Director of global macro for @stoneX_official

Prof of finance at Saint Mary's College and (former) CFA Society

Not investment advice, it is just a X account

10 subscribers

How to get URL link on X (Twitter) App

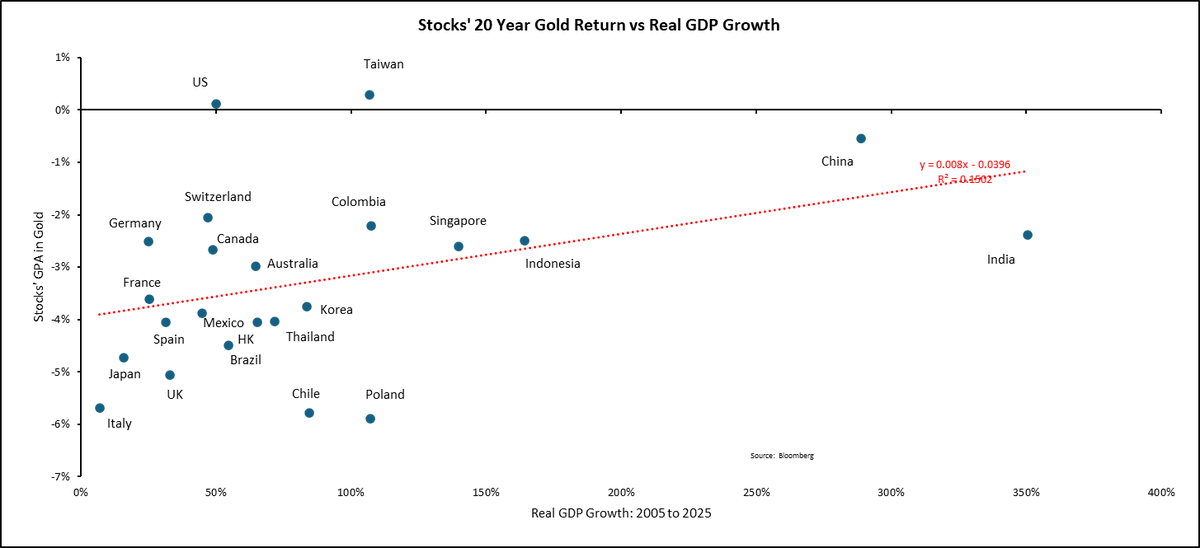

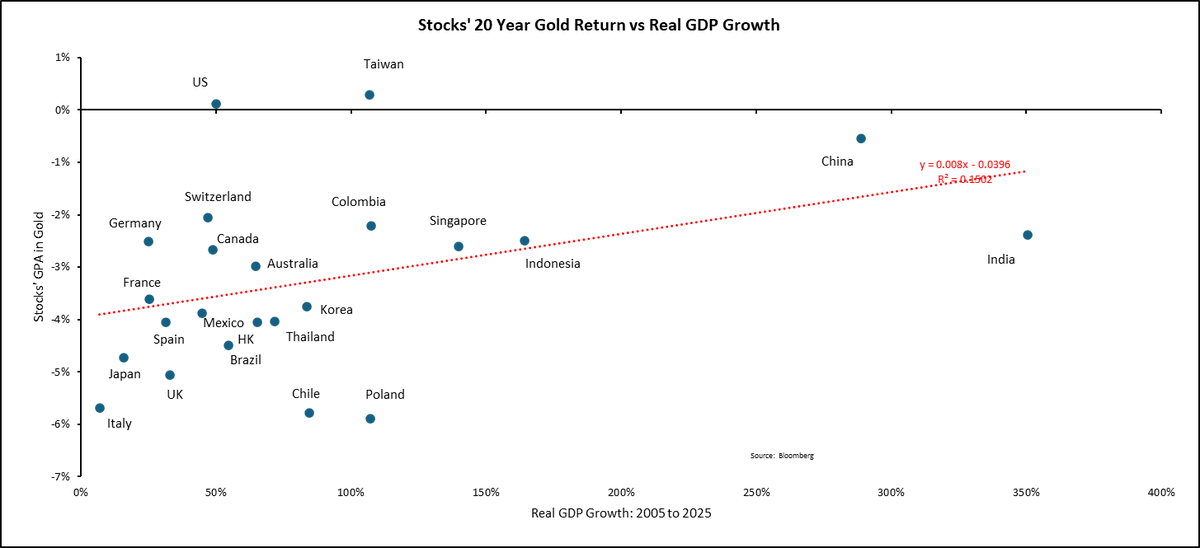

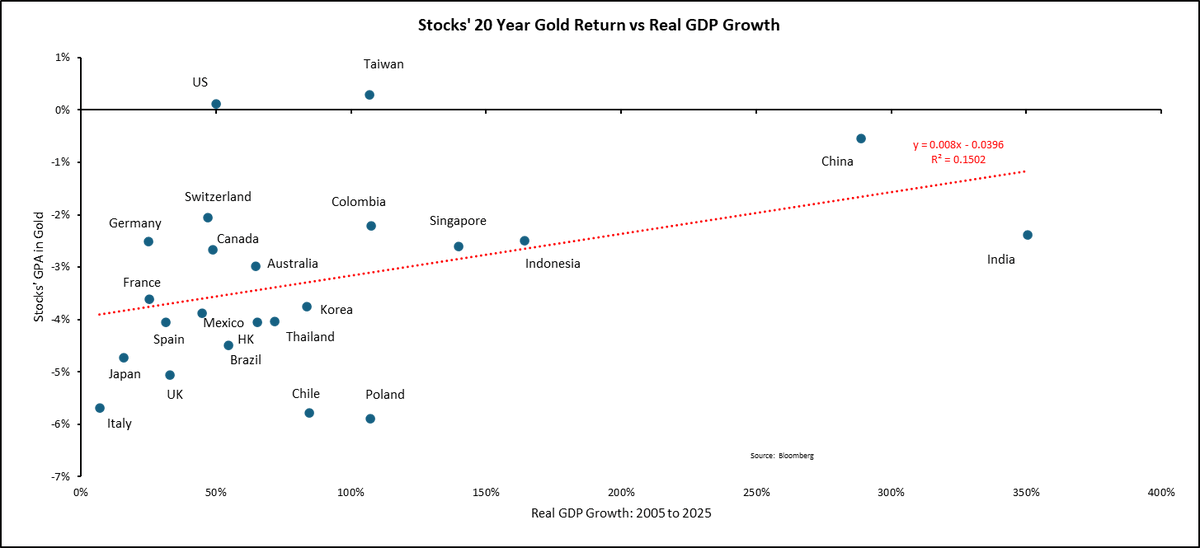

First, there is little relation between economic growth and stocks' return, even over 20 years

First, there is little relation between economic growth and stocks' return, even over 20 years

First, the Good - Shelter

First, the Good - Shelter

Please spare me knee-jerk political comments

Please spare me knee-jerk political comments

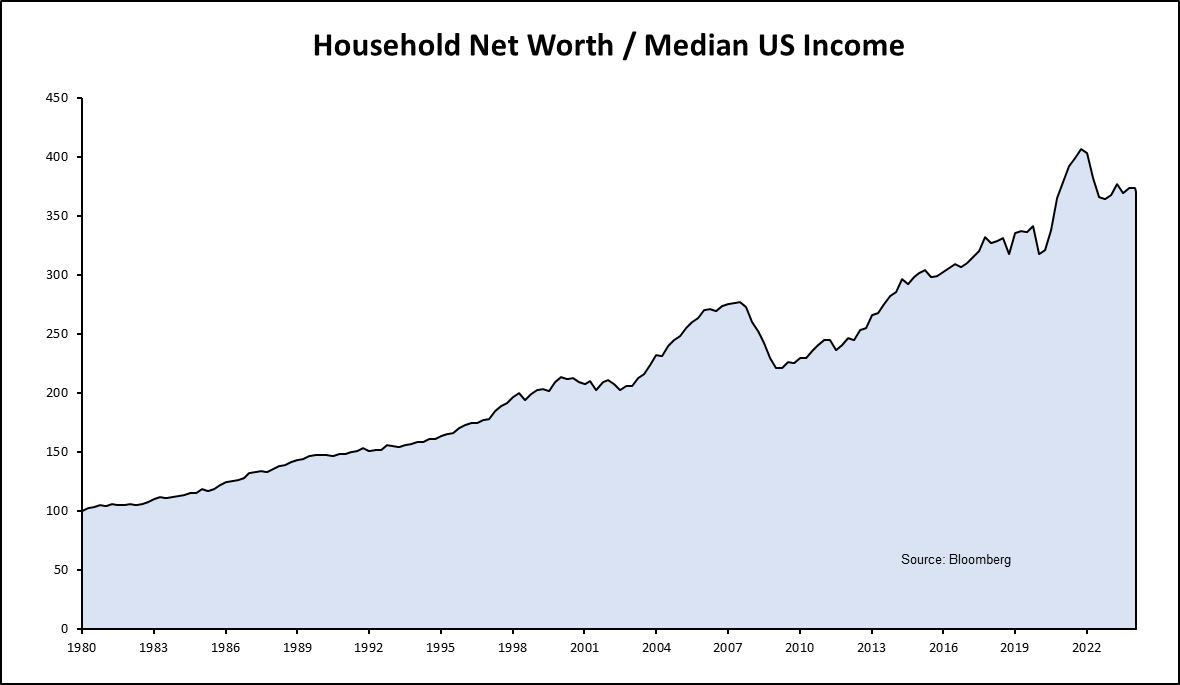

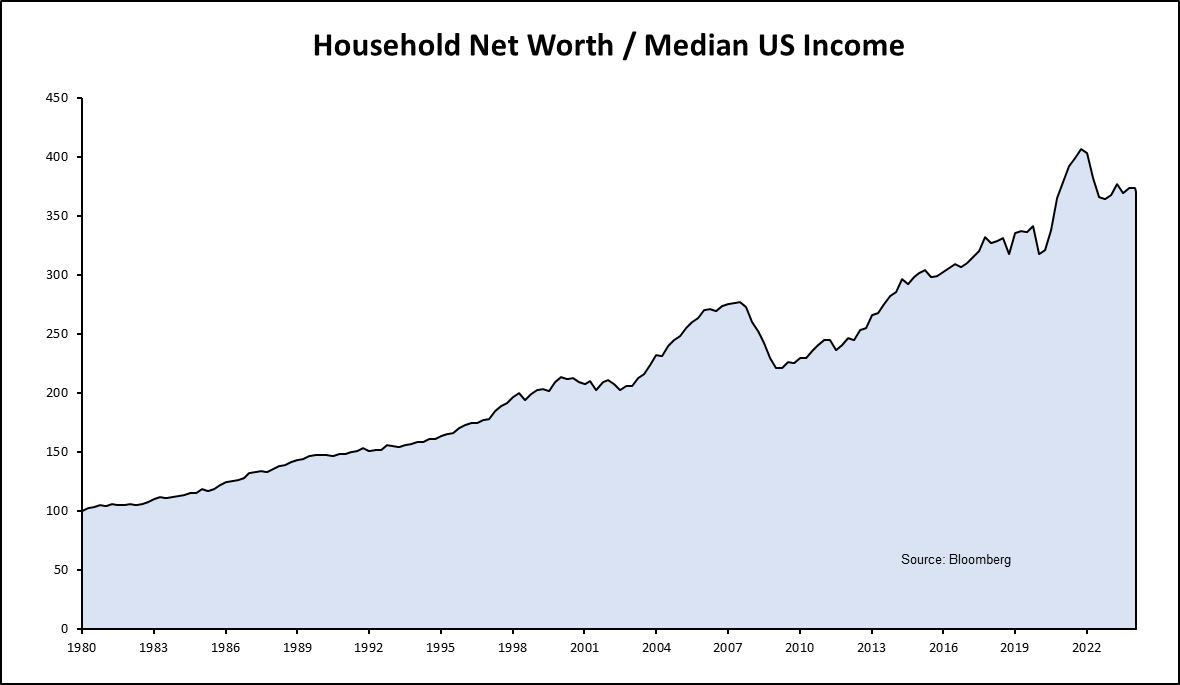

This chart summarizes the 700 pages of Piketty's Capital in the 21st Century

This chart summarizes the 700 pages of Piketty's Capital in the 21st Century

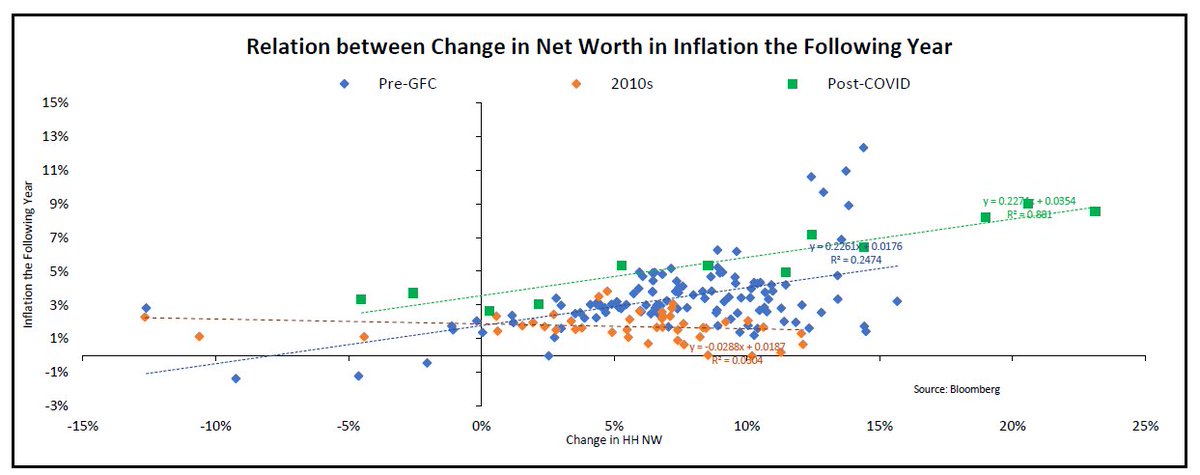

In the 2010s, the wealth effect channel was clogged -when Bernanke needed it

In the 2010s, the wealth effect channel was clogged -when Bernanke needed it

In the deflationist view, inflation is the CPI, and what gets measured is what matters.

In the deflationist view, inflation is the CPI, and what gets measured is what matters.

Shelter should be disinflationary in 2024, right?

Shelter should be disinflationary in 2024, right?

However, most gig economy prices are consolidating

However, most gig economy prices are consolidating

#1 COLA AND INCOME TAX BRACKET INCREASE

#1 COLA AND INCOME TAX BRACKET INCREASE

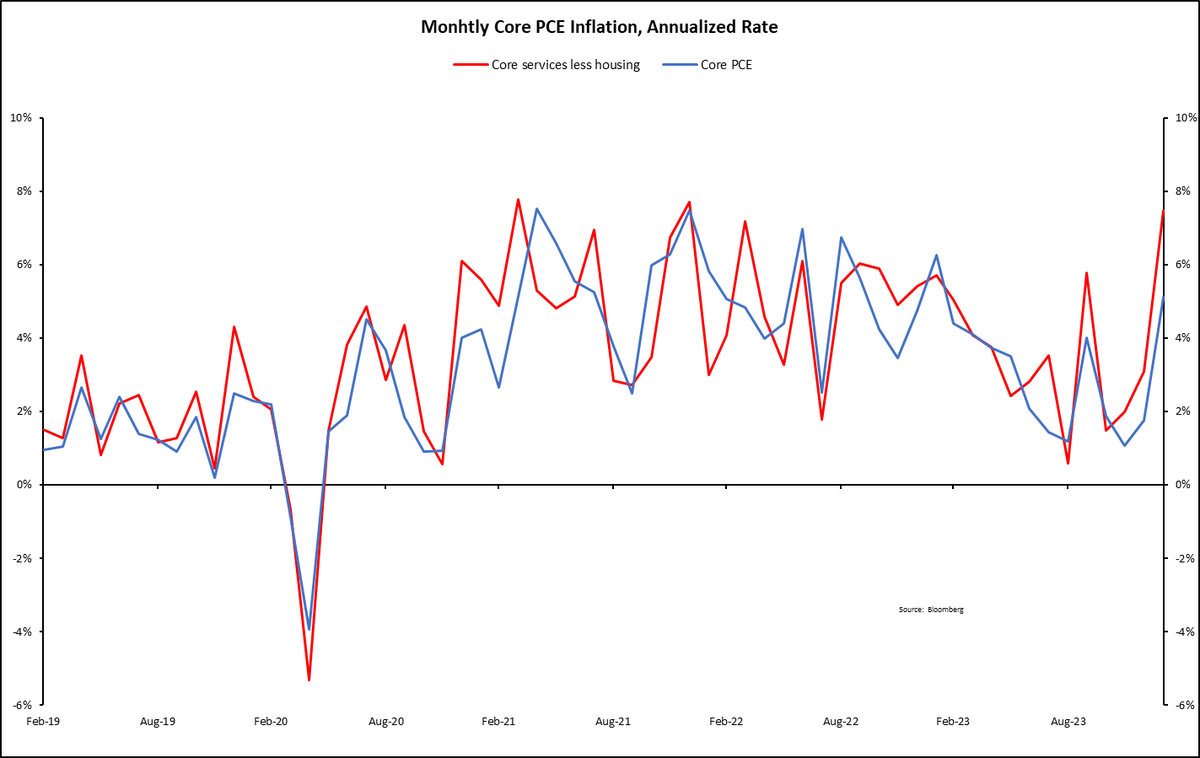

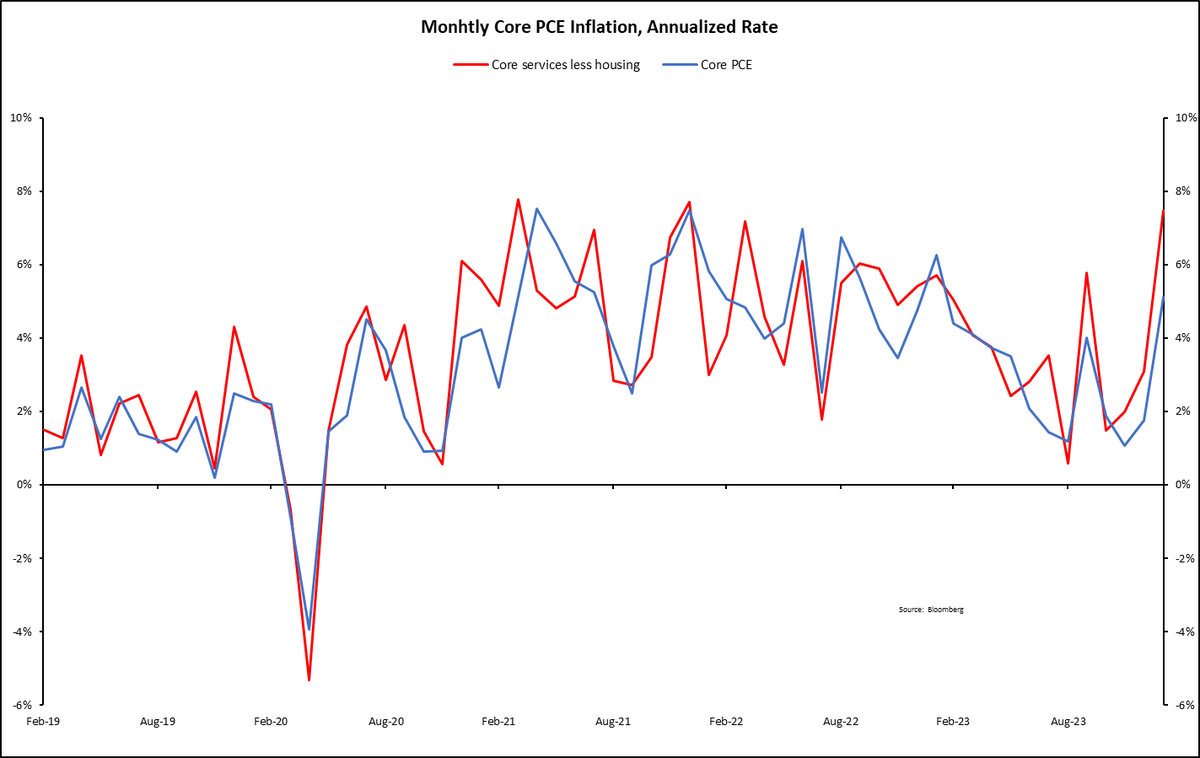

First, we need to understand why inflation dropped

First, we need to understand why inflation dropped

This behavior can be explained by an oligopolistic pricing model with variable elasticity

This behavior can be explained by an oligopolistic pricing model with variable elasticity

Turning to rents, nationawide average is $28 /sq ft, 30% more than during the GFC.

Turning to rents, nationawide average is $28 /sq ft, 30% more than during the GFC.

Besides the budget balance, two factors drive public-debt-to-GDP ratios

Besides the budget balance, two factors drive public-debt-to-GDP ratios

In addition, Meta issued $37 billion in stock-based compensation – effectively using buybacks to transfer the cost of its fabulous stock-option packages to shareholders.

In addition, Meta issued $37 billion in stock-based compensation – effectively using buybacks to transfer the cost of its fabulous stock-option packages to shareholders.

First, inflation was ignored... then it was called transitory... it was just base effects ... then it was blamed on lumber ... then car prices ... then supply chain disruptions ... then airfare tickets ... then Russia.

First, inflation was ignored... then it was called transitory... it was just base effects ... then it was blamed on lumber ... then car prices ... then supply chain disruptions ... then airfare tickets ... then Russia.

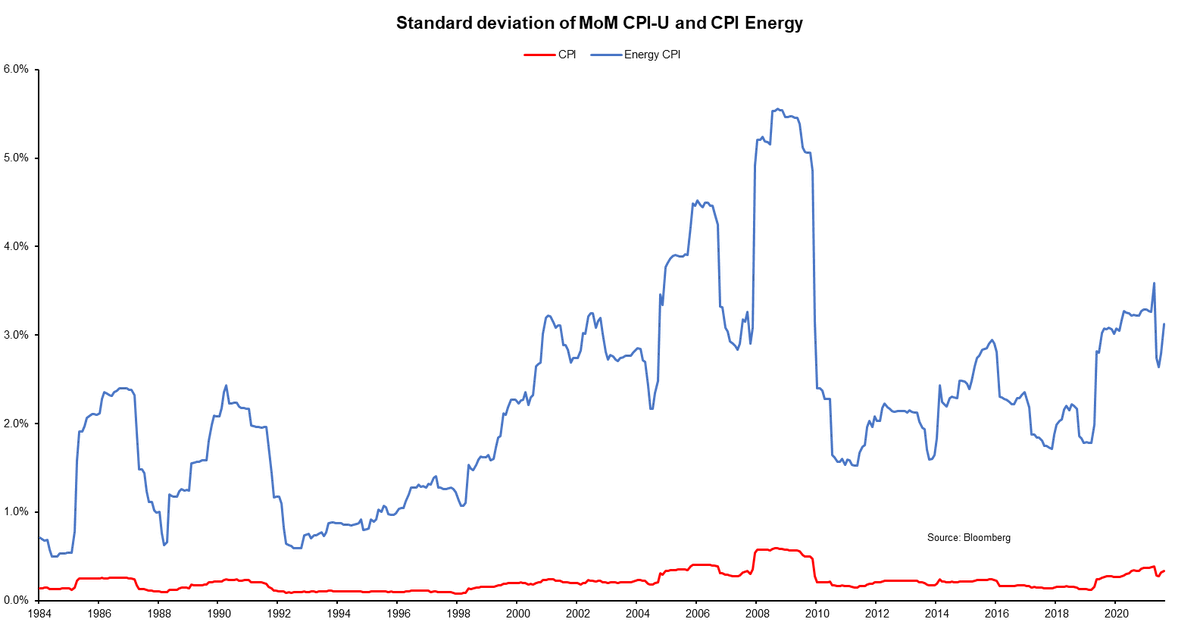

This is a common problem for portfolio managers. A high-variance asset will cause most of the fund's volatility, even if it has a low weight (BTW that is the case for risk-parity)

This is a common problem for portfolio managers. A high-variance asset will cause most of the fund's volatility, even if it has a low weight (BTW that is the case for risk-parity)

Yeah, I know, I just annualized returns observed 5 weeks, and I have taken a stats class

Yeah, I know, I just annualized returns observed 5 weeks, and I have taken a stats class

The indicator also works for HY spreads

The indicator also works for HY spreads