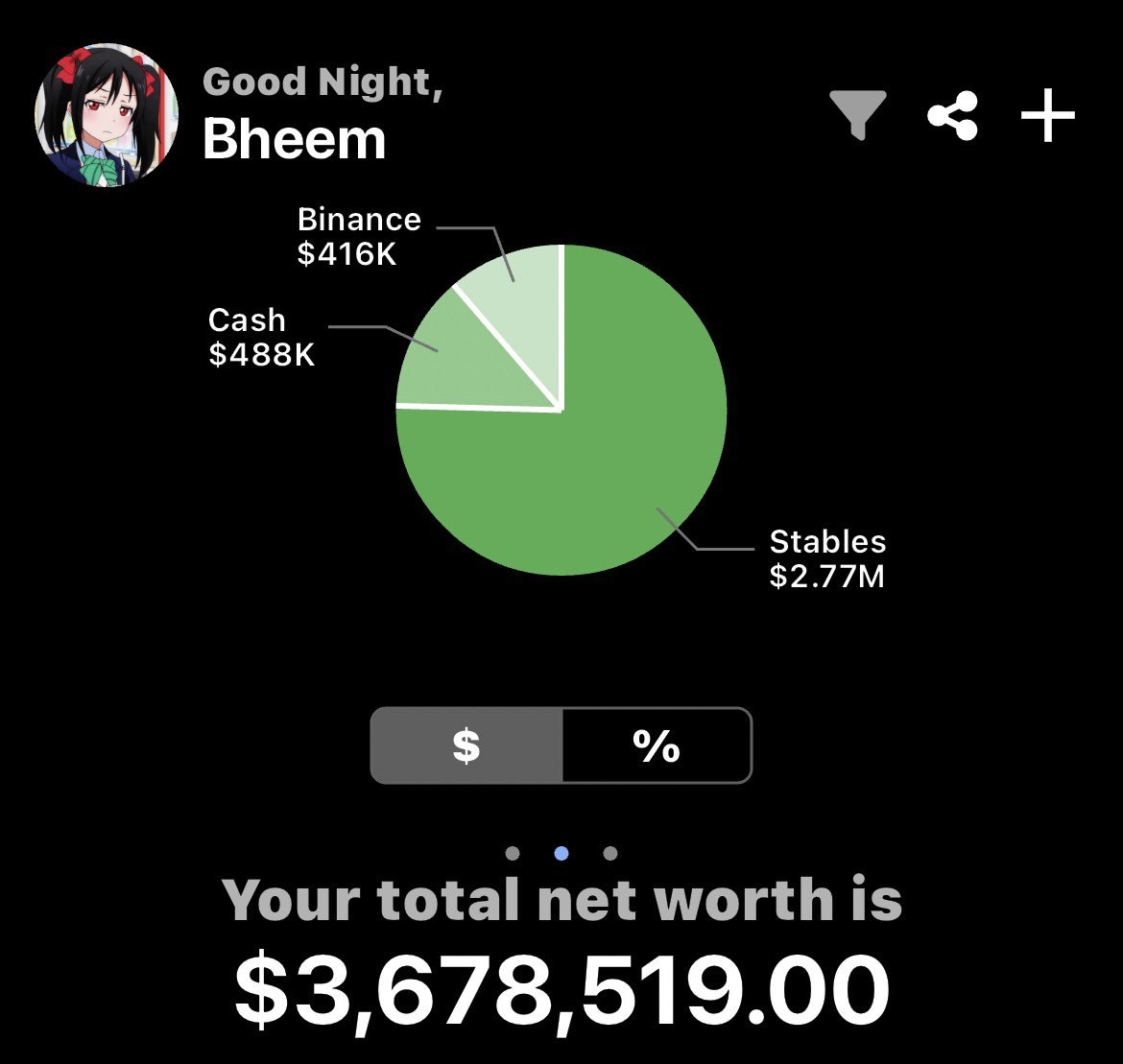

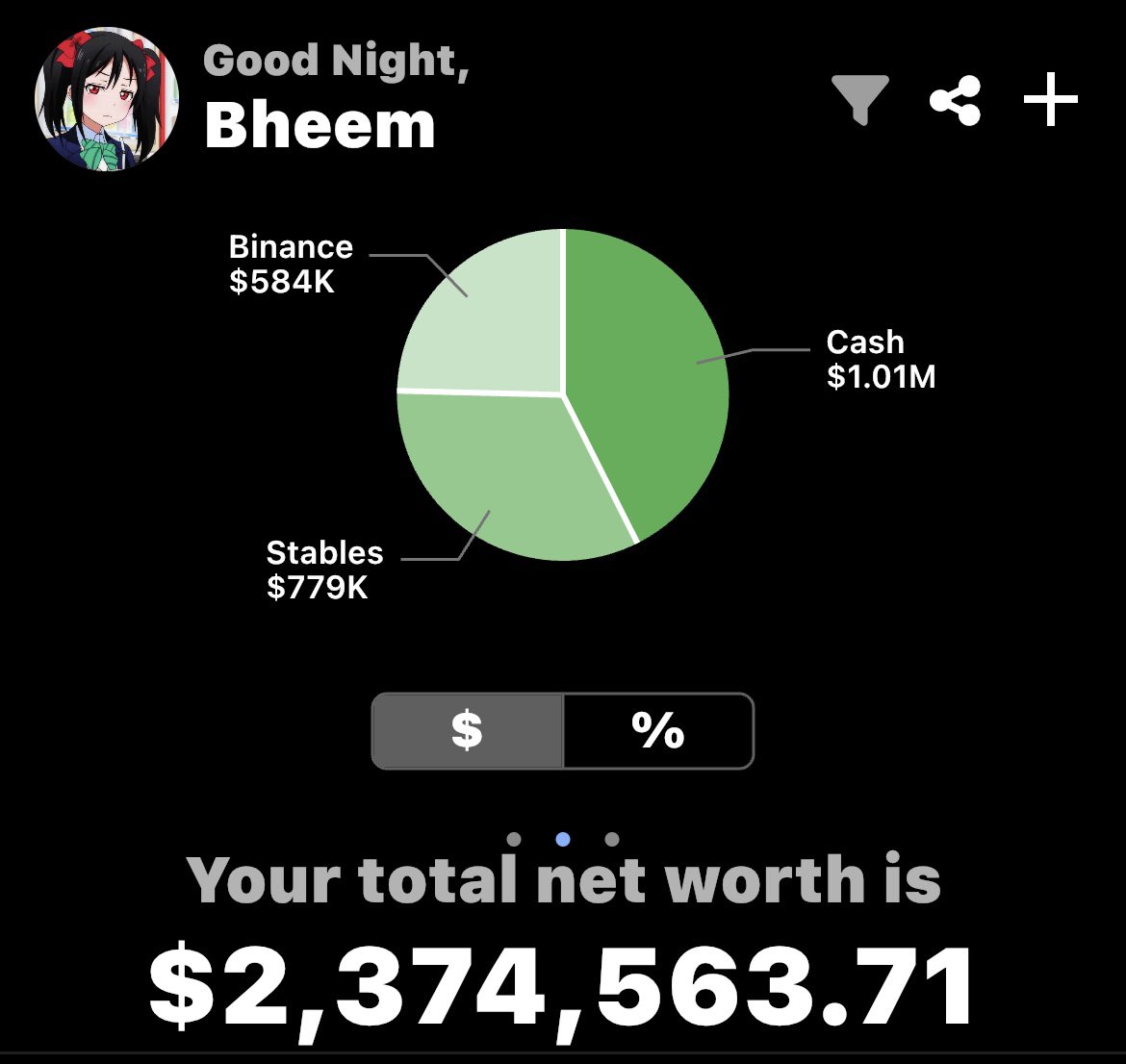

I’ve traded $1000 to $600,000 in less than 2 years without an investor approach, one question I get asked often is; where should a beginner start?

In this thread I’ll list some major references from start to finish which I’ve mastered functional for the current market… https://t.co/O2YYHVpACatwitter.com/i/web/status/1…

In this thread I’ll list some major references from start to finish which I’ve mastered functional for the current market… https://t.co/O2YYHVpACatwitter.com/i/web/status/1…

1. Technical Analysis does work & you shouldn’t fall prey to people that say it doesn’t. In-fact, TA can help predict news events too like I do for myself before major events like FOMC.

The best channel I recommend for beginners to learn everything about traditional TA is… https://t.co/NOX5wpk5betwitter.com/i/web/status/1…

The best channel I recommend for beginners to learn everything about traditional TA is… https://t.co/NOX5wpk5betwitter.com/i/web/status/1…

Speaking of TA, you’ve now learnt what 99.99% already know, so where is the edge you’re going to generate to be profitable in a market dominated by makers & hedge funds?

You will come across breakouts & breakdowns across each trade but only knowing the difference between their… https://t.co/V8cEkEWk33twitter.com/i/web/status/1…

You will come across breakouts & breakdowns across each trade but only knowing the difference between their… https://t.co/V8cEkEWk33twitter.com/i/web/status/1…

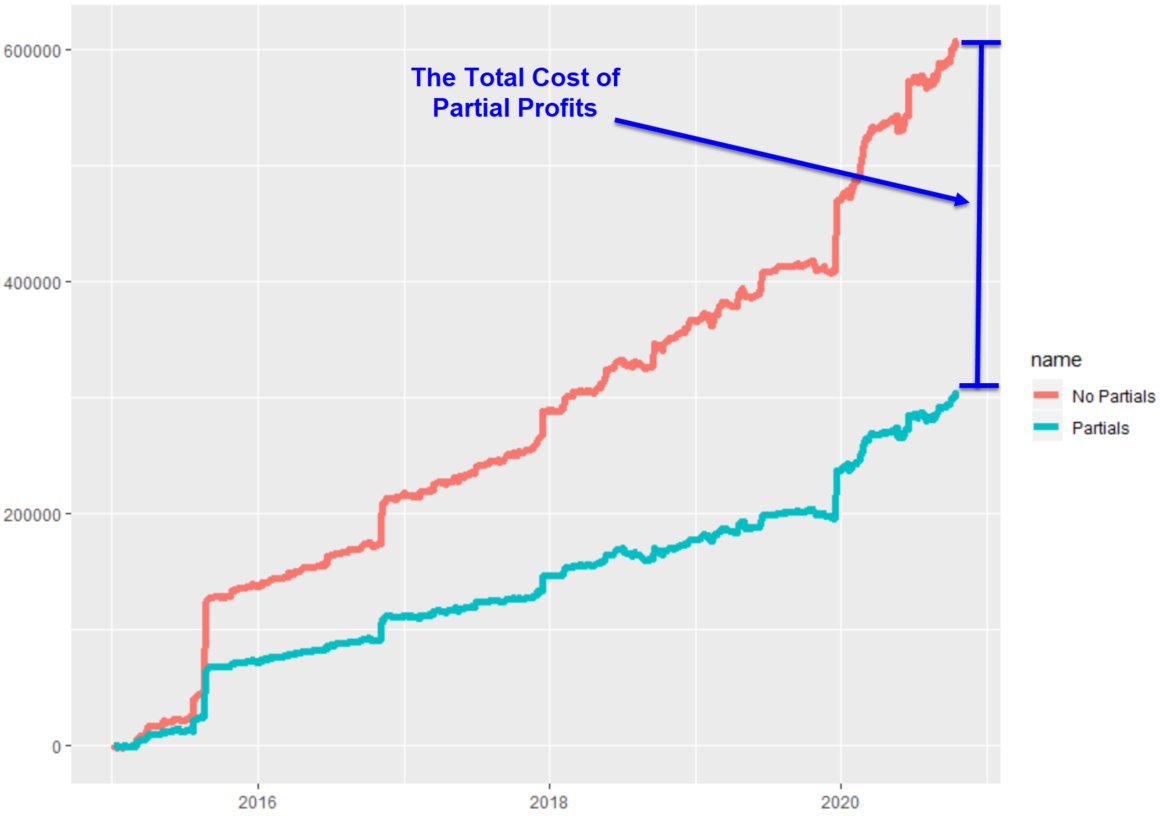

Without knowing position sizing, loss control & expected profit, you are nothing more than a gambler in this market.

Once again, I’ve uploaded the complete risk management series to my own channel:

Playlist:

Without this, you’re guaranteed to fail in… https://t.co/5uLZHynfsH https://t.co/QqovxzZSdxrb.gy/c96gx

twitter.com/i/web/status/1…

Once again, I’ve uploaded the complete risk management series to my own channel:

Playlist:

Without this, you’re guaranteed to fail in… https://t.co/5uLZHynfsH https://t.co/QqovxzZSdxrb.gy/c96gx

twitter.com/i/web/status/1…

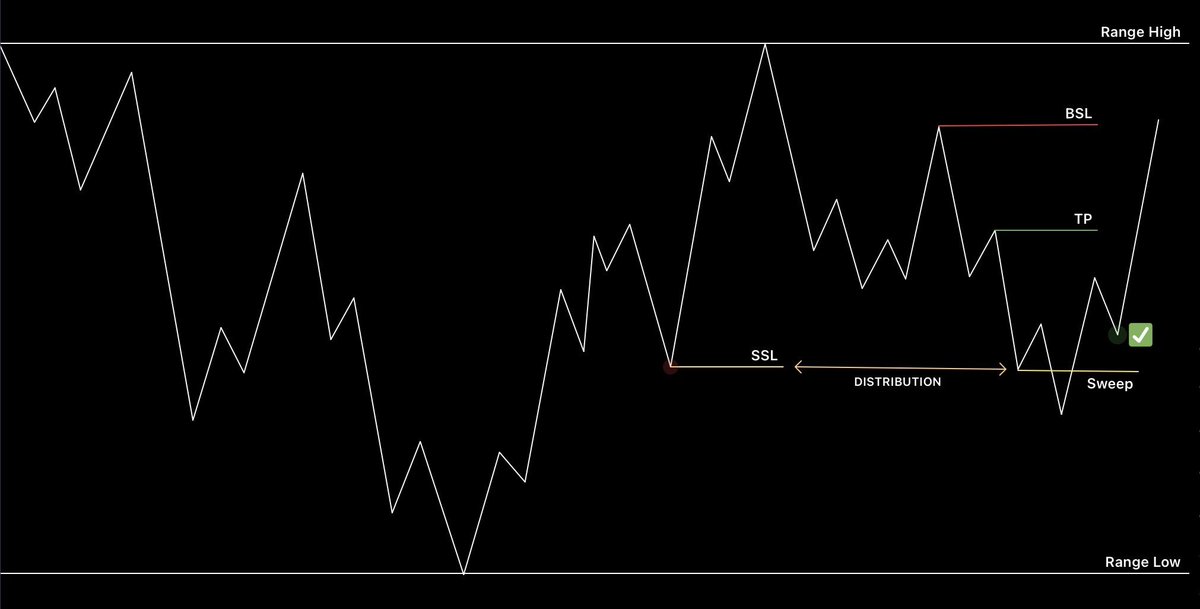

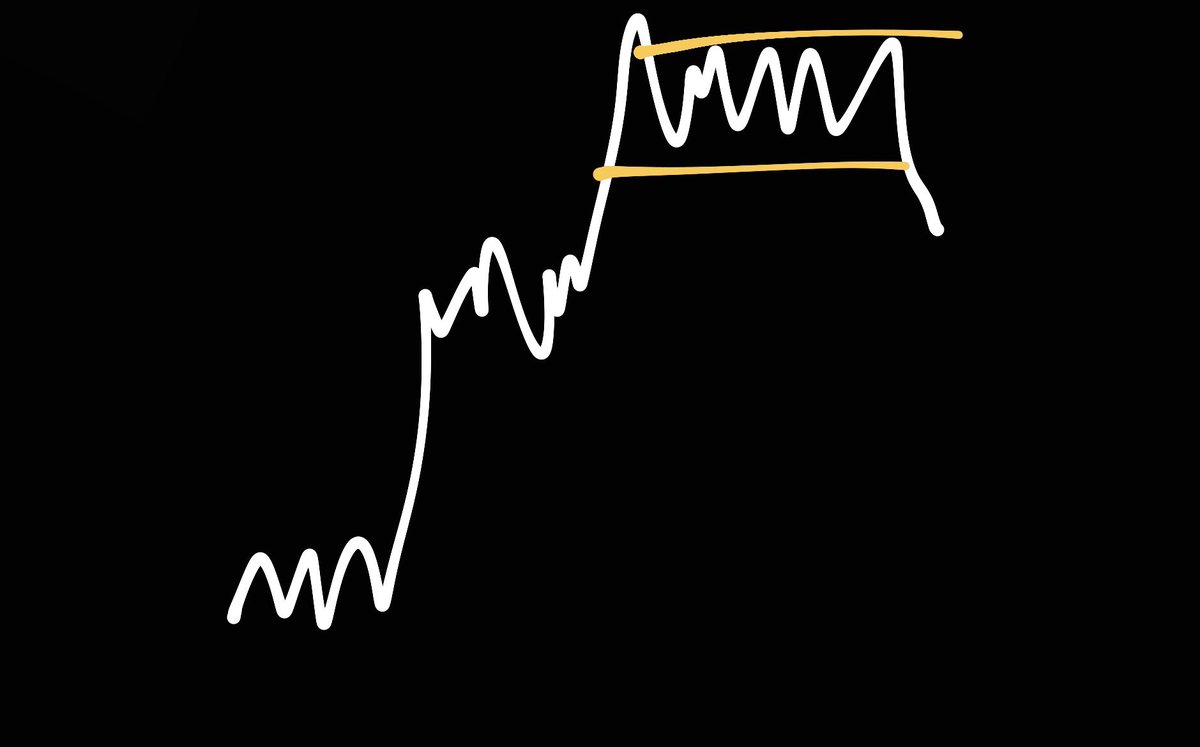

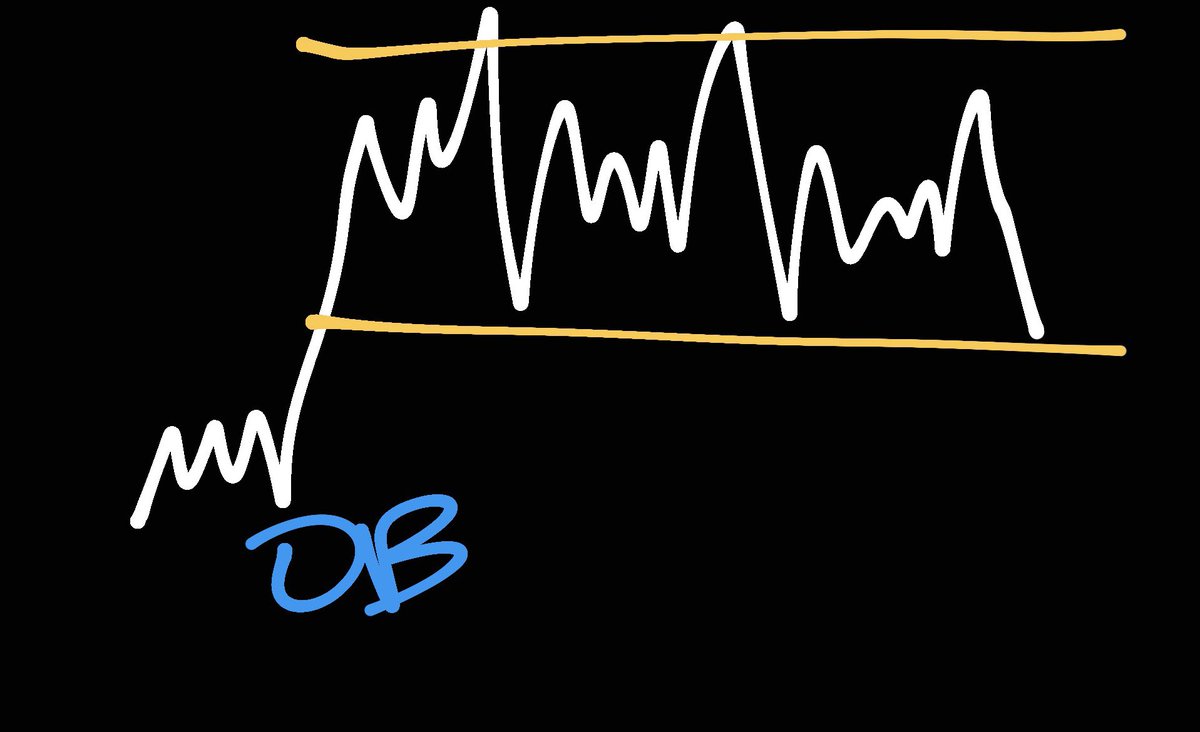

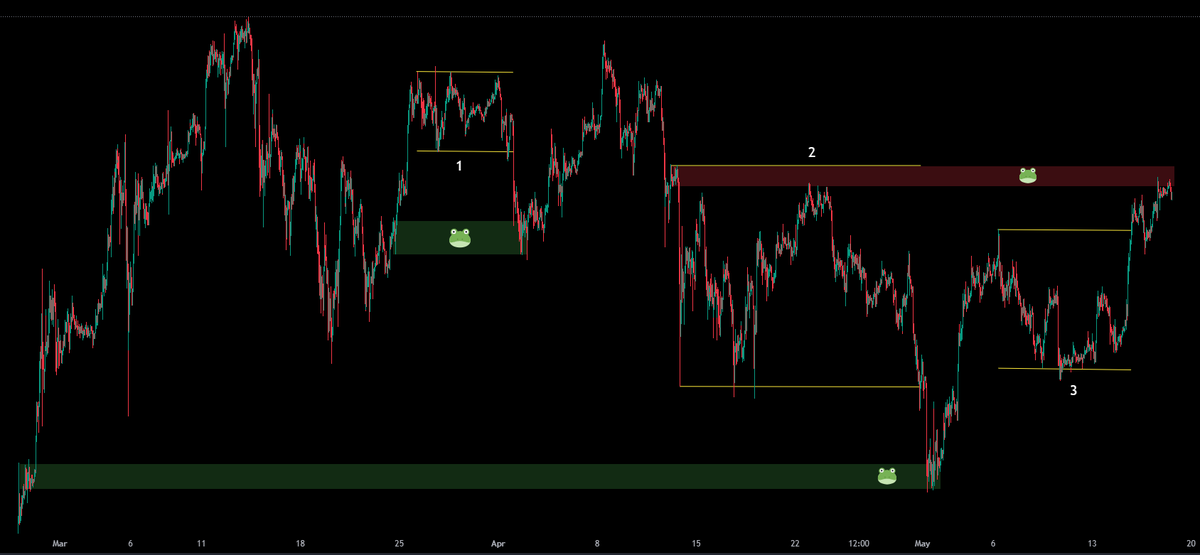

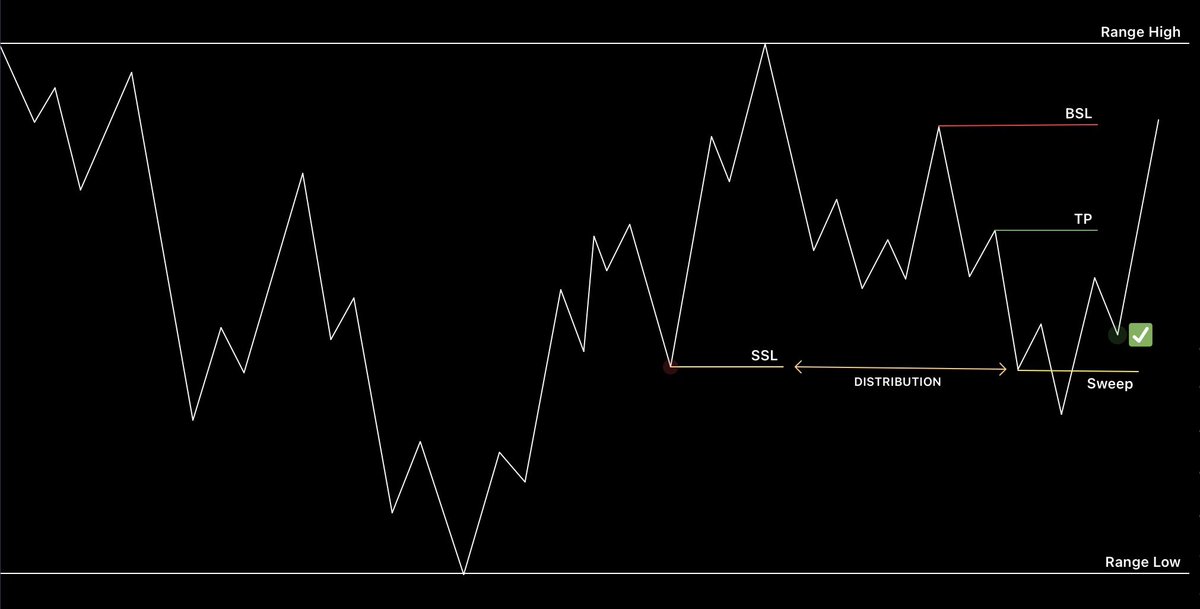

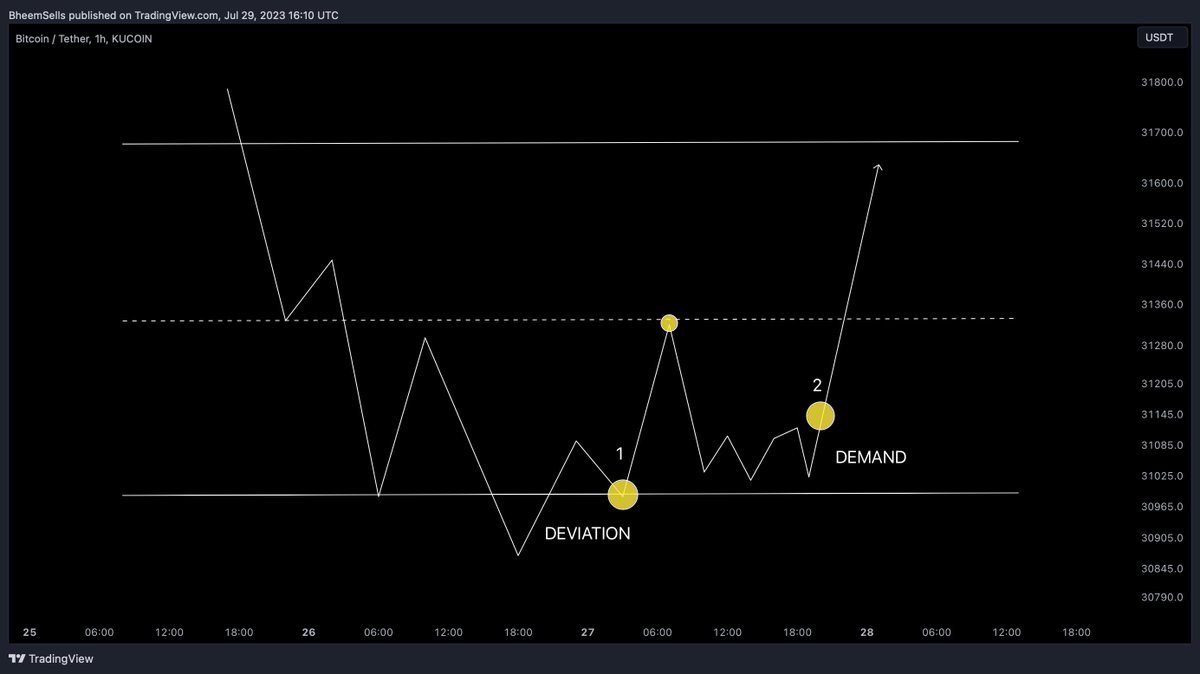

Adapt the meta of trading ranges. The big pump or dump candle will leave a wick on either side & this will act as your igniting candle to form a future range. Wait for certain high/lows to form then go from there.

The best way to trade a range is the 3 tap setup. In this case,… https://t.co/bmztN9NGnntwitter.com/i/web/status/1…

The best way to trade a range is the 3 tap setup. In this case,… https://t.co/bmztN9NGnntwitter.com/i/web/status/1…

To further elaborate on range trading, never trade a Monday. You want to wait for the week’s opening high & lows to form then apply the OB, Supply & Demand or 3BP concepts to trade inside a range I will discuss in tweets below.

From my experience, the Monday range is best… https://t.co/jqAx9dyKWYtwitter.com/i/web/status/1…

From my experience, the Monday range is best… https://t.co/jqAx9dyKWYtwitter.com/i/web/status/1…

TA & risk management is done, what next?

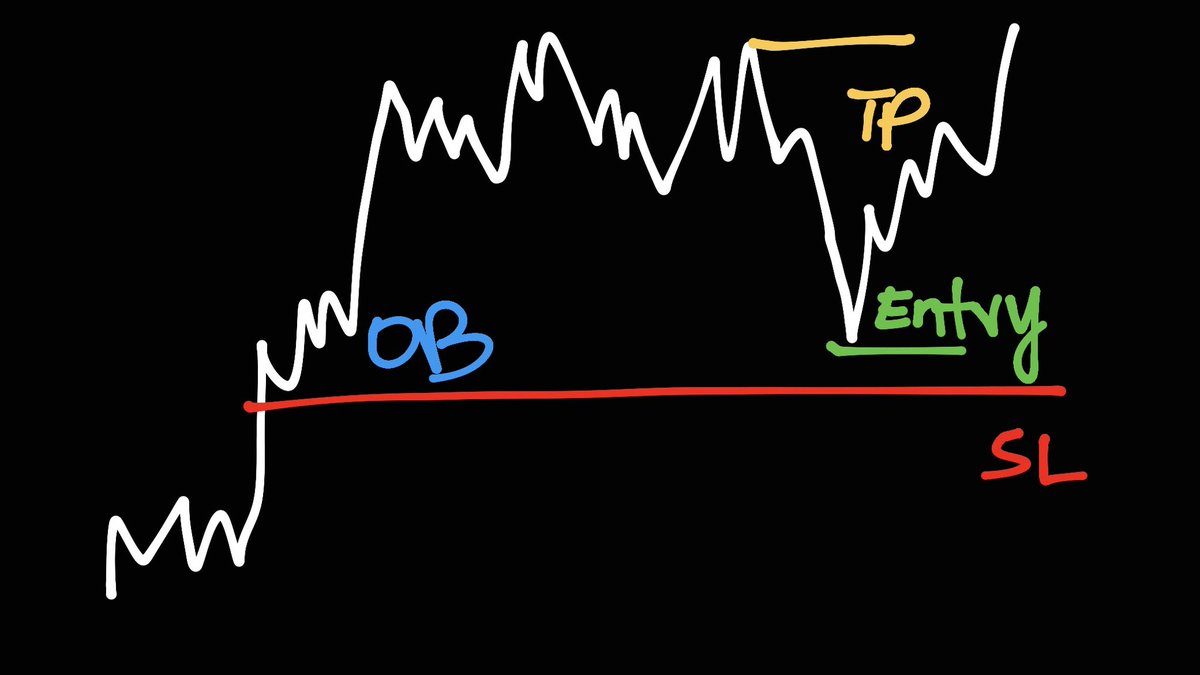

Well its simple, we’re going to step into what they call ‘institutional’ trading guides which get sold to you by mentors who haven’t even made their first 6 figures yet from trading.

Lets begin with the first concept of order-blocks.… https://t.co/lmO3BSeVfhtwitter.com/i/web/status/1…

Well its simple, we’re going to step into what they call ‘institutional’ trading guides which get sold to you by mentors who haven’t even made their first 6 figures yet from trading.

Lets begin with the first concept of order-blocks.… https://t.co/lmO3BSeVfhtwitter.com/i/web/status/1…

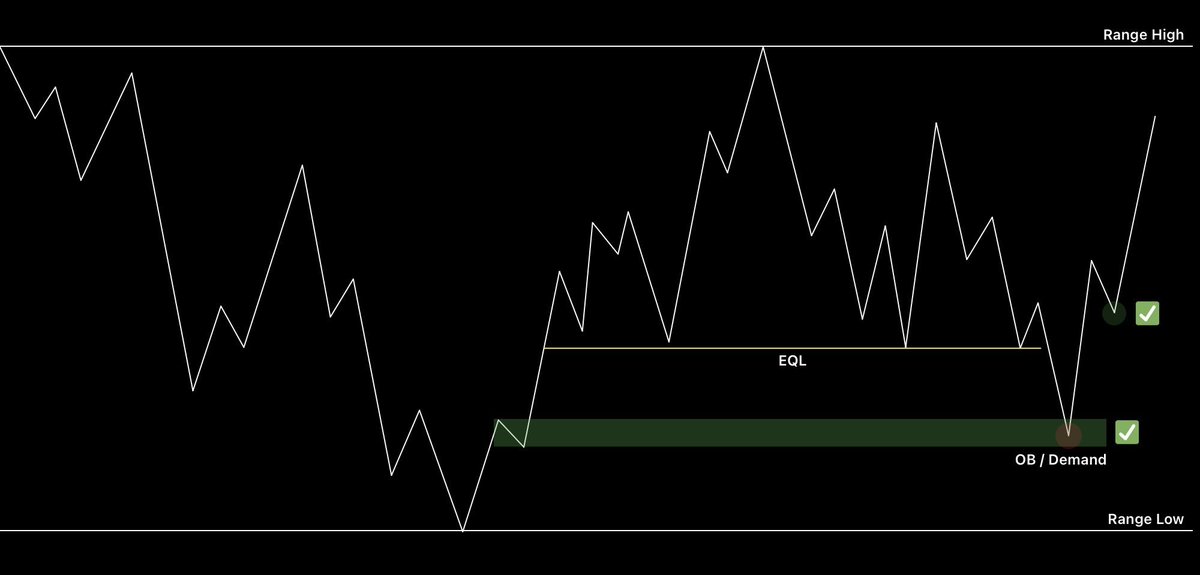

Next is supply and demand. Many examples exist for these but lets skip to the working one only:

Find accumulation or distribution > wait for an impulse > trade the retest of impulse.

The retest zone is always the previous candle to the igniting candle. The igniting candle is… https://t.co/hZVOqCiahhtwitter.com/i/web/status/1…

Find accumulation or distribution > wait for an impulse > trade the retest of impulse.

The retest zone is always the previous candle to the igniting candle. The igniting candle is… https://t.co/hZVOqCiahhtwitter.com/i/web/status/1…

Next is Volume Profile analysis. This one will require a lot of back testing but its a game changer. The POC’s & nPOC’s alone can act as the entire school of TA for such traders:

In my example you can see how a range forms & the POC acts as support first combined with demand… https://t.co/BCJnHVEoo7twitter.com/i/web/status/1…

In my example you can see how a range forms & the POC acts as support first combined with demand… https://t.co/BCJnHVEoo7twitter.com/i/web/status/1…

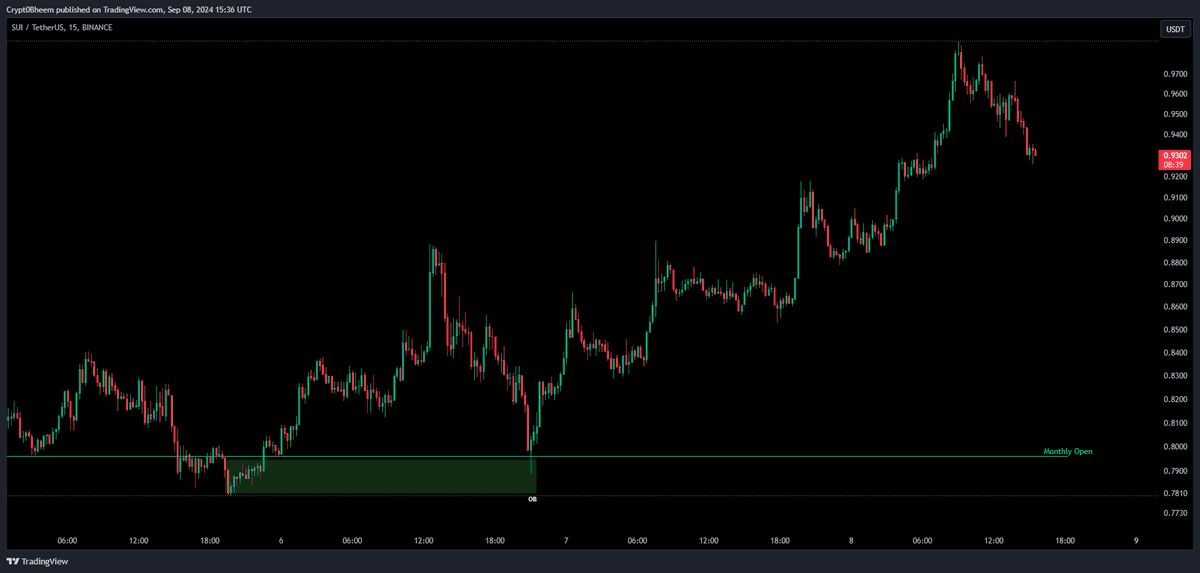

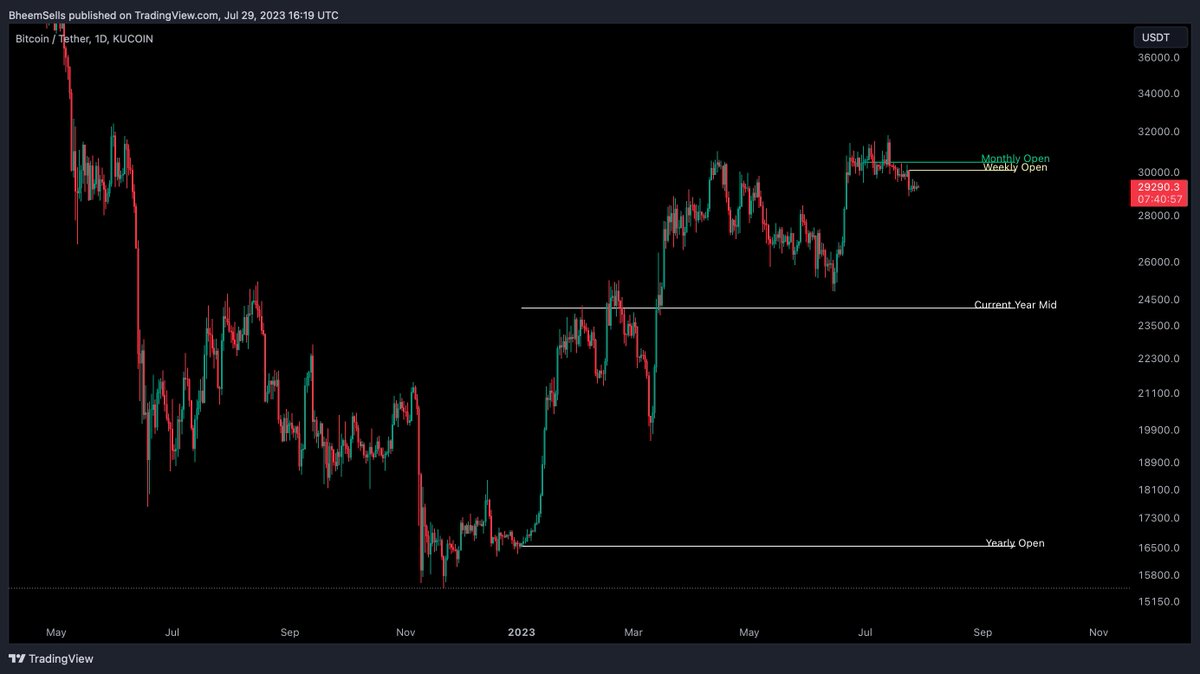

The last important ranges/key levels you must be aware of are Monthly Open & Weekly Open levels. Just combine these into primary analysis to further strengthen bias.

Use the Spaceman BTC key levels Indicator to get these asap. Map out HTF targets & use this indicator to your… https://t.co/us2KHXNRVutwitter.com/i/web/status/1…

Use the Spaceman BTC key levels Indicator to get these asap. Map out HTF targets & use this indicator to your… https://t.co/us2KHXNRVutwitter.com/i/web/status/1…

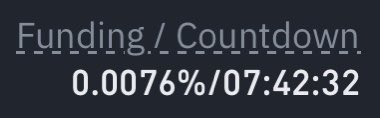

Last but not the least, trade based on H4 confirmations. The reason you may ask? It’s simple, crypto is led by funding fees, every 2xH4 closes there is a funding reset. Waiting 1H after a funding reset gives confirmation on which side is holding the PA stronger despite… https://t.co/24FW7tsgBCtwitter.com/i/web/status/1…

Bonus Question 1: Do I need to learn ICT or SMC?

Answer: Whatever you trade, is a combination of one concept or the other. I’ve never selectively went to Youtube to learn ‘ICT’ or ‘SMC’. I developed a simple style of trading support & resistance; the other concepts came into my… twitter.com/i/web/status/1…

Answer: Whatever you trade, is a combination of one concept or the other. I’ve never selectively went to Youtube to learn ‘ICT’ or ‘SMC’. I developed a simple style of trading support & resistance; the other concepts came into my… twitter.com/i/web/status/1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh