THE INFLATION MIRACLE WILL NOT LAST - a 🧵for smart people

Inflation fell to 4.8% YoY in June and 0.2% MoM in June, 10 bp below expectations.

Core CPI was also better than expected.

Is this the end of the great inflation scare?

Inflation fell to 4.8% YoY in June and 0.2% MoM in June, 10 bp below expectations.

Core CPI was also better than expected.

Is this the end of the great inflation scare?

First, we need to understand why inflation dropped

The energy CPI fell by 16.5%, which shave 1.1 pct off the CPI

Since oil prices collapsed in H2 2022, base effects will turn into a headwind

At constant prices, energy should start having a positive impact on inflation in Sep

The energy CPI fell by 16.5%, which shave 1.1 pct off the CPI

Since oil prices collapsed in H2 2022, base effects will turn into a headwind

At constant prices, energy should start having a positive impact on inflation in Sep

Second, airfare and car rental prices dropped at annual clip of 18.9% and 12.4% as prices normalized from their re-opening spikes.

Car rentals prices were messed up by COVID

Also, we just broke a new record for planes in the air & jet fuel prices are up by 14%this month

Car rentals prices were messed up by COVID

Also, we just broke a new record for planes in the air & jet fuel prices are up by 14%this month

Third, the price of used cars dropped by 0.5% last month, following a 4.4% increase in June.

Used car prices shaved about 10 basis from MoM CPI, fully explaining the positive surprise for June.

Based on the Manheim Used Car Value index, this could last for another 2 months

Used car prices shaved about 10 basis from MoM CPI, fully explaining the positive surprise for June.

Based on the Manheim Used Car Value index, this could last for another 2 months

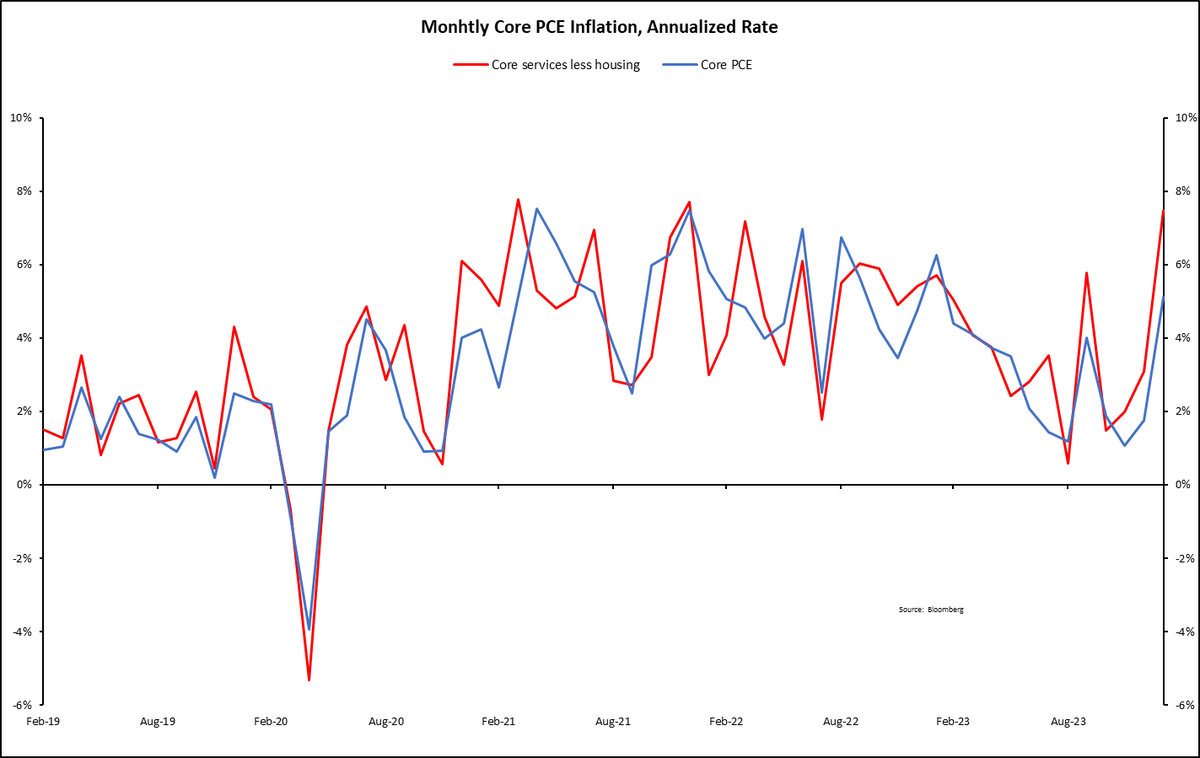

Fourth, medical care services prices dropped by 0.8% year-over-year in June. Healthcare has been a consistent drag on inflation since COVID.

The drop in healthcare inflation is a technical glitch, rather than a true fall in costs.

The drop in healthcare inflation is a technical glitch, rather than a true fall in costs.

The medical CPI is based on lagged data, even more so than other CPI categories. Prescription drug prices do not immediately reflect the introduction of new, high-priced drugs.

Health insurance prices are derived from insurers' retained earnings and do not reflect paid premia.

Health insurance prices are derived from insurers' retained earnings and do not reflect paid premia.

Filings with state regulators for 2023 by ACA marketplace insurance show premium increase of 10% in 2023

Source: Peterson Center on HC

Source: Peterson Center on HC

Also, wages for doctors and nurses are soaring due to shortages.

Nurse Theroy gives advice on "How Nurse Can Make $300k Per Year" (good for them!)

https://t.co/TOq1iptl77nursetheory.com/how-registered…

Nurse Theroy gives advice on "How Nurse Can Make $300k Per Year" (good for them!)

https://t.co/TOq1iptl77nursetheory.com/how-registered…

Given its weight in the CPI, a normalization ogf healthcare inflation to its pre-COVID average of 4% would add 40 bp to the CPI.

Going to the median CPI of 6.4% would add 64 bp to the CPI. OUCH!

Going to the median CPI of 6.4% would add 64 bp to the CPI. OUCH!

Based on base effects and the 12% rally in oil prices since June, I expect inflation to re-accelerate to 0.3% MoM and 3.4% YoY in July.

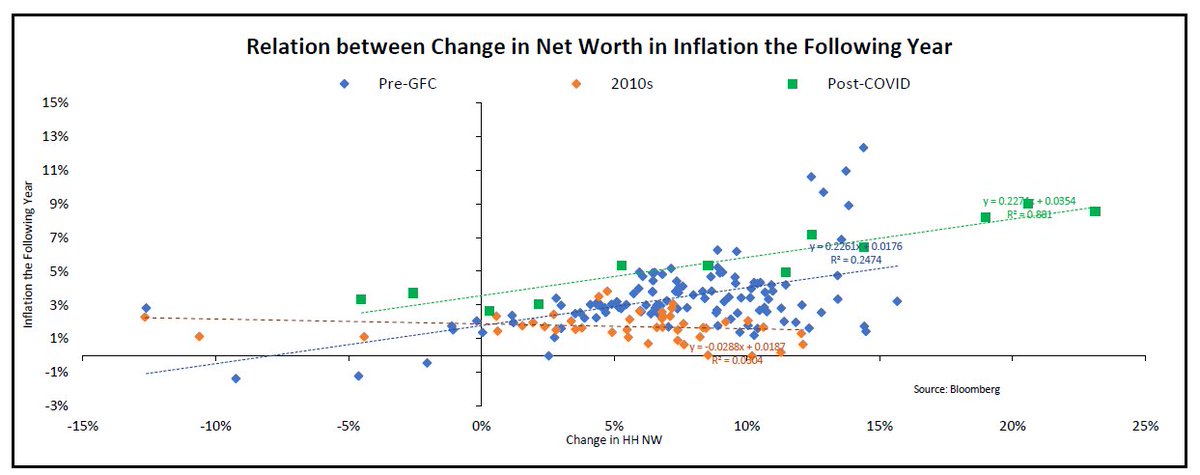

Long-term I beleive inflation will settle at a plateau of 3-5%, which is not a problem per se - there is nothing magical about the 2% target.

Long-term I beleive inflation will settle at a plateau of 3-5%, which is not a problem per se - there is nothing magical about the 2% target.

Keep in mind that inflation always comes in waves!

There were 3 waves in the late 40s and 50s inflation, and 3 peaks in the 70s

We just had the first peak, but the curve does not price the second and third peaks

That is bad for long duration assets, especially growth stocks

There were 3 waves in the late 40s and 50s inflation, and 3 peaks in the 70s

We just had the first peak, but the curve does not price the second and third peaks

That is bad for long duration assets, especially growth stocks

Want more insights like this?

Sign up for a free trial of my research at

.. and catch me on podcasts and RealVision.

/fin.marketintel.intlfcstone.com/MIPublic/Landi…

Sign up for a free trial of my research at

.. and catch me on podcasts and RealVision.

/fin.marketintel.intlfcstone.com/MIPublic/Landi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh