How to get URL link on X (Twitter) App

1/ Smart Post: This execution type finds the best price across multiple exchanges and liquidity pools, ensuring minimal slippage. For example, if you want to buy 10 BTC, Smart Post will break it into smaller trades across various platforms to get the best price.

1/ Smart Post: This execution type finds the best price across multiple exchanges and liquidity pools, ensuring minimal slippage. For example, if you want to buy 10 BTC, Smart Post will break it into smaller trades across various platforms to get the best price.

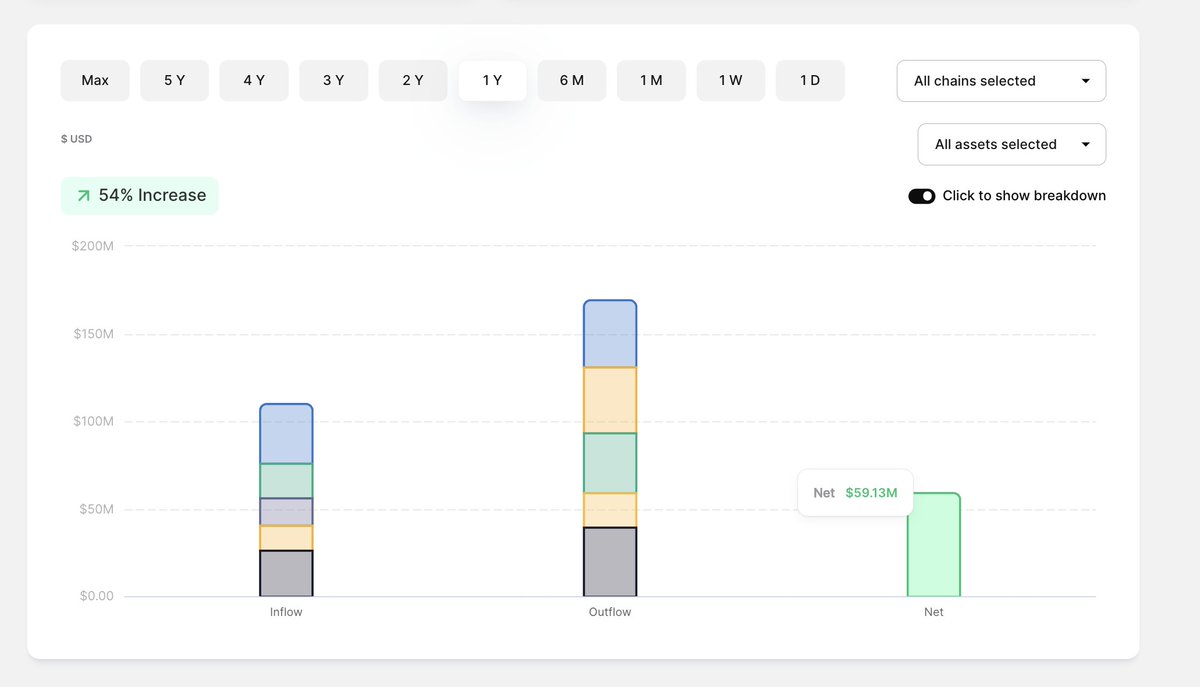

1. Overall Metrics

1. Overall Metrics

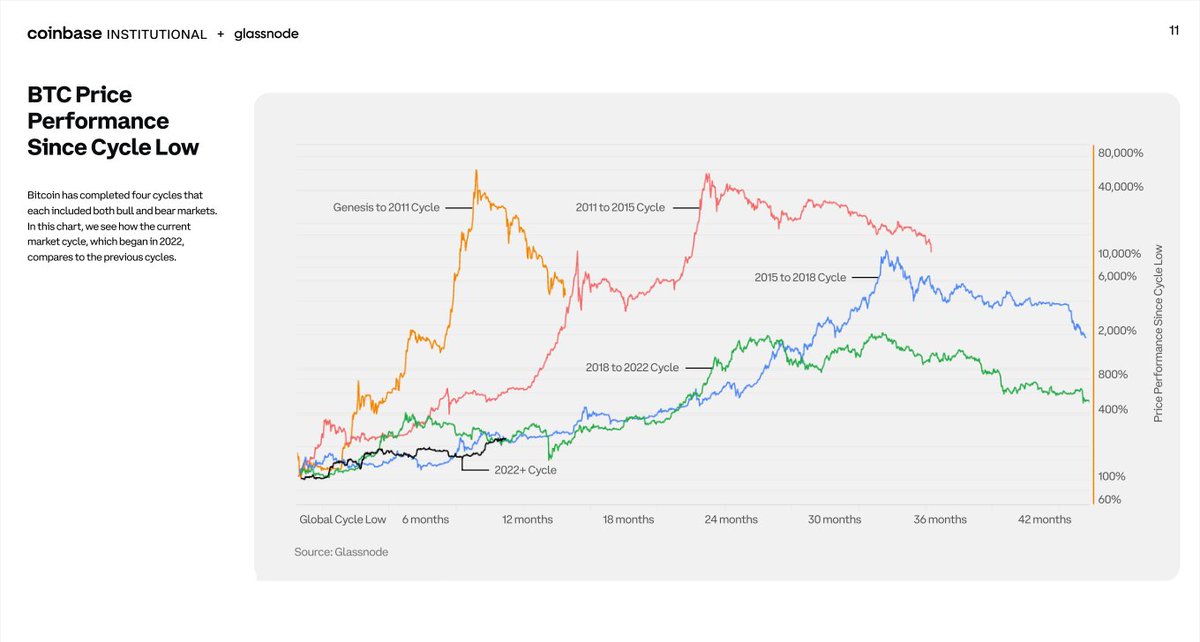

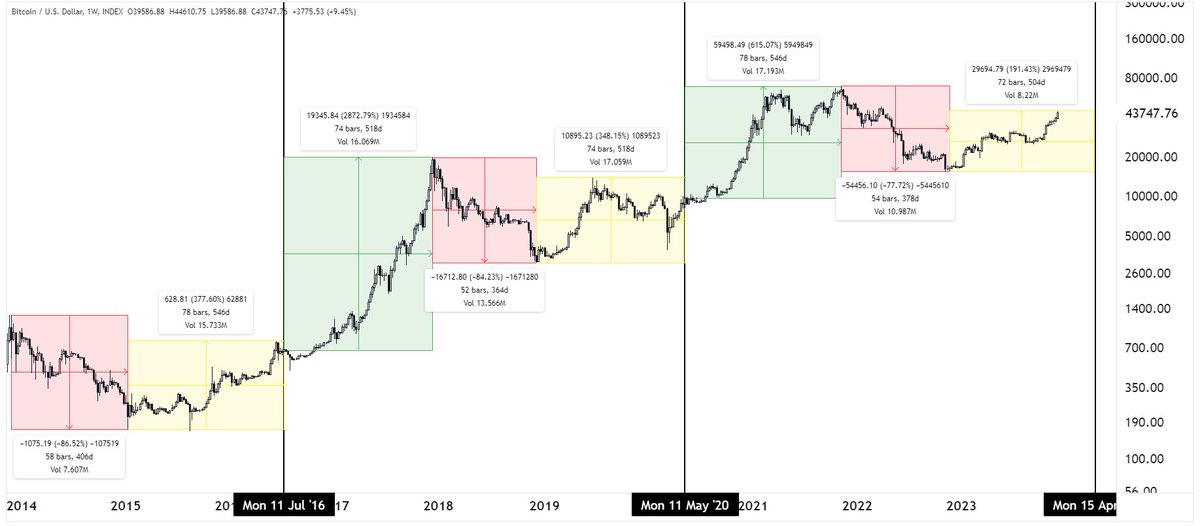

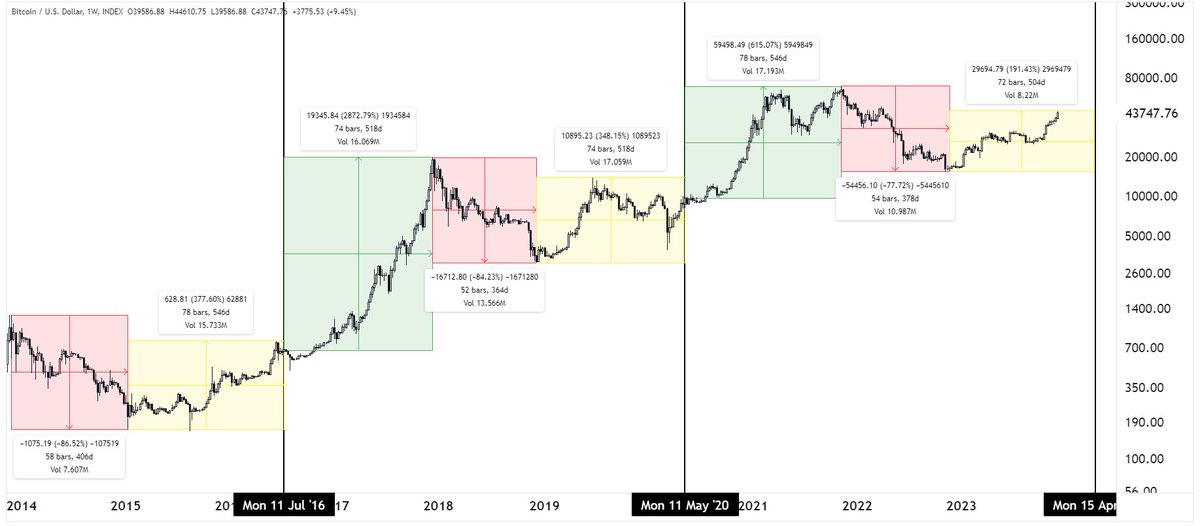

1) $BTC

1) $BTC

1. In this report, we'll explore:

1. In this report, we'll explore:

https://twitter.com/Uniswap/status/1668603580184502276?s=20

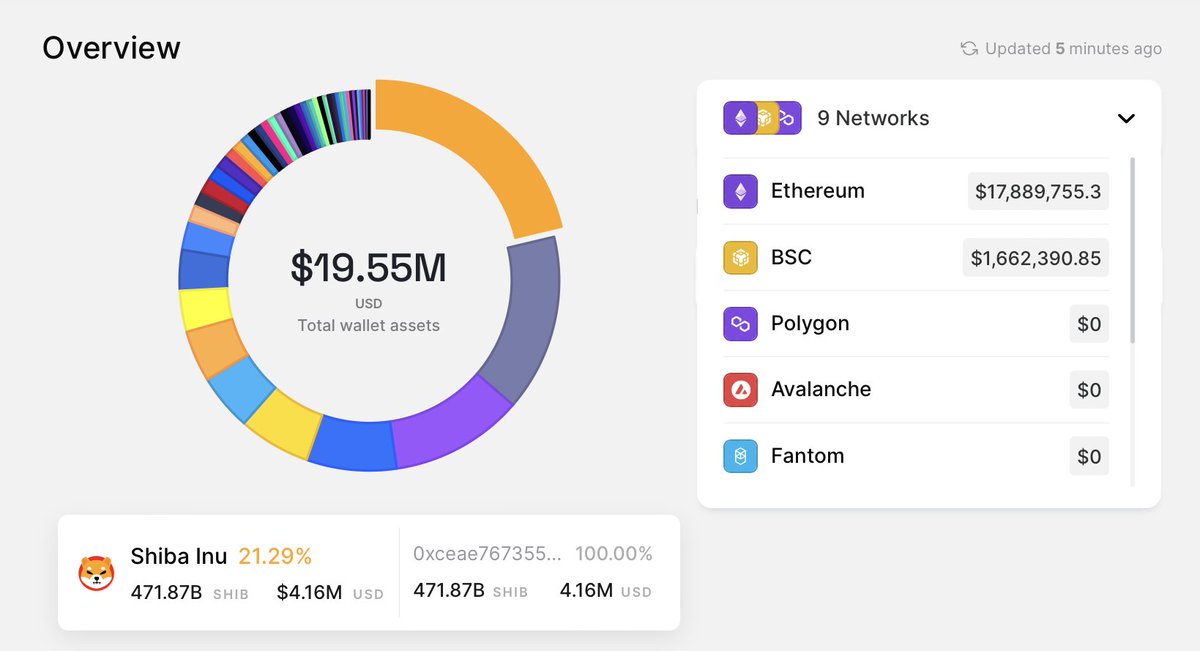

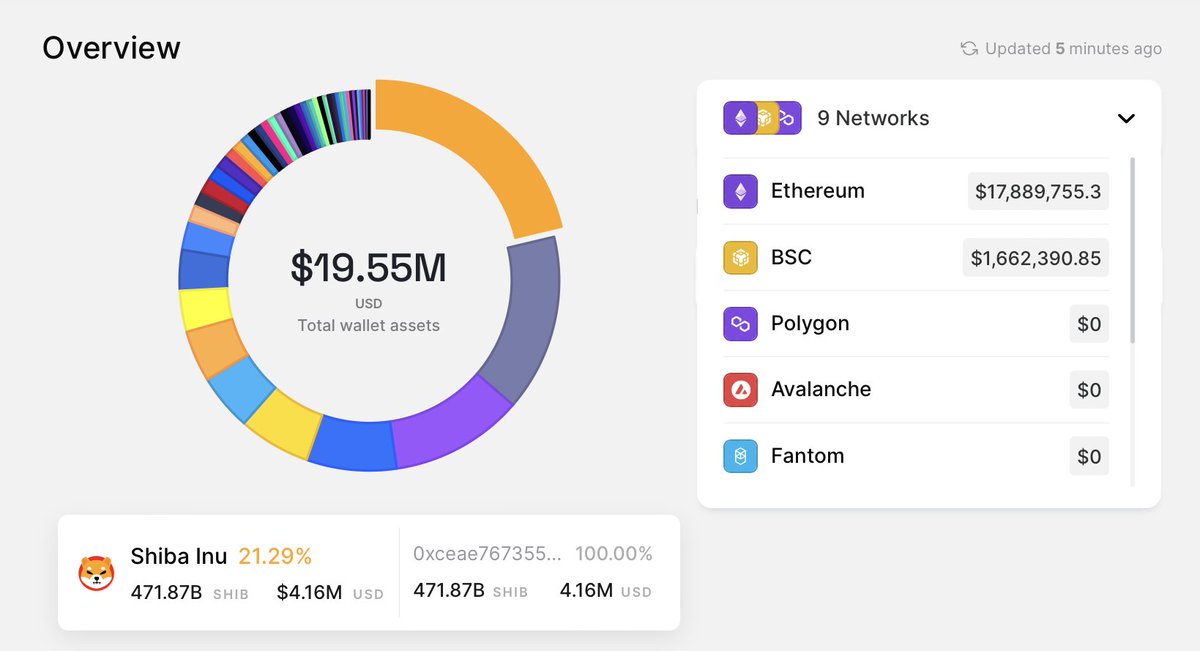

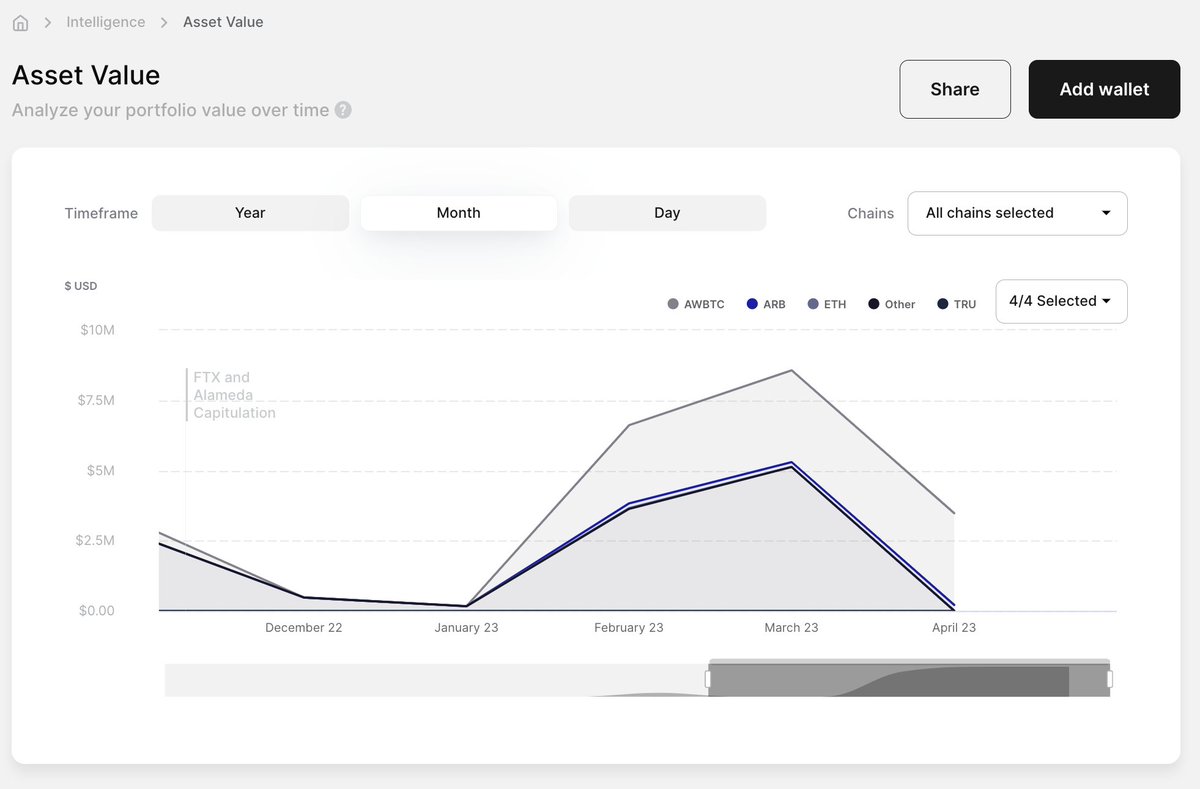

1) He DCA'd into $WBTC and $ETH at good levels.

1) He DCA'd into $WBTC and $ETH at good levels.

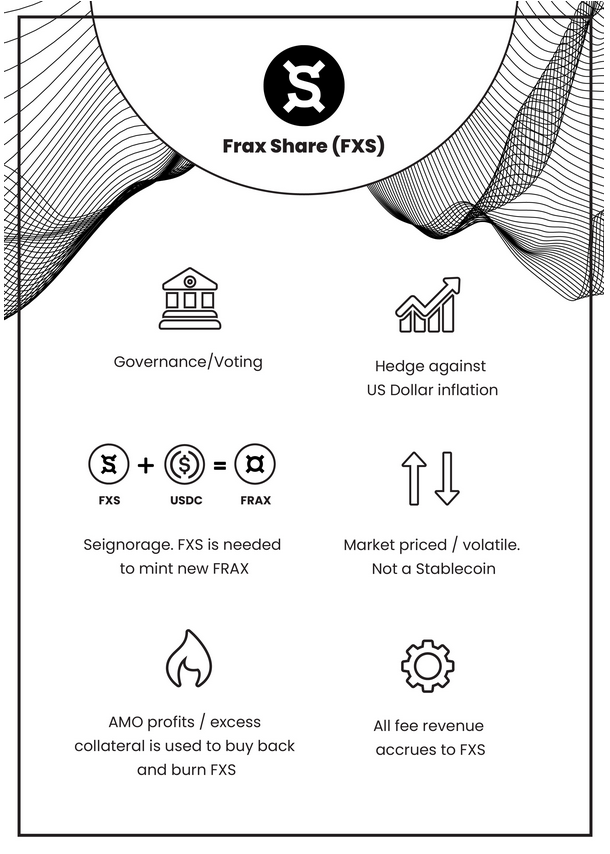

1. Token float risk:

1. Token float risk: