Semi Retired | Quantitative Insights • Macro Sentiment | Intersection of Liquidity Cycles

How to get URL link on X (Twitter) App

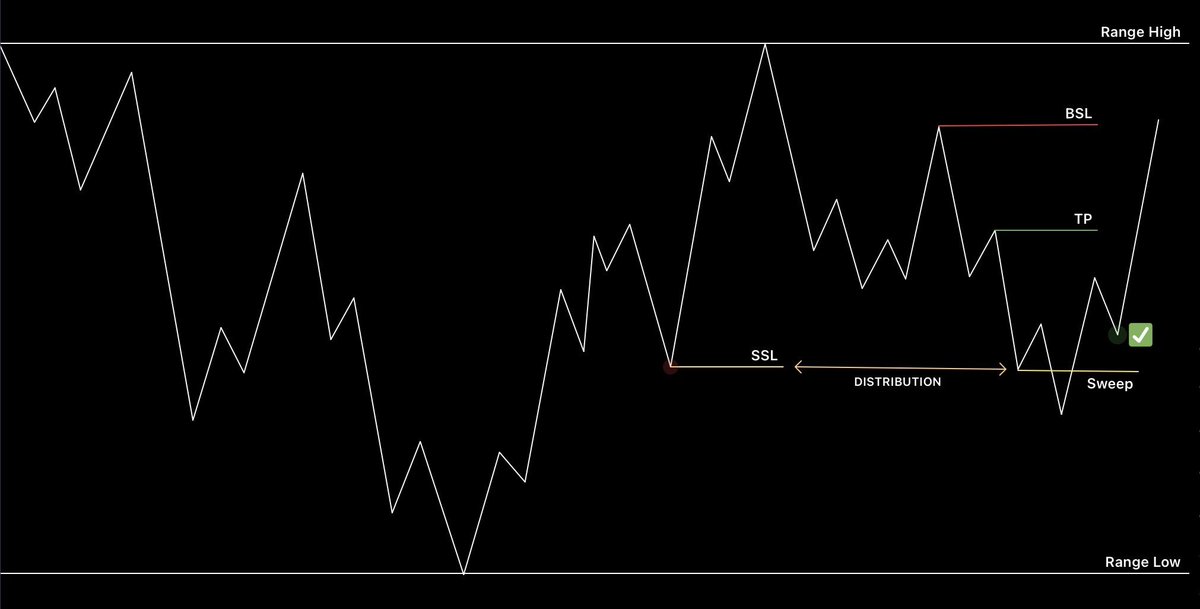

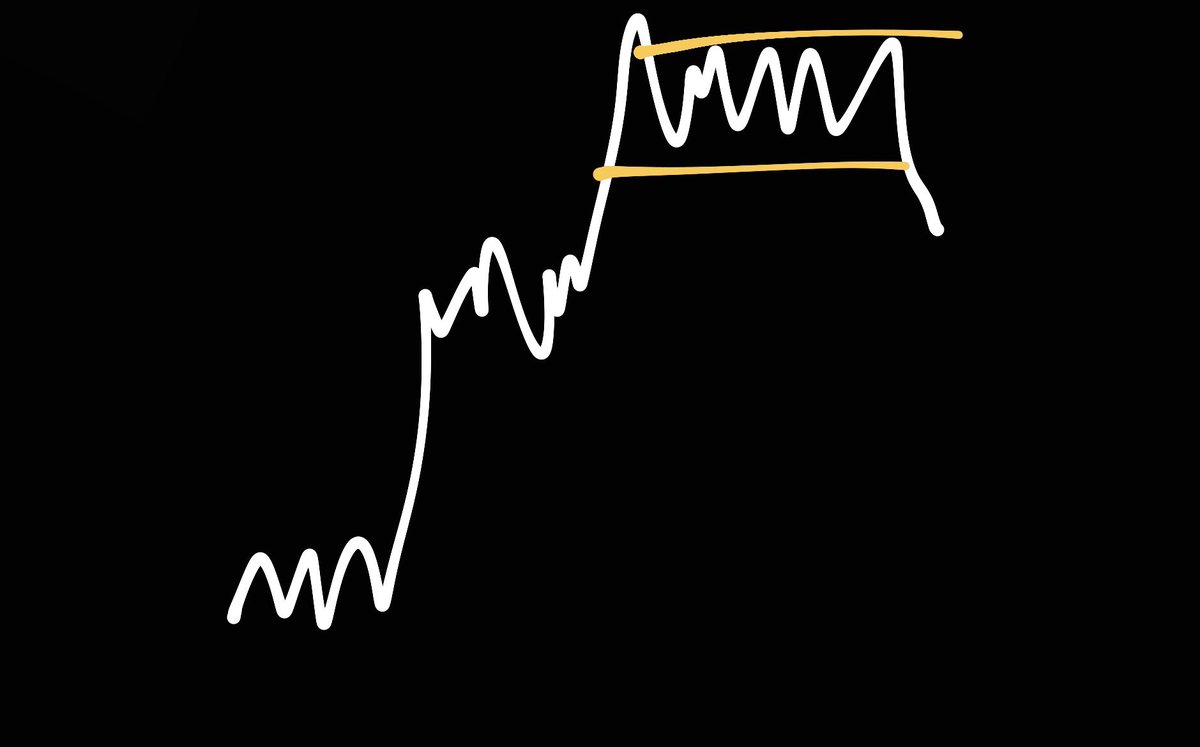

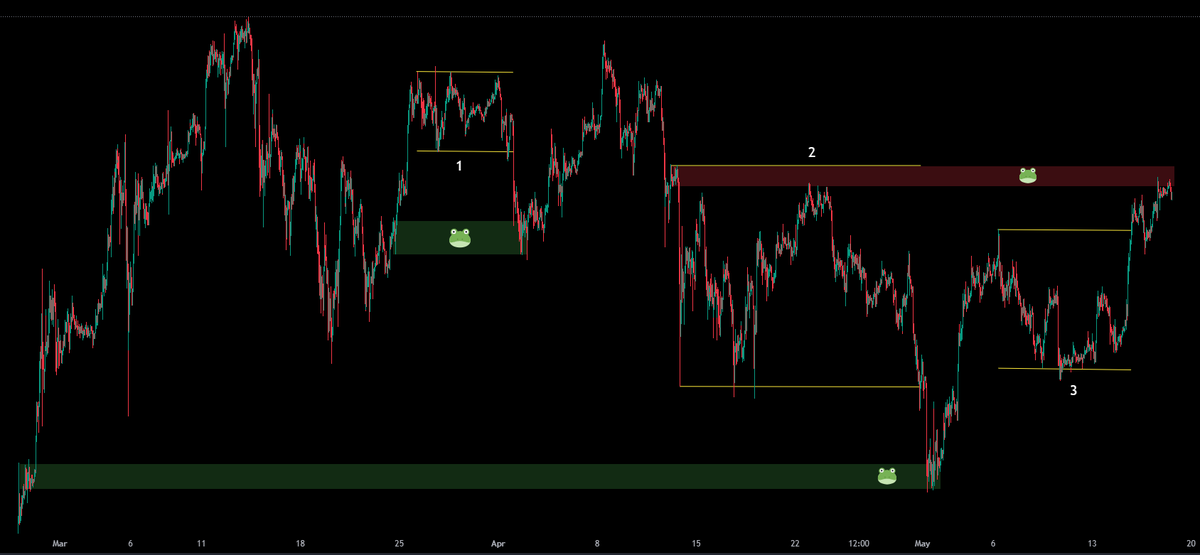

1. Sell Side Liquidity Model📈

1. Sell Side Liquidity Model📈

1. Range Bound Liquidity:

1. Range Bound Liquidity:

I’m going to talk to in configuration of a long setup (vice versa applies to shorting)

I’m going to talk to in configuration of a long setup (vice versa applies to shorting)

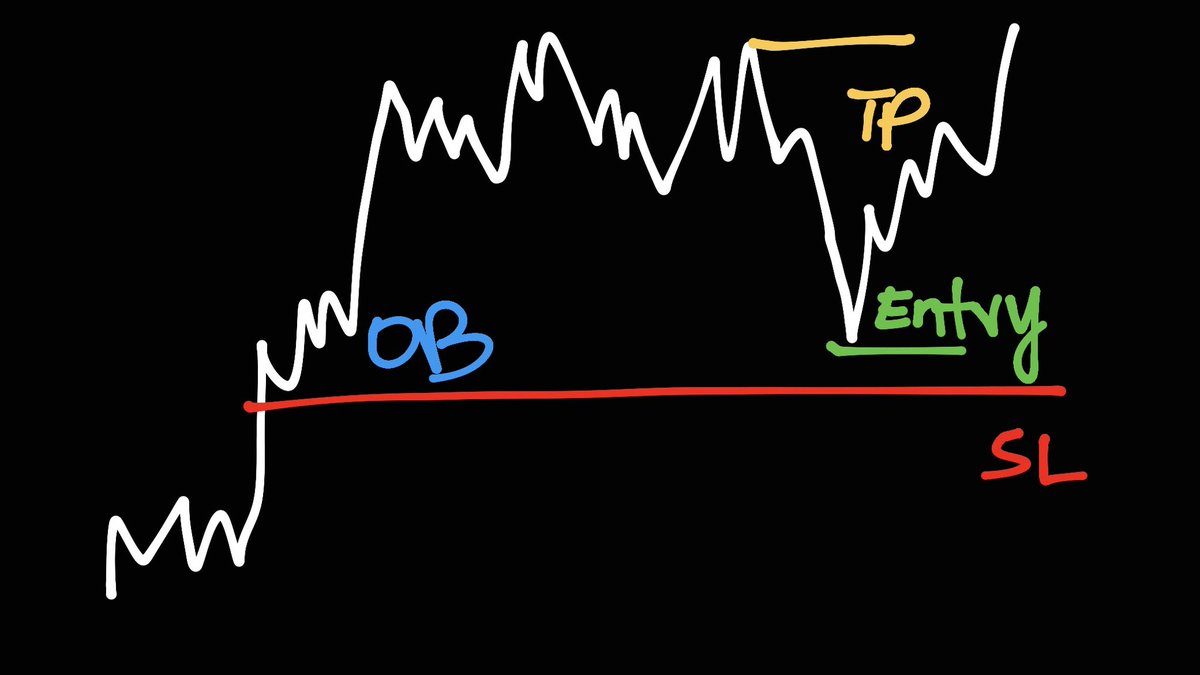

