As "quantitative tapering" continues, you'll see an enormous number of bad takes about "collapsing" M2, bank credit and so forth.

It will help to understand it's not loans that are declining, but idle cash reserves, held indirectly by depositors, well in excess of FDIC coverage.

It will help to understand it's not loans that are declining, but idle cash reserves, held indirectly by depositors, well in excess of FDIC coverage.

2/ QE didn't encourage greater lending by banks. Bank lending since 2008 has grown at just 3.4% - slowest growth rate in U.S. history.

QE created a pile of (previously) zero-interest reserves that someone had to hold, everyone wanted to get rid of, and in aggregate, could not. https://t.co/fMqmjfPWBytwitter.com/i/web/status/1…

QE created a pile of (previously) zero-interest reserves that someone had to hold, everyone wanted to get rid of, and in aggregate, could not. https://t.co/fMqmjfPWBytwitter.com/i/web/status/1…

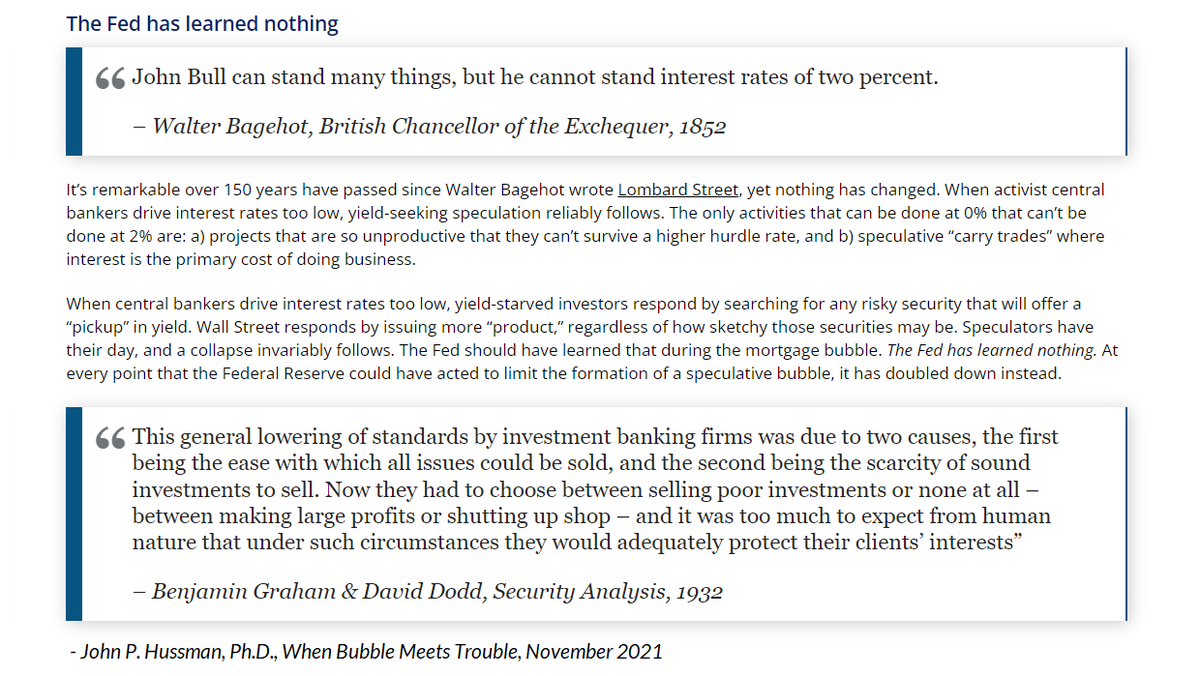

3/ So what did QE accomplish? For more than a decade, someone - in aggregate - had to hold those Fed liabilities at zero. That discomfort caused investors to lose their minds trying to pass it off, buyer to seller, driving other investment assets to zero prospective returns. https://t.co/mj3ucsk0Xgtwitter.com/i/web/status/1…

4/ The problem is that market cap is not "wealth." The wealth is in the cash flows. Extreme valuation only allows one holder to obtain a wealth transfer from some buyer who will hold the bag. Deferring risk does not eliminate risk. Here's what over a decade of ZIRP has created. https://t.co/JXYftA5lhztwitter.com/i/web/status/1…

5/ Here is what people are calling a "new bull market." On our most historically reliable measure, equity valuations are more extreme than at any point in U.S. history prior to December 2020, with the exception of a few weeks surrounding the 1929 peak.

6/ Same valuation metric versus actual subsequent 12-year S&P 500 nominal total returns in data since 1928

More on valuations, popular "but what about" considerations, and other details here: https://t.co/LkOi7QndWhhussmanfunds.com/comment/mc2302…

More on valuations, popular "but what about" considerations, and other details here: https://t.co/LkOi7QndWhhussmanfunds.com/comment/mc2302…

7/ Same metric with S&P 500 levels. The dotted lines use prevailing Treasury bond yields at each point in time to show levels that would be associated with varying "risk premiums" relative to bonds. The yellow bubbles show where estimated S&P 500 return vs bonds was negative.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter