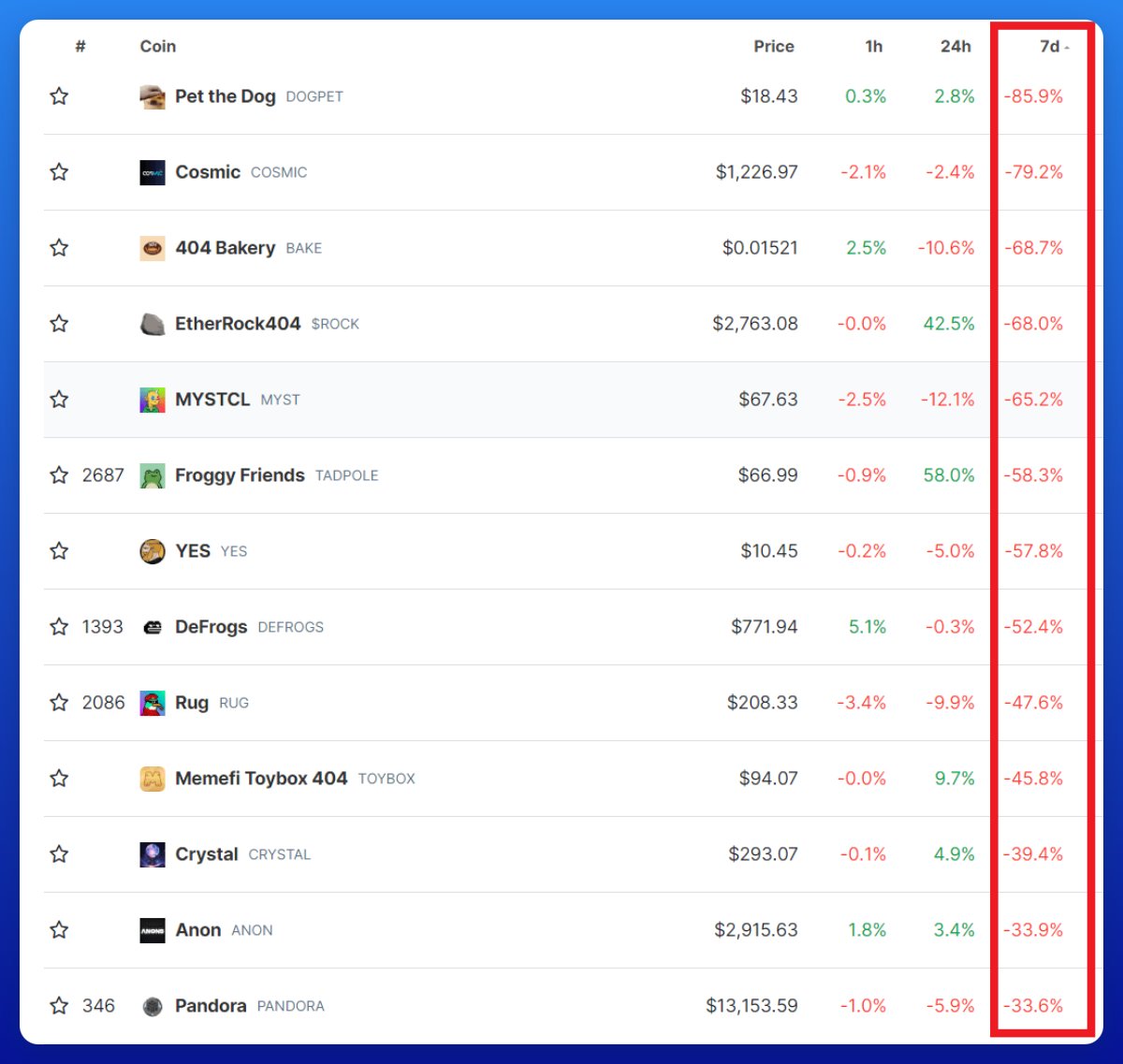

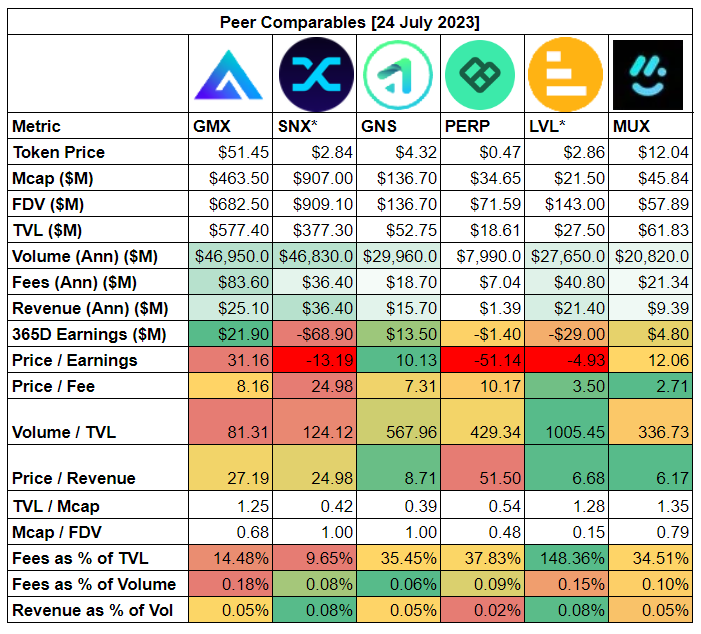

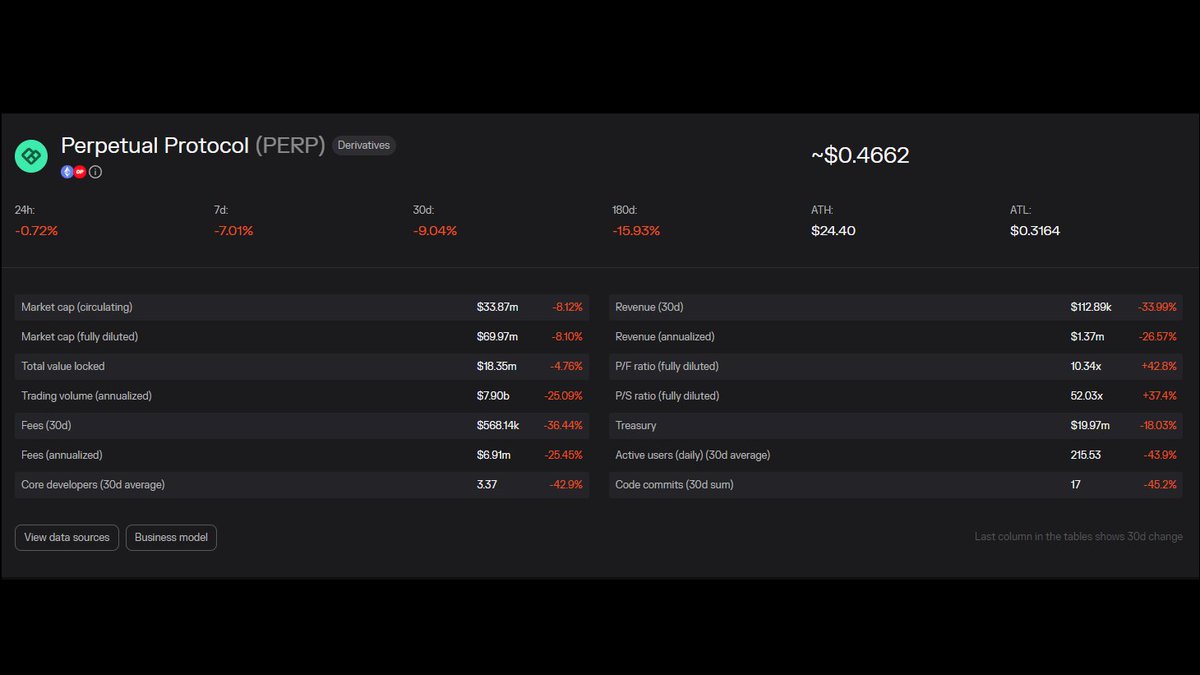

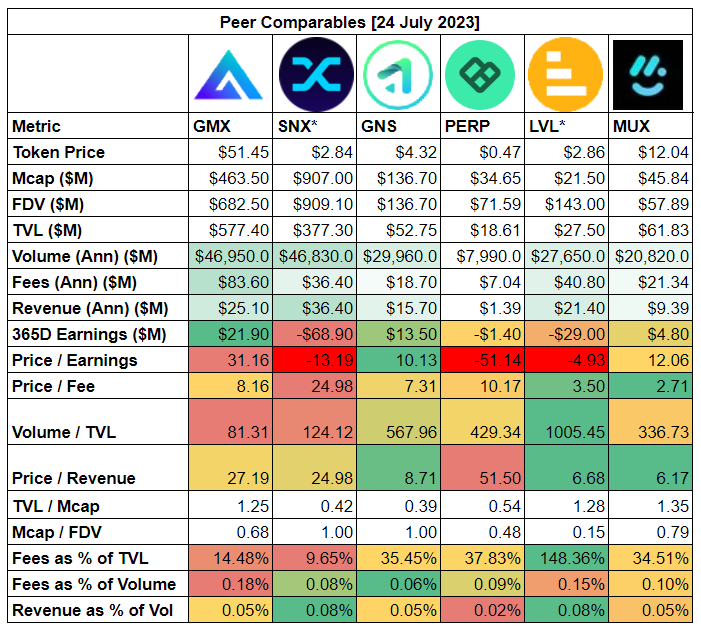

1/🧵 On-chain Derivatives sector is the most competitive in DeFi with dozens of protocols live and many new projects about to launch.

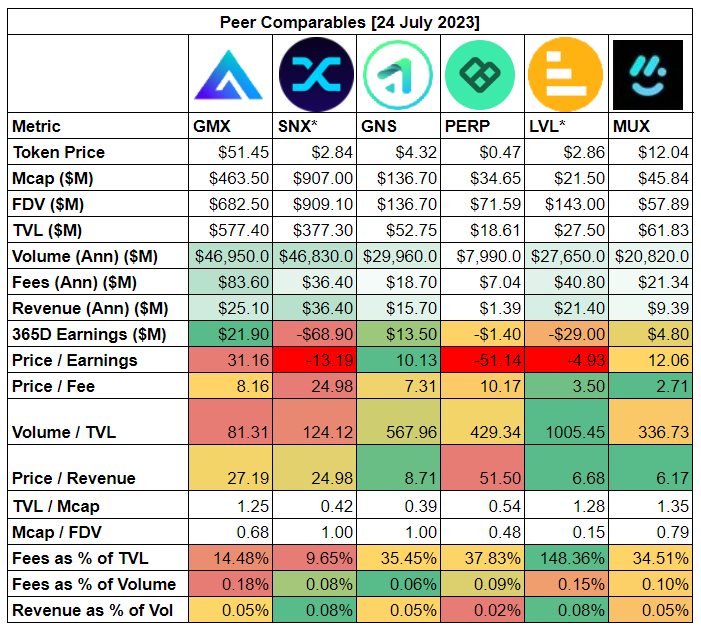

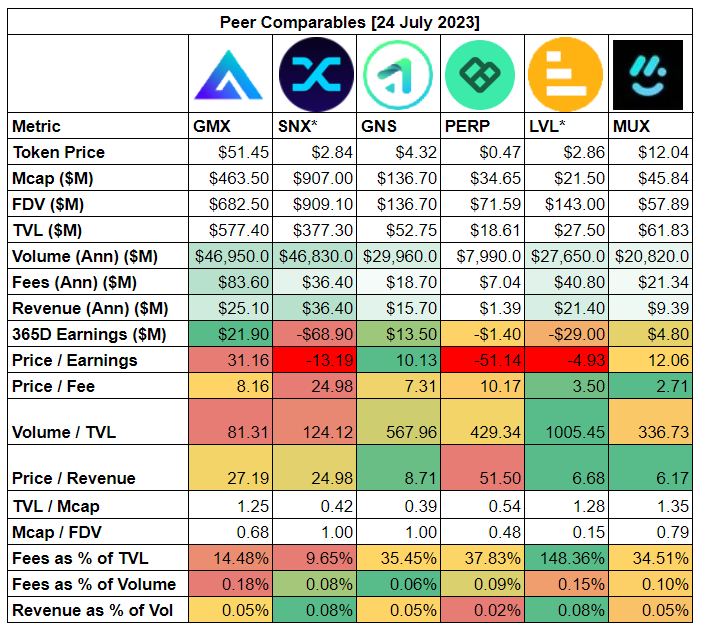

Follow this thread for the Key Metrics analysis on $GMX $SNX $GNS $PERP $LVL $MUX and more

Follow this thread for the Key Metrics analysis on $GMX $SNX $GNS $PERP $LVL $MUX and more

2/ While perp DEX volume is only 2% of CEX trading volume, decentralized exchanges are making billions in daily volume combined.

This might not sound like a lot, but perp DEX space was pioneered by @dydx only 2 years back.

This might not sound like a lot, but perp DEX space was pioneered by @dydx only 2 years back.

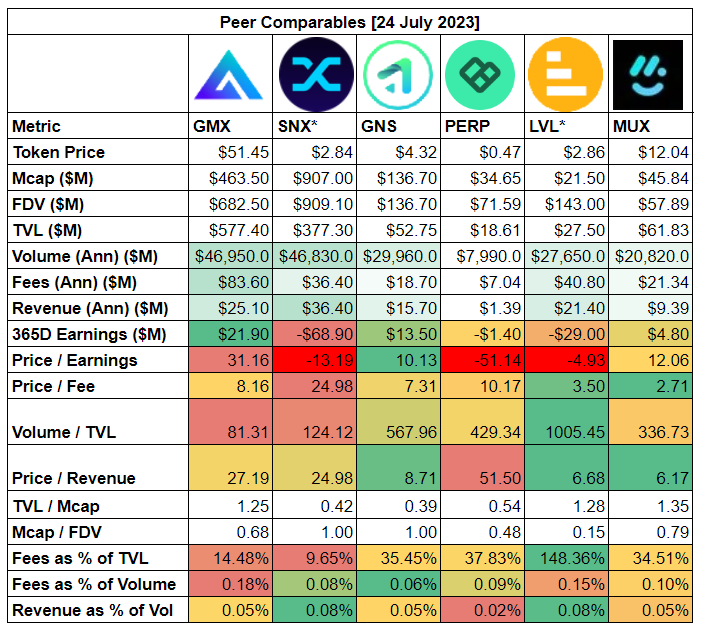

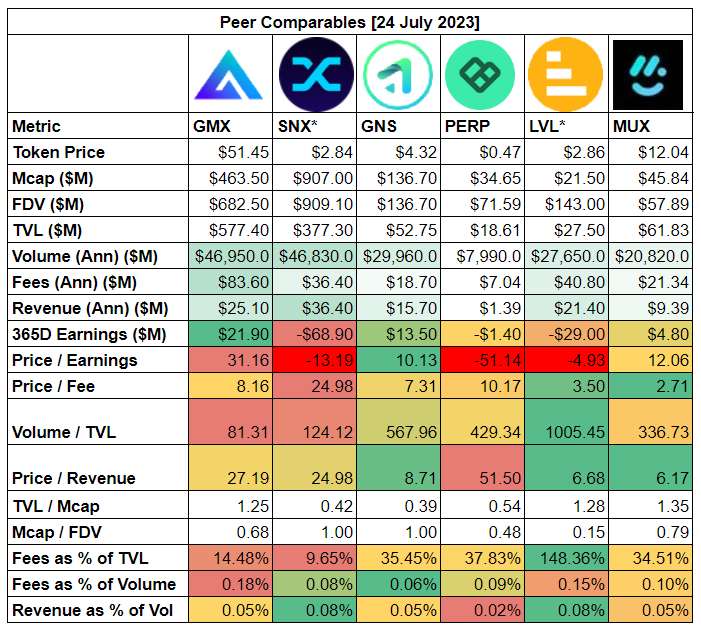

@dYdX 3/ While raw data might indicate that one or another protocol looks like a good investment,

It's important to understand the context, especially the design and revenue share model.

* - incentivized trading

It's important to understand the context, especially the design and revenue share model.

* - incentivized trading

@dYdX 4/ @GMX_IO

GMX is a synthetic perp DEX with its most famous feature - Zero Slippage trades.

It is the biggest protocol from this list by TVL, Volume, Fees, and Earnings.

GMX is a synthetic perp DEX with its most famous feature - Zero Slippage trades.

It is the biggest protocol from this list by TVL, Volume, Fees, and Earnings.

@dYdX @GMX_IO 5/ GMX shares 70% of the fees with liquidity providers and 30% with $GMX stakers.

This made GMX very popular and attractive to investors.

Price/Earnings (Revenue minus Token Incentives) ratio is 31.16 which makes $GMX rather expensive but investors might be pricing in GMX v2.

This made GMX very popular and attractive to investors.

Price/Earnings (Revenue minus Token Incentives) ratio is 31.16 which makes $GMX rather expensive but investors might be pricing in GMX v2.

@dYdX @GMX_IO 6/ GMX V2 will be introduced in a matter of weeks with the following features:

• Chainlink low-latency oracles for better real-time market data

• More assets (not only crypto)

• Lower trading fees

• Slippage

GMX v1 and v2 will coexist.

• Chainlink low-latency oracles for better real-time market data

• More assets (not only crypto)

• Lower trading fees

• Slippage

GMX v1 and v2 will coexist.

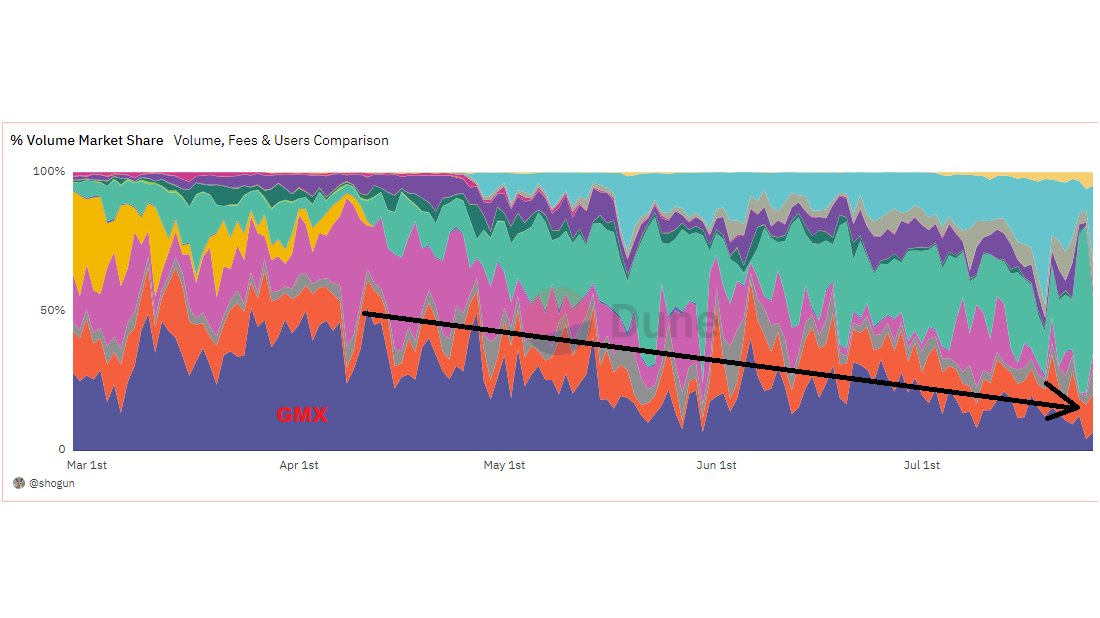

@dYdX @GMX_IO 7/ With the increased competition, GMX is losing its market share, and if v2 will not bring more volume and fees to the platform,

$GMX fair price might be $40 at ~ 20 P/E

$GMX fair price might be $40 at ~ 20 P/E

@dYdX @GMX_IO 8/ @synthetix_io

Synthetix allows users to mint synthetic assets against its native token $SNX.

Other projects like @Kwenta_io can build their own front end to allow traders to access perp trading.

Synthetix allows users to mint synthetic assets against its native token $SNX.

Other projects like @Kwenta_io can build their own front end to allow traders to access perp trading.

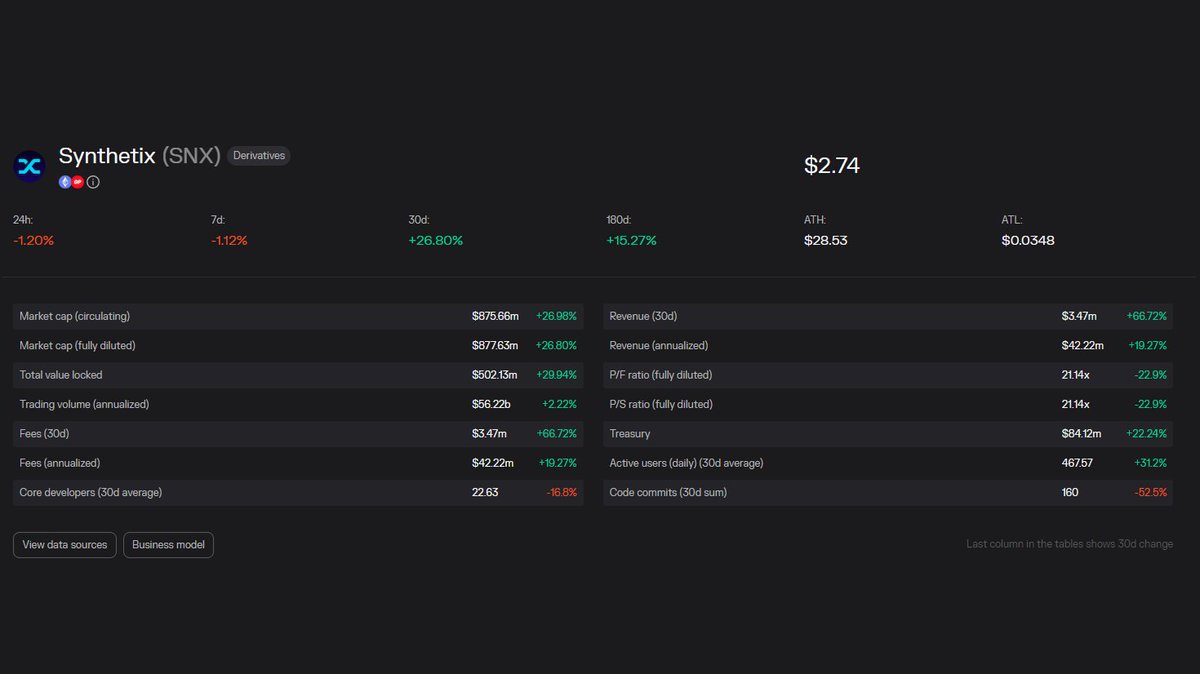

@dYdX @GMX_IO @synthetix_io @Kwenta_io 9/ Synthetix is the biggest protocol by MC and Revenue with 100% of fees distributed to $SNX stakers.

The problem is that $SNX stakers are the liquidity providers as well.

The problem is that $SNX stakers are the liquidity providers as well.

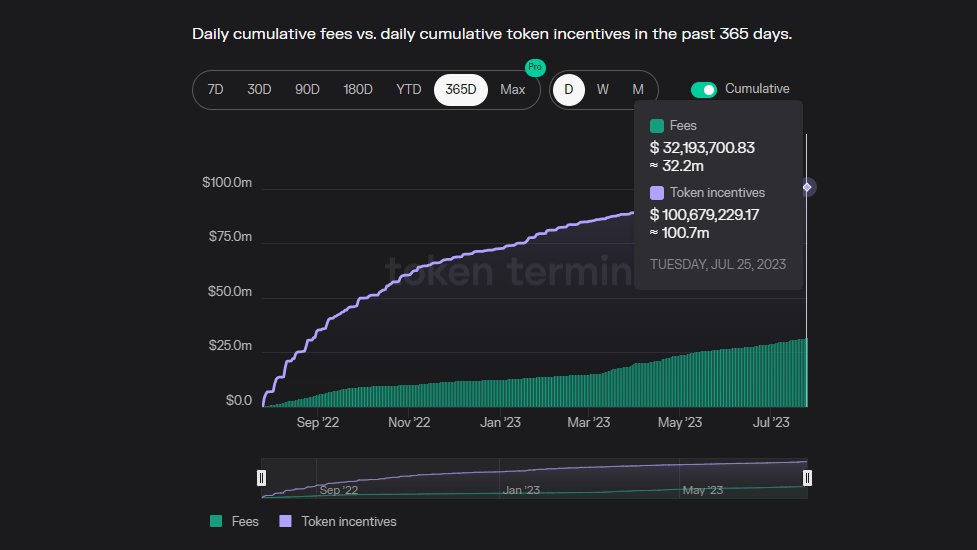

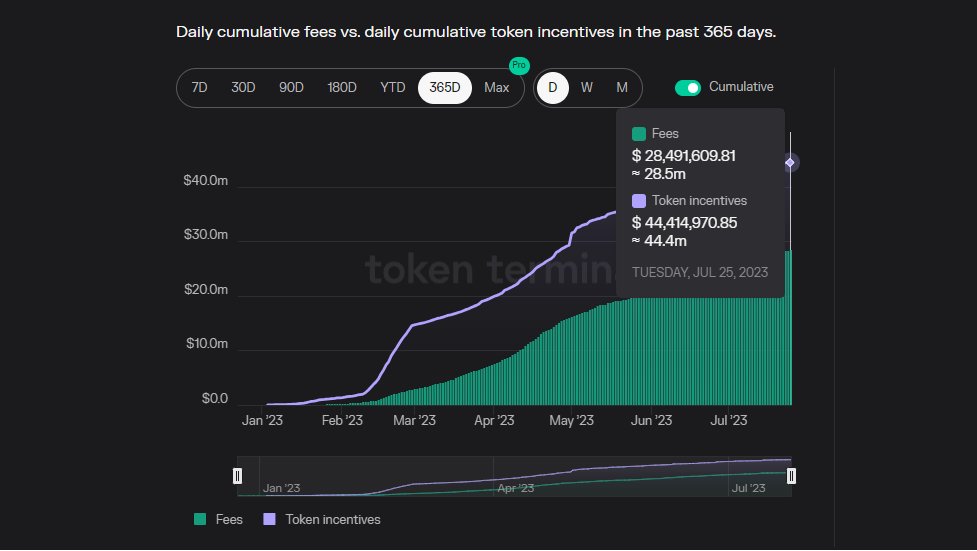

@dYdX @GMX_IO @synthetix_io @Kwenta_io 10/ To stimulate users to provide liquidity, Synthetix incentivizes stakers with $SNX emissions.

More than $100M in $SNX incentives were paid out to stakers while only $36M in fees were generated.

It brings Synthetix to negative P/E - they are losing money.

More than $100M in $SNX incentives were paid out to stakers while only $36M in fees were generated.

It brings Synthetix to negative P/E - they are losing money.

@dYdX @GMX_IO @synthetix_io @Kwenta_io 11/ It is also worth mentioning that trading on Synthetix is heavily incentivized with $OP rewards and they are not accounted for expenses.

Without extra incentives, trading volume might fall in the future.

Without extra incentives, trading volume might fall in the future.

@dYdX @GMX_IO @synthetix_io @Kwenta_io 12/ At current valuation, fees, and emissions $SNX seems like a very expensive token.

However, investors might be pricing in future v3 updates and protocol adoption.

At the moment Key metrics are growing day by day.

However, investors might be pricing in future v3 updates and protocol adoption.

At the moment Key metrics are growing day by day.

@dYdX @GMX_IO @synthetix_io @Kwenta_io 13/ @GainsNetwork_io

Gains is a synthetic platform that allows Crypto, Forex, and Commodities leveraged trading.

Gains shares ~33% fees with $gns stakers and ~17% fees with liquidity providers.

Gains is a synthetic platform that allows Crypto, Forex, and Commodities leveraged trading.

Gains shares ~33% fees with $gns stakers and ~17% fees with liquidity providers.

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io 14/ However, from the 1st of September Gains will be sharing ~61% fees with $GNS stakers which could increase its valuation.

https://twitter.com/bee_926/status/1683465296622010368?s=20

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io 15/ Gains has the lowest P/E ratio of 10, a low Price/Revenue ratio of 8.7, and the highest Volume/TVL ratio (unincentivized) of 568.

These Key metrics, product development, and future updates make $GNS the most undervalued project on the list.

These Key metrics, product development, and future updates make $GNS the most undervalued project on the list.

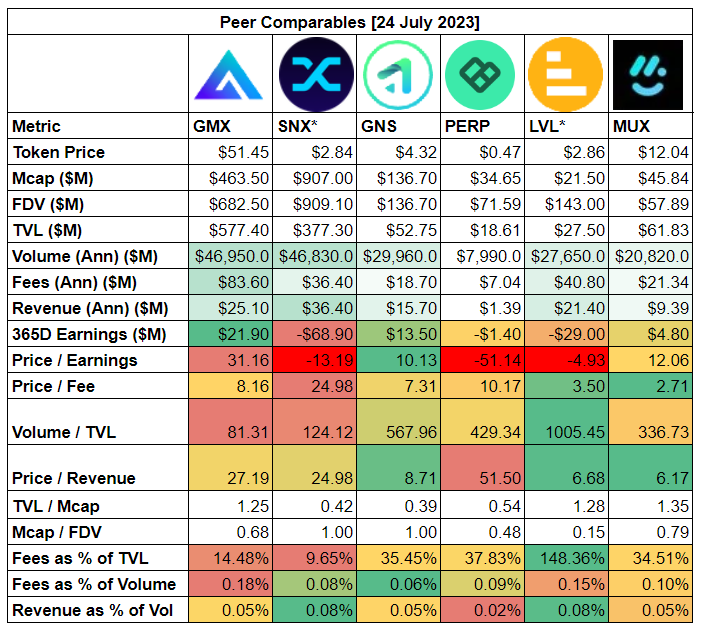

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io 16/ @perpprotocol

Perp is built on top of Uniswap v3 smart contracts and it is the smallest protocol on the list.

80% of the fees are distributed to the LPs and ~14% to $perp stakers.

Perp is built on top of Uniswap v3 smart contracts and it is the smallest protocol on the list.

80% of the fees are distributed to the LPs and ~14% to $perp stakers.

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io @perpprotocol 17/ Perp annual revenue is $1.4m while there are $2.8m of emissions which brings it to -$1.4m Earnings.

Overall Perp metrics do not indicate that the protocol can be attractive for investors and can be difficult for it to compete with Kwenta (Synthetix) on Optimism.

Overall Perp metrics do not indicate that the protocol can be attractive for investors and can be difficult for it to compete with Kwenta (Synthetix) on Optimism.

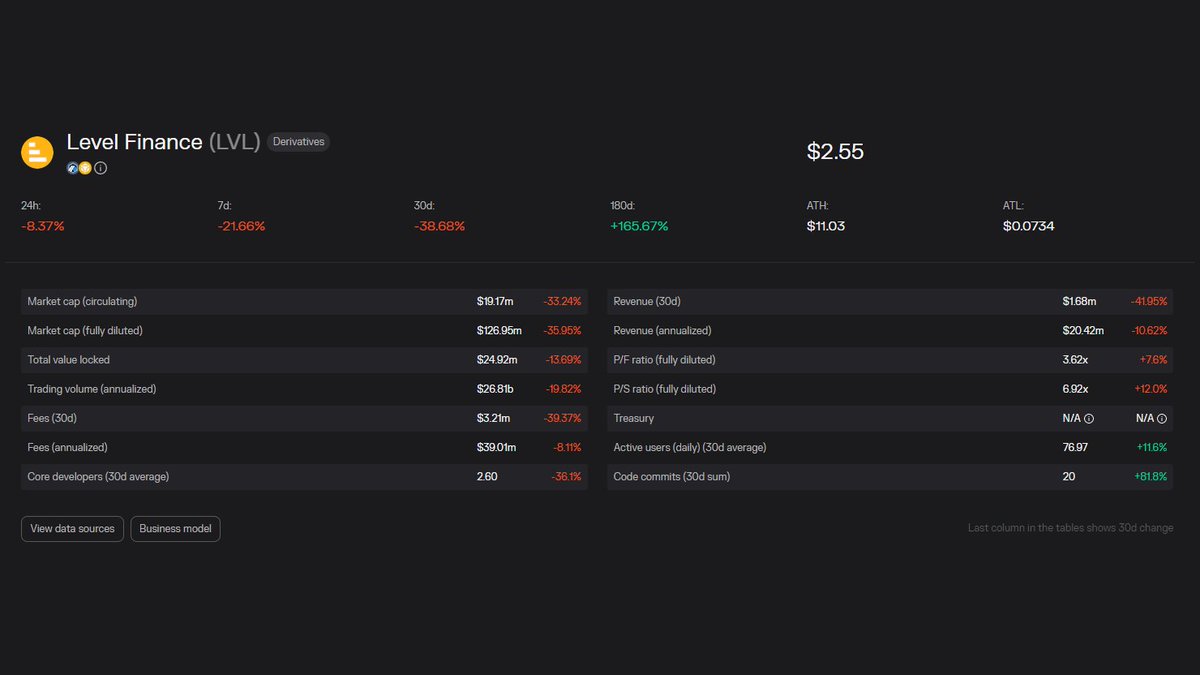

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io @perpprotocol 18/ @Level__Finance

Level got a lot of traction during its early days due to heavily incentivized trading with its own $LVL token.

Level has been doing billions in volume but since the emissions and price of the token went down, Level Key metrics are in a downtrend.

Level got a lot of traction during its early days due to heavily incentivized trading with its own $LVL token.

Level has been doing billions in volume but since the emissions and price of the token went down, Level Key metrics are in a downtrend.

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io @perpprotocol @Level__Finance 19/ Volume/TVL ratio of 1000 looks artificially high taking into account that Level has a similar to GMX design.

Despite a lot of fees generated, Earnings are negative - the protocol is giving away more tokens than it generates fees.

Despite a lot of fees generated, Earnings are negative - the protocol is giving away more tokens than it generates fees.

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io @perpprotocol @Level__Finance 20/ Level distributes 45% of the fees to LPs, 10% to $LVL stakers, and 10% to $LGO stakers.

LGO is the second token in the Level ecosystem, that has governance and treasury rights.

LGO is the second token in the Level ecosystem, that has governance and treasury rights.

https://twitter.com/DeFi_Made_Here/status/1668309405631229965?s=20

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io @perpprotocol @Level__Finance 21/ Level metrics seem to be inflated by the volume generated during the early incentivized trading phase, its earnings are negative, and metrics are heading downwards.

$LVL does not seem to be an attractive option for the investment.

$LVL does not seem to be an attractive option for the investment.

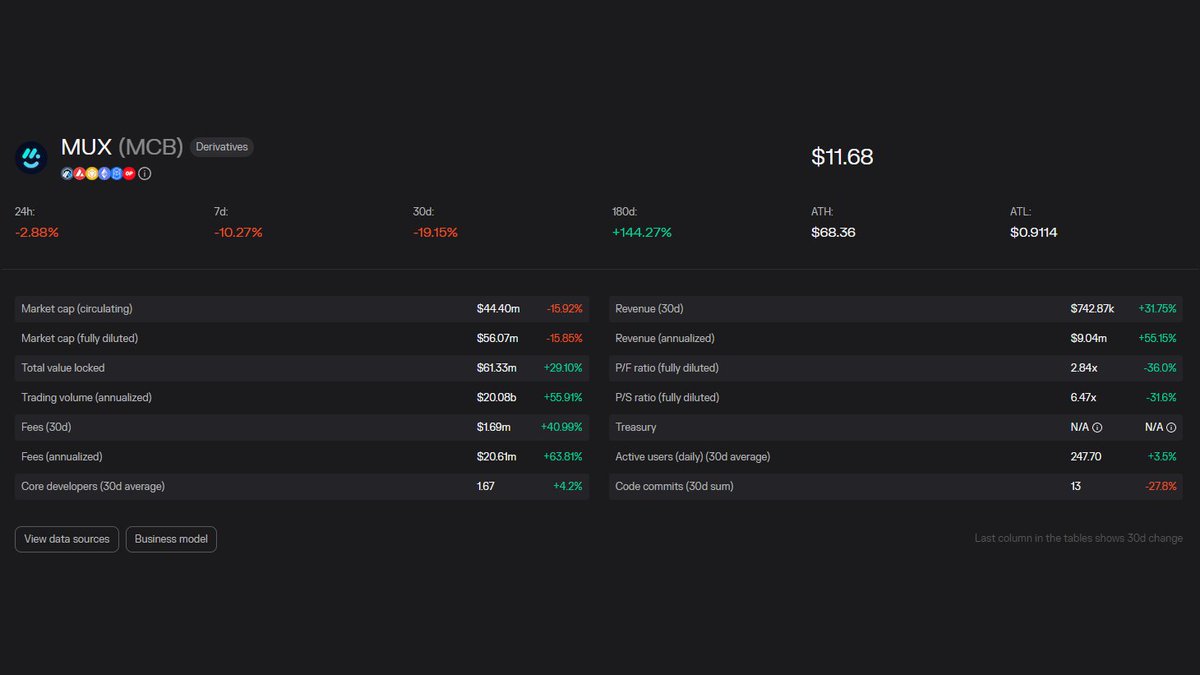

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io @perpprotocol @Level__Finance 22/ @muxprotocol

MUX is both a trading protocol and an aggregator. Trades are routed against muxLP or other protocols (GMX, Gains) depending on where the costs will be the lowest for the traders.

70% of the protocol income is distributed to LPs and $MUX stakers in ETH.

MUX is both a trading protocol and an aggregator. Trades are routed against muxLP or other protocols (GMX, Gains) depending on where the costs will be the lowest for the traders.

70% of the protocol income is distributed to LPs and $MUX stakers in ETH.

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io @perpprotocol @Level__Finance @muxprotocol 23/ As MUX is deployed on 5 widely-adopted ecosystems, there are endless opportunities for MUX to composite with different types of protocols:

• Other perp platforms

• Options platforms

• Betting platforms, etc

• Other perp platforms

• Options platforms

• Betting platforms, etc

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io @perpprotocol @Level__Finance @muxprotocol 24/ With its relatively low MC, scaling capabilities, and solid Key metrics,

MUX can be considered an interesting investment opportunity.

MUX can be considered an interesting investment opportunity.

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io @perpprotocol @Level__Finance @muxprotocol 25/ Conclusion

Perp DEXes become more competitive every day and it is difficult to spot the most promising protocols as well as to predict which one will succeed over time.

Perp DEXes become more competitive every day and it is difficult to spot the most promising protocols as well as to predict which one will succeed over time.

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io @perpprotocol @Level__Finance @muxprotocol 26/ Overall perp DEX sector can become one of the biggest when more volume from CEXes starts flowing to DeFi.

Nothing in this thread is financial advice.

Nothing in this thread is financial advice.

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io @perpprotocol @Level__Finance @muxprotocol 27/ Things to note:

@dydx is by far the biggest protocol with ~$350b trading volume over the past year that will be moving to its own app chain.

$dydx token does not have a revenue share and will not have it in the future.

@dydx is by far the biggest protocol with ~$350b trading volume over the past year that will be moving to its own app chain.

$dydx token does not have a revenue share and will not have it in the future.

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io @perpprotocol @Level__Finance @muxprotocol 28/ Protocols to monitor:

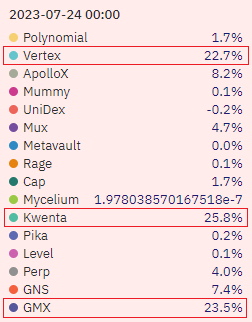

@vertex recently launched with token incentives for traders and great UI. Surprisingly it has ~25% market share same as GMX and Kwenta.

Btw @wintermute_t is providing liquidity on Vertex.

@ThenaFi_ RFQ-based trading platform.

@vertex recently launched with token incentives for traders and great UI. Surprisingly it has ~25% market share same as GMX and Kwenta.

Btw @wintermute_t is providing liquidity on Vertex.

@ThenaFi_ RFQ-based trading platform.

@dYdX @GMX_IO @synthetix_io @Kwenta_io @GainsNetwork_io @perpprotocol @Level__Finance @muxprotocol @vertex @wintermute_t @ThenaFi_ 29/ Here's the list of other perp DEXes you can take a look at:

https://twitter.com/DeFi_Made_Here/status/1662156547768680450?s=20

30/ Thanks for reading!

If you enjoyed this thread:

1. Follow @DeFi_Made_Here for more helpful threads

2. RT the tweet below to share this thread with your audience

Thank You and stay safe!

If you enjoyed this thread:

1. Follow @DeFi_Made_Here for more helpful threads

2. RT the tweet below to share this thread with your audience

Thank You and stay safe!

https://twitter.com/DeFi_Made_Here/status/1684233479607705601?s=20

31/ ah, and I forgot to mention that the data source is @tokenterminal

• • •

Missing some Tweet in this thread? You can try to

force a refresh