1// Not having a rolling cash flow forecast

Forecasted cash flows show your company’s projected operating, investing and financing cash flows for the next fiscal period (and beyond, for rolling cash flows), based on year-to-date results, fiscal year plans, and the ongoing effects of current strategic initiatives.

2// Not securing access to a short term working capital line of credit

Short term lines of credit for the financing of working capital assets are critical for growing companies or those with seasonal or irregular cash flow patterns.

Short term lines of credit for the financing of working capital assets are critical for growing companies or those with seasonal or irregular cash flow patterns.

3// Not negotiating sufficient access to short term working capital financing

A line of credit with an insufficient limit will be of little use for a growing company faced with a large sale opportunity.

A line of credit with an insufficient limit will be of little use for a growing company faced with a large sale opportunity.

A line of credit with a sufficient limit but which cannot be accessed due to an insufficient borrowing base of accounts receivable and inventory will pose a similar challenge.

4// Not managing your cash conversion cycle

4// Not managing your cash conversion cycle

If the DSO + DIO - DPO is starting to creep up, you should be noticing and proactively investigating to avoid it generating a cash flow deficit.

5// Your suppliers will want to be paid as soon as possible, meanwhile your clients will ask for the exact opposite.

5// Your suppliers will want to be paid as soon as possible, meanwhile your clients will ask for the exact opposite.

Negotiate with both parties to maximize your cash flow position while also managing your supply chain relationships.

6// Late invoicing

6// Late invoicing

This signals a lack of adequate processes and systems, so consider automation solutions and embed a relevant KPI in the performance metrics of responsible team members.

7//Overstocking inventory

7//Overstocking inventory

Effective inventory management involves balancing supply and demand, optimizing inventory levels, minimizing costs and avoiding stock outs so you can meet customer needs.

8// Manual and paper based collection process

8// Manual and paper based collection process

To maximize cash flow, make it easy for your customers to pay you, so replace manual and paper based processes with electronic payments and digital reporting solutions.

9// Misaligning cash flow sources

9// Misaligning cash flow sources

Permanent increases in operating assets need to be financed with permanent capital, whether equity or debt (financing cash inflows).

Cash inflows from asset sales (investing cash inflows) for example, are not a sustainable source of financing for operating cash flow deficits

10// Ignoring cash flow quality

10// Ignoring cash flow quality

Cash absorbed by low quality assets, such as accounts receivable with a low collection probability or obsolete inventory should be properly reflected in your reserves so you can appropriately plan your cash flow financing requirements.

11// Under budgeting debt payments

11// Under budgeting debt payments

Debt obligations (principal, interest, bonuses, royalties, warrants, etc) are repayable with cash, so you need to correctly provision both the timing and the amounts in your cash flow forecast to ensure obligations can be met when they come due.

12// Not having a cash flow culture

Thriving cash flow starts with the top executive leaders making cashflow a priority on equal footing with profitability and growth, and establishing appropriate cash flow KPIs to drive the desired performance.

13// Not following up

Thriving cash flow starts with the top executive leaders making cashflow a priority on equal footing with profitability and growth, and establishing appropriate cash flow KPIs to drive the desired performance.

13// Not following up

Effective follow-up relies on systems and procedures that help ensure timely payment collections and disbursements, and it can help identify potential issues early on.

14// Miscalculating the cash flow basis for bank covenant calculations.

14// Miscalculating the cash flow basis for bank covenant calculations.

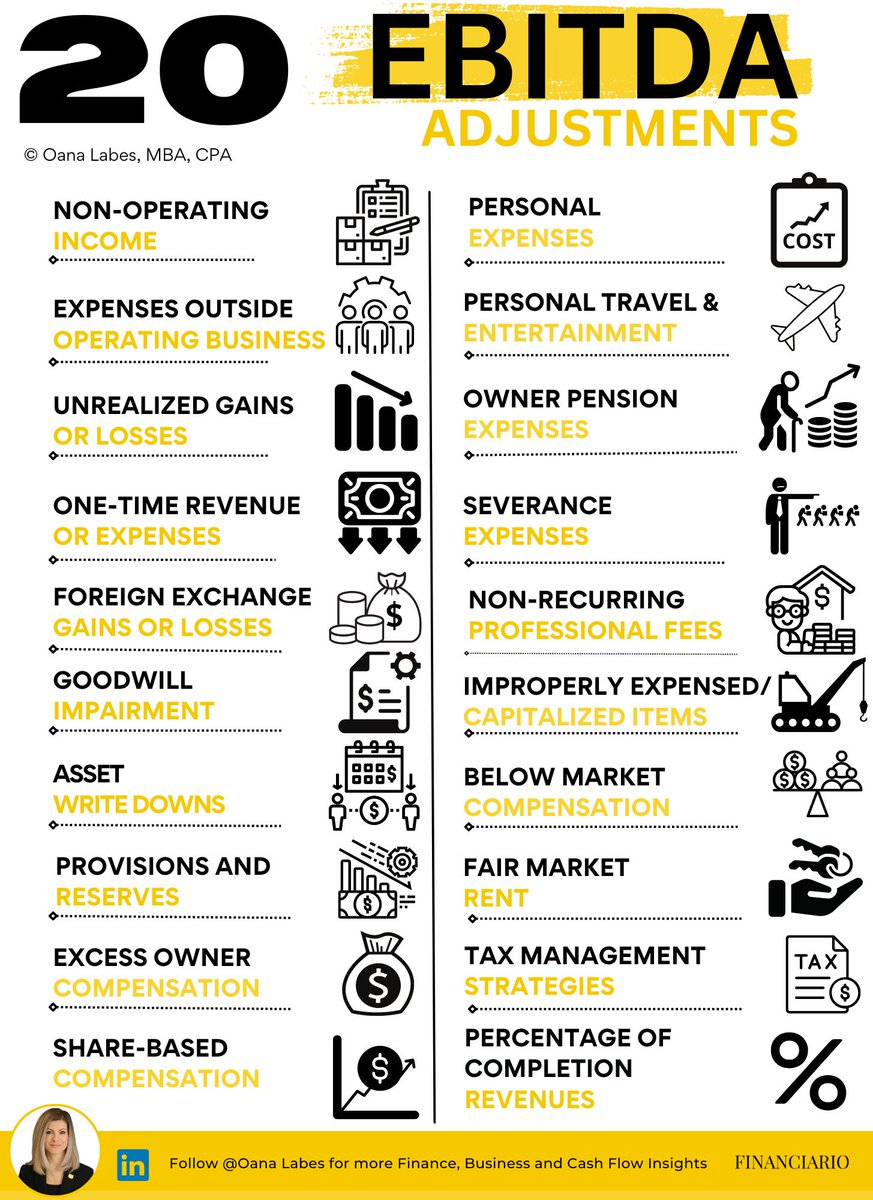

Covenant calculations can be based on:

✔️EBITDA

✔️Adjusted EBITDA (individual formula)

✔️Free Cash Flow (FCF)

✔️Operating Cash Flow (OCF)

✔️EBITDA

✔️Adjusted EBITDA (individual formula)

✔️Free Cash Flow (FCF)

✔️Operating Cash Flow (OCF)

Understand the specific terms provisioned in your lending agreements to avoid covenant breaches and maintain compliance with contractual obligations.

15// Paying suppliers early

15// Paying suppliers early

With the exception of attractive early payment discounts and a few other strategic reasons, making early payments to suppliers outside of contractual terms has little benefit for your company while putting unnecessary pressure on your cash flows.

16// Improperly using payment discounts

Cash is king so understandably you will want to accelerate collections.

Cash is king so understandably you will want to accelerate collections.

However, offering early payment discounts which you cannot afford will not be of much help, which is why proper costing is critical to inform your minimum pricing levels.

What would you add?

If you enjoyed this thread:

1. Follow me @IAmOanaLabes for more of these

2. Sign up for my free newsletter. and join 30,000 subscribers:

3. RT the tweet below to share the knowledge: https://t.co/CIwOdkjGmkthe-finance-gem.beehiiv.com/subscribe

If you enjoyed this thread:

1. Follow me @IAmOanaLabes for more of these

2. Sign up for my free newsletter. and join 30,000 subscribers:

3. RT the tweet below to share the knowledge: https://t.co/CIwOdkjGmkthe-finance-gem.beehiiv.com/subscribe

https://twitter.com/1612701806697627650/status/1684202504307740673

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter