Data-driven Investment Research | Follow to learn about markets & global economy | Get swing trade ideas & market analysis at https://t.co/s4iOZprKNo

35 subscribers

How to get URL link on X (Twitter) App

2/ This is what it looks like when a $2 trillion industry collapses in real time.

2/ This is what it looks like when a $2 trillion industry collapses in real time.

2/ In the next 12-months, nearly $10 trillion worth of US government debt is coming due.

2/ In the next 12-months, nearly $10 trillion worth of US government debt is coming due.

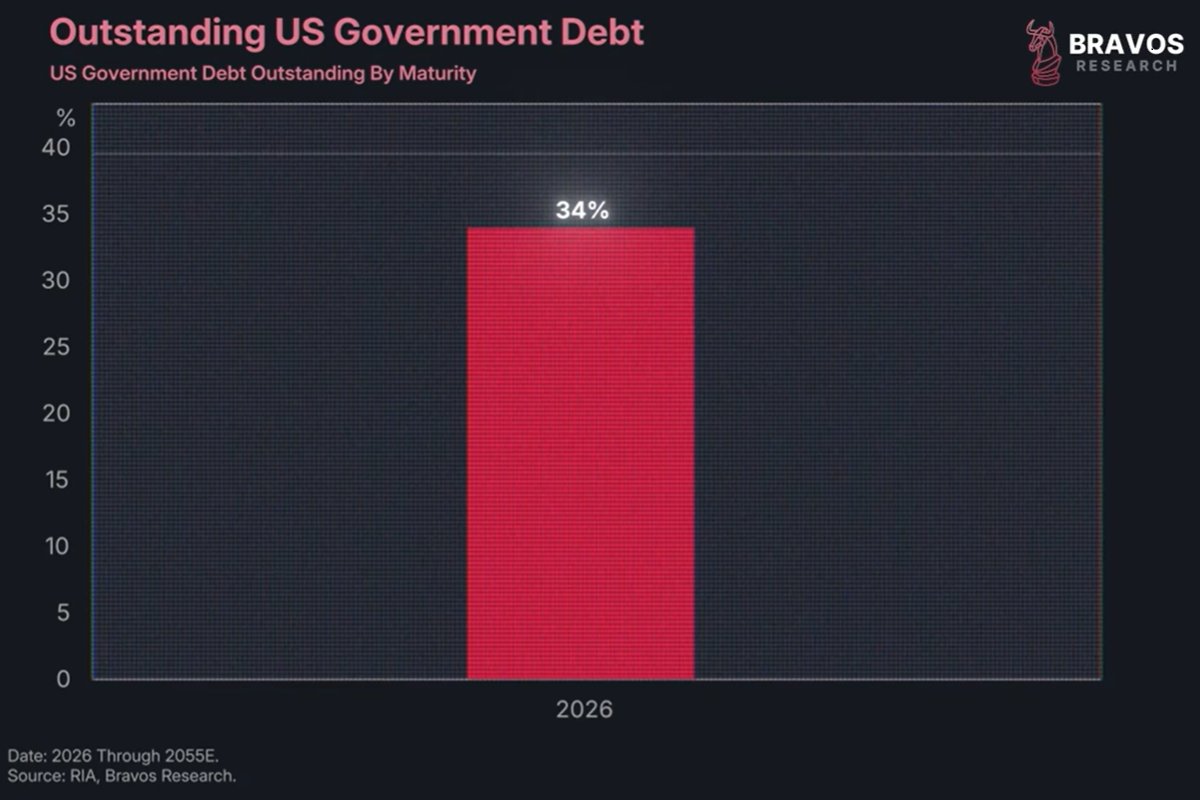

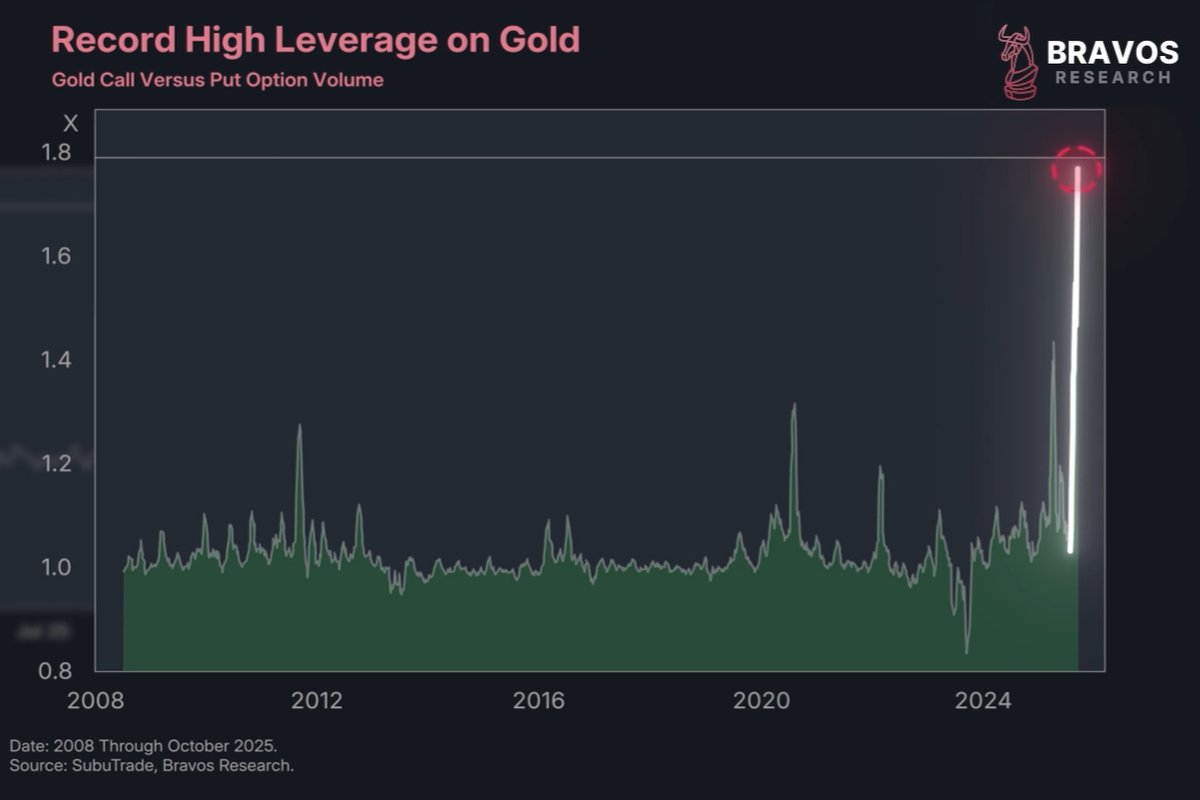

2/ Since the start of 2026, gold has added roughly $4 trillion to its market capitalization.

2/ Since the start of 2026, gold has added roughly $4 trillion to its market capitalization.

2/ Something quite rare has been happening on the US treasury market.

2/ Something quite rare has been happening on the US treasury market.

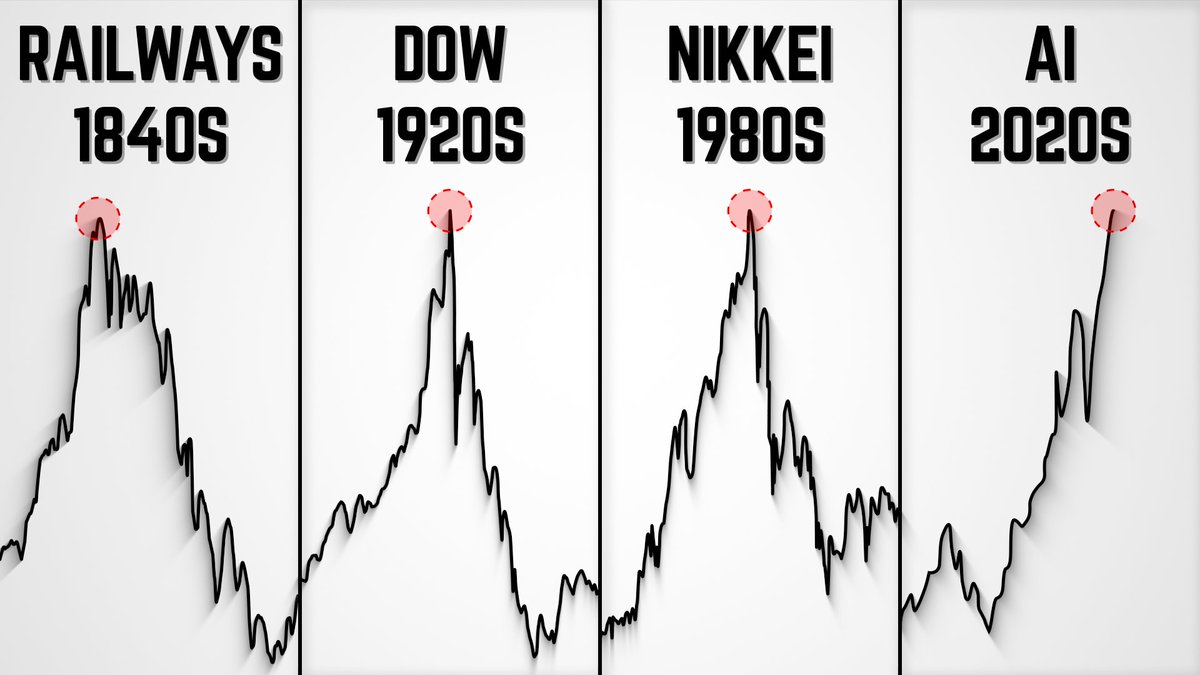

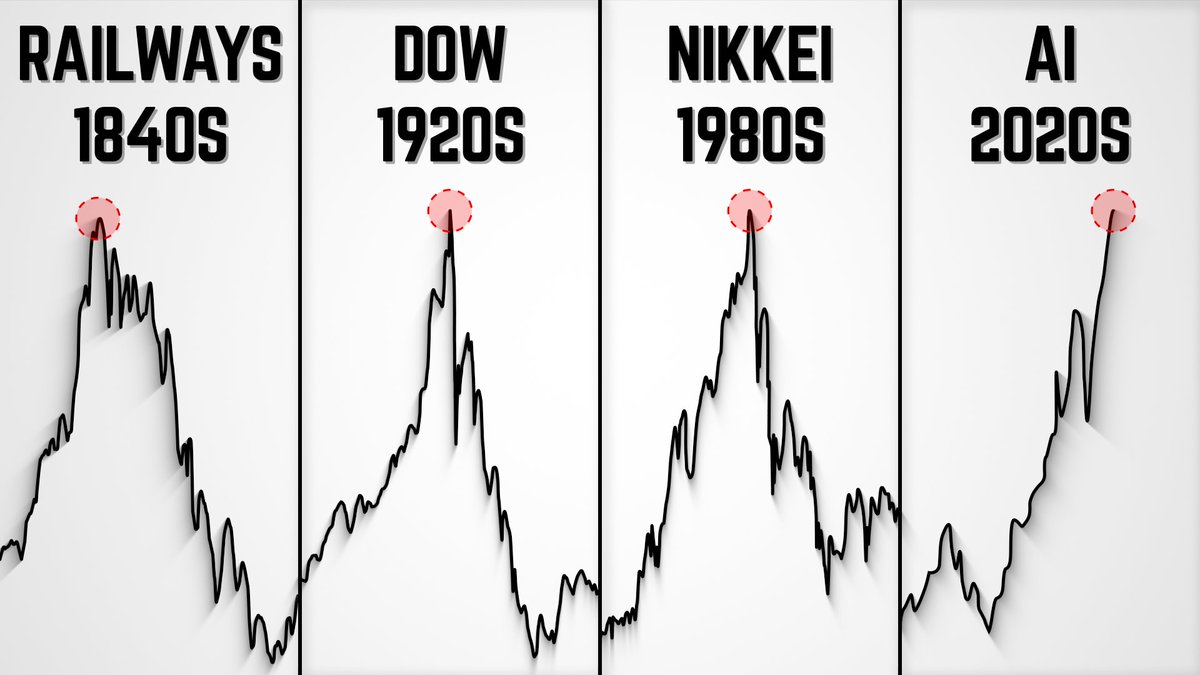

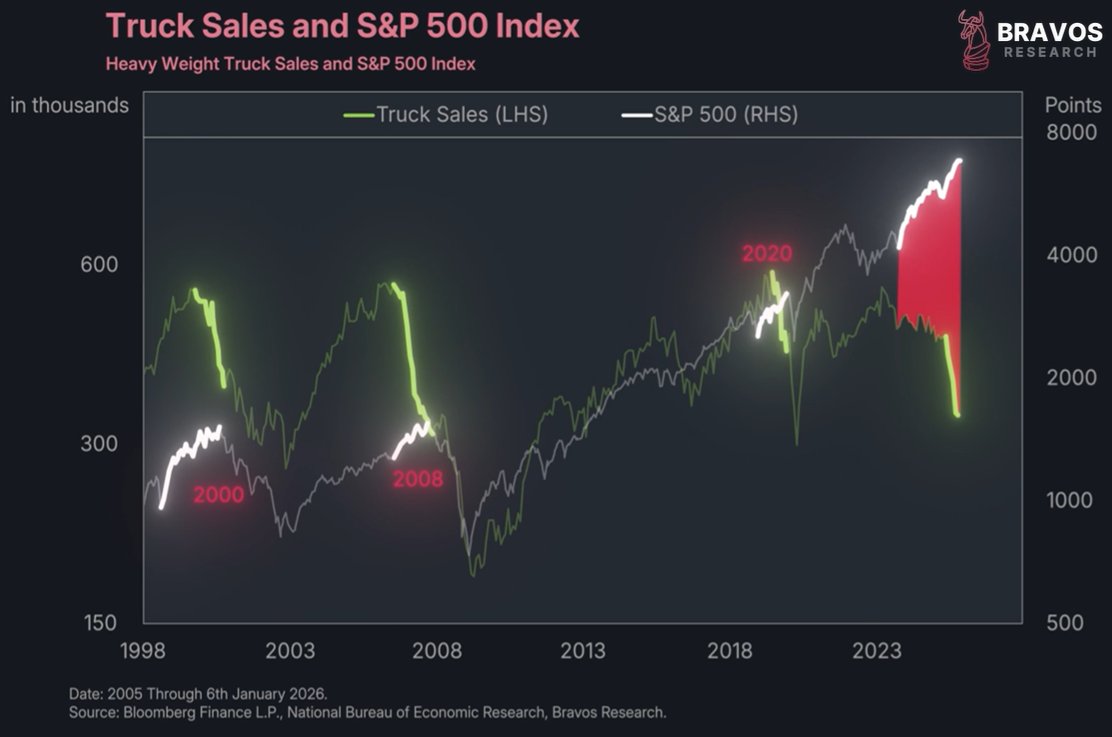

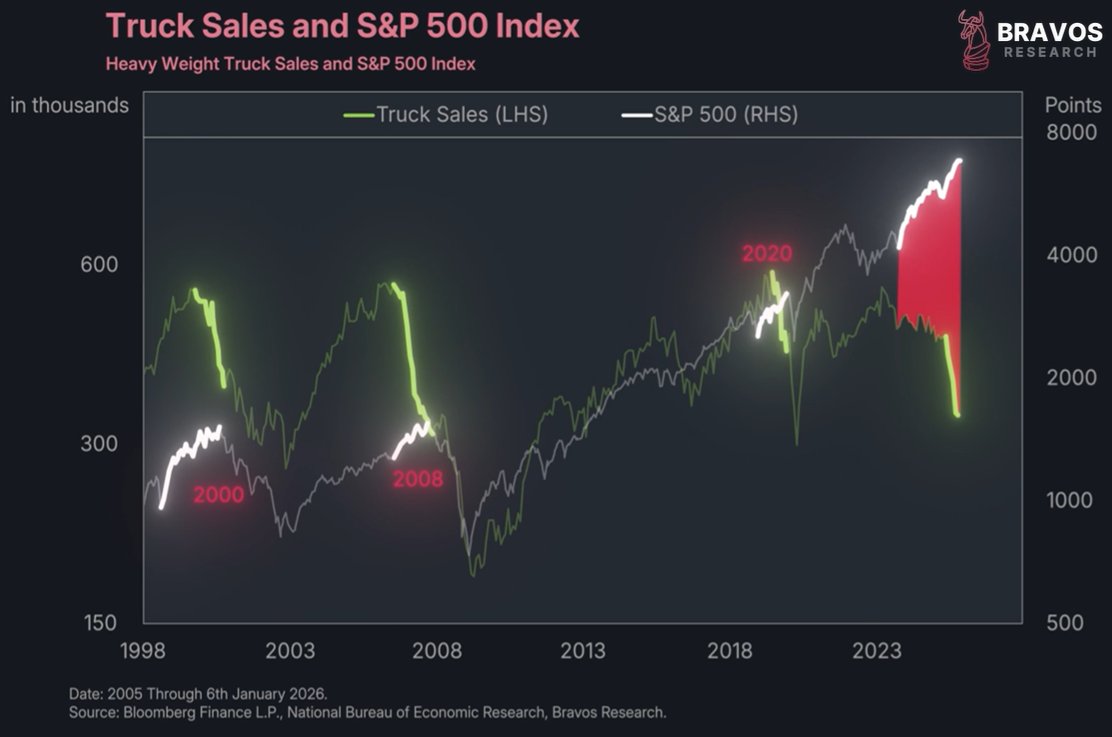

2/ The National Bureau of Economic Research has 3 specific conditions to define an asset bubble:

2/ The National Bureau of Economic Research has 3 specific conditions to define an asset bubble:

2/ The shifts unfolding today in the global monetary system, the geopolitical order, and global trade have major implications for the markets.

2/ The shifts unfolding today in the global monetary system, the geopolitical order, and global trade have major implications for the markets.

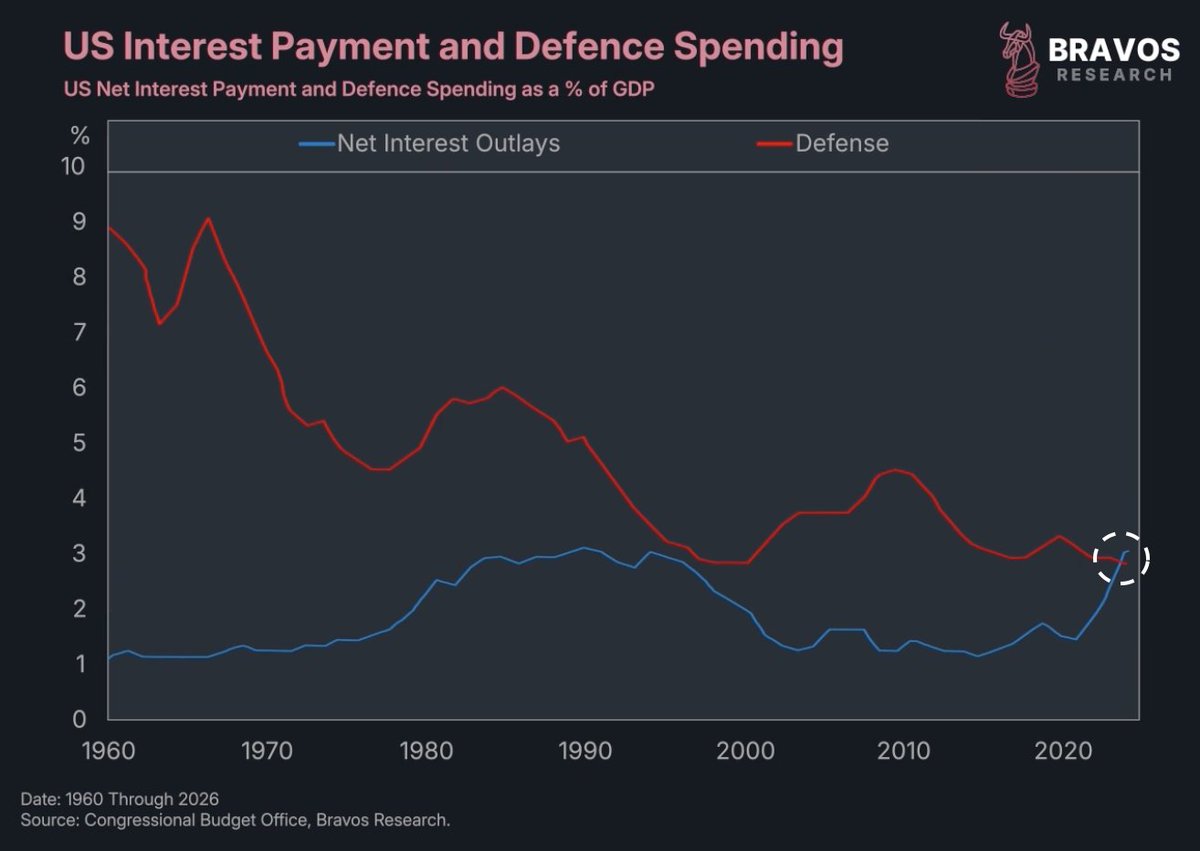

2/ The US government has a problem.

2/ The US government has a problem.

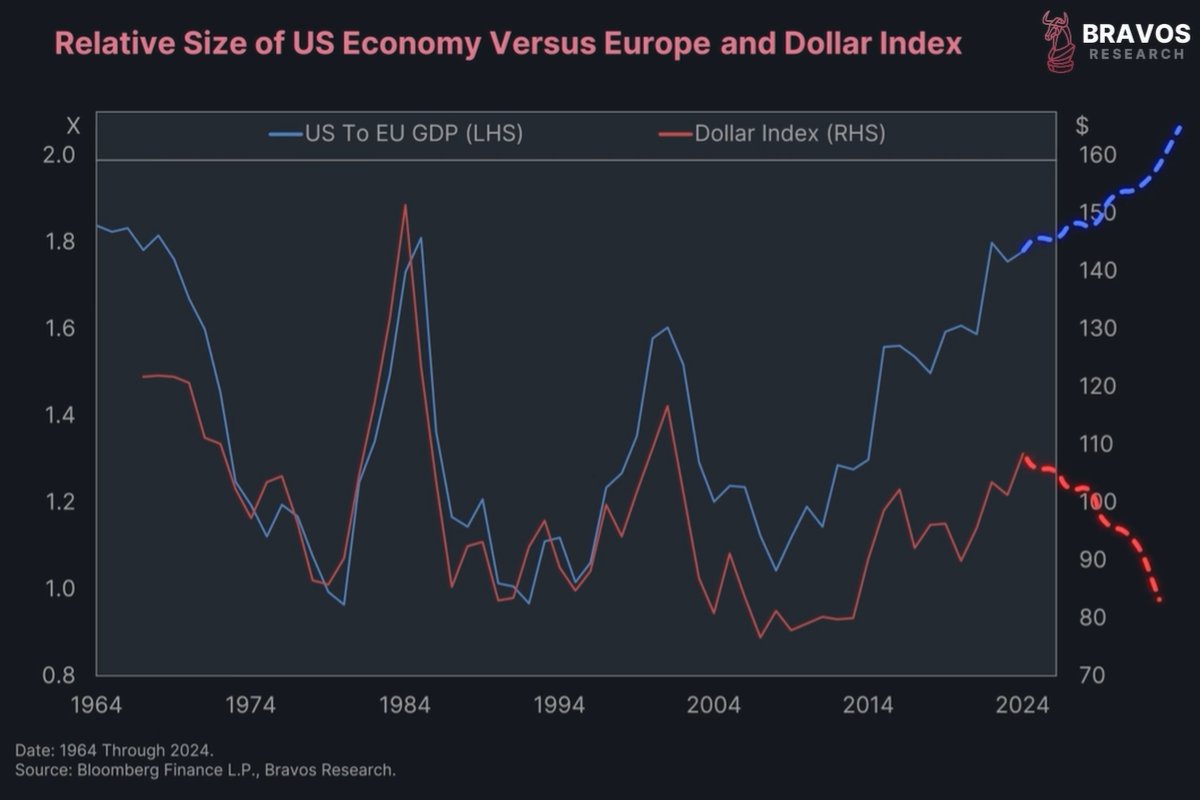

2/ 1 of the most fundamental relationships in financial markets is breaking right now.

2/ 1 of the most fundamental relationships in financial markets is breaking right now.

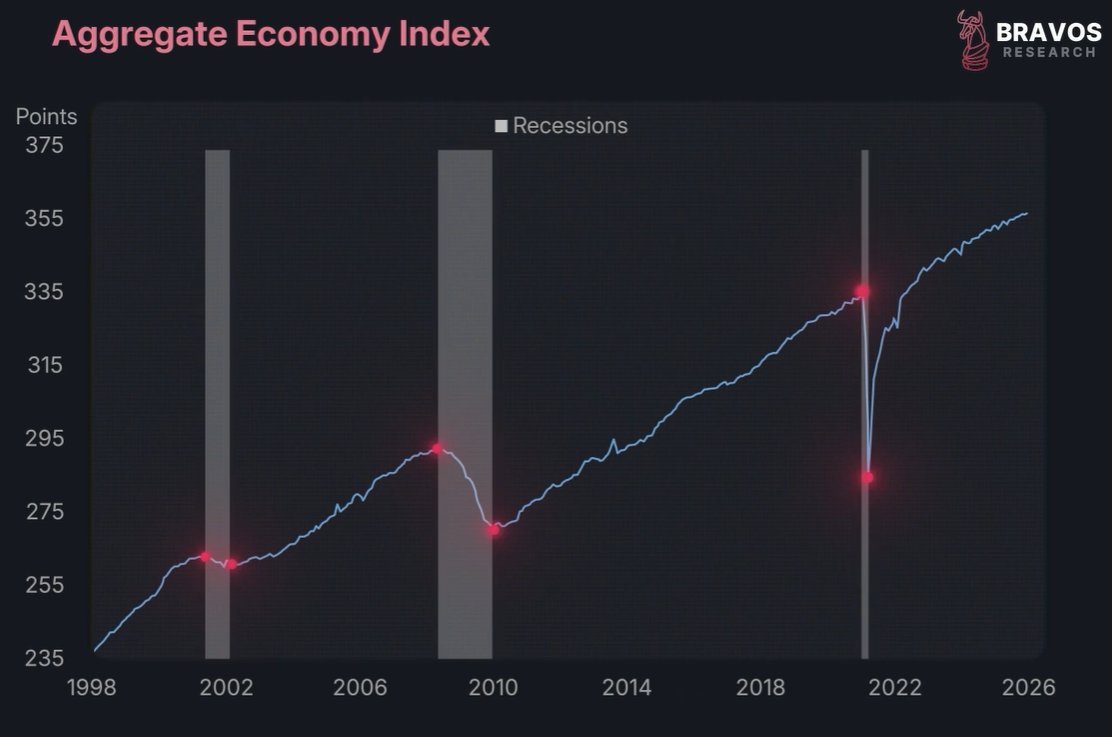

2/ This chart shows the aggregate economy index.

2/ This chart shows the aggregate economy index.

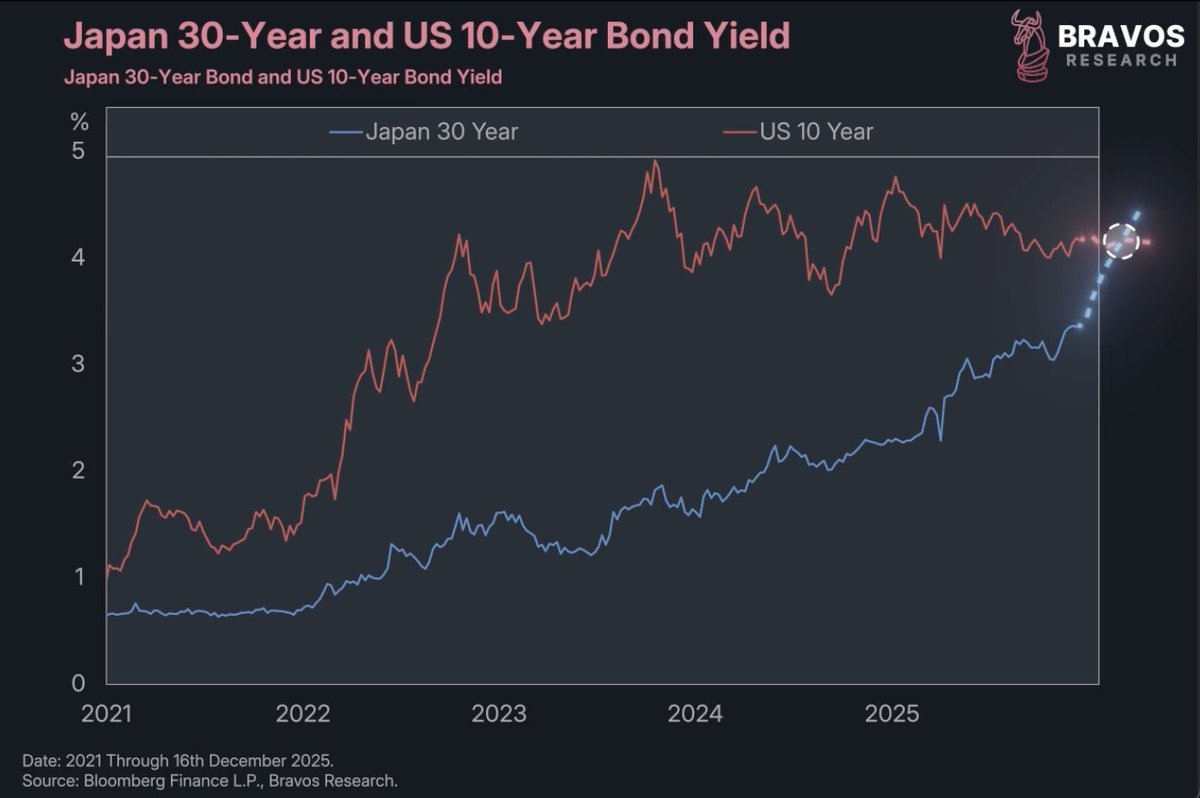

2/ The yield on Japan’s 30-year bond is starting to close in on the yield of the US 30-year bond.

2/ The yield on Japan’s 30-year bond is starting to close in on the yield of the US 30-year bond.

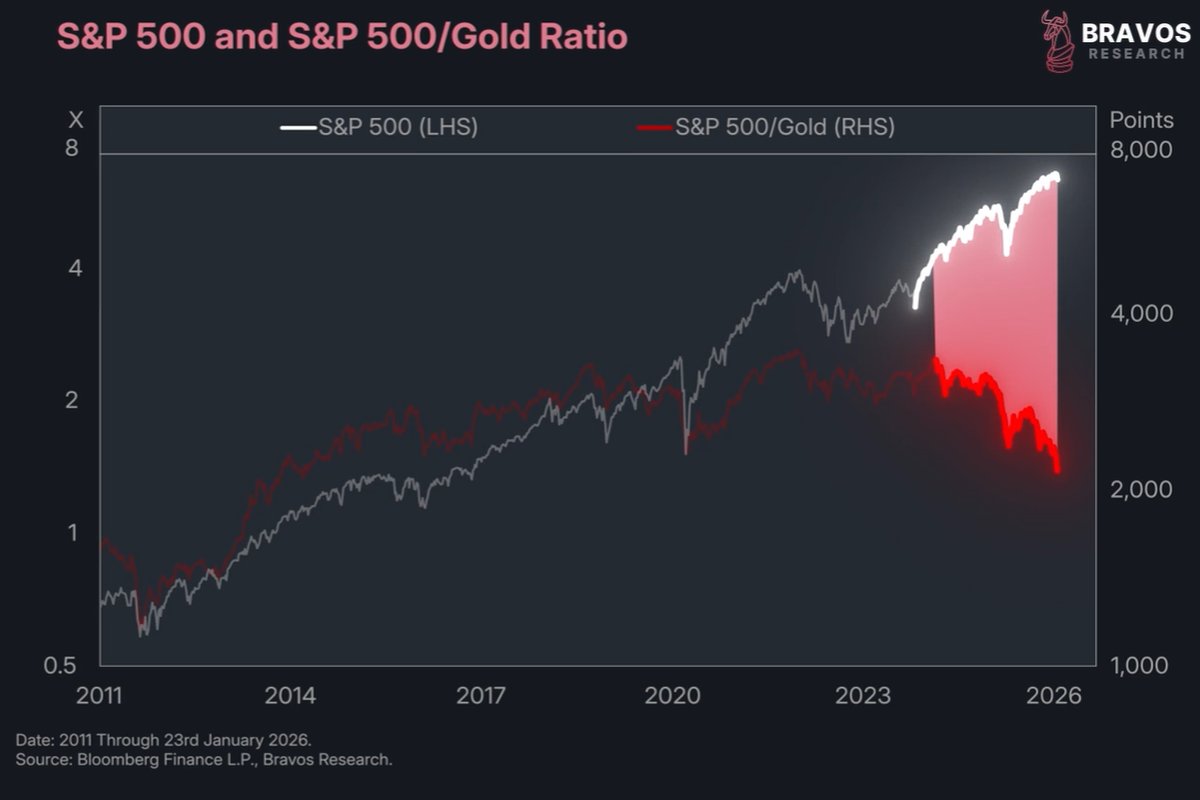

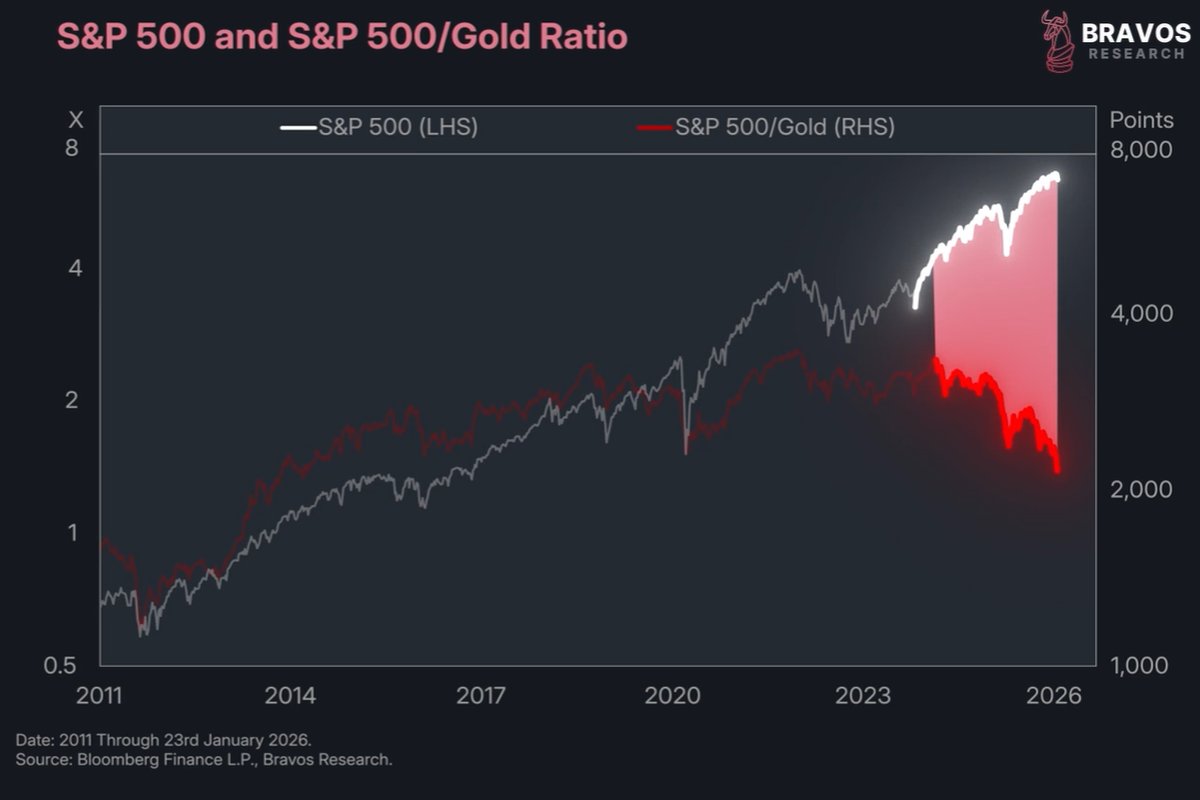

2/ Something unusual is happening in the stock market right now.

2/ Something unusual is happening in the stock market right now.

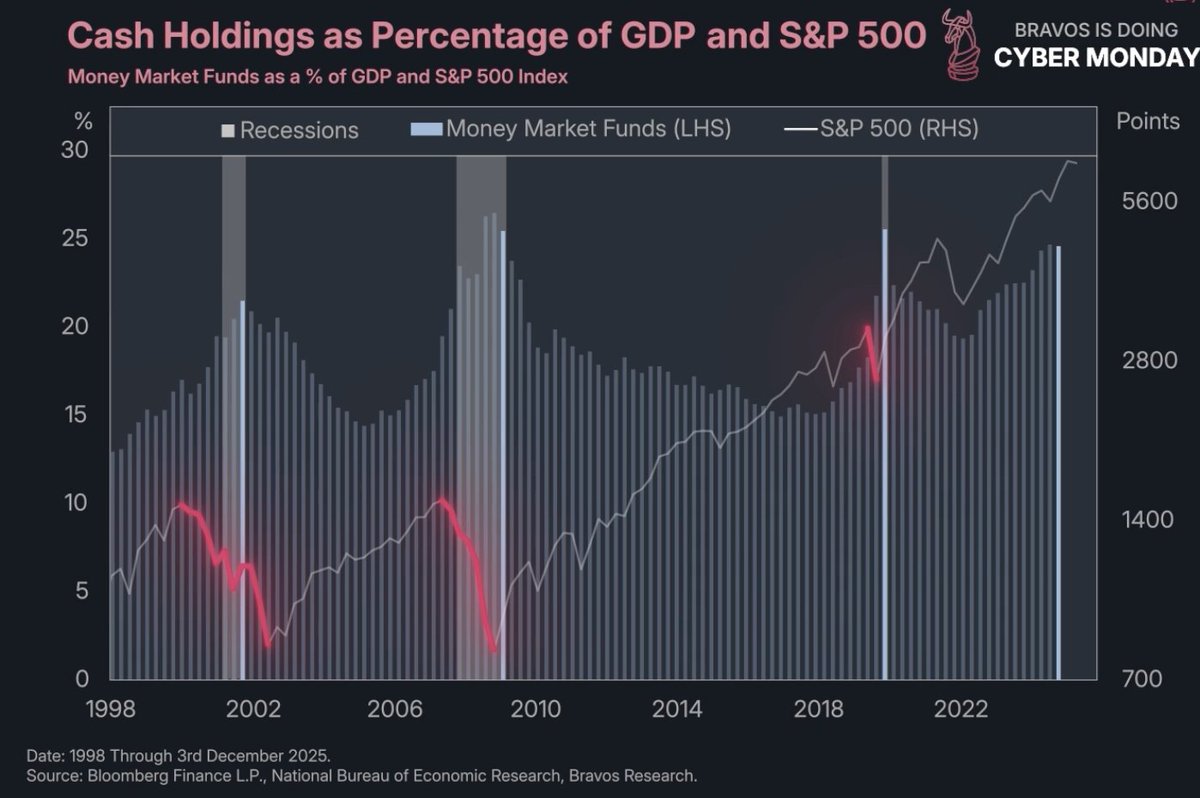

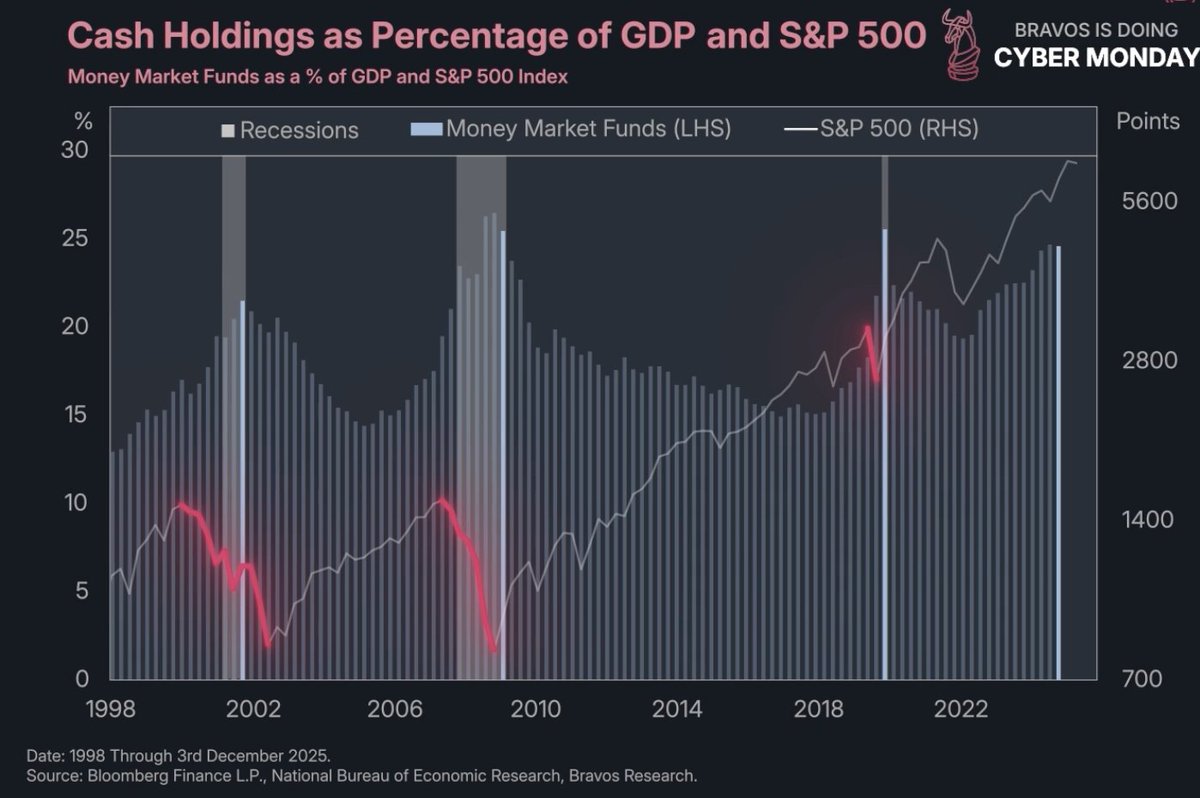

2/ This chart shows us the share of total US GDP comprised of cash.

2/ This chart shows us the share of total US GDP comprised of cash.

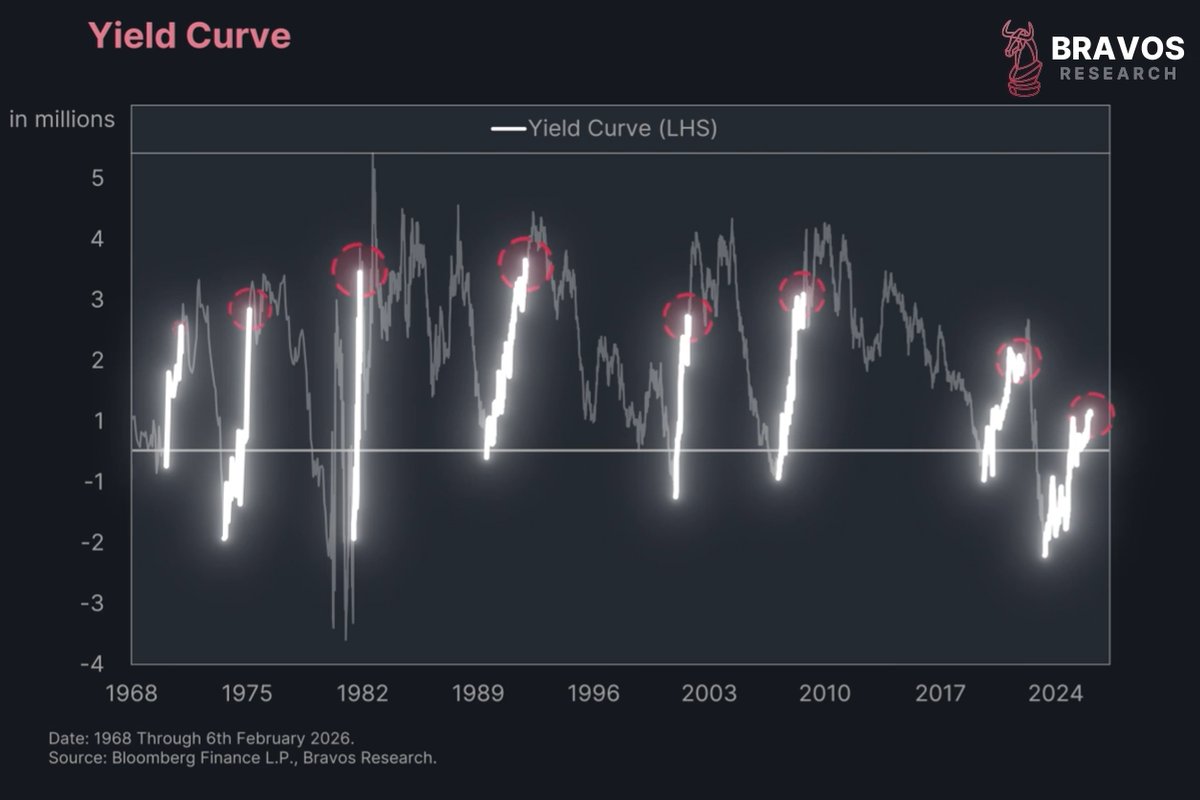

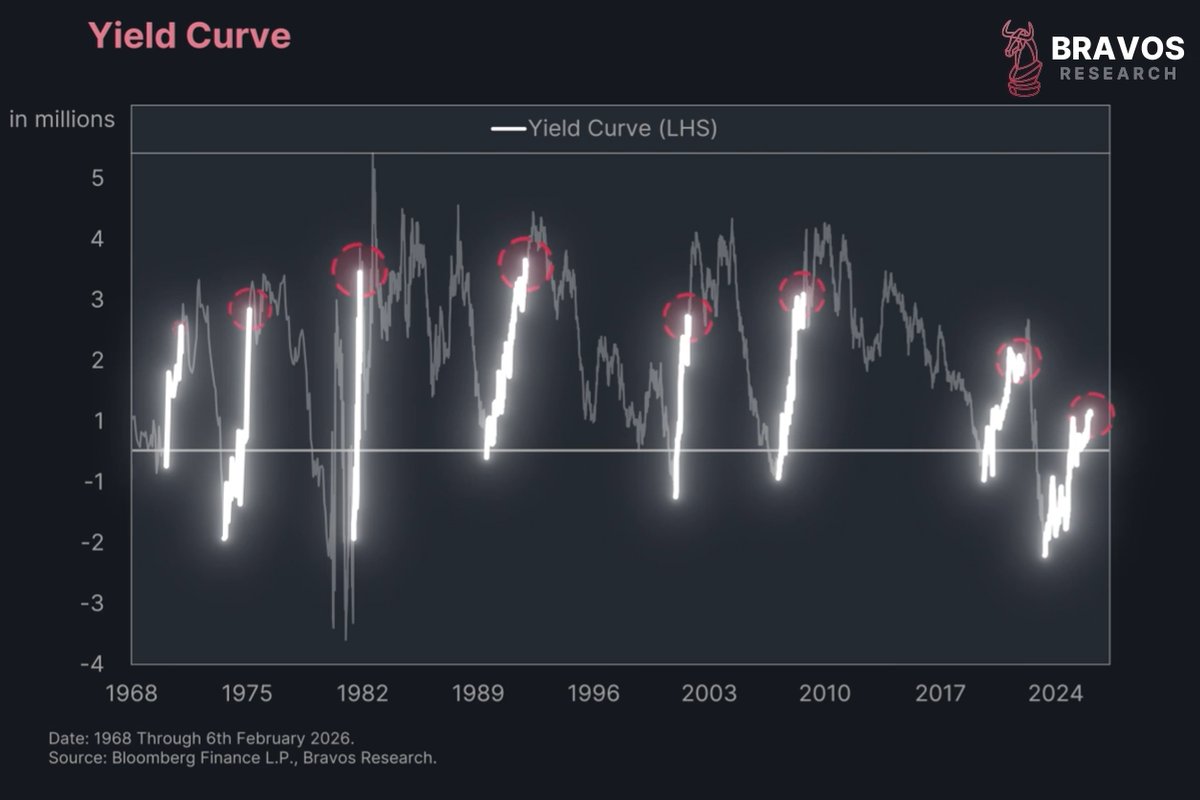

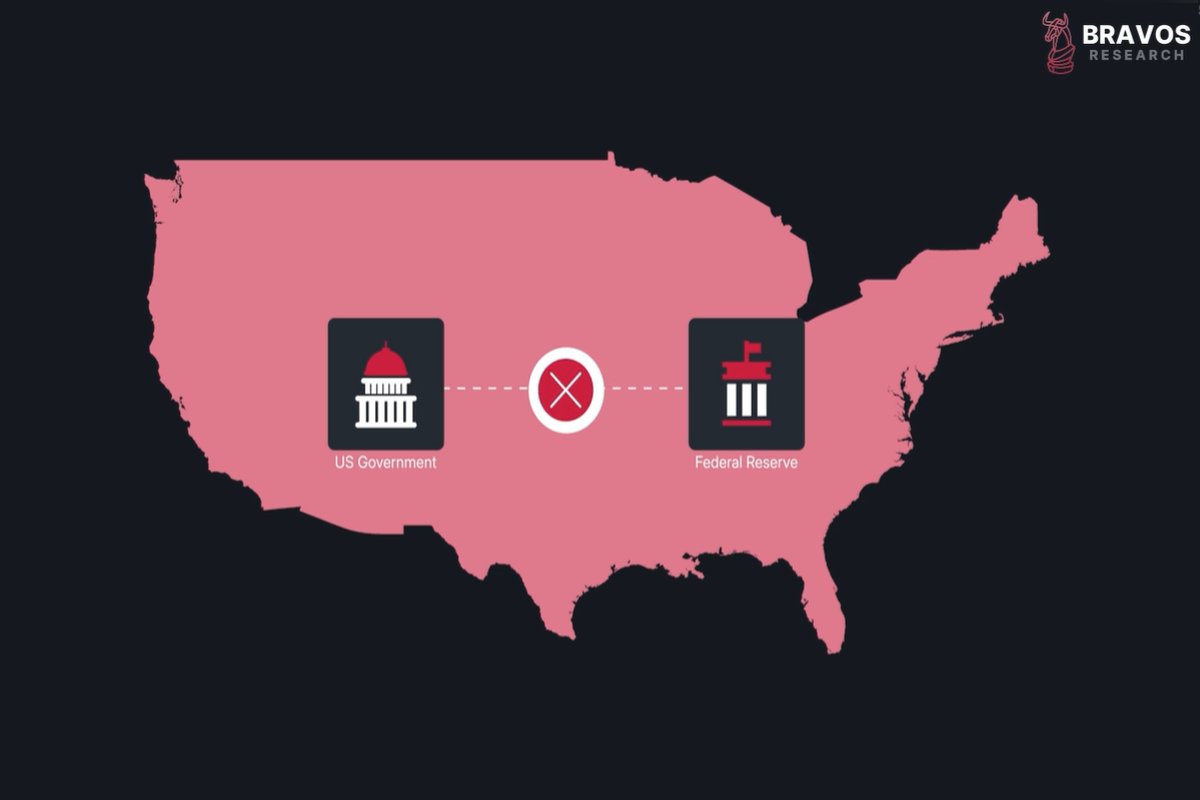

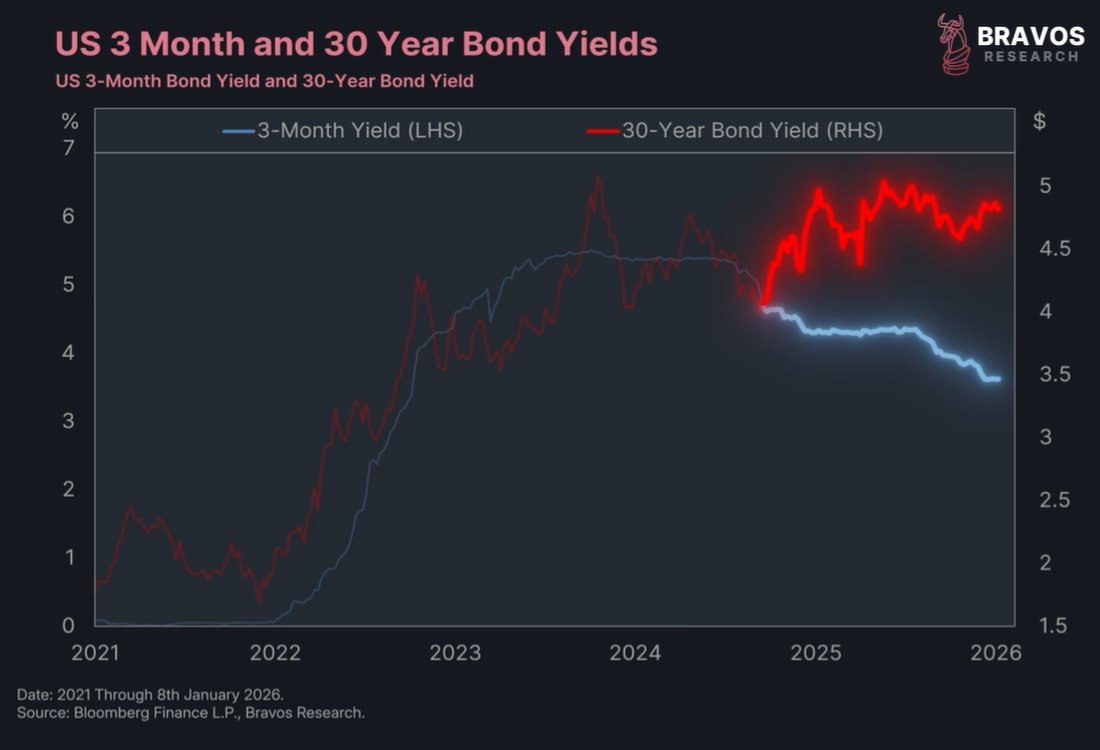

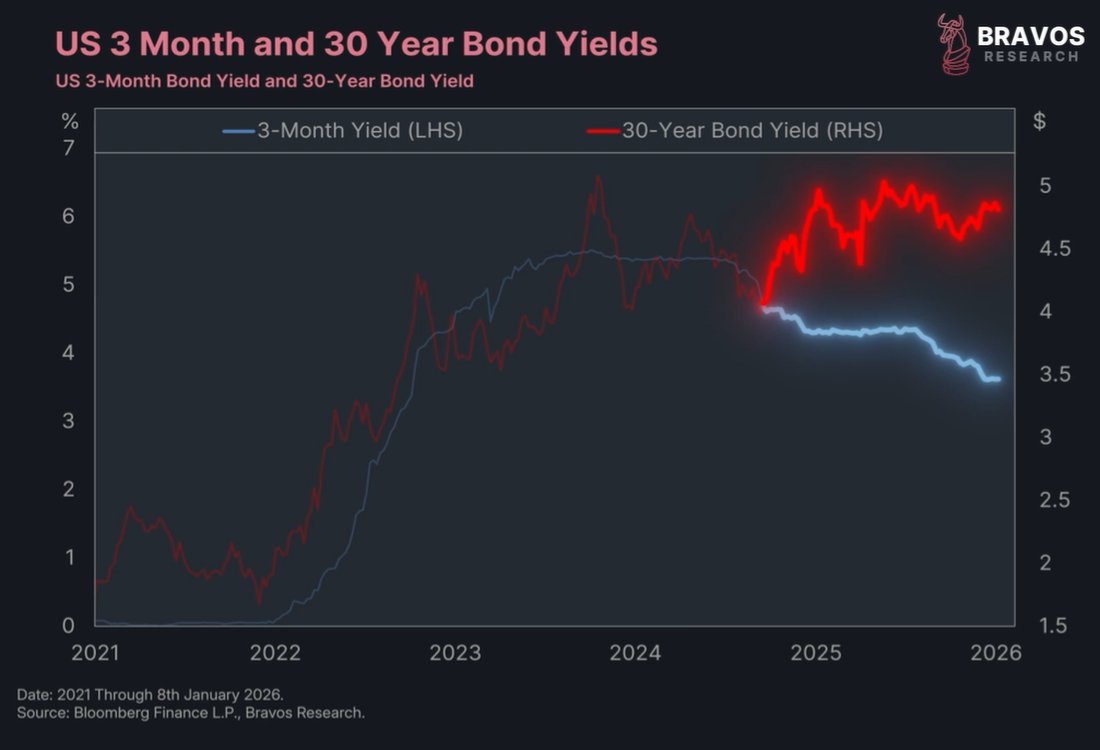

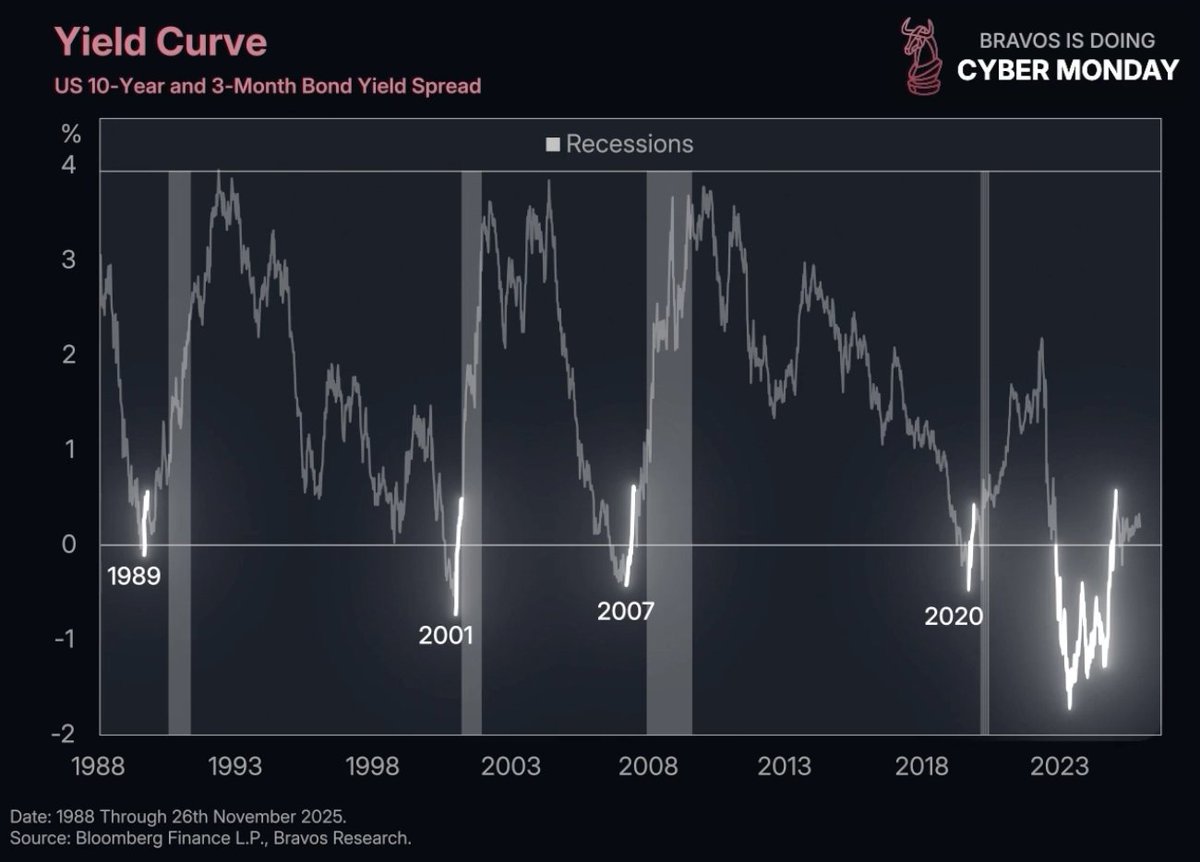

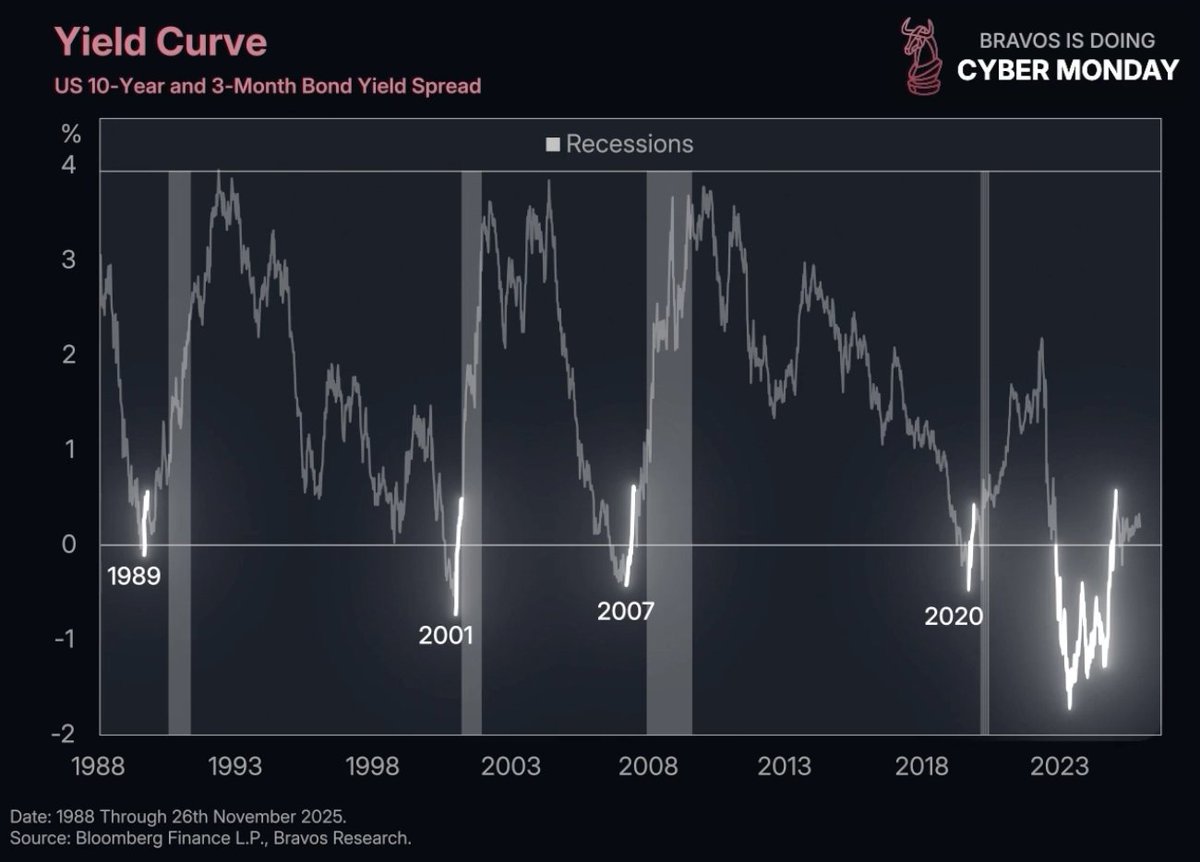

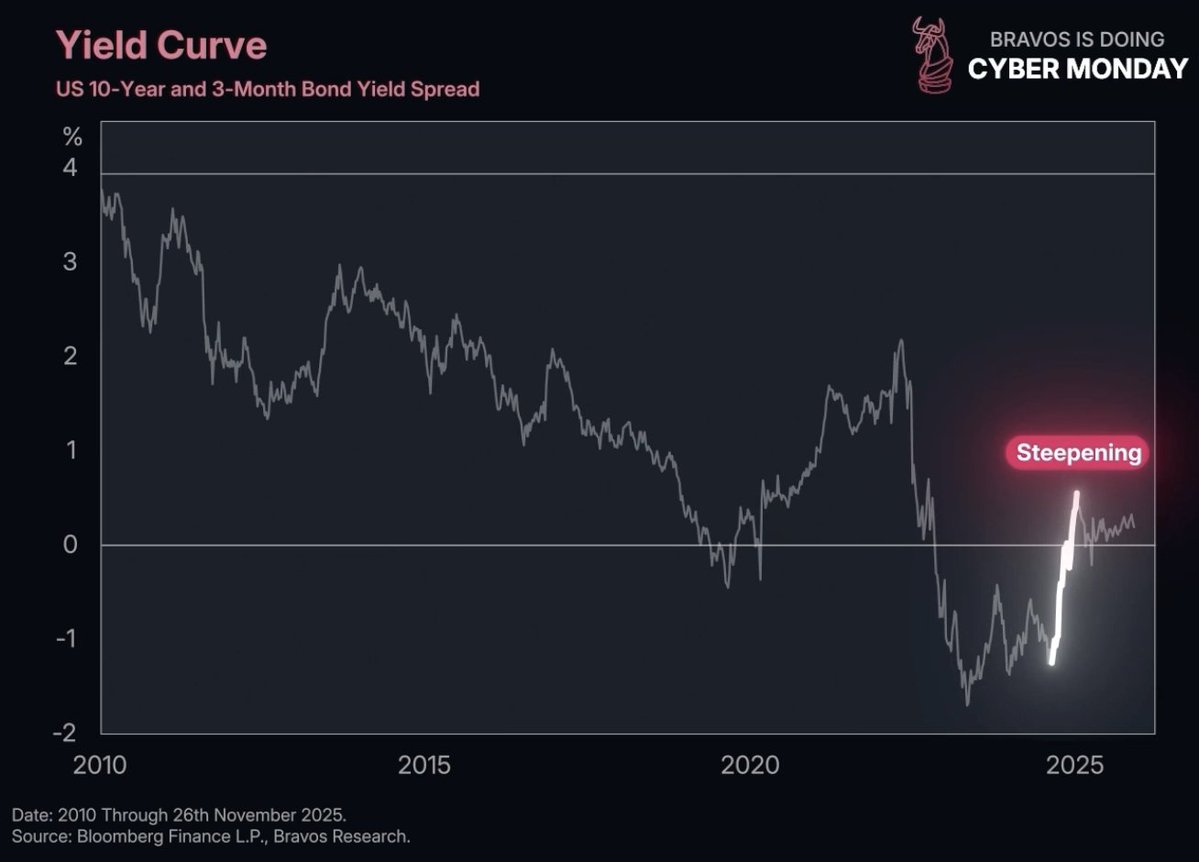

2/ The yield curve has officially begun a countdown that will bring the economy to a major turning point in 3-months.

2/ The yield curve has officially begun a countdown that will bring the economy to a major turning point in 3-months.

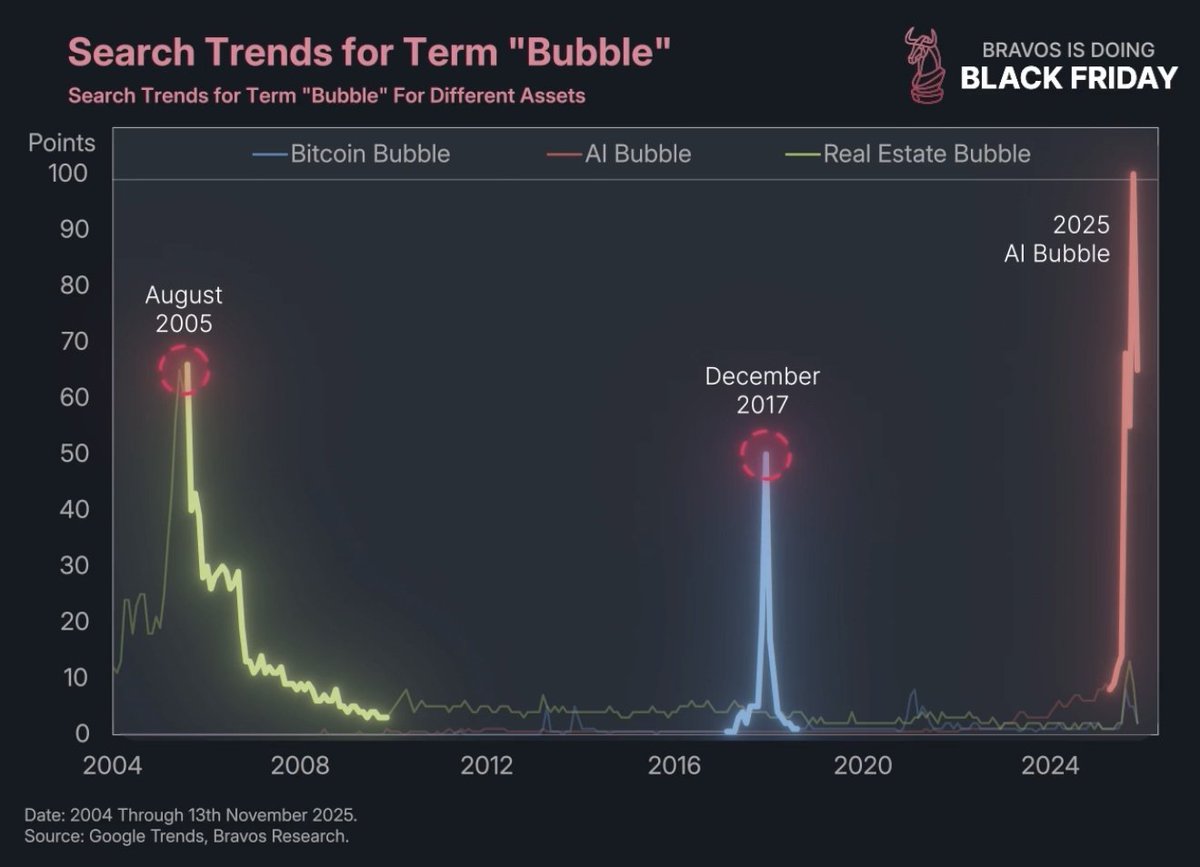

2/ This chart compares the euphoria of the 2025 AI boom with the Bitcoin frenzy of 2017 and the housing bubble of 2005 using Google search trends

2/ This chart compares the euphoria of the 2025 AI boom with the Bitcoin frenzy of 2017 and the housing bubble of 2005 using Google search trends

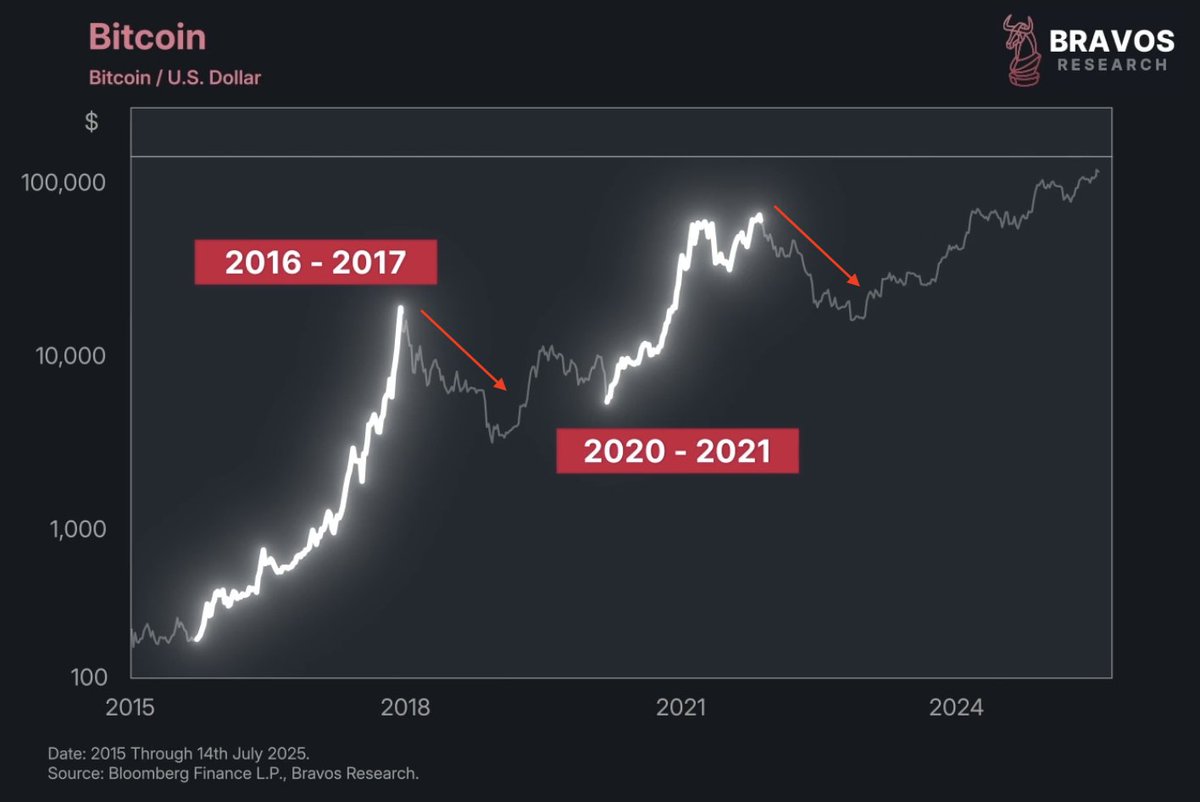

2/ What if I told you there’s 1 macro force that’s appeared before every major move Bitcoin has made over the last decade?

2/ What if I told you there’s 1 macro force that’s appeared before every major move Bitcoin has made over the last decade?

2/ We just sold most of our US stock market exposure on our website

2/ We just sold most of our US stock market exposure on our website

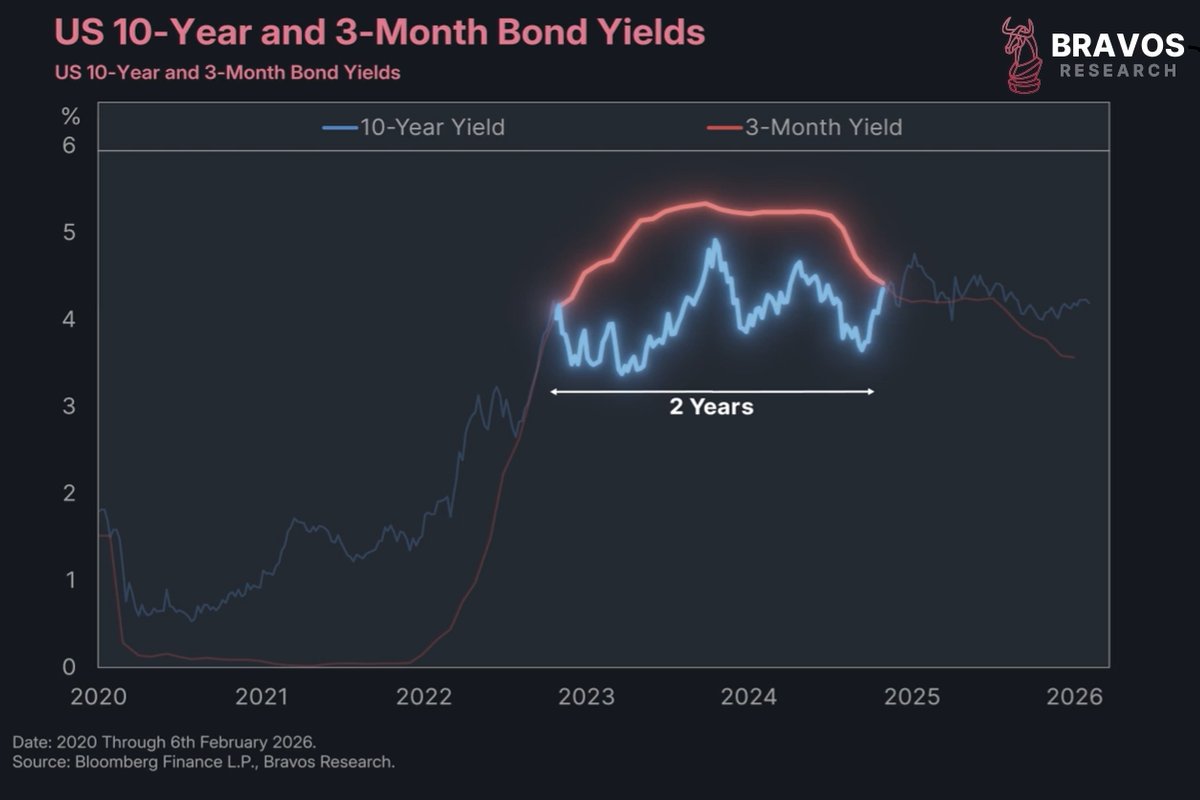

2/ This line you see here has surged right before every US recession since the 1980s

2/ This line you see here has surged right before every US recession since the 1980s

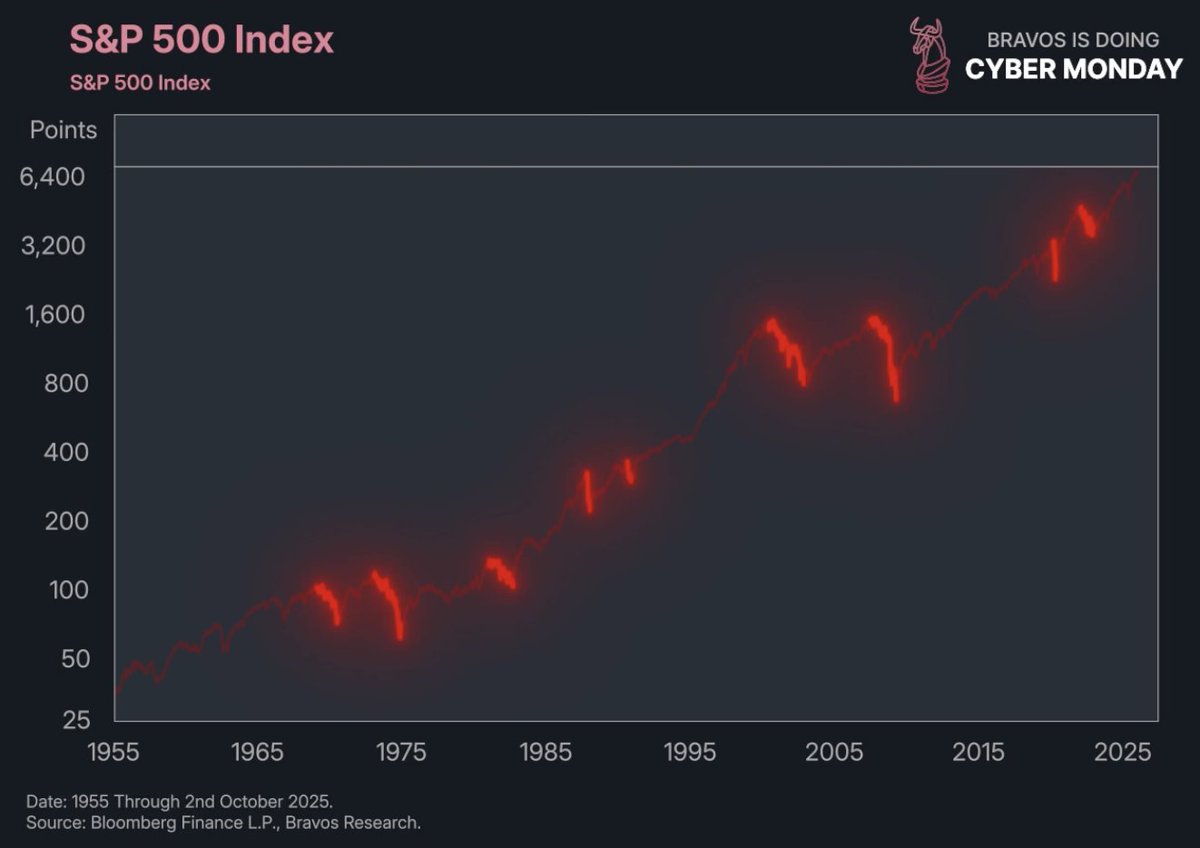

2/ The S&P 500 has hit new all time highs following a V-shaped recovery

2/ The S&P 500 has hit new all time highs following a V-shaped recovery