Over the past 4 years, I've read almost 100 trading books.

99% were useless in progressing my trading journey.

Especially for trying to become a systematic trader.

Save yourself the time and just read these 5 👇

99% were useless in progressing my trading journey.

Especially for trying to become a systematic trader.

Save yourself the time and just read these 5 👇

Evidence-Based Technical Analysis: Applying the Scientific Method and Statistical Inference to Trading Signals: 274

By David Aronson

By David Aronson

Trade Like a Hedge Fund 20 Successful Uncorrelated Strategies & Techniques to Winning Profits How to Play the QQQ-SPY Spread Using Unilateral Pairs Trading

By James Altucher

By James Altucher

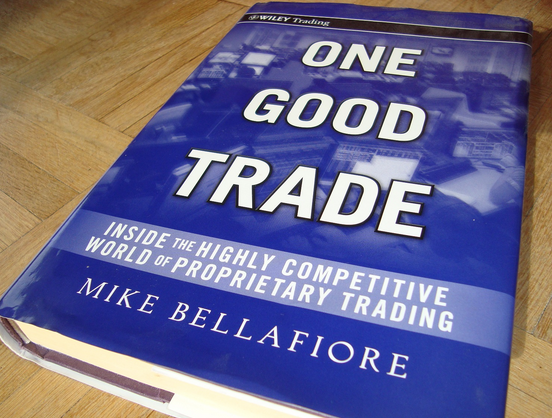

These 5 books have helped me the most. If you're considering buying one, give this tweet a like.

If you have any other suggestion leave them down below.

If you found this content valuable:

1. Follow me @GoshawkTrades for more content like this

2. Jump to the top & retweet

If you have any other suggestion leave them down below.

If you found this content valuable:

1. Follow me @GoshawkTrades for more content like this

2. Jump to the top & retweet

https://twitter.com/1336829759884550155/status/1682115728927862785

Benefit from Coding Your Strategy Without The Time Loss Learning It!

If you have 2+ years of trading experience, custom code can take your trading game to the next level!

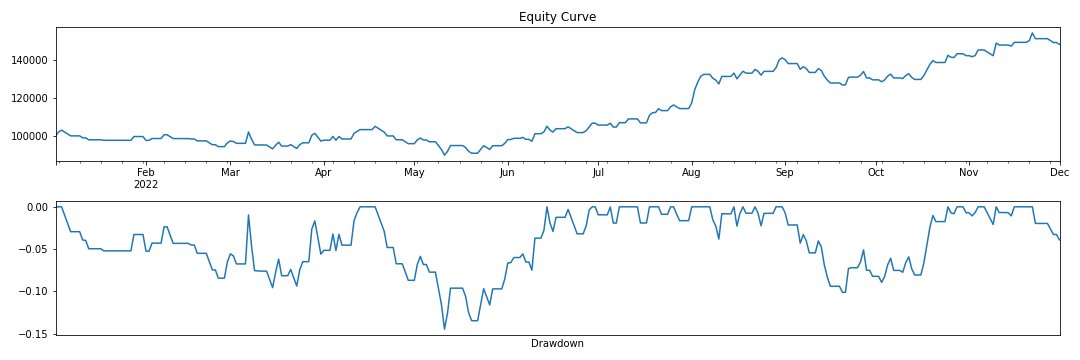

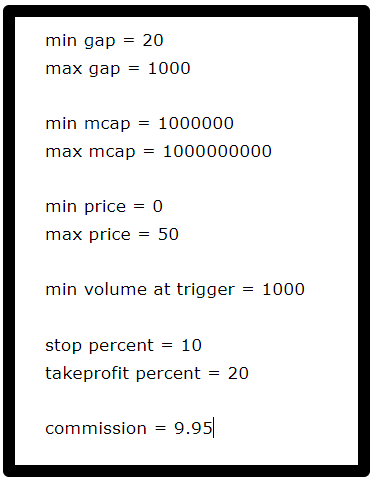

•Robust backtests

•Algos

•Custom Needs

I've got you.

Visit the link below:

unbiasedtrading.carrd.co

If you have 2+ years of trading experience, custom code can take your trading game to the next level!

•Robust backtests

•Algos

•Custom Needs

I've got you.

Visit the link below:

unbiasedtrading.carrd.co

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter