1/ a short summary of a recent talk on silicon, satoshis, and superpowers

power in our world is changing. a decade ago, oil and gas companies and banks ruled markets. now it's tech companies and financialization runs rampant (>100x P/E ratios etc)

power in our world is changing. a decade ago, oil and gas companies and banks ruled markets. now it's tech companies and financialization runs rampant (>100x P/E ratios etc)

2/ as our lives become increasingly digitized, value creation is happening on a new frontier, and a handful of industries and companies are well positioned to capitalize on this shift

3/ this is also impacting the geopolitical landscape. we live in a multipolar world, and power has historically been dependent on the ability of a nation to secure access to natural resources, namely oil

4/ but there's a new power structure emerging.

numerous corporations book annual revenues > than the GDP of G20 economies. people are spending insane amounts of time and energy in virtual worlds. and public blockchain protocols are growing in power and influence.

numerous corporations book annual revenues > than the GDP of G20 economies. people are spending insane amounts of time and energy in virtual worlds. and public blockchain protocols are growing in power and influence.

5/ so as an investor, i ask myself - how should i position my portfolio?

energy, compute, and digital currency will make this digital, multi-polar future possible

energy, compute, and digital currency will make this digital, multi-polar future possible

6/ one idea i keep coming back to is this - producing and processing bits and bytes (in the digital world) still requires atoms (in the physical world)

we don't often talk about these in the same context, but both matter

we don't often talk about these in the same context, but both matter

7/ let's start with energy

more technology means generating and consuming more energy. our culture loves vilifying energy consumption, but it is an inescapable reality of human progress.

while renewables generation is growing, fossil fuels still dominate our energy mix

more technology means generating and consuming more energy. our culture loves vilifying energy consumption, but it is an inescapable reality of human progress.

while renewables generation is growing, fossil fuels still dominate our energy mix

8/ but there are new models for energy generation and management, below are some that i'm excited about

- new energy sources are needed - i am a big proponent of nuclear, esp SMRs (small modular reactors) from co's like @oklo and @NuScale_Power

- the growth of peer to peer… https://t.co/ynLvIur4gDtwitter.com/i/web/status/1…

- new energy sources are needed - i am a big proponent of nuclear, esp SMRs (small modular reactors) from co's like @oklo and @NuScale_Power

- the growth of peer to peer… https://t.co/ynLvIur4gDtwitter.com/i/web/status/1…

@oklo @NuScale_Power 9/ next, compute and connectivity

access to on-demand high performance compute and connectivity is constrained by (a) supply - there simply isn't enough of it, and (b) physics - data isn’t massless (crazy innit) and doesn’t travel in a straight line

access to on-demand high performance compute and connectivity is constrained by (a) supply - there simply isn't enough of it, and (b) physics - data isn’t massless (crazy innit) and doesn’t travel in a straight line

@oklo @NuScale_Power 10/ but there are exciting new models that could help ease some of these practical constraints

- new types of semiconductors are leveraging innovations in materials science, like graphene, to ease supply chain and production bottlenecks to lower costs and innovating in chip… https://t.co/Yx5HX53z7Otwitter.com/i/web/status/1…

- new types of semiconductors are leveraging innovations in materials science, like graphene, to ease supply chain and production bottlenecks to lower costs and innovating in chip… https://t.co/Yx5HX53z7Otwitter.com/i/web/status/1…

@oklo @NuScale_Power 11/ and so we come to my favorite topic, cryptocurrency. bitcoin is money backed by energy and compute.

an increasingly digital world will require a native currency for transacting between not only billions of humans but the trillions of AI agents and connected devices

an increasingly digital world will require a native currency for transacting between not only billions of humans but the trillions of AI agents and connected devices

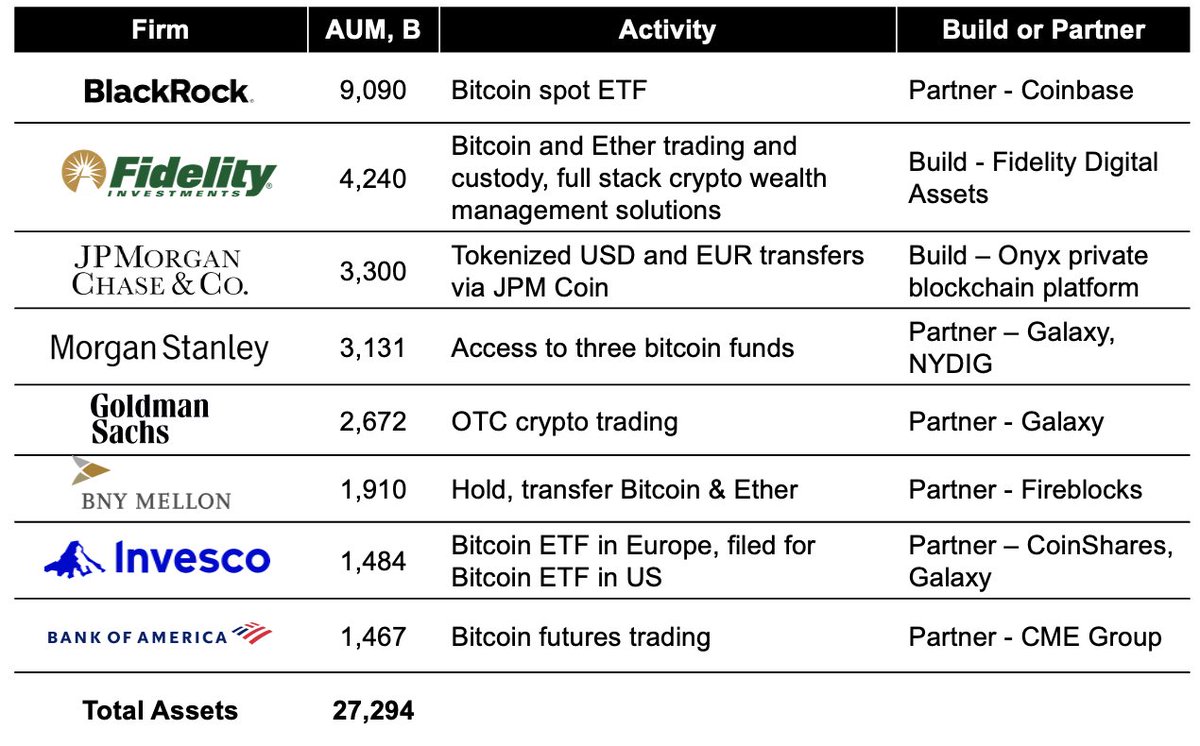

@oklo @NuScale_Power 12/ aside from fueling the digital economy, there's a much larger opportunity at stake for cryptocurrencies and public blockchain networking to provide the substrate for the trillions of dollars of infrastructure investment needed to usher in the future

whether you call it RWAs… https://t.co/mrUCvIteOStwitter.com/i/web/status/1…

whether you call it RWAs… https://t.co/mrUCvIteOStwitter.com/i/web/status/1…

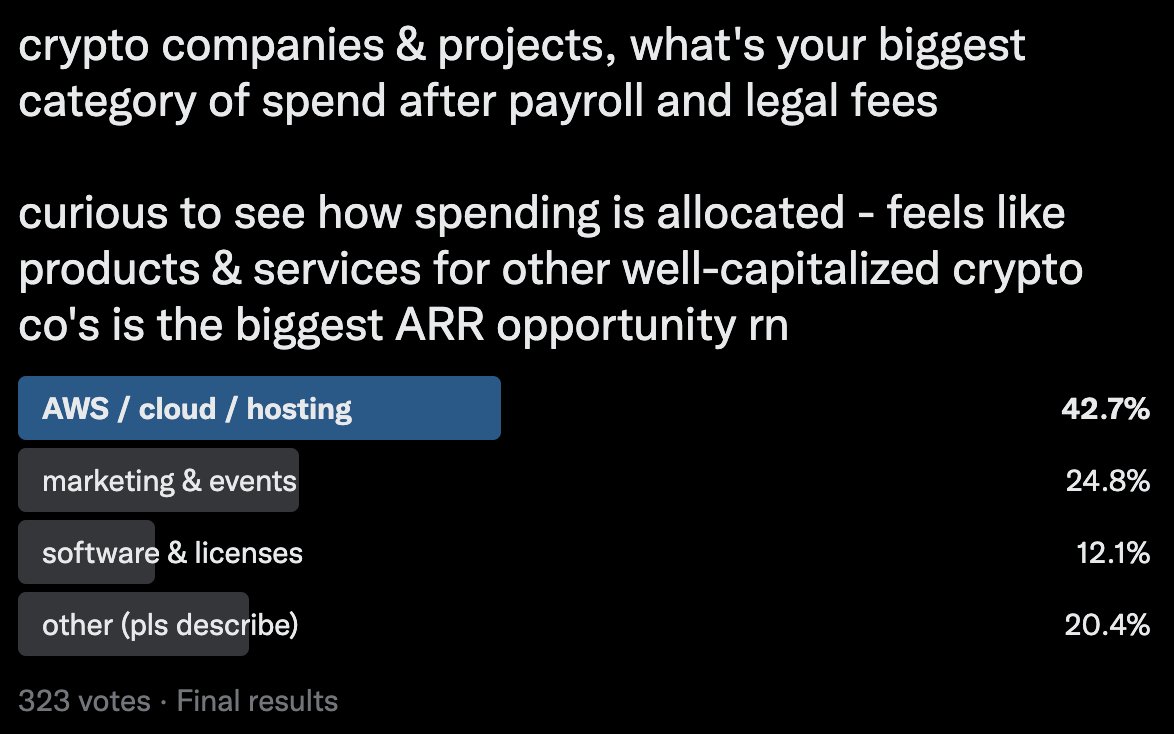

@oklo @NuScale_Power 13/ we are still in the early days of exploring how crypto primitives can change the unit economics of infrastructure investing

many of the early experiments have not succeeded when it comes to adoption and scale, but have demonstrated the potential of shifting from a corporate… https://t.co/nd8WEj2boEtwitter.com/i/web/status/1…

many of the early experiments have not succeeded when it comes to adoption and scale, but have demonstrated the potential of shifting from a corporate… https://t.co/nd8WEj2boEtwitter.com/i/web/status/1…

@oklo @NuScale_Power 14/ Bitcoin (and PoW Ethereum) have catalyzed billions of dollars of investment in physical infrastructure in the form of ASICs co-located with renewable generational assets (and GPUs) and now support trillions of dollars in annual economic activity with this physical… https://t.co/YUO9aS3pGCtwitter.com/i/web/status/1…

@oklo @NuScale_Power 15/ i'm excited to continue exploring this intersection, and looking forward to working with companies and projects in the crypto ecosystem to bend the arc of reality in our digital and physical world alike

it's time to build... power plants and data centers!

it's time to build... power plants and data centers!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter