Market makers can't see your stop loss orders, but they and everyone else can see your resting limit orders.

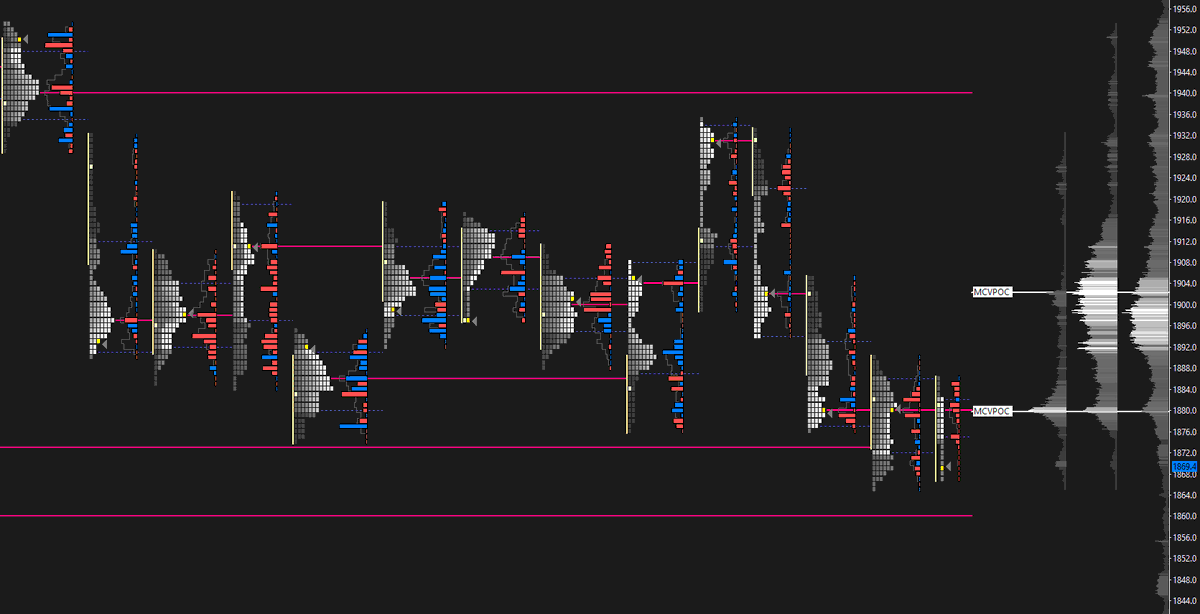

Traders use a depth graph to visualize this data, with different colors representing various order sizes.

In this thread, I'll show you how to set one up.🧵👇

Traders use a depth graph to visualize this data, with different colors representing various order sizes.

In this thread, I'll show you how to set one up.🧵👇

Before beginning, it’s key to have two things for Sierra Chart ready:

- Service package that supports this study, such as #11

- Activated depth of market data

Link:

https://t.co/1ZiSojaP8Dsierrachart.com/index.php?page…

- Service package that supports this study, such as #11

- Activated depth of market data

Link:

https://t.co/1ZiSojaP8Dsierrachart.com/index.php?page…

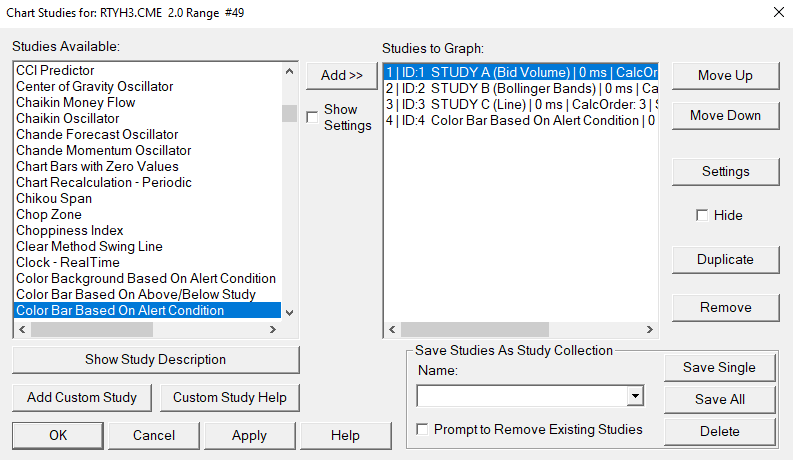

- Open a new chart in Sierra Chart

- Add the Market Depth Historical Graph study

- Click to select it, then hit Settings

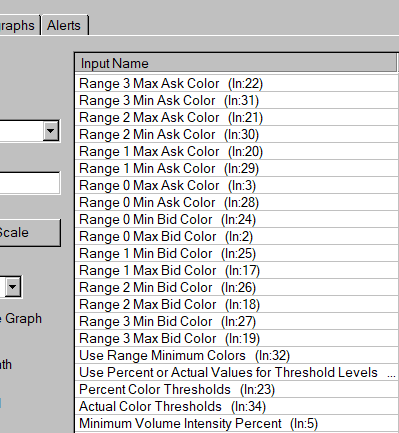

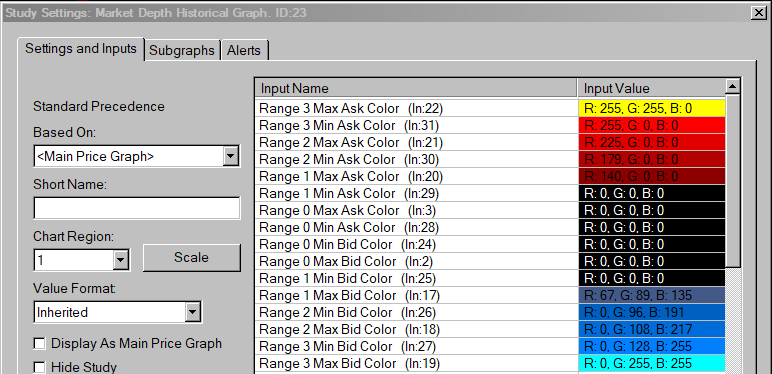

First is colors. Separately colored are Bids and Offers, then there are thresholds for that coloring. Typically, Range 0-1 = Small lots, 2 & 3 for bigger.

- Add the Market Depth Historical Graph study

- Click to select it, then hit Settings

First is colors. Separately colored are Bids and Offers, then there are thresholds for that coloring. Typically, Range 0-1 = Small lots, 2 & 3 for bigger.

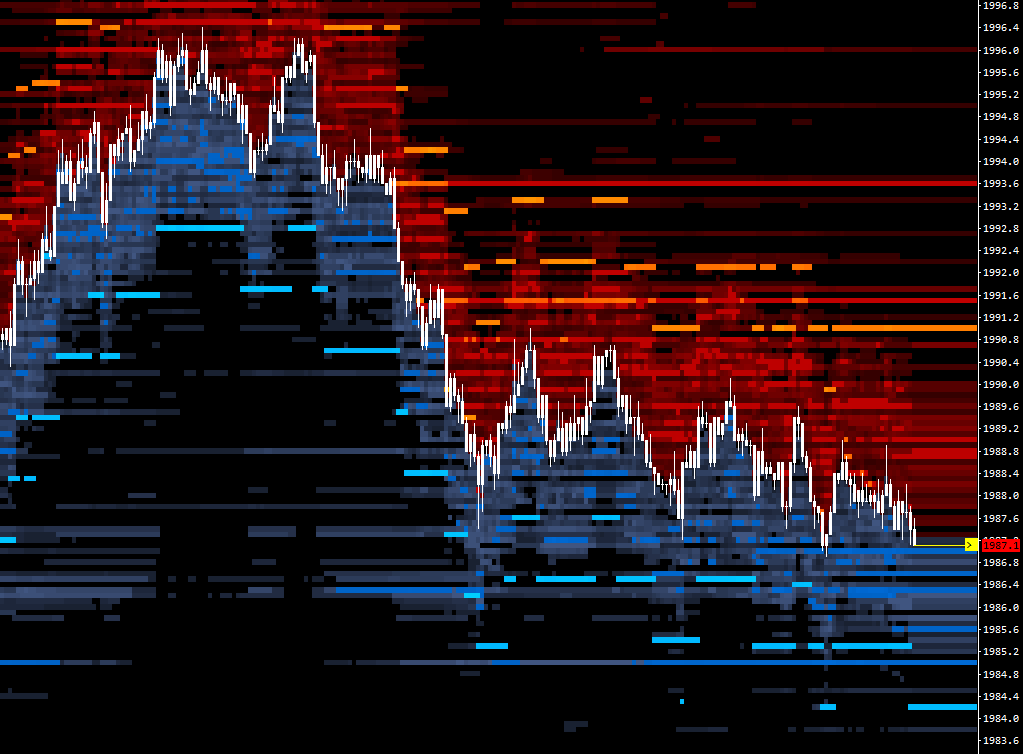

Can get creative with colors. Common themes:

- Bookmap® style: Blue, yellow, orange

- Grey vista: Grey and white

- TYP style: Blue bids, Red offers

These are on the Basic Colors pallet, nothing unique:

- Bookmap® style: Blue, yellow, orange

- Grey vista: Grey and white

- TYP style: Blue bids, Red offers

These are on the Basic Colors pallet, nothing unique:

My preferred settings:

Use Range Minimum Colors: Yes

Use Percent or Actual Values… : Actual Value

Actual Color Thresholds: Small, medium, large (ex: 90,149,300)

Extend Last Known Depth: Yes

Show Quantity Numbers: None

Max Levels to Display: 0 (or try 20)

- Then press OK

Use Range Minimum Colors: Yes

Use Percent or Actual Values… : Actual Value

Actual Color Thresholds: Small, medium, large (ex: 90,149,300)

Extend Last Known Depth: Yes

Show Quantity Numbers: None

Max Levels to Display: 0 (or try 20)

- Then press OK

Notes and Ideas:

- Try out only showing bigger lots, ignoring small lots

- Avoid too many copies of this study in an instance

- Adjust the Scale Settings as needed

- Ensure the Chart Update Interval is low

- Bid Ask lines instead of candlesticks

- Volume dots

- Try out only showing bigger lots, ignoring small lots

- Avoid too many copies of this study in an instance

- Adjust the Scale Settings as needed

- Ensure the Chart Update Interval is low

- Bid Ask lines instead of candlesticks

- Volume dots

That’s it. Super simple to set it all up.

I include a few more detailed examples including screenshots of settings and a chart for depth graphs in my Sierra Chart handbook. It contains that and many more guides for beginner to intermediate users: 👇

ziiiggy.com/sierra-chart-h…

I include a few more detailed examples including screenshots of settings and a chart for depth graphs in my Sierra Chart handbook. It contains that and many more guides for beginner to intermediate users: 👇

ziiiggy.com/sierra-chart-h…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter