The end of the DeFi bear market is upon us.

As a full-time DeFi analyst who's experienced pain for far too long, here's why I believe DeFi is finally in the VERY EARLY stages of a bull market 🧵

As a full-time DeFi analyst who's experienced pain for far too long, here's why I believe DeFi is finally in the VERY EARLY stages of a bull market 🧵

https://twitter.com/DegenSpartan/status/1323467463409901569

To understand why, let's understand what catalyzed and ended the DeFi bull market in the first place: zero interest rates.

TradFi yields in 2020 were so low that capital found their way on-chain to seek higher yield opportunities.

TradFi yields in 2020 were so low that capital found their way on-chain to seek higher yield opportunities.

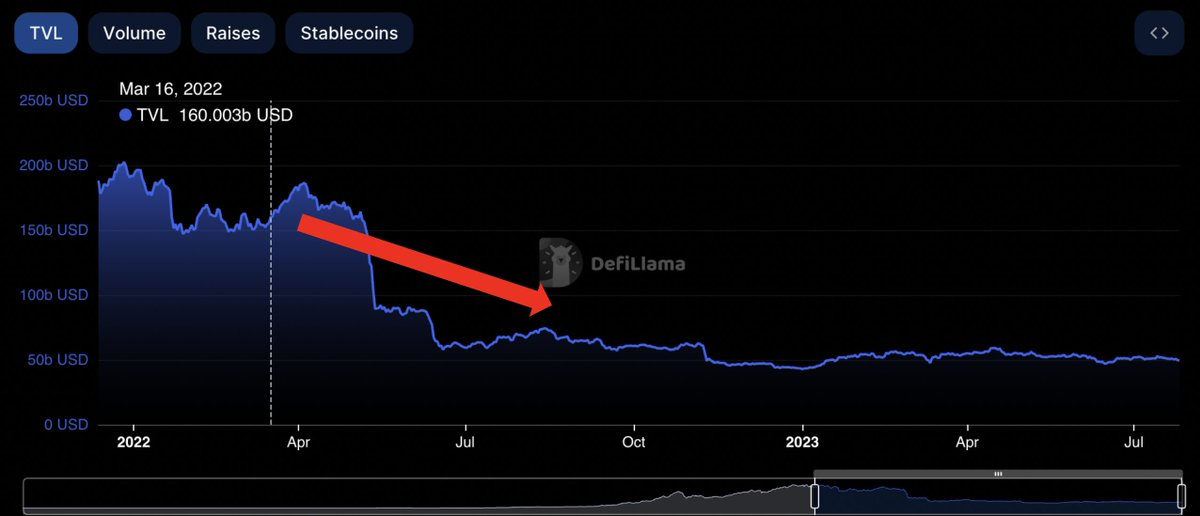

This is clearly visible when you monitor DeFi TVL since 2020. It went from near zero to over $200B in less than 2 years!!!

Stablecoin liquidity is important for crypto prices because for every dollar that enters the ecosystem, some % trickles into buying tokens (price go up).

Stablecoin liquidity is important for crypto prices because for every dollar that enters the ecosystem, some % trickles into buying tokens (price go up).

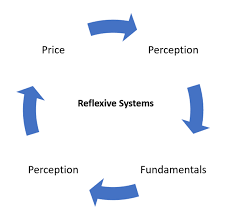

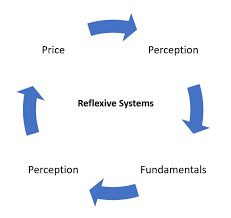

Since crypto yields are extremely reflexive, this led to all sorts of DeFi bubbles that we're all aware of.

If on-chain yields are denominated in tokens and price is going up, people will continue to chase them as long as TradFi yields were at zero.

More speculation!

If on-chain yields are denominated in tokens and price is going up, people will continue to chase them as long as TradFi yields were at zero.

More speculation!

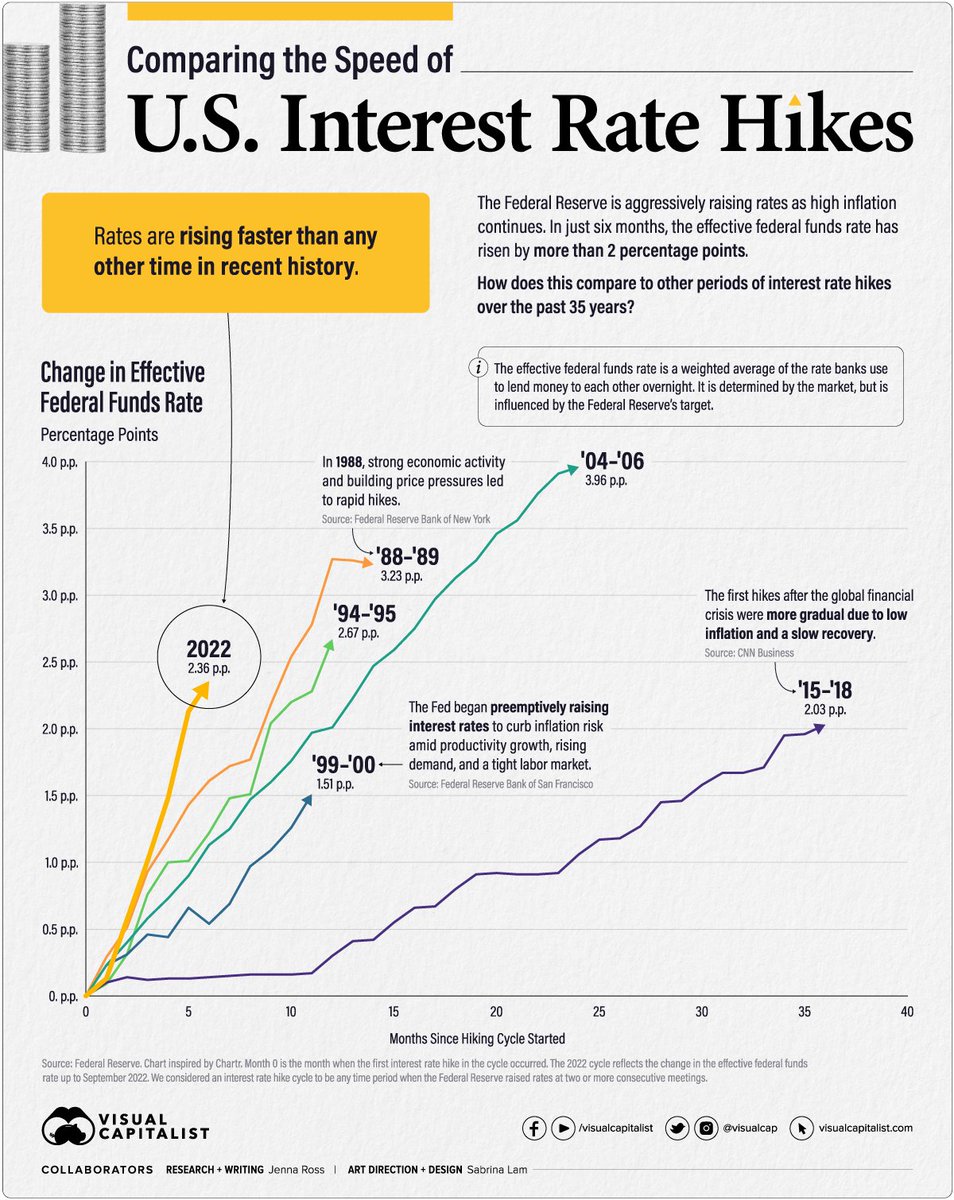

Of course, all good things must come to an end. To counter inflation, the Fed began its most aggressive hiking campaign on March 16, 2022.

Guess what that did to DeFi TVL?

Guess what that did to DeFi TVL?

Yup, down.

DeFi continues to face headwinds because people can earn the risk-free rate in TradFi above 5% while the safest on-chain yields struggle to get above 4%.

DeFi continues to face headwinds because people can earn the risk-free rate in TradFi above 5% while the safest on-chain yields struggle to get above 4%.

So what's the takeaway here?

Until on-chain yields (that are perceived "very safe") can offer HIGHER YIELDS than the risk-free rate, we CANNOT have a sustained DeFi bull market.

But today, I finally see a world where this is possible.

Until on-chain yields (that are perceived "very safe") can offer HIGHER YIELDS than the risk-free rate, we CANNOT have a sustained DeFi bull market.

But today, I finally see a world where this is possible.

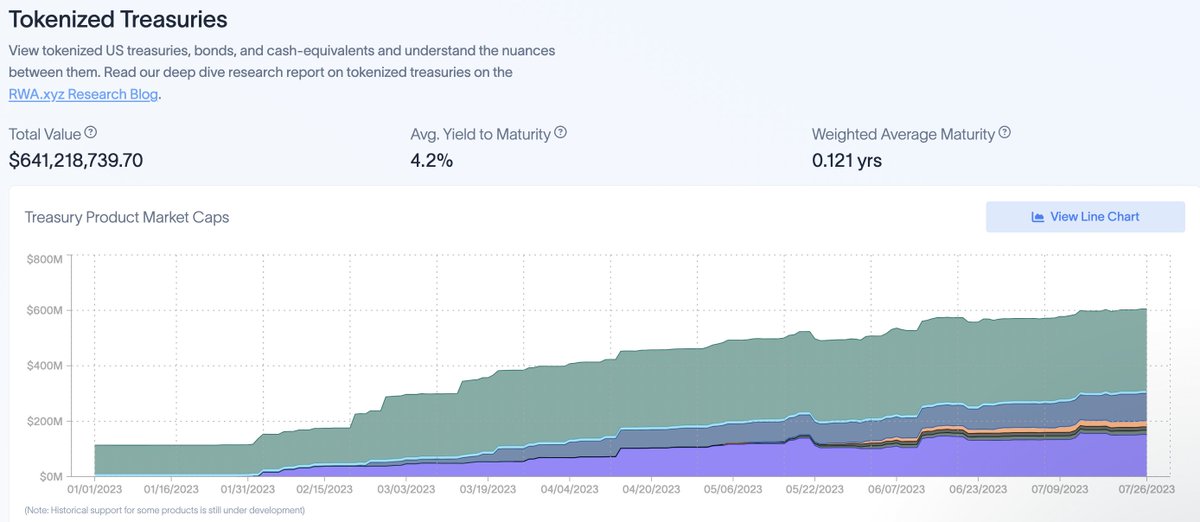

Enter RWAs (Real World Assets).

There's a growing trend of DeFi protocols tokenizing US T-bills on chain. They are buying short-term treasuries off-chain through a KYC'd counterparty, and transferring the yield to on-chain participants.

There's a growing trend of DeFi protocols tokenizing US T-bills on chain. They are buying short-term treasuries off-chain through a KYC'd counterparty, and transferring the yield to on-chain participants.

Not listed above is @MakerDAO who is the largest DeFi treasuries buyer, with over $2B purchased.

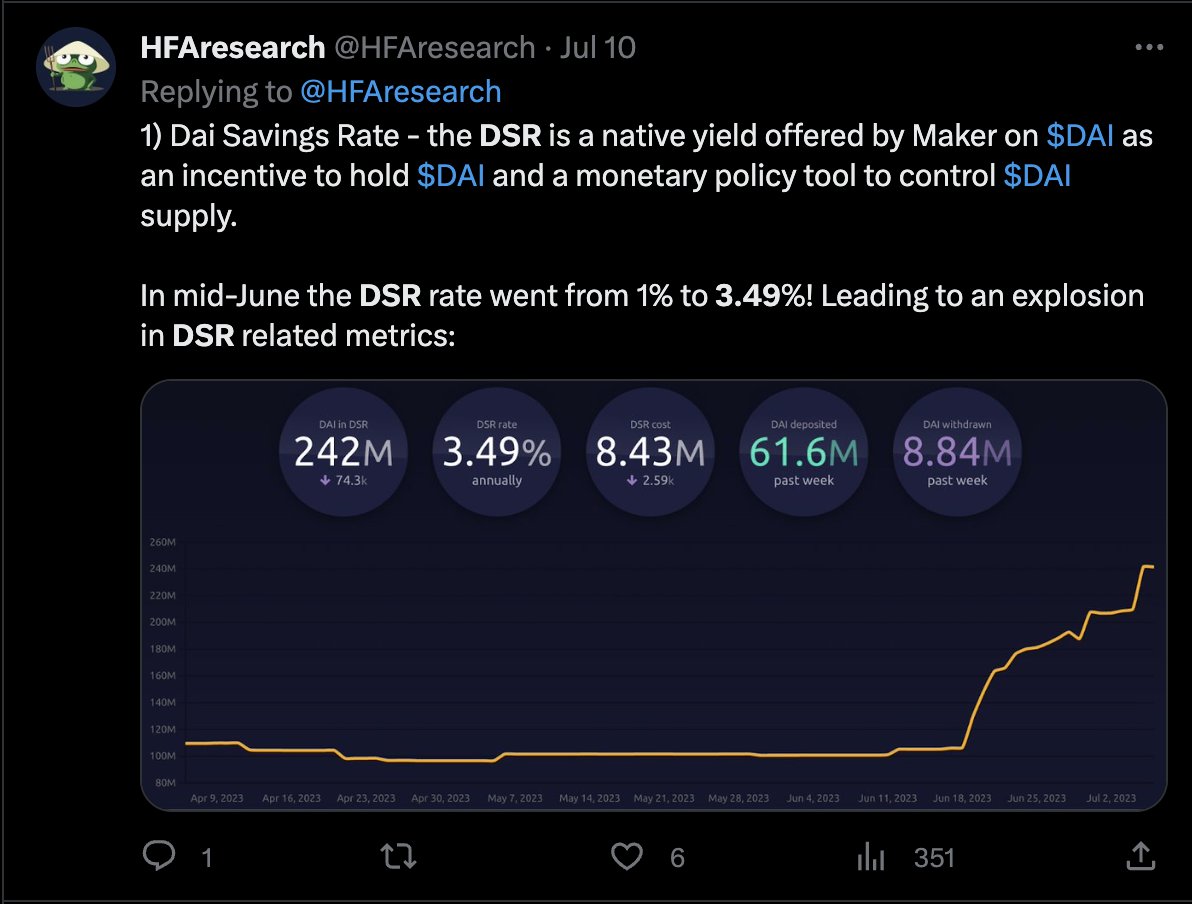

With the interest payments, they are currently offering 3.49% to $DAI stakers, called the Dai Savings Rate. Currently, the yields are low due to some middlemen taking fees.

With the interest payments, they are currently offering 3.49% to $DAI stakers, called the Dai Savings Rate. Currently, the yields are low due to some middlemen taking fees.

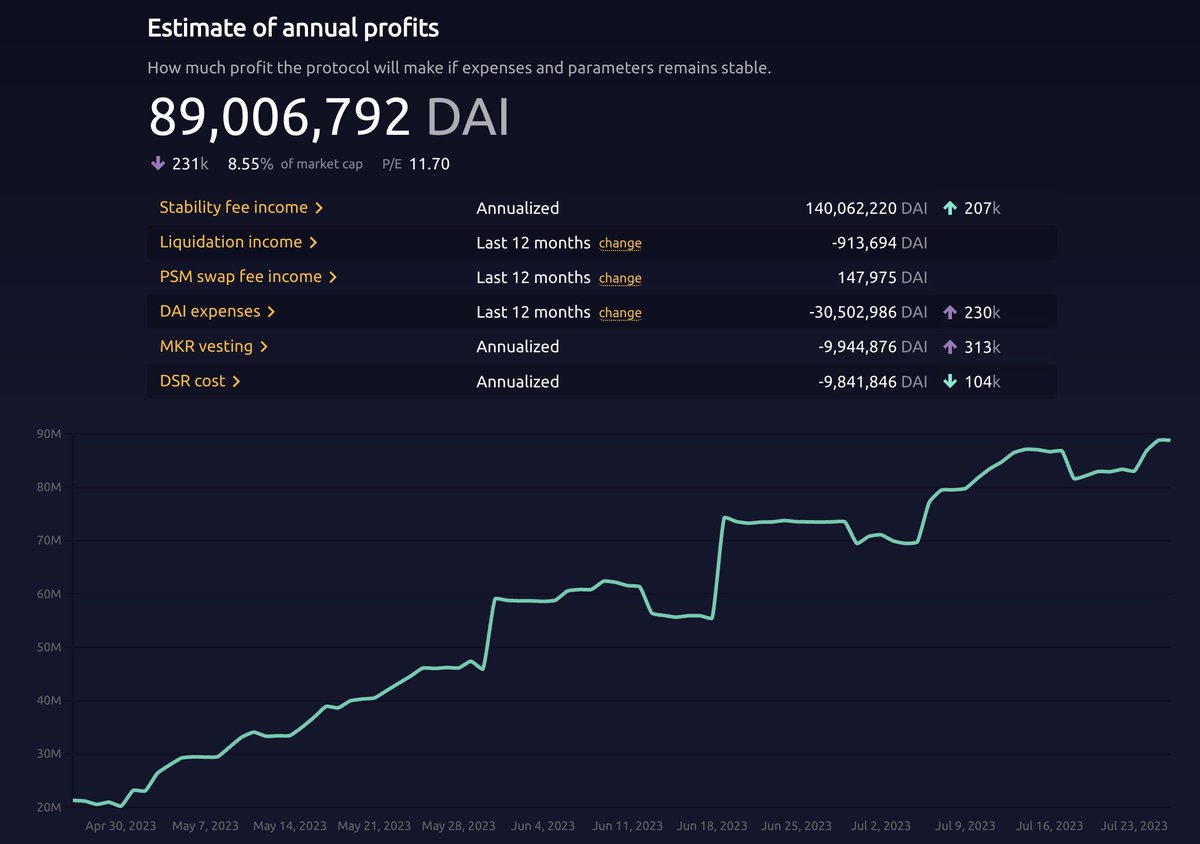

You can see how lucrative a business this is, with $MKR's annualized profits going up only since they can collect the delta as a profit.

It's a similar business to Tether, who recorded a $1.48B profit in Q1, 2023!!!

It's a similar business to Tether, who recorded a $1.48B profit in Q1, 2023!!!

But wait, 3.49% is too low!

Yes, I agree. But allow me to explain how DeFi can offer a yield above the risk-free rate (5%) without the need of extravagant ponzinomics.

Yes, I agree. But allow me to explain how DeFi can offer a yield above the risk-free rate (5%) without the need of extravagant ponzinomics.

Enter DeFi money legos!

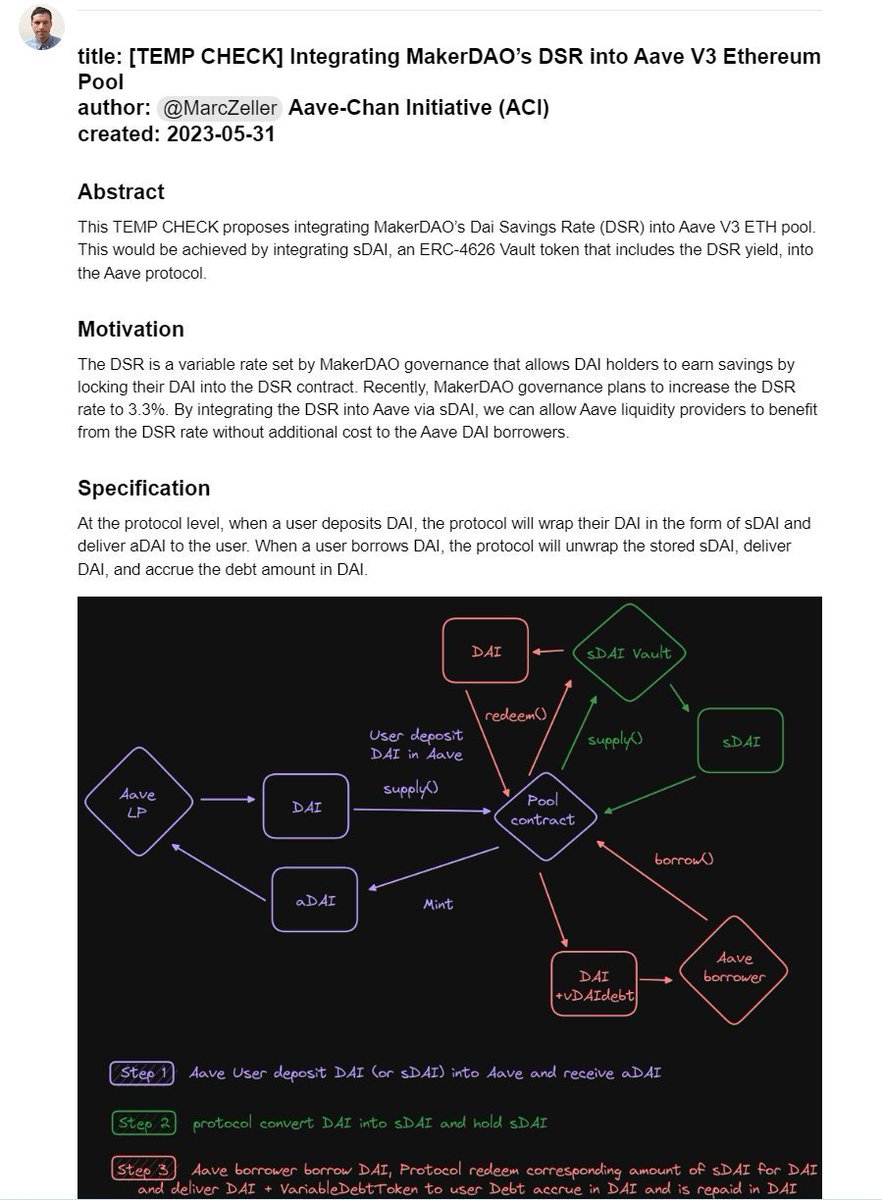

You can currently stake DAI to receive sDAI, which is a liquid representation of your DAI earning the DSR. Technically, this can be used as collateral and allow all sorts of strategies.

For example, @AaveAave is working to implement this.

You can currently stake DAI to receive sDAI, which is a liquid representation of your DAI earning the DSR. Technically, this can be used as collateral and allow all sorts of strategies.

For example, @AaveAave is working to implement this.

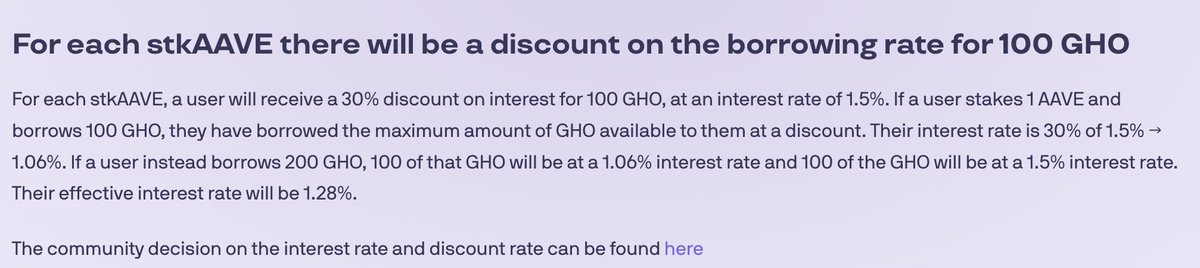

So imagine DSR at 3.49%, and the borrow rate for $GHO, AAVE's stablecoin, is 1.5%.

If you loop this 5 times (sDAI collateral, borrow GHO, buy sDAI, repeat), you can actually get to a ~10% APY!!!

If you loop this 5 times (sDAI collateral, borrow GHO, buy sDAI, repeat), you can actually get to a ~10% APY!!!

Technically, @MakerDAO and @AaveAave can have a mutually beneficial partnership by Maker staking a bunch of $AAVE to get a discount in the borrow rate.

Woah, governance tokens can be useful!?

Woah, governance tokens can be useful!?

Historically, 10% yields on stablecoins carry some risk and is subsidized by token inflation.

But in this case, this has the potential to be a positive sum game (subsidies from government interest payments).

Economic value is created here, and it can actually scale!

But in this case, this has the potential to be a positive sum game (subsidies from government interest payments).

Economic value is created here, and it can actually scale!

Keep in mind this isn't going to happen overnight, and looping isn't risk-free since it introduces leverage.

However, this type of "loop" product has been done before and we know exactly where the yield is coming from (US government interest payments).

However, this type of "loop" product has been done before and we know exactly where the yield is coming from (US government interest payments).

If DeFi can offer a 10% yield from leveraged T-bills, I bet it would make DeFi TVL a lot stickier might even bring some sidelined liquidity back on-chain.

And more stablecoin liquidity brings more economic activity, leading to more $ETH burn.... Ohhhh yes.

And more stablecoin liquidity brings more economic activity, leading to more $ETH burn.... Ohhhh yes.

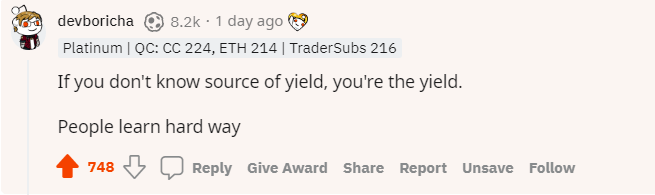

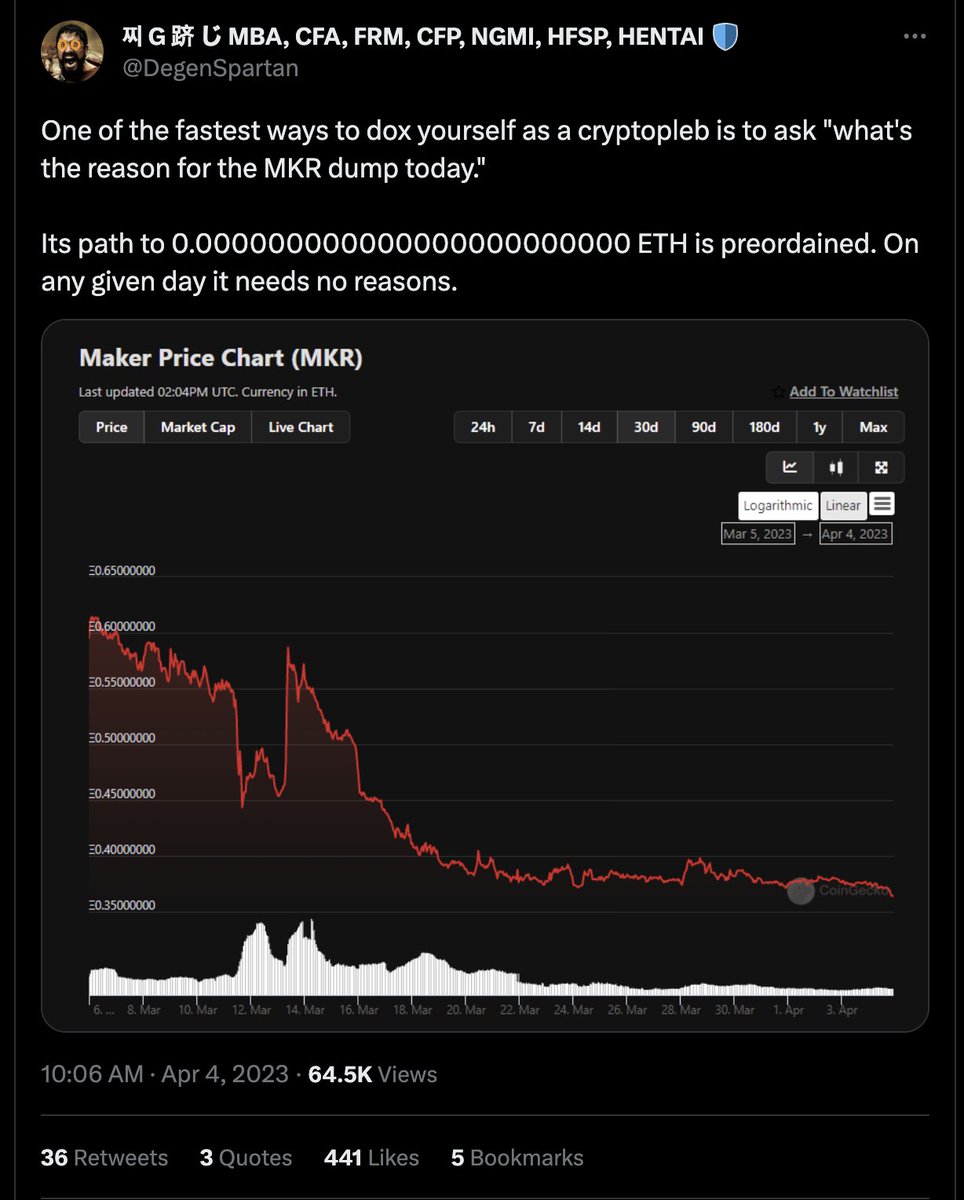

And how iconic would it be if $MKR helps revitalize DeFi after it's been the poster child of DeFi underperformance?

Can MKR becoming a RWA project finally put in a bottom in the MKRETH ratio? Only time will tell...

Can MKR becoming a RWA project finally put in a bottom in the MKRETH ratio? Only time will tell...

Another reason I'm excited for RWAs is that it's bringing off-chain cash flows, on-chain.

Instead of playing in PvP (Player vs. Player) games, maybe we can finally see PvE (Player vs. Environment) where most of us can finally...win?

Instead of playing in PvP (Player vs. Player) games, maybe we can finally see PvE (Player vs. Environment) where most of us can finally...win?

RWAs are also the most obvious sector to benefit in the upcoming bull.

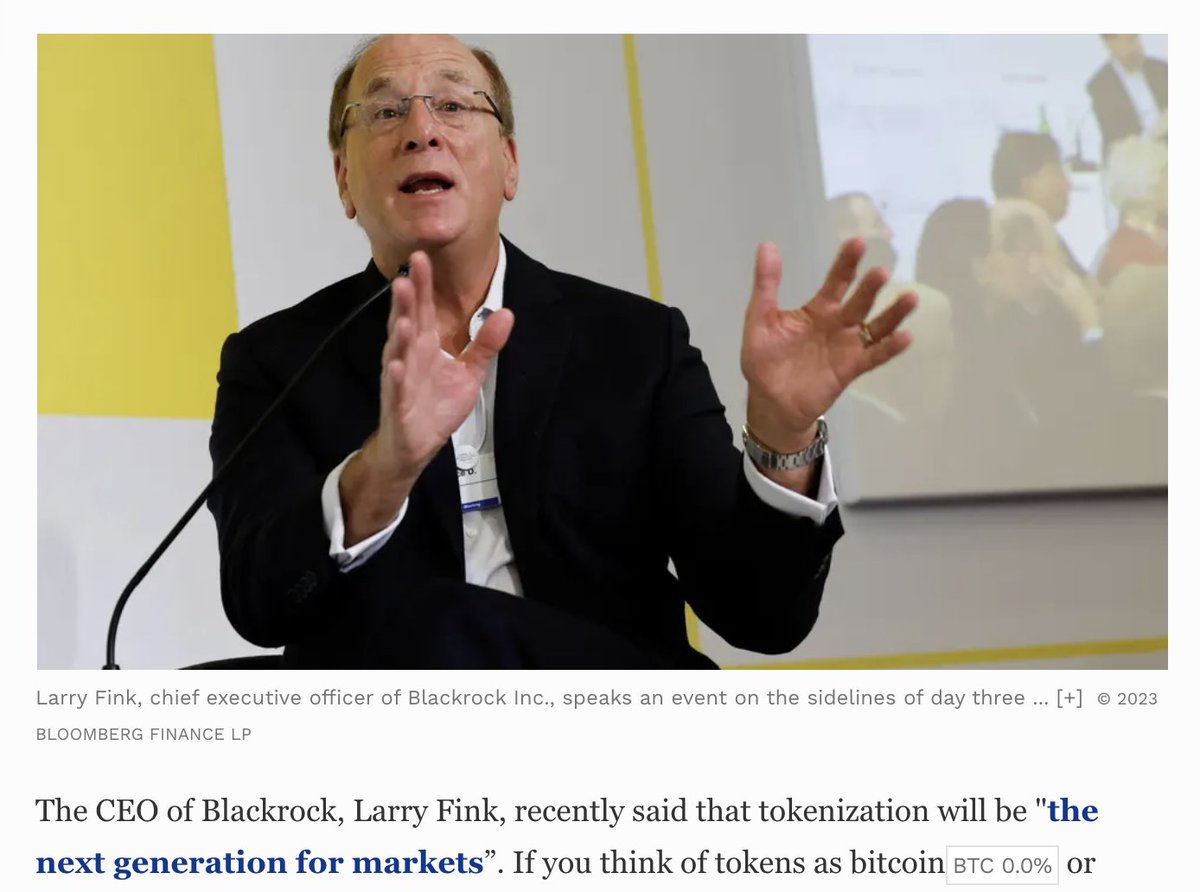

Larry Fink thinks that the "next generation of finance" is going to be around the tokenization of securities.

In other words, he and Blackrock is extremely bullish the RWA sector.

Larry Fink thinks that the "next generation of finance" is going to be around the tokenization of securities.

In other words, he and Blackrock is extremely bullish the RWA sector.

Honestly, I've been full-time crypto for over 3 years and never expected myself to be writing a thread about how $MKR can potentially save DeFi.

But here we are!

But here we are!

I believe RWAs are going to be an "up only in TVL" sector in the coming months, years, and decades.

More competition and innovation will lead to more opportunities to earn a "safe" yield above the risk-free rate, permissionlessly on-chain.

More competition and innovation will lead to more opportunities to earn a "safe" yield above the risk-free rate, permissionlessly on-chain.

And with higher stablecoin yields, more TVL will flow into DeFi.

Then we have the multiplier effect where for each dollar that enters the system, some % will trickle into buying tokens, increasing price.

Higher price, higher yield. Reflexivity!

Then we have the multiplier effect where for each dollar that enters the system, some % will trickle into buying tokens, increasing price.

Higher price, higher yield. Reflexivity!

This is how the DeFi bear market will end. And how the next bull market will emerge.

I've been in a lot of pain as a DeFi believoooooor but I finally see the light at the end of the tunnel and couldn't be more excited.

I've been in a lot of pain as a DeFi believoooooor but I finally see the light at the end of the tunnel and couldn't be more excited.

Final thought: it's kind of funny that Celsius/BlockFi imploded after trying to bring on-chain yields to off-chain investors.

And now, we're trying to bring off-chain yields on-chain. Time is a flat circle.

Hopefully nothing blows up this time 😂

And now, we're trying to bring off-chain yields on-chain. Time is a flat circle.

Hopefully nothing blows up this time 😂

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter