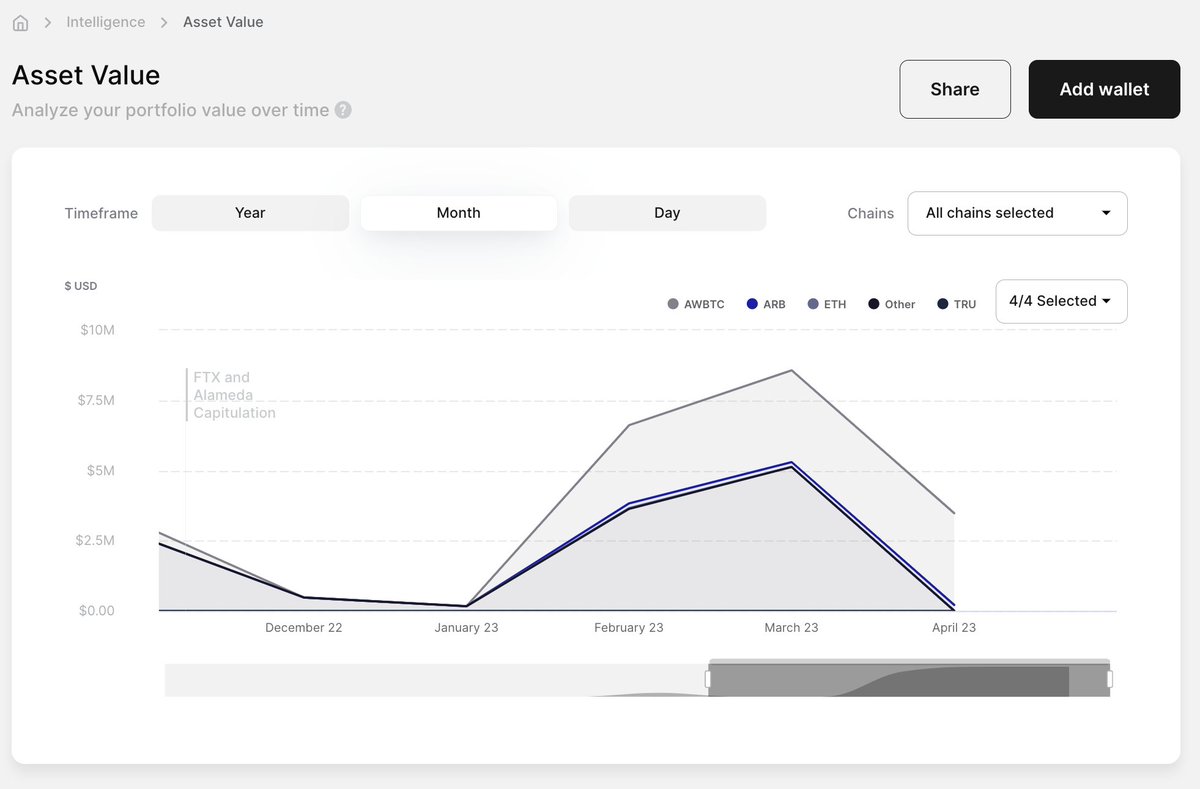

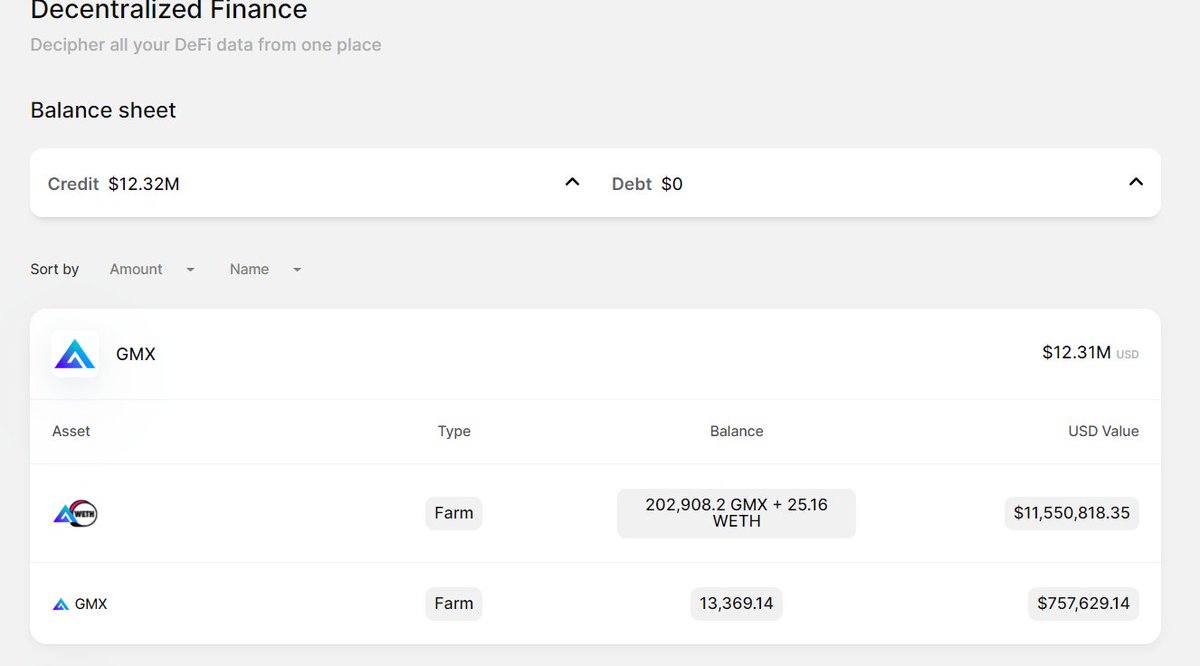

Here, we can have a closer look at his staked $GMX:

LPed in GMX-WETH farm($11.5M)

Single staked GMX($757K)

LPed in GMX-WETH farm($11.5M)

Single staked GMX($757K)

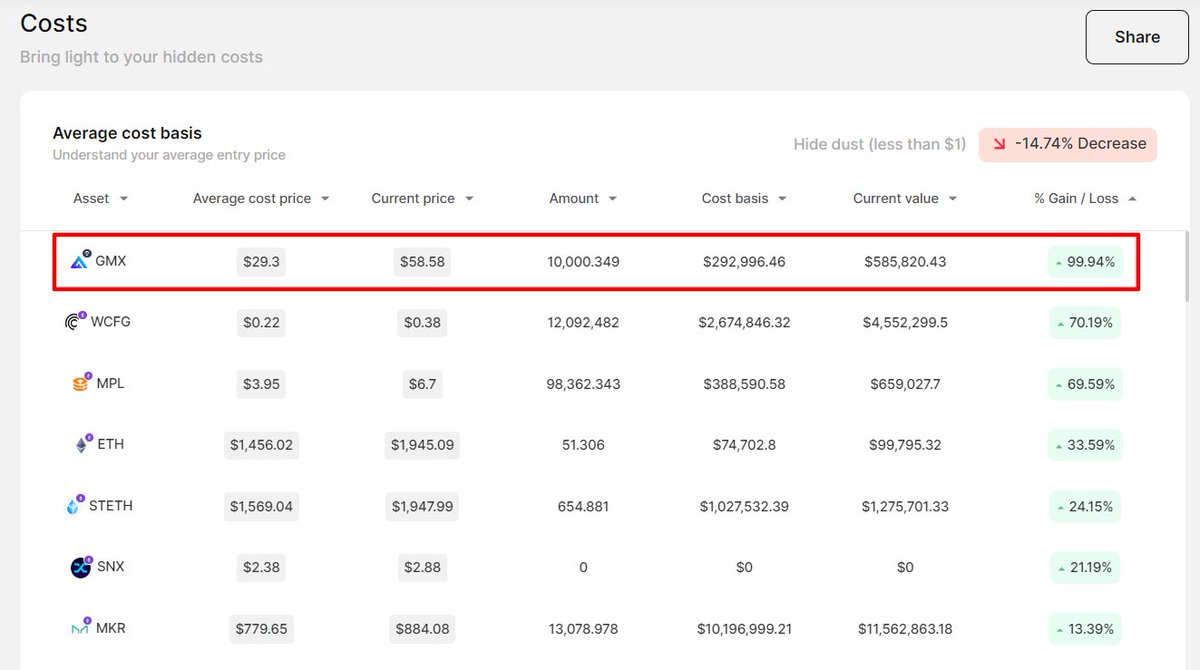

2. 0x58f

$GMX - $585K, Average price - $29.3

This smart money is 100% up and still holding onto his bag.

Other holdings:

$NXM

$RSR

$MPL

DeFi:

Staked 654 ETH($1.2M) on Lido

$GMX - $585K, Average price - $29.3

This smart money is 100% up and still holding onto his bag.

Other holdings:

$NXM

$RSR

$MPL

DeFi:

Staked 654 ETH($1.2M) on Lido

3. 0x297

$GMX - $839K

Here we can see the art of DCA, this smart money has been accumulating $GMX since April in small chunks.

DeFi:

LPed in GMX-WETH farm($434K)

Single staked GMX($5K)

$GMX - $839K

Here we can see the art of DCA, this smart money has been accumulating $GMX since April in small chunks.

DeFi:

LPed in GMX-WETH farm($434K)

Single staked GMX($5K)

These are links to the different wallets. Check it out!

1.

2. https://t.co/RZBqRhsSSw

3. https://t.co/I0sLvum5sRapp.loch.one/home/0x534a007…

app.loch.one/home/0x58f5F06…

app.loch.one/home/0x297903a…

1.

2. https://t.co/RZBqRhsSSw

3. https://t.co/I0sLvum5sRapp.loch.one/home/0x534a007…

app.loch.one/home/0x58f5F06…

app.loch.one/home/0x297903a…

Thanks to these chads who have helped me navigate this market

@MacBubblemaps

@rektdiomedes

@defitrader_

@Dynamo_Patrick

@VirtualKenji

@crypto_linn

@shivsakhuja

@AkadoSang

@CryptoGirlNova

@paulvinitsky

@Louround_

@Only1temmy

@AngeloDodaro

@MacBubblemaps

@rektdiomedes

@defitrader_

@Dynamo_Patrick

@VirtualKenji

@crypto_linn

@shivsakhuja

@AkadoSang

@CryptoGirlNova

@paulvinitsky

@Louround_

@Only1temmy

@AngeloDodaro

I hope you've found this thread informative and simple to understand.

Follow me @Prithvir12 for more insightful content like this.

Like/Retweet the first tweet below if you can as it greatly helps with the algorithm :

Follow me @Prithvir12 for more insightful content like this.

Like/Retweet the first tweet below if you can as it greatly helps with the algorithm :

https://twitter.com/Prithvir12/status/1680930625652682753

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter