Laurus Labs reported its results yesterday

The company saw a 90% erosion in profits!😥😥😥

What is happening with Laurus Labs?🤔🤔

A thread🧵on the business performance of Laurus Labs

Lets go👇

The company saw a 90% erosion in profits!😥😥😥

What is happening with Laurus Labs?🤔🤔

A thread🧵on the business performance of Laurus Labs

Lets go👇

What has happened?

Over the last 1 year, the Stock price has severely corrected

The stock has fallen nearly 35%

The company reported its numbers yesterday

Let's see how were the numbers👇

Over the last 1 year, the Stock price has severely corrected

The stock has fallen nearly 35%

The company reported its numbers yesterday

Let's see how were the numbers👇

Laurus Labs operates in the following areas:-

1. Active Pharmaceutical Ingredient(APIs)

2. Custom Synthesis

3. Formulations(FDF)

4. Biosynthesis

1. Active Pharmaceutical Ingredient(APIs)

2. Custom Synthesis

3. Formulations(FDF)

4. Biosynthesis

Major focus in APIs is on ARV, oncology and other APIs.

It owns 11 manufacturing units (six FDA approved sites) with 74 DMFs, 32 ANDAs filed (15 Para IV, 11 first to file) and 192 patents granted

It owns 11 manufacturing units (six FDA approved sites) with 74 DMFs, 32 ANDAs filed (15 Para IV, 11 first to file) and 192 patents granted

China+1 playing out:-

Sourcing from China:-

Generic or big Pharma for custom synthesis+APIs is very difficult!

Big Pharma wants to reduce its dependency on China India will have a lot of opportunities in custom synthesis and APIs

Sourcing from China:-

Generic or big Pharma for custom synthesis+APIs is very difficult!

Big Pharma wants to reduce its dependency on China India will have a lot of opportunities in custom synthesis and APIs

So how were the Q1FY24 results?

The results were not good

🧪Revenue declined by 23%

🧪Operating Margins eroded to just 14.2%

🧪Net profit fell by 90%

So what happened here?👇

The results were not good

🧪Revenue declined by 23%

🧪Operating Margins eroded to just 14.2%

🧪Net profit fell by 90%

So what happened here?👇

Formulations business(FDF):-

The business saw a sharp decline

🧪ARV business which is a commodity business saw a sharp slowdown

🧪The business also saw a sharp price erosion

🧪The management expects this to recover from Q@

The business saw a sharp decline

🧪ARV business which is a commodity business saw a sharp slowdown

🧪The business also saw a sharp price erosion

🧪The management expects this to recover from Q@

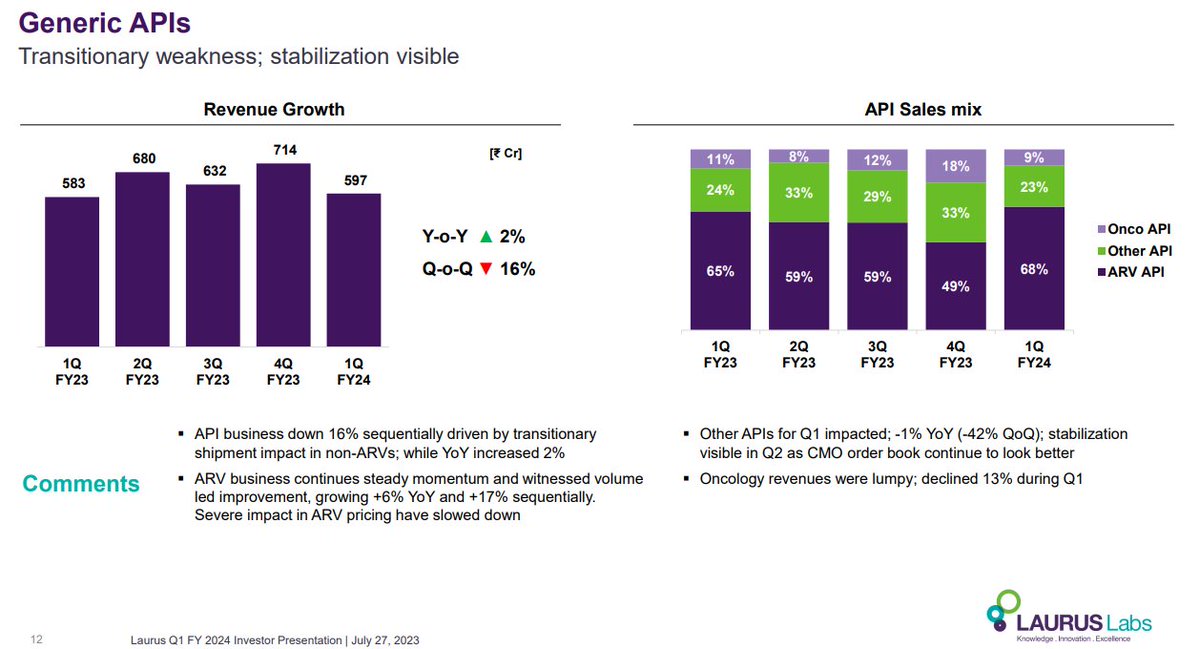

APIs:-

API business also saw a slowdown:-

🧪 Non-ARV business also showed a slowdown

🧪Oncology APIs are also seeing a slowdown

Both FDF+API businesses are experiencing a slowdown due to delayed procurement and pricing erosion

API business also saw a slowdown:-

🧪 Non-ARV business also showed a slowdown

🧪Oncology APIs are also seeing a slowdown

Both FDF+API businesses are experiencing a slowdown due to delayed procurement and pricing erosion

Custom Synthesis:-

The business remains stable.

The revenue declined due to a larger base.

Manufacturing to begin from 2HFY25.

This business is steady.

The business remains stable.

The revenue declined due to a larger base.

Manufacturing to begin from 2HFY25.

This business is steady.

Management commentary:-

🧪Saw continued slowdown in ARV APIs

🧪As guided FY24 will be a difficult year

🧪No revenue guidance for the year

🧪Margins have probably bottomed out

🧪Saw continued slowdown in ARV APIs

🧪As guided FY24 will be a difficult year

🧪No revenue guidance for the year

🧪Margins have probably bottomed out

🧪In FY25 animal health CDMO will be a key trigger

🧪Large volume APIs will commercialize in FY25

🧪Laurus Bio will continue to see a ramp up

🧪Large volume APIs will commercialize in FY25

🧪Laurus Bio will continue to see a ramp up

Reasons for margin erosion to just 14%?

🧪ARV and FDF offtake is lower which meant negative operating leverage played out

🧪Higher cost inventory meant the selling prices were lower but the raw material price was high

🧪Pricing pressure is already there

🧪ARV and FDF offtake is lower which meant negative operating leverage played out

🧪Higher cost inventory meant the selling prices were lower but the raw material price was high

🧪Pricing pressure is already there

Risks/monitorable to the business:

Most of Laurus's new facilities come online in end of FY24 and FY25:

🧪Any delay in commercialization can be a material risk to the business.

🧪Pricing pressure and slower demand in the API / FDF space remain concerns.

Most of Laurus's new facilities come online in end of FY24 and FY25:

🧪Any delay in commercialization can be a material risk to the business.

🧪Pricing pressure and slower demand in the API / FDF space remain concerns.

🧪Ramp up in CDMO and Biotechnology segments

🧪Delay in the procurement of APIs in the developed world

🧪Delay in the procurement of APIs in the developed world

Valuation:-

Given the strong pipeline of expansion in the coming two years

Laurus now trades at roughly 15x EV/EBITDA

The Valuation is certainly not cheap

Given the strong pipeline of expansion in the coming two years

Laurus now trades at roughly 15x EV/EBITDA

The Valuation is certainly not cheap

Conclusion:-

🧪Laurus's core API and FDF business are facing a continued slowdown

🧪Despite management guidance in Q4 of pricing erosion bottoming out. There was further price erosion

🧪While the management remains optimistic,the ramp up remains to be seen

🧪Laurus's core API and FDF business are facing a continued slowdown

🧪Despite management guidance in Q4 of pricing erosion bottoming out. There was further price erosion

🧪While the management remains optimistic,the ramp up remains to be seen

🧪CDMO business should start to to do well from Q3

🧪Laurus Bio should also start to do well

🧪Laurus Bio should also start to do well

Laurus labs is a story of a company diversifying its API base with brilliant execution over the last 5 years.

The API and FDF businesses are undergoing a downcycle.

But what goes into a upcycle will definitely bottom out and go into an upcycle

The API and FDF businesses are undergoing a downcycle.

But what goes into a upcycle will definitely bottom out and go into an upcycle

When will the cycle bottom out and move up?

According to the management,the business has bottomed out now and should start to improve from Q2 onwards.

However, this needs to be closely monitored

According to the management,the business has bottomed out now and should start to improve from Q2 onwards.

However, this needs to be closely monitored

Follow me on Twitter @AdityaD_Shah to stay updated on the following:

📈 Equity Market

📊 Stock Analysis

💰 Investing

💼 Personal Finance

📈 Equity Market

📊 Stock Analysis

💰 Investing

💼 Personal Finance

Disclaimer:-

This is my own study

Not an investment recommendation

Please consult your own financial advisor before making any investment decisions

This is my own study

Not an investment recommendation

Please consult your own financial advisor before making any investment decisions

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter