Pushin' τ @cruciblelabs | prev: @OSSCapital, @MessariCrypto | i like AI x crypto, DePIN, macro, geopolitics and bitcoin

2 subscribers

How to get URL link on X (Twitter) App

Bittensor draws much inspiration from Bitcoin's design and principles.

Bittensor draws much inspiration from Bitcoin's design and principles.

Compute marketplaces dominated 2023. However, the challenge for 2024 will be storage networks finding more paying users, compute networks sourcing high quality GPUs, and retrieval networks increasing their density.

Compute marketplaces dominated 2023. However, the challenge for 2024 will be storage networks finding more paying users, compute networks sourcing high quality GPUs, and retrieval networks increasing their density.

The transparency of blockchains poses challenges for enterprise adoption, as most businesses are unwilling to publicize every aspect of their operations onchain.

The transparency of blockchains poses challenges for enterprise adoption, as most businesses are unwilling to publicize every aspect of their operations onchain.

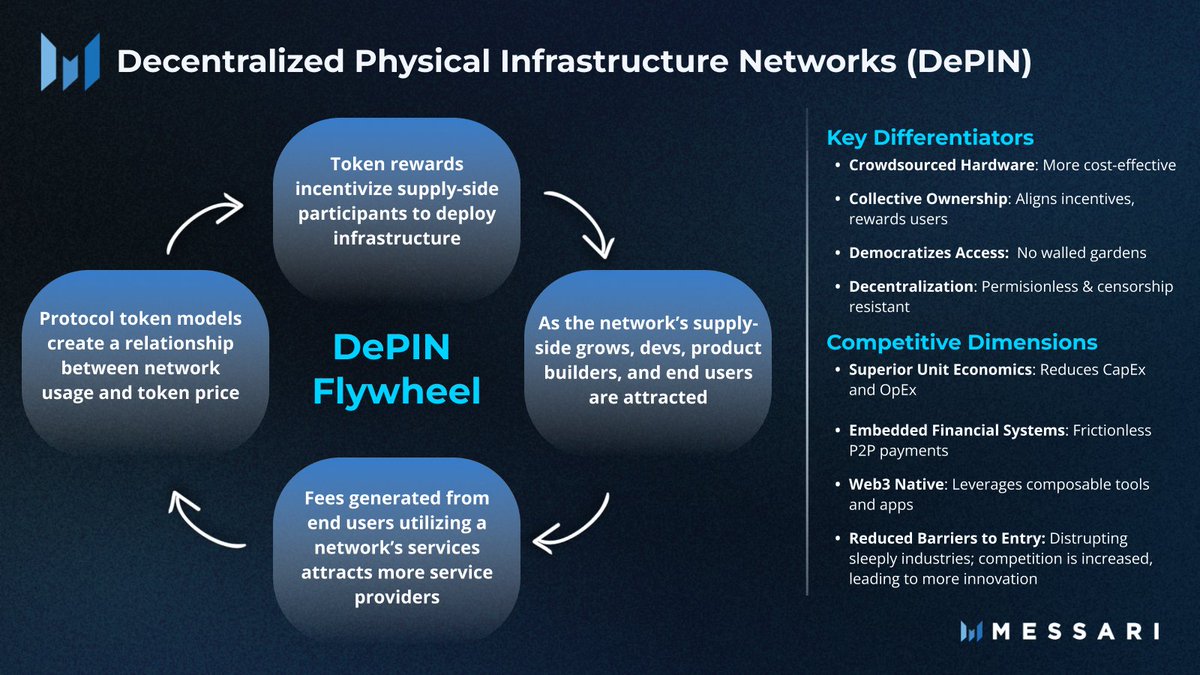

DePINs use token rewards to incentivize the crowdsourcing and building of real-world physical infra.

DePINs use token rewards to incentivize the crowdsourcing and building of real-world physical infra.

What is DePIN?

What is DePIN?

In a decentralized cloud storage model, data is distributed across a global P2P network of individually operated nodes, rather than on a single server located in a data center.

In a decentralized cloud storage model, data is distributed across a global P2P network of individually operated nodes, rather than on a single server located in a data center.

Q3'22 has been challenging for the Web3 infrastructure sector. Although the sector’s fully diluted market cap slightly declined by 2%, the overall revenue generated declined by a staggering 67% QoQ from $16.8 million to $5.6 million.

Q3'22 has been challenging for the Web3 infrastructure sector. Although the sector’s fully diluted market cap slightly declined by 2%, the overall revenue generated declined by a staggering 67% QoQ from $16.8 million to $5.6 million.

https://twitter.com/rawrmaan/status/15647181741127270402. Access to Solana's dev ecosystem.

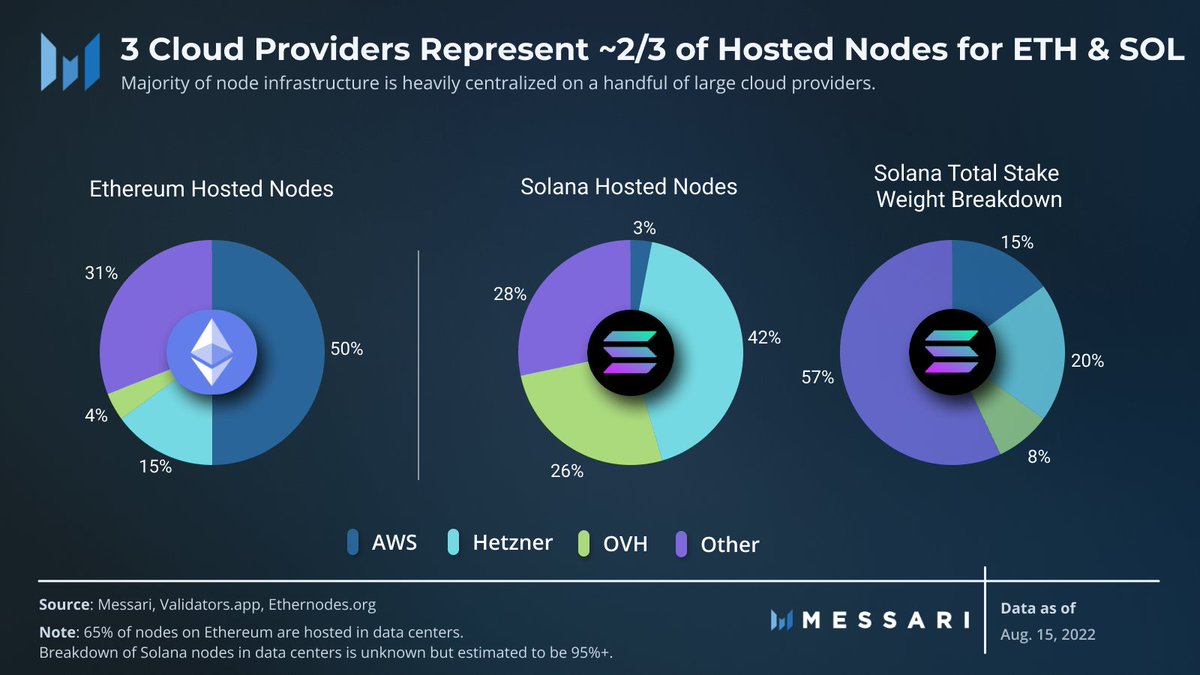

Centralized Infra-as-a-Service businesses (e.g., Infura and Alchemy) tend to rely on a single cloud provider. As a result, nodes have become centralized on the servers of a handful of large cloud providers.

Centralized Infra-as-a-Service businesses (e.g., Infura and Alchemy) tend to rely on a single cloud provider. As a result, nodes have become centralized on the servers of a handful of large cloud providers.

Using this framework, protocols are rewarding tokens to participants for helping build and maintain large scale networks including decentralized weather station, map, 5G, car data & compute networks.

Using this framework, protocols are rewarding tokens to participants for helping build and maintain large scale networks including decentralized weather station, map, 5G, car data & compute networks.

Mining alt PoW coins is what a majority of miners are defaulting to, but this *won't* play out well.

Mining alt PoW coins is what a majority of miners are defaulting to, but this *won't* play out well.

Last month, @THORChain integrated Terra onto the network. In 3 weeks the network amassed $90mn in #UST and #LUNA liquidity.

Last month, @THORChain integrated Terra onto the network. In 3 weeks the network amassed $90mn in #UST and #LUNA liquidity.