Coding Trading Strategies | From 0 to 12 Algos in 6 Years | Follow For Insights Into Systematic And Algorithmic Trading | Not Financial Advice

9 subscribers

How to get URL link on X (Twitter) App

First before you can automate, you need to quantify.

First before you can automate, you need to quantify.

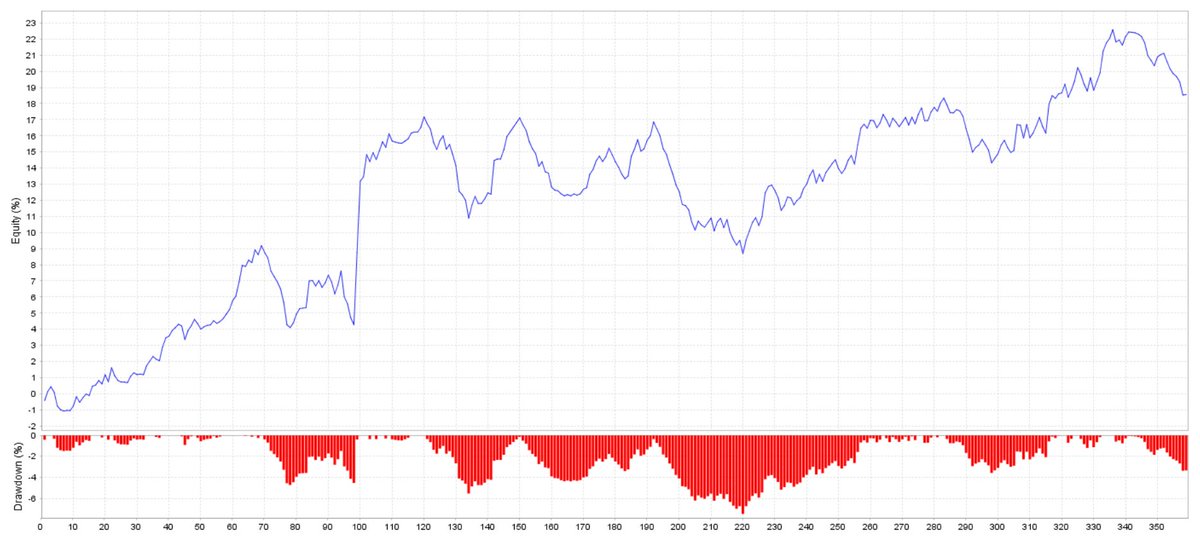

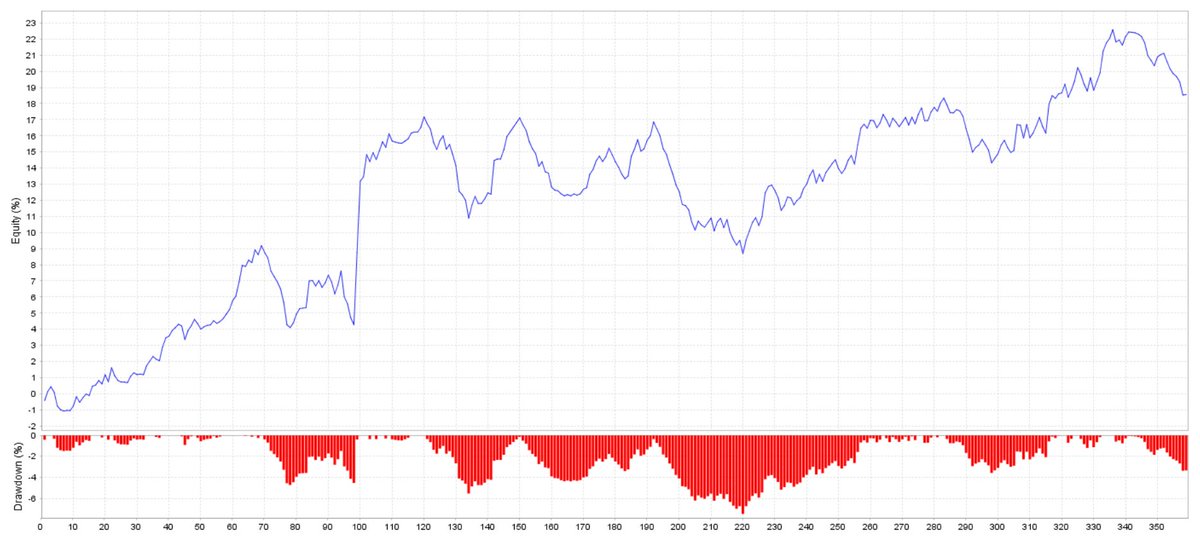

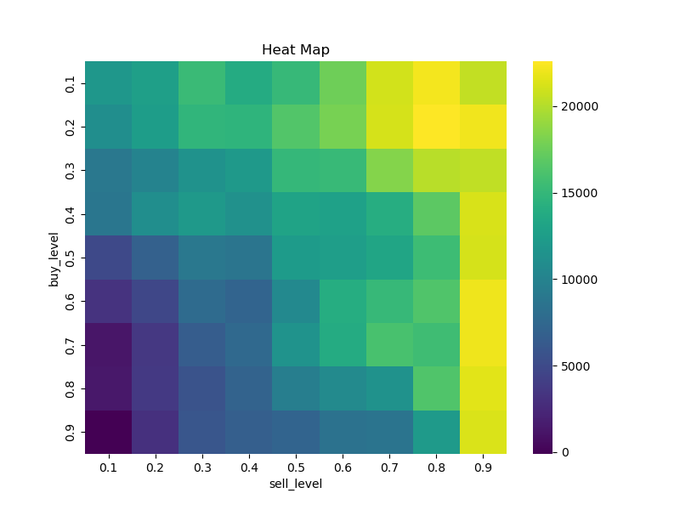

1. Parameter Sensitivity

1. Parameter Sensitivity

Context:

Context:

1. Most returns come from risk (or mispricing).

1. Most returns come from risk (or mispricing).

1. Start with simple.

1. Start with simple.

1. Systematic thinking.

1. Systematic thinking.

1. Position sizing is everything.

1. Position sizing is everything.

1. You don't need a PhD to succeed.

1. You don't need a PhD to succeed.

1. What is Parameter Sensitivity?

1. What is Parameter Sensitivity?

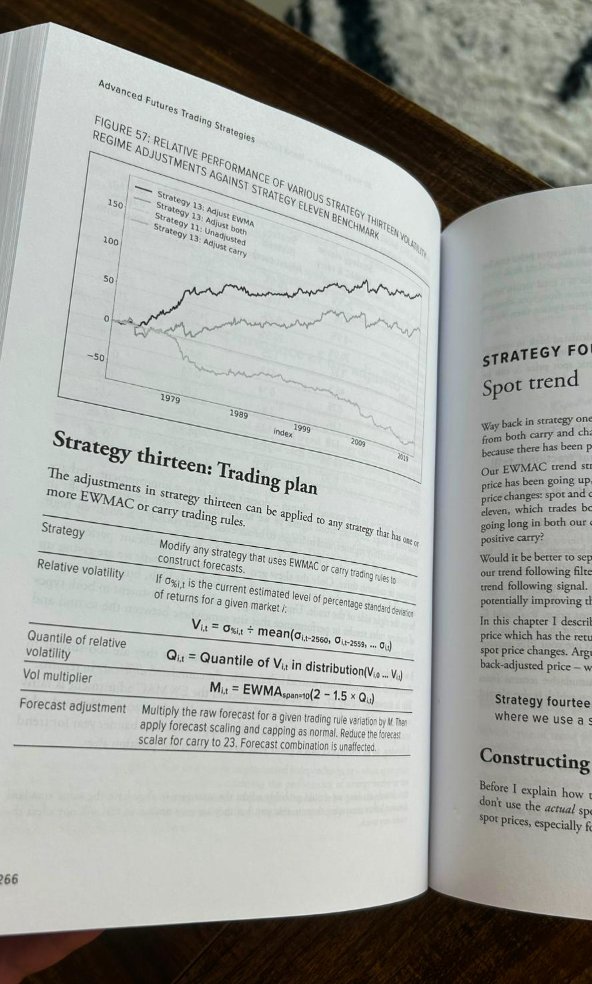

1. Complex Strategies Fail Because of Overfitting.

1. Complex Strategies Fail Because of Overfitting.

There are THREE main ways to trade:

There are THREE main ways to trade:

1. Subjective vs objective analysis.

1. Subjective vs objective analysis.

1. Systematic over discretionary.

1. Systematic over discretionary.