1. This 25-Year-Old Document Was At The Center Of #Econet's Historic IPO And Will Teach You About Vision, Building A Team and Being Bold Even As Young Person.

You can read all 46 pages or spend 5 minutes reading the thread below - you won't regret it.

🧵 + V11s below👇🏾

You can read all 46 pages or spend 5 minutes reading the thread below - you won't regret it.

🧵 + V11s below👇🏾

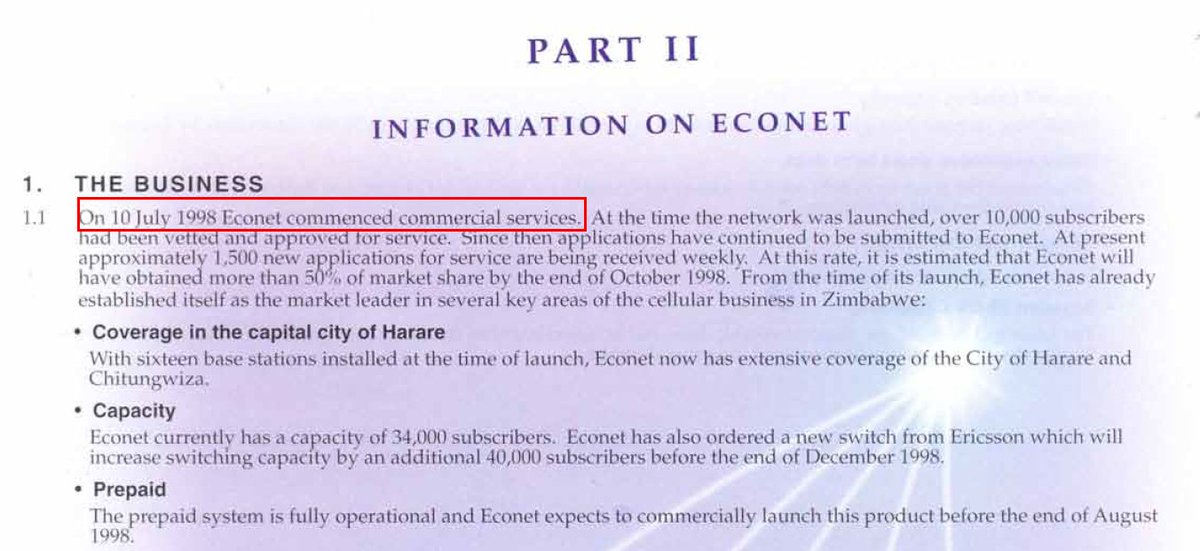

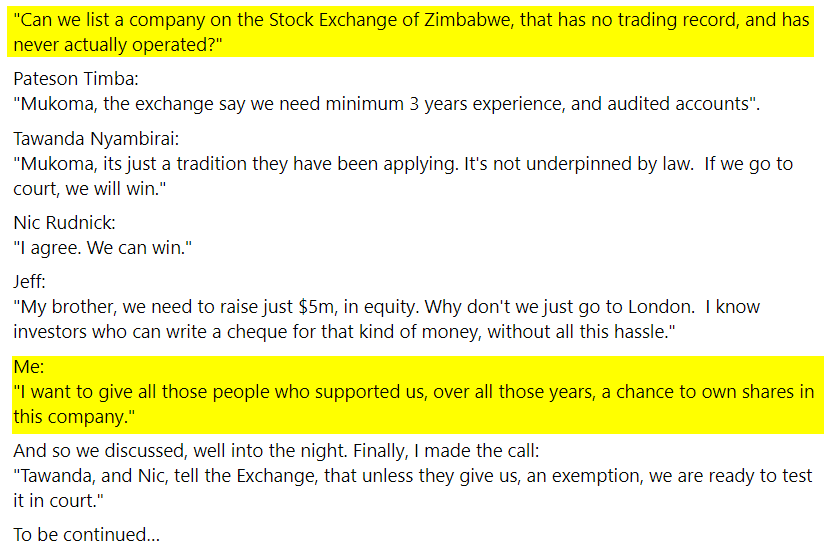

2. By December 1997, Econet had finally been awarded a telecom license. But after a long battle, the company was financially stretched & so Strive Masiyiwa & team came up with a crazy idea - raise cash directly from the public through an Initial Public Offering (IPO).

