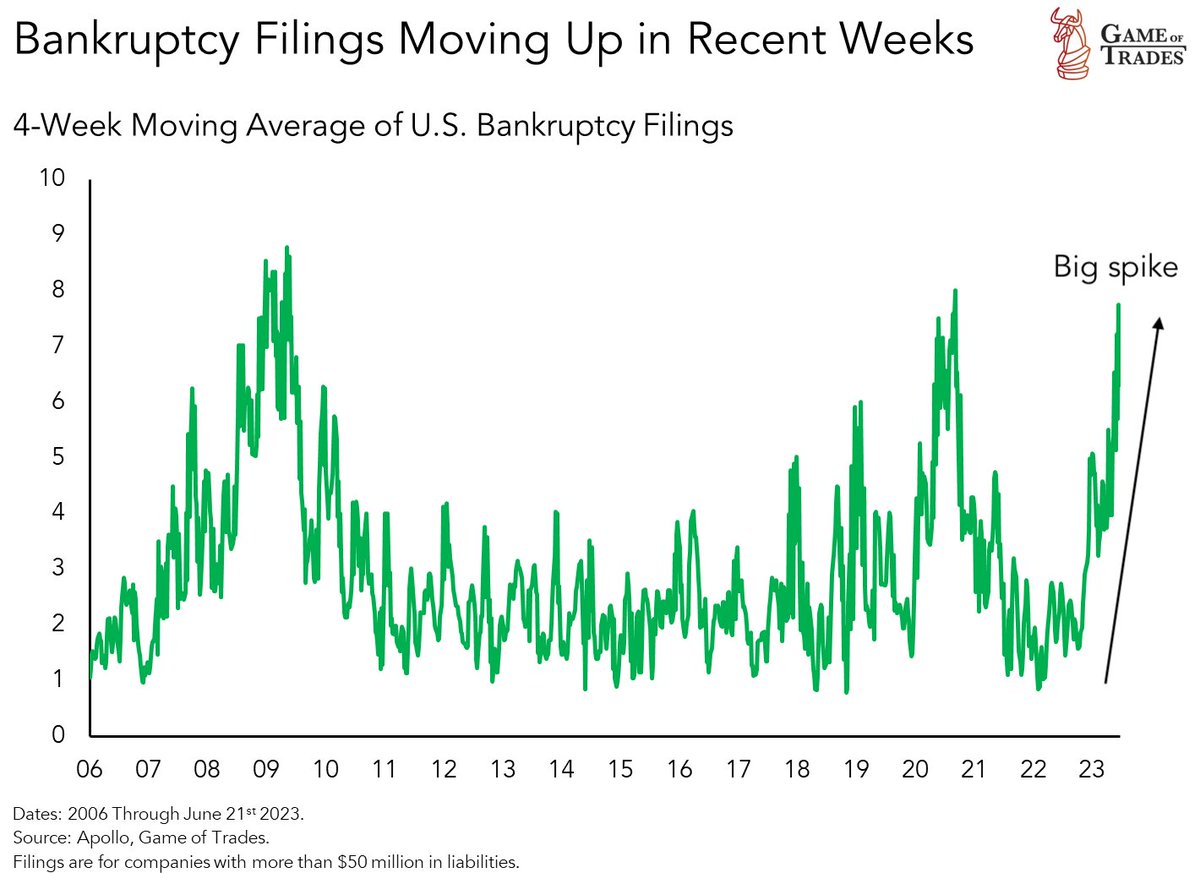

Corporate bankruptcies have been spiking in recent weeks

Let's take a look at why and the market implications

An important thread 🧵

Let's take a look at why and the market implications

An important thread 🧵

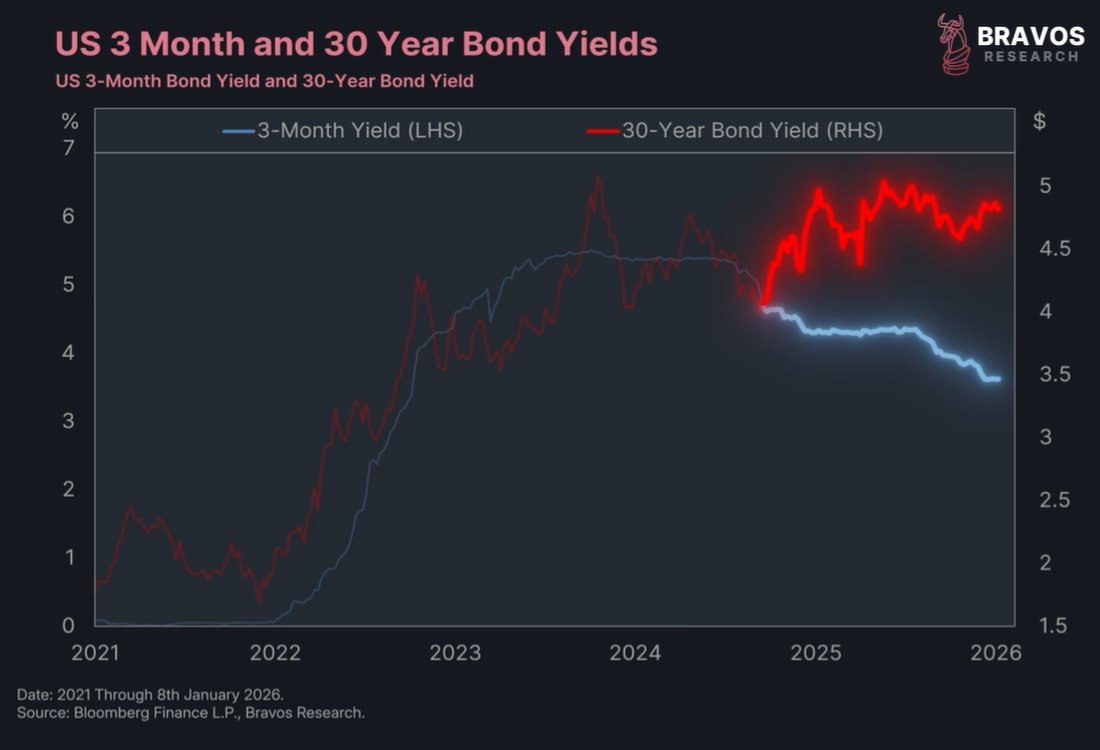

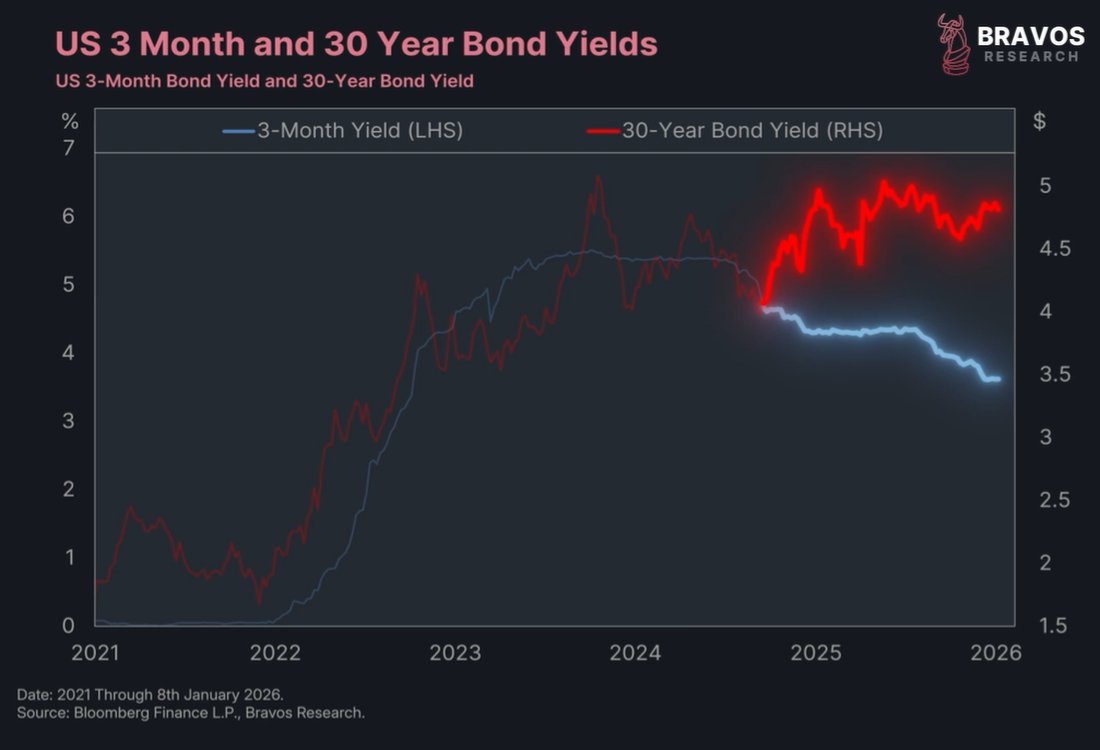

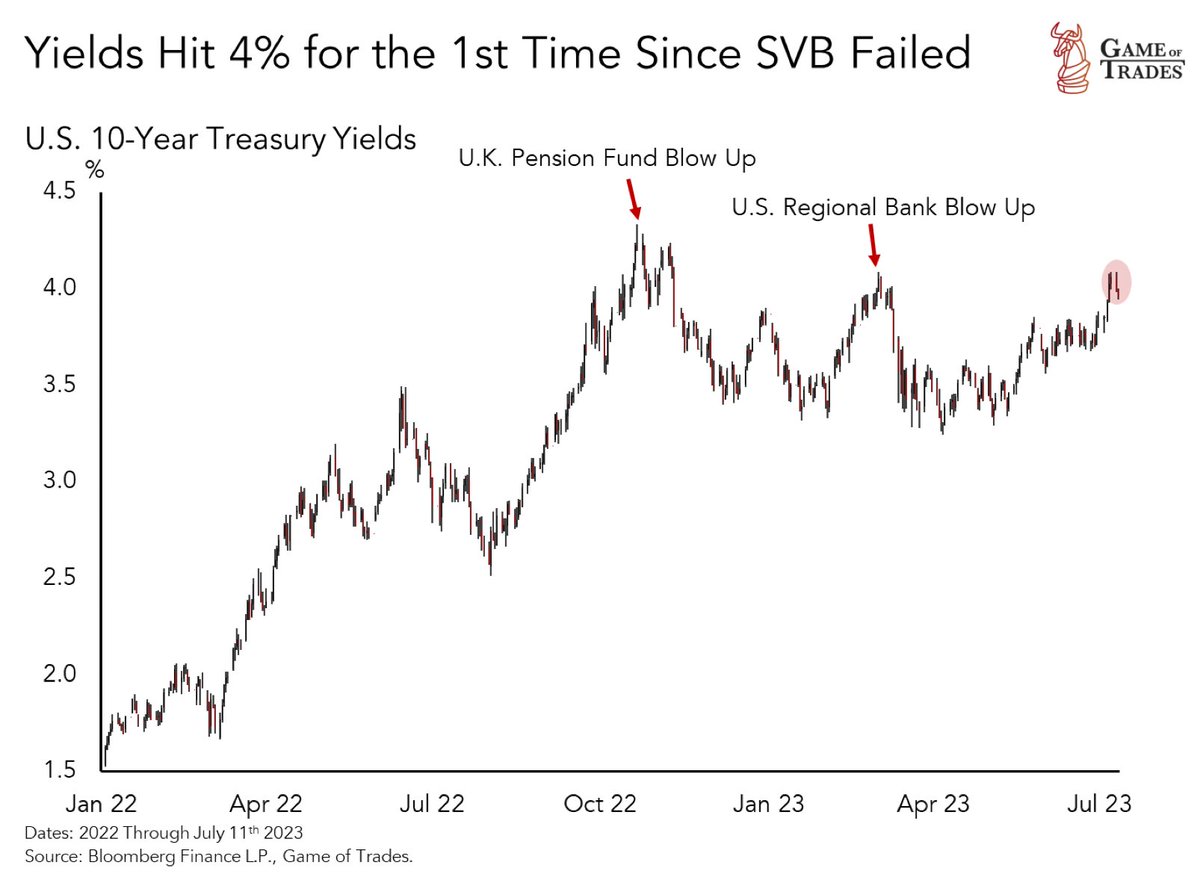

2/ Rising bankruptcies coincides with bond yields hitting 4%, a level previously associated with the Silicon Valley Bank collapse and UK pension fund crisis

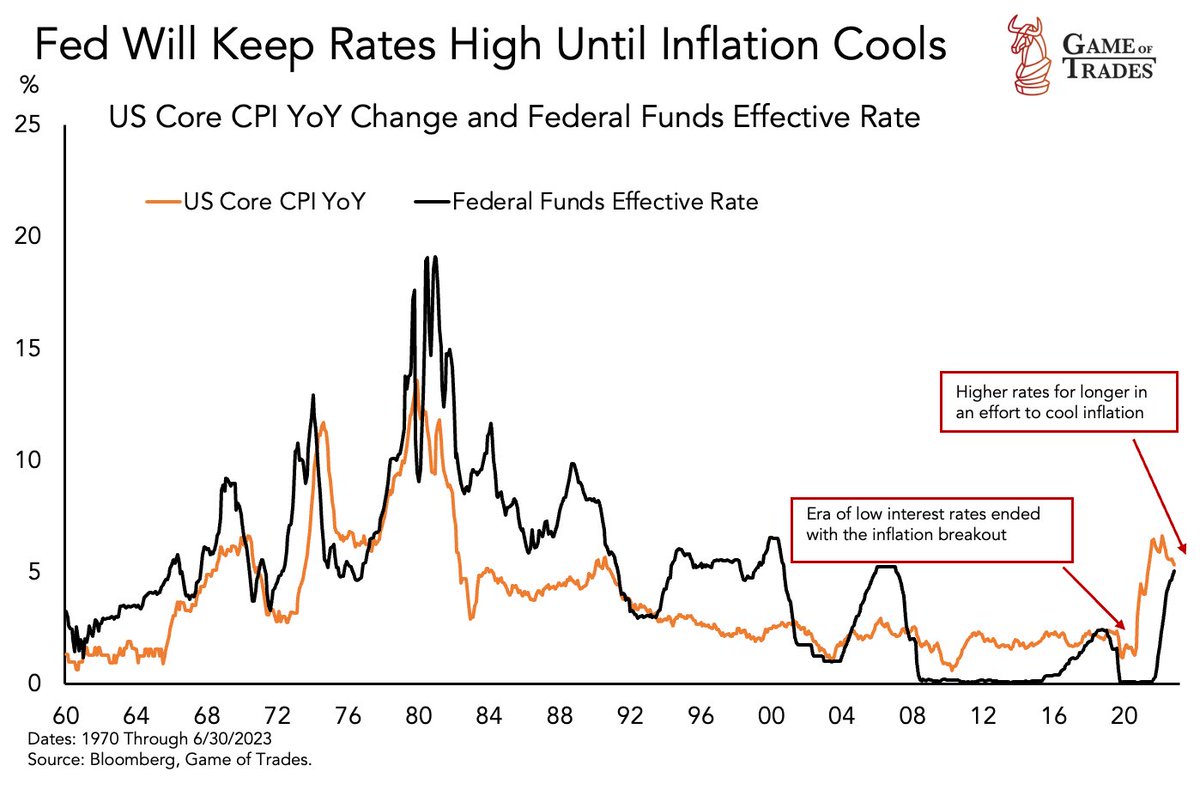

3/ Despite escalating financial stress, the Fed maintains a 'higher for longer' stance to curb inflation

This is amidst a U.S core CPI inflation rate persistently above 5% and the Fed funds rate

This is amidst a U.S core CPI inflation rate persistently above 5% and the Fed funds rate

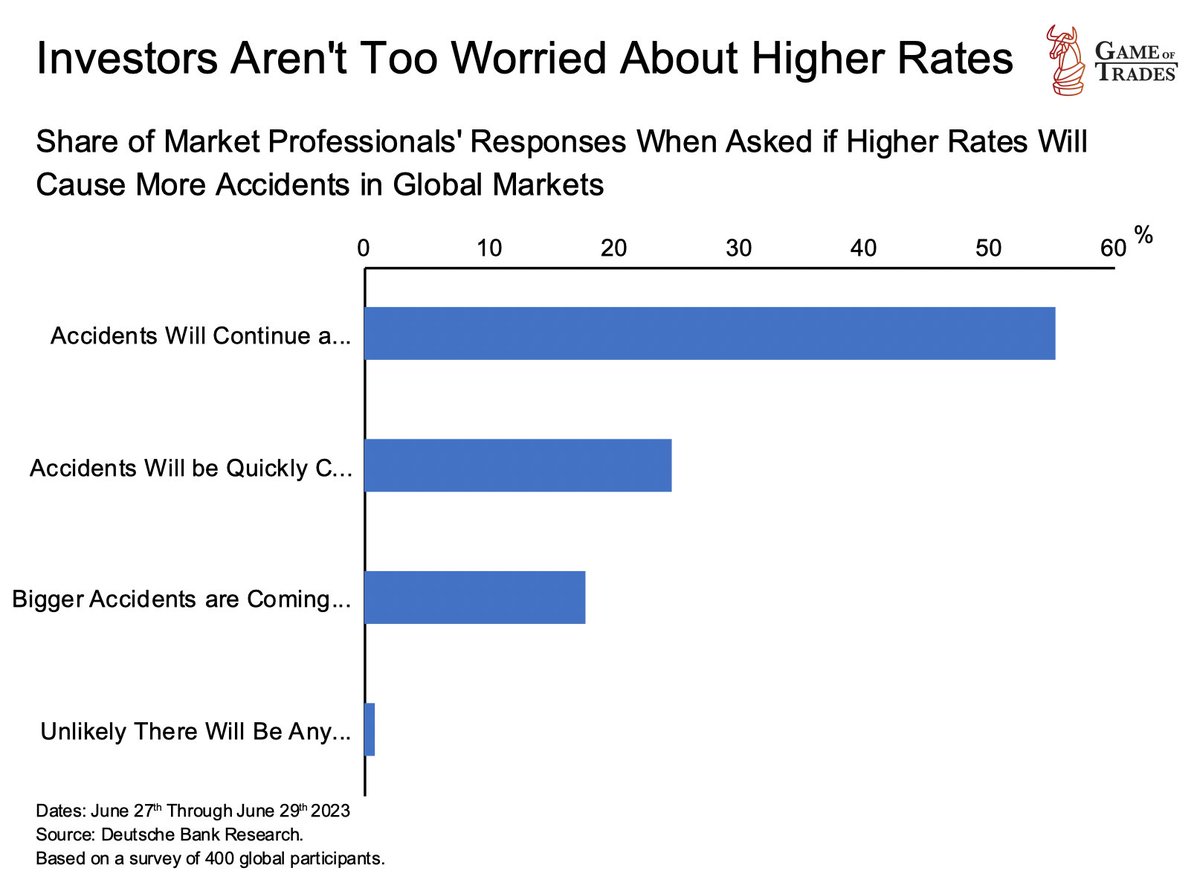

4/ A Deutsche Bank survey indicates that over half of market professionals anticipate market stress due to higher rates

While 20% foresee minimal impact, and approximately 17% warn of potential severe financial stress

While 20% foresee minimal impact, and approximately 17% warn of potential severe financial stress

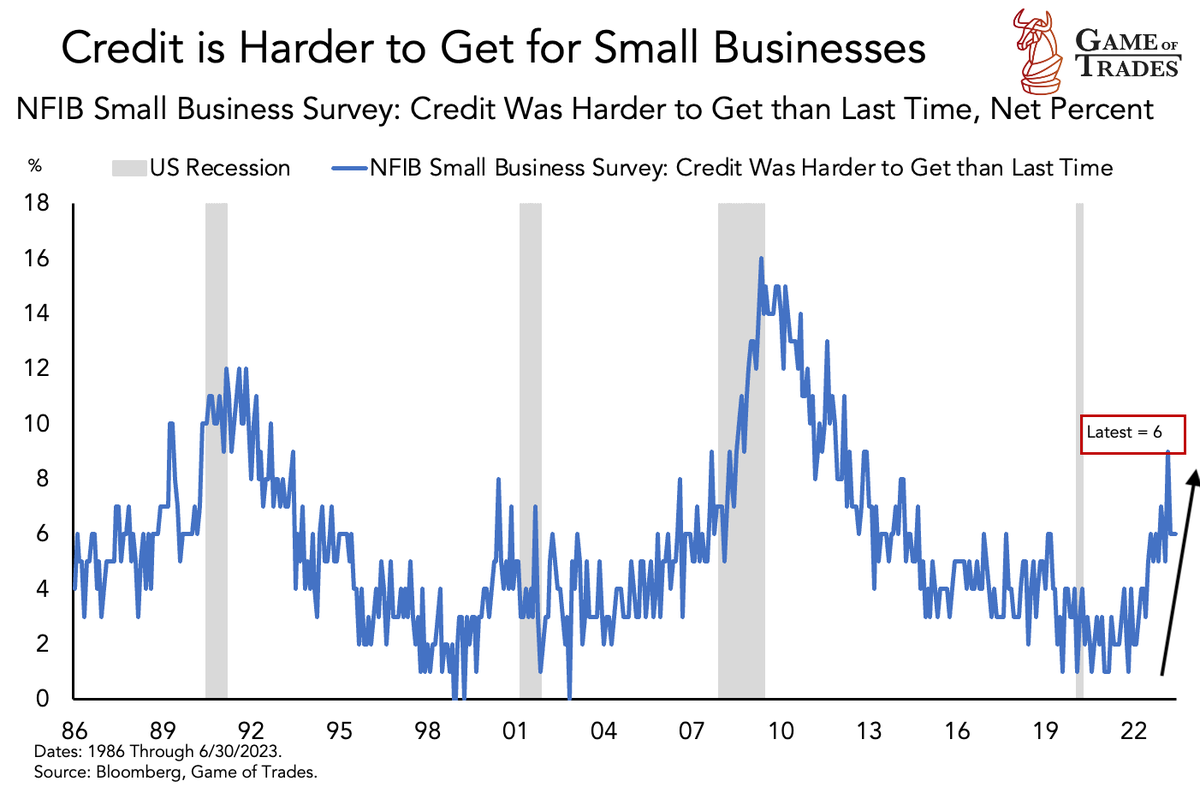

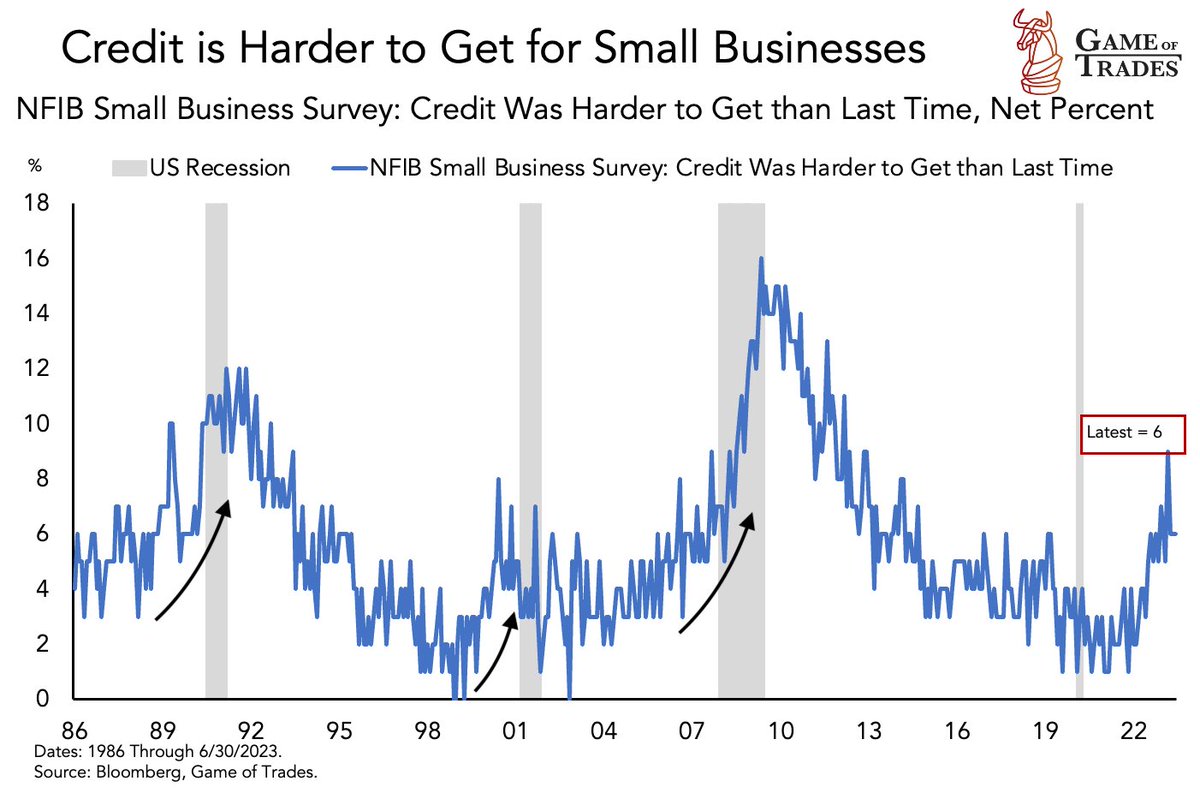

5/ Businesses are finding it increasingly challenging to secure loans due to stricter credit standards, a consequence of higher rates

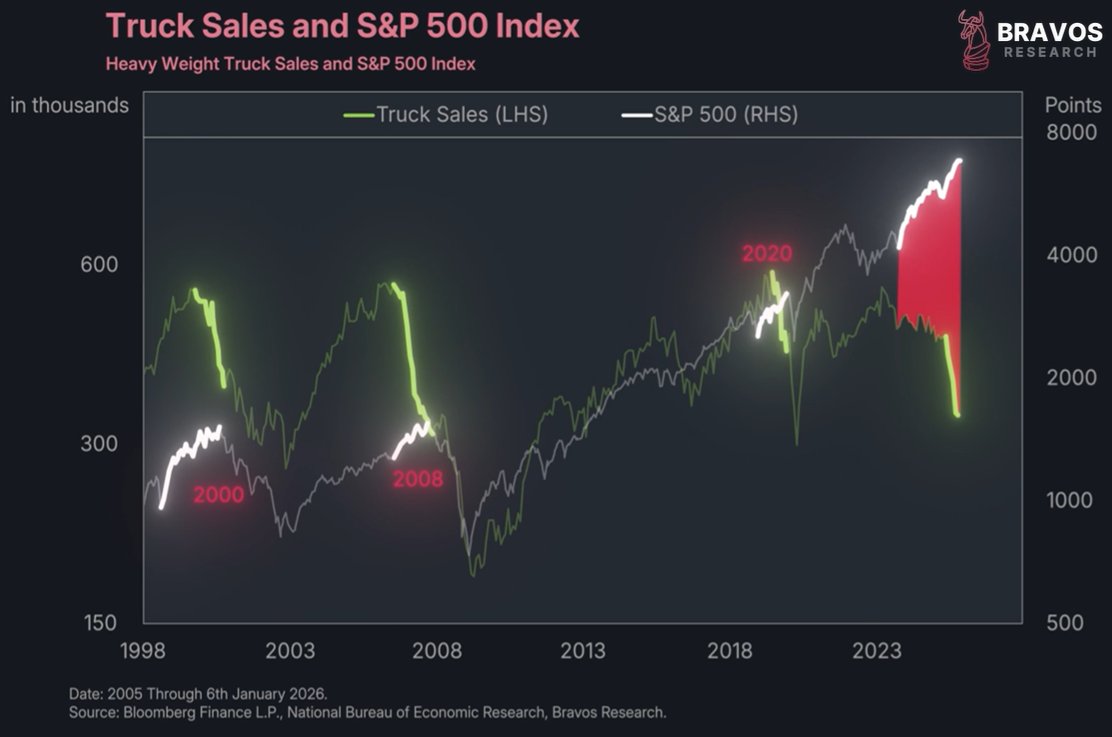

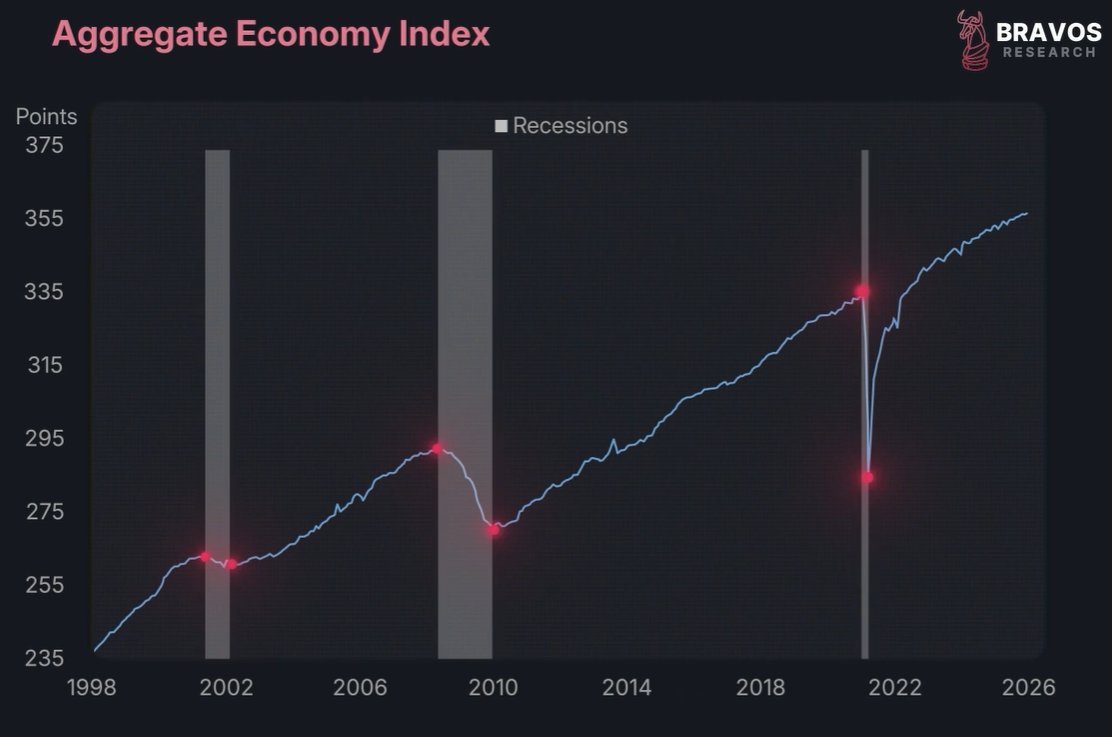

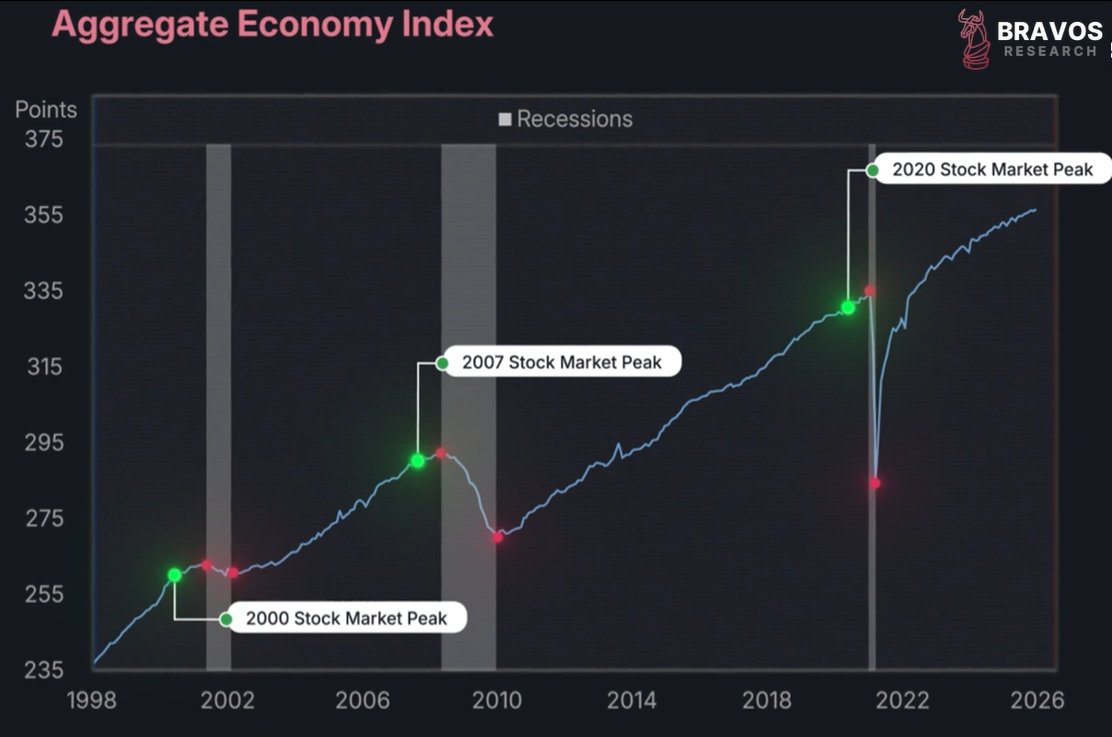

6/ Historically, tighter lending standards precede recessions, as evidenced in:

- 1989

- 1999

- 2007

In each case, the Fed was in a tightening cycle

- 1989

- 1999

- 2007

In each case, the Fed was in a tightening cycle

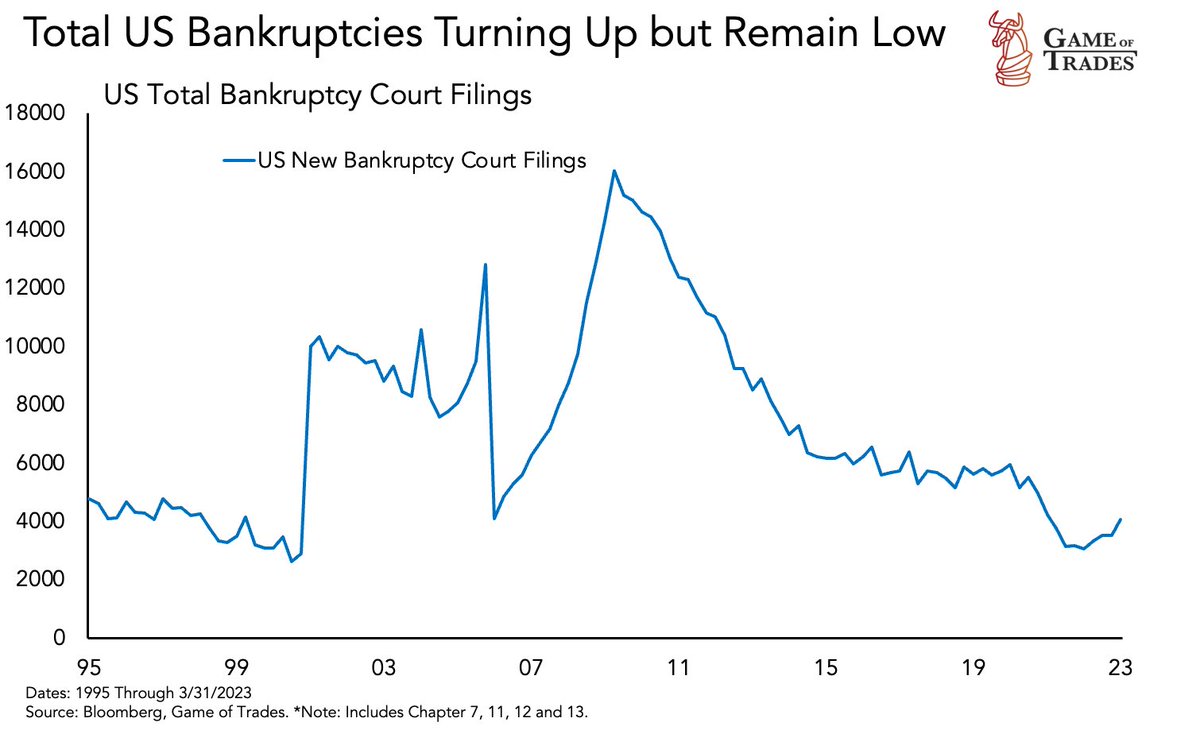

7/ The stricter credit standards aligns with the rise in bankruptcy filings, as per Apollo research

It’s important to note that the bankruptcy filings are from companies with liabilities exceeding $50 million, a specific sample

It’s important to note that the bankruptcy filings are from companies with liabilities exceeding $50 million, a specific sample

8/ A broader view of total U.S. bankruptcy court filings from a different dataset presents a different narrative

Bankruptcy filings remain low on a relative basis, but have been trending higher

Bankruptcy filings remain low on a relative basis, but have been trending higher

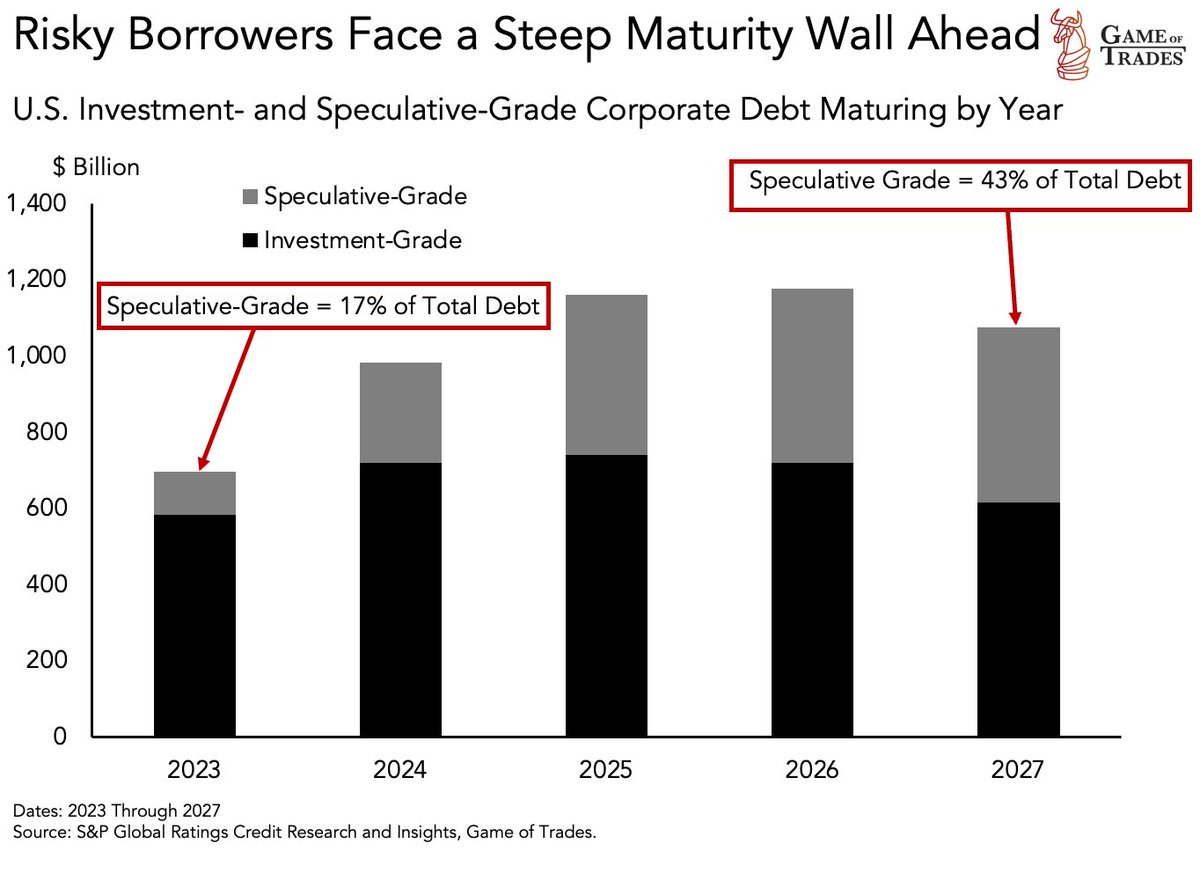

9/ The current default rate is merely the beginning

As the Fed sustains high rates, bankruptcy figures are set to worsen

While 2023 sees limited debt maturing, refinancing concerns escalate from 2024 onwards

As the Fed sustains high rates, bankruptcy figures are set to worsen

While 2023 sees limited debt maturing, refinancing concerns escalate from 2024 onwards

10/ The chart below illustrates annual debt maturity and the breakdown of speculative vs investment-grade debt maturing

11/ In 2023, approximately $700 billion of debt matures, sparing businesses that refinanced at low rates in 2020/21 from higher rate environments

However, in 2024, debt maturity is expected to surge to $1 trillion, and in 2025, it is expected to reach $1.2 trillion

However, in 2024, debt maturity is expected to surge to $1 trillion, and in 2025, it is expected to reach $1.2 trillion

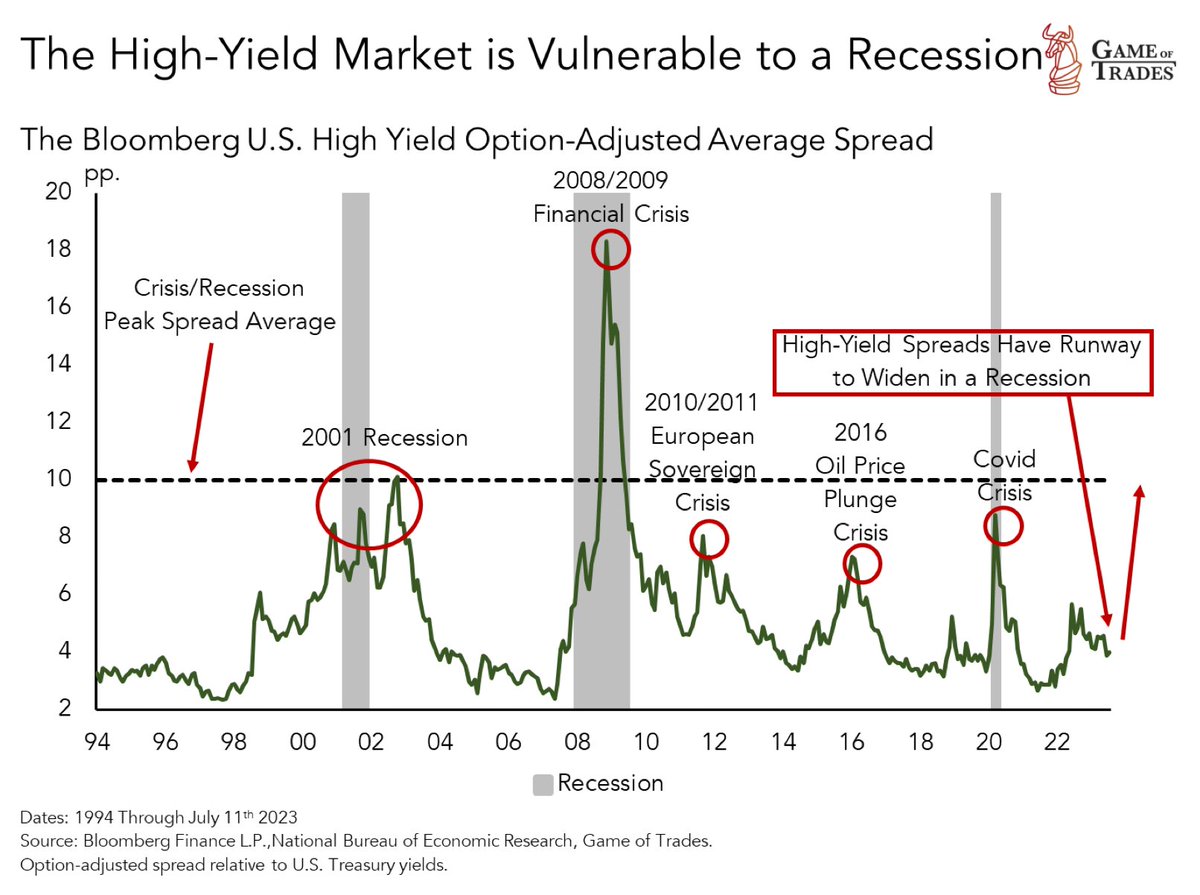

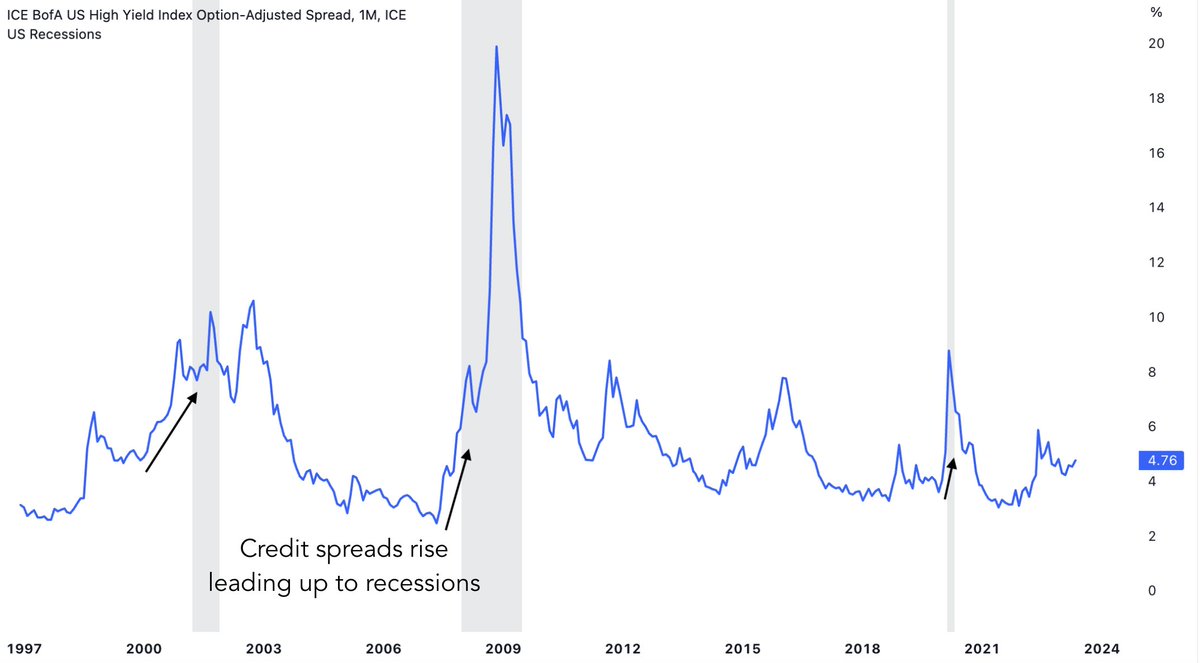

12/ The market's current lack of concern stems from the economy's delayed response to interest rate hikes since 2022

Which also explains the persistently low credit spreads

Which also explains the persistently low credit spreads

13/ Credit spreads, indicative of credit risk pricing in financial markets, typically rise ahead of recessions, as seen in 2001, 2008 and 2020

14/ Despite recent bankruptcies, credit spreads remain stable due to 2 factors:

1. Most companies have yet to refinance their debt

2. The economy has not yet entered a recession

1. Most companies have yet to refinance their debt

2. The economy has not yet entered a recession

15/ As the Fed persists with restrictive rates, the market is likely to price in more risk as bankruptcies increase

This could lead to wider credit spreads and lower stock prices, with the peak panic occurring during the recession

This could lead to wider credit spreads and lower stock prices, with the peak panic occurring during the recession

16/ Our goal at is to help you navigate uncertain markets through evidence based insights

We're committed to the thoroughness of our research, striving to comprehend underlying dynamics and fundamental reasons behind behaviors

Get your FREE 7-day trialgameoftrades.net

We're committed to the thoroughness of our research, striving to comprehend underlying dynamics and fundamental reasons behind behaviors

Get your FREE 7-day trialgameoftrades.net

• • •

Missing some Tweet in this thread? You can try to

force a refresh