The DePIN, or decentralized physical infra networks, narrative has been growing stronger recently.

So I wrote a 7k+ word report on everything you could possibly need to know before the next bull market.

So I wrote a 7k+ word report on everything you could possibly need to know before the next bull market.

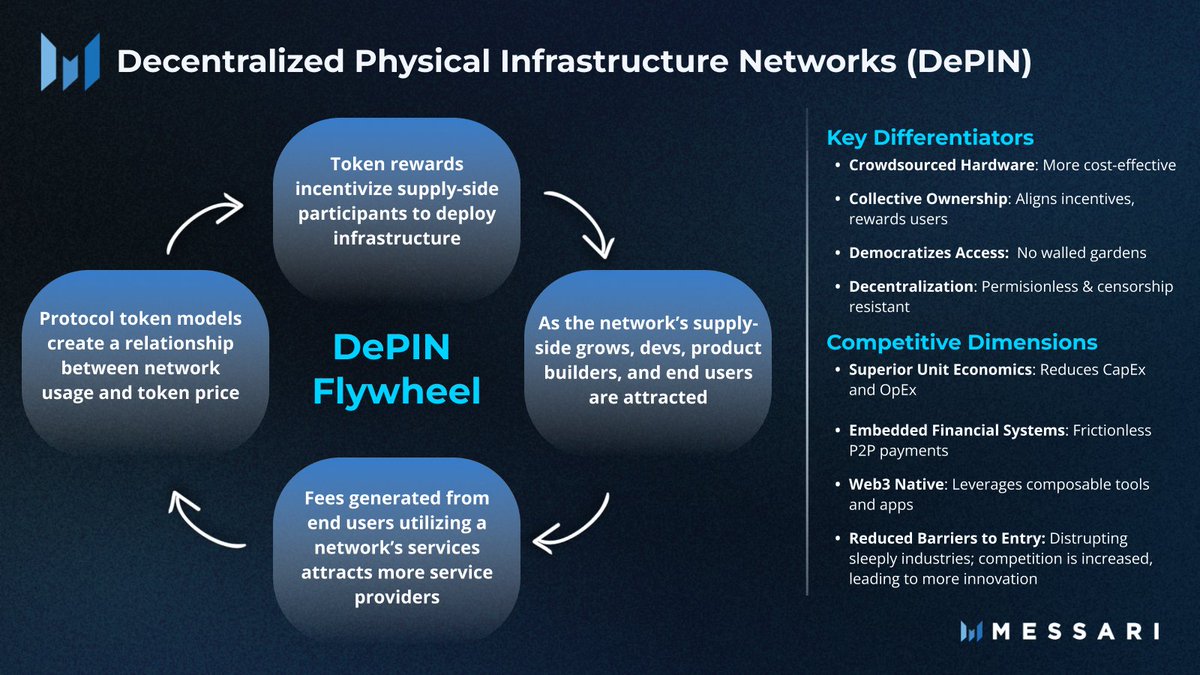

DePINs use token rewards to incentivize the crowdsourcing and building of real-world physical infra.

The "real world" part is important because it represents crypto branching out out of the digital realm and into the meatspace.

The "real world" part is important because it represents crypto branching out out of the digital realm and into the meatspace.

DePINs aim to tap into existing Web2 demand by offering cheaper services, while also unlocking new use cases, and supporting crypto apps

The tangible aspect of DePIN and the focus on large existing markets is more digistibile for investors

See bloomberg:

The tangible aspect of DePIN and the focus on large existing markets is more digistibile for investors

See bloomberg:

https://twitter.com/dorloechter/status/1679559327575580696

The initial DePIN sector map was delineated into four categories:

Server, wireless, sensor, and energy networks

However, as distinct variations between these categories became apparent, we chose to add two subcategories: Physical Resource Networks and Digital Resource Networks

Server, wireless, sensor, and energy networks

However, as distinct variations between these categories became apparent, we chose to add two subcategories: Physical Resource Networks and Digital Resource Networks

Physical resource networks incentivize users to deploy location-dependent hardware to offer non-fungible services, such as energy, & connectivity

Digital resource networks incentivize users to deploy hardware to offer fungible digital resources like compute, storage, and bandwidth

The report also covers:

1. How DePINs have successfully built the supply side but are struggling to attract the demand side. Includes what is being done to address this

1. How DePINs have successfully built the supply side but are struggling to attract the demand side. Includes what is being done to address this

2. Emerging trends

In PRNs:

- Leveraging smartphones as the device

- Transitioning from passive to active participation

- Web2 businesses adopting the DePIN model

3. Investment opportunities

- GPU marketplaces

- Geospatial and mobility projects

- DeWi 5G networks

In PRNs:

- Leveraging smartphones as the device

- Transitioning from passive to active participation

- Web2 businesses adopting the DePIN model

3. Investment opportunities

- GPU marketplaces

- Geospatial and mobility projects

- DeWi 5G networks

The report also covers challenges DePINs face, adoption timelines, and most importantly, the business models and moats

This report is packed with information. It's a @MessariCrypto enterprise report which you can read here. Please reach out if you have any questions/request.

messari.io/report/navigat…

messari.io/report/navigat…

• • •

Missing some Tweet in this thread? You can try to

force a refresh