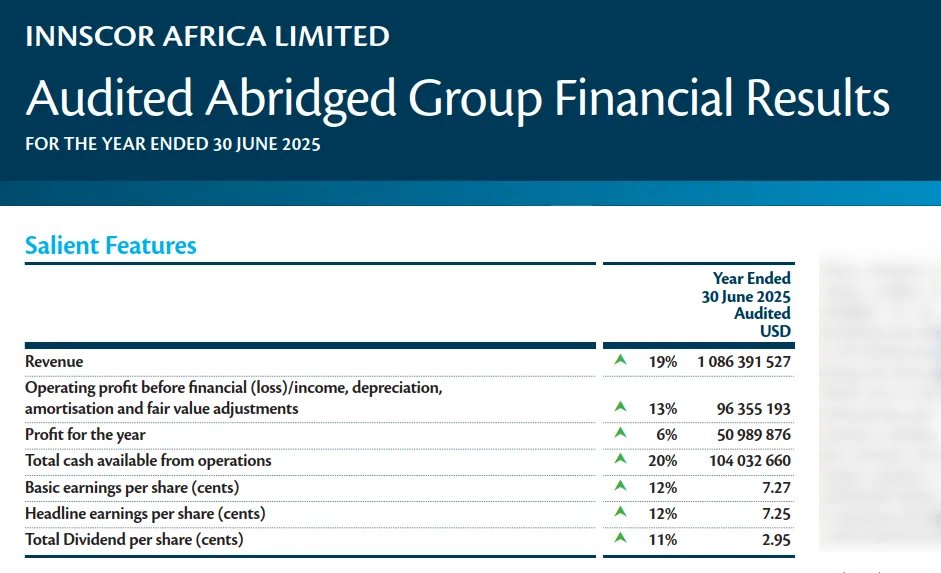

3. IPOs are usually for established companies with a long track record. At the time Econet was very much a startup. They had only started operating in July 1998 but planned to IPO in September🤯 - two months later! Even Google which also launched in 1998 waited for 6 years.

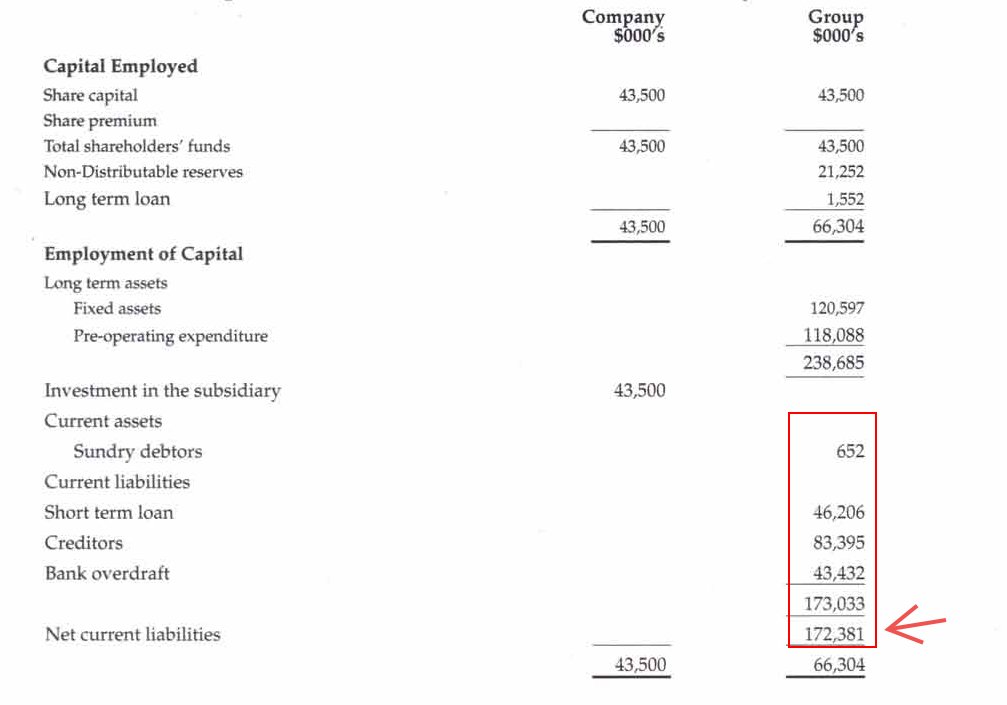

4. This IPO plan was daring & brilliant at the same time. Econet needed cash and quickly🥵 . They had creditors, loans & bank overdrafts of ZW$172m (about US$8m) that needed to be paid off soon. They still also needed cash to invest in the business and pay 150 employees.

5. This idea to IPO Econet so early was sparked from a discussion between Strive Masiyiwa, Patterson Timba, Nic Rudnick, Jeff Mzwimbi & Tawanda Nyambirai.

Strive Masiyiwa tells the story himself on his Facebook page.👇🏾

Strive Masiyiwa tells the story himself on his Facebook page.👇🏾

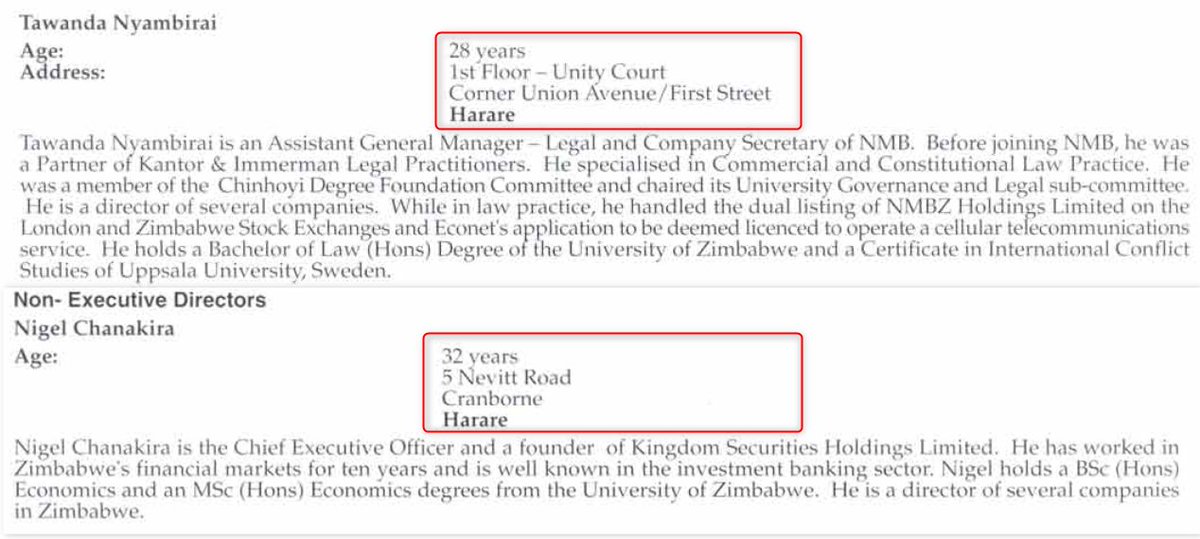

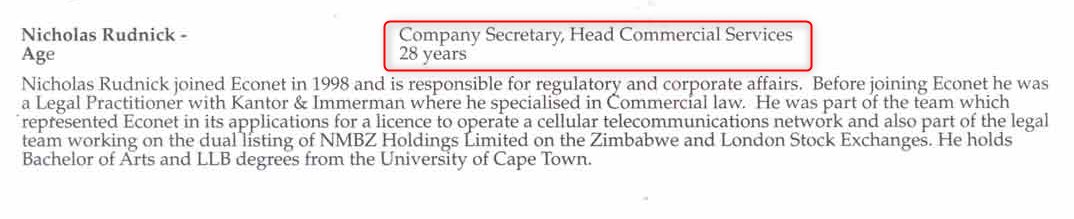

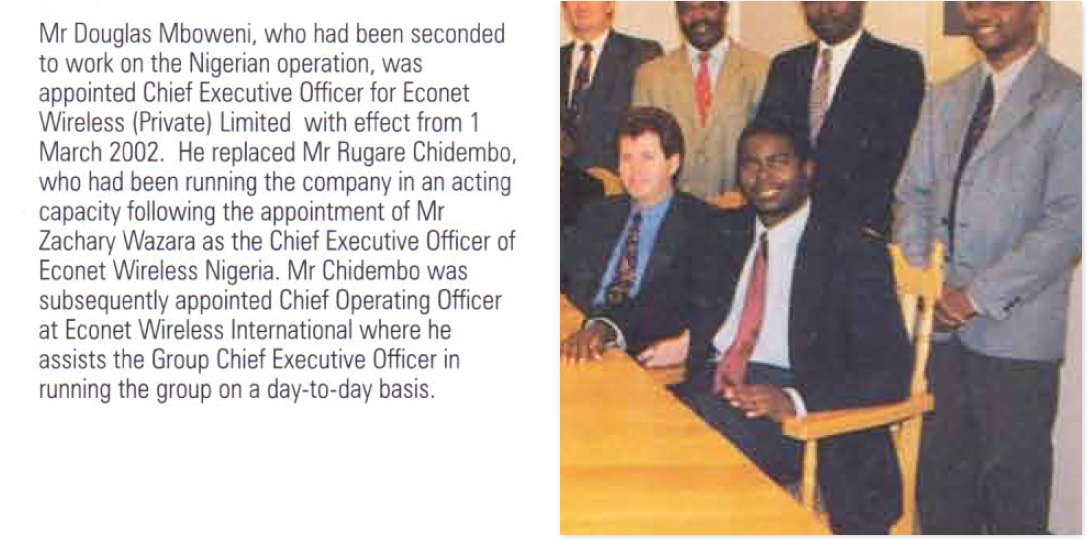

6. Tangent - It is pretty inspiring seeing how may young people played important roles early on with Econet. Nigel Chanakira 32 (Non Exec Director), Tawanda Nyambirai 28 (Non Exec Director), Nic Rudnic 28 (Company Sectretary), Douglas Mboweni 34 (GM) and many others. 🙌

7. Most of those young people didn't have many years of experience but by working on big problems early had accelerated development.

It also challenges more young leaders to consider stepping out of corporate to start new ventures which is not as common the last few years.

It also challenges more young leaders to consider stepping out of corporate to start new ventures which is not as common the last few years.

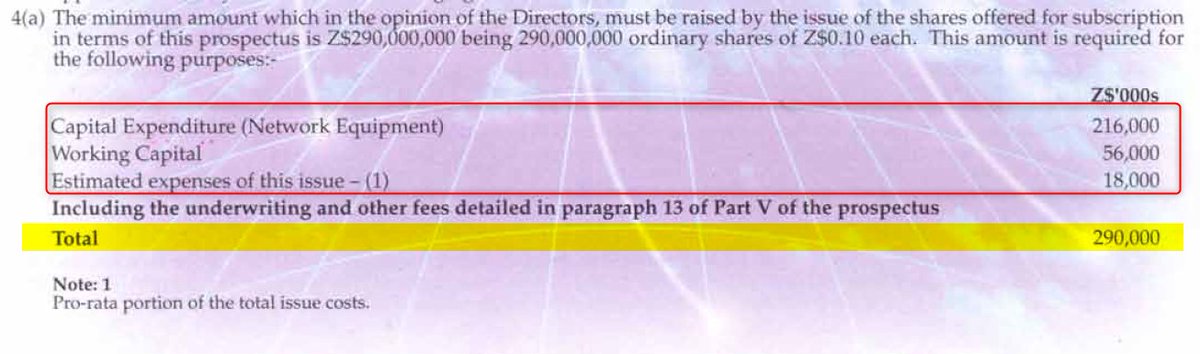

8. Back to the story - Econet needed to raise ZW$290m (US$16m) from the share issue & more from debentures. But with a new business, new technology, young team and unproven market would investors be willing hand over over US$16m to this Zimbabwean Engineer & his team?

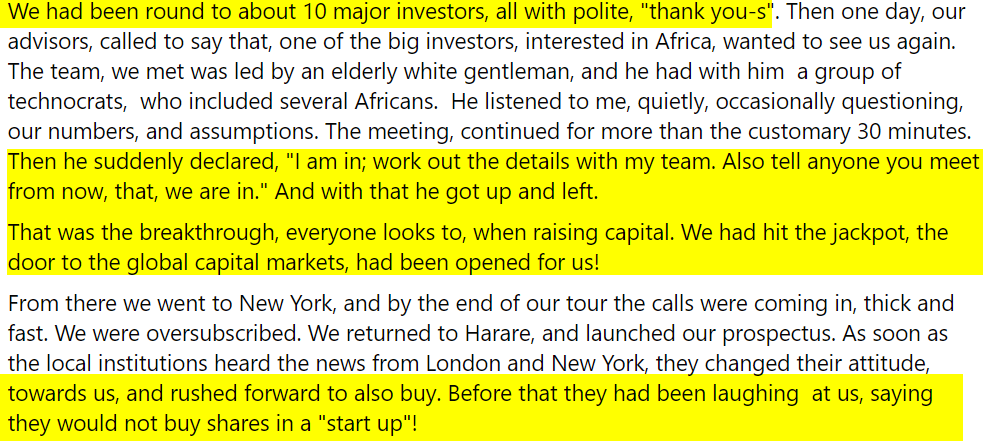

9. As could be expected, raising the money wasn't easy.

As the saying goes a prophet is without honor only in his hometown - Only after international investors backed Econet did the local institutional investors start taking interest.

Strive tells the story better 👇🏾

As the saying goes a prophet is without honor only in his hometown - Only after international investors backed Econet did the local institutional investors start taking interest.

Strive tells the story better 👇🏾

10. The IPO was a success! It was oversubscribed i.e. too many people wanted Econet shares.

Econet then grew rapidly between 1998 - 2002🚀 more than doubling subscribers & surpassing projections even after inflation adjustments.

No wonder Strive was smiling like this in 2002😂

Econet then grew rapidly between 1998 - 2002🚀 more than doubling subscribers & surpassing projections even after inflation adjustments.

No wonder Strive was smiling like this in 2002😂

11. Today Econet is still one of the biggest companies in Zimbabwe and is celebrating 25 years of operations. The success of Econet Wireless set in course the foundation for businesses and helped make Strive the first Forbes Billionaire from Zimbabwe.

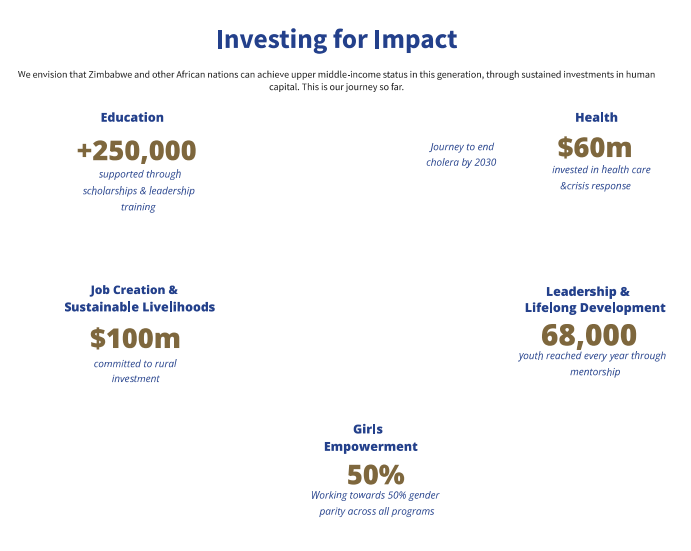

12. And whilst the billionaire status is impressive, Strive & Tsitsi Masiyiwa's greatest achievements may be the impact made through the Higher Life Foundation.

The foundation was founded in 1996 even before Econet had a license &has impacted the lives of millions positively.🙏

The foundation was founded in 1996 even before Econet had a license &has impacted the lives of millions positively.🙏

13. Some reflections: There is value in loyalty - Many who were there in the early days ended up with great opportunities. Nic Rudnick became CEO of Liquid Telecom, Douglas Mboweni of CEO of the Econet etc. There are many other whose early sacrifices were rewarded in others ways.

14. There is power is a compelling vision - The team Strive put together was phenomenal and he could have never afforded to pay them what they were worth at the time.

They stayed because of the vision and the opportunity to do something with impact.

They stayed because of the vision and the opportunity to do something with impact.

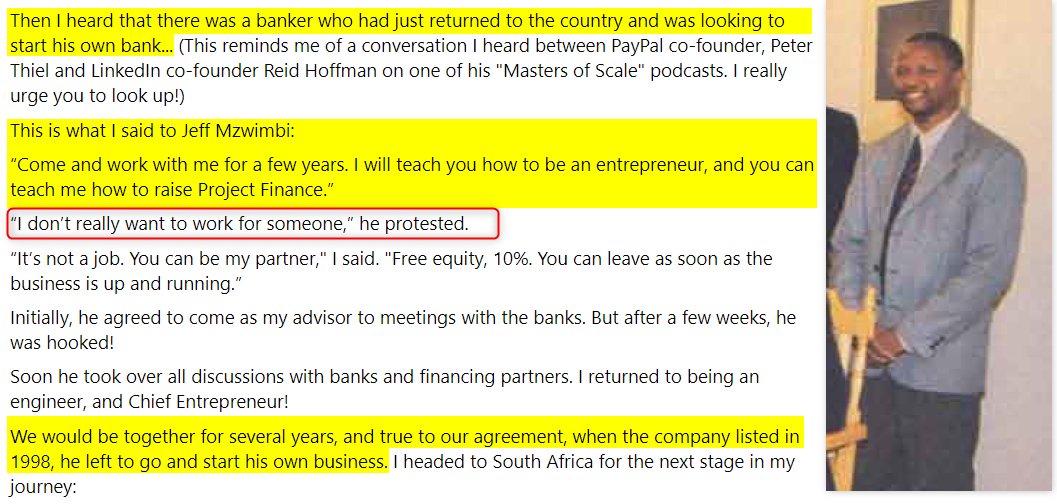

15. It is also good to build someone else's vision - Jeff Mzwimbi wanted to build his own business - but in the end took Strive's offer & thrived.

He was still able to launch his own business later (maybe too soon?) but his time at Econet put him in a better position to do so.

He was still able to launch his own business later (maybe too soon?) but his time at Econet put him in a better position to do so.

16. Corporate Men & Assumptions 🤭 - Both Deloitte & NMB addressed letters to Econet to "Gentlemen"🤦♂️ even though a woman, Marion More was a Director & responsible for Finance.

I am sure this would not happen today as now the Deloitte CEO & the NMB CFO are women.👏

I am sure this would not happen today as now the Deloitte CEO & the NMB CFO are women.👏

17. What you think about Econet's IPO 25 Years Ago? Has anything inspired you?

If you found this interesting please comment, share or retweet!

PS: Part of a weekly deep dive into the Finance & Strategy behind the most important companies impacting Africa & The World.

If you found this interesting please comment, share or retweet!

PS: Part of a weekly deep dive into the Finance & Strategy behind the most important companies impacting Africa & The World.

18. If you want to retweet! Here you go!

Thanks for the read and the retweet & please let me know what you think!

https://twitter.com/tmukogo/status/1682320244818288641?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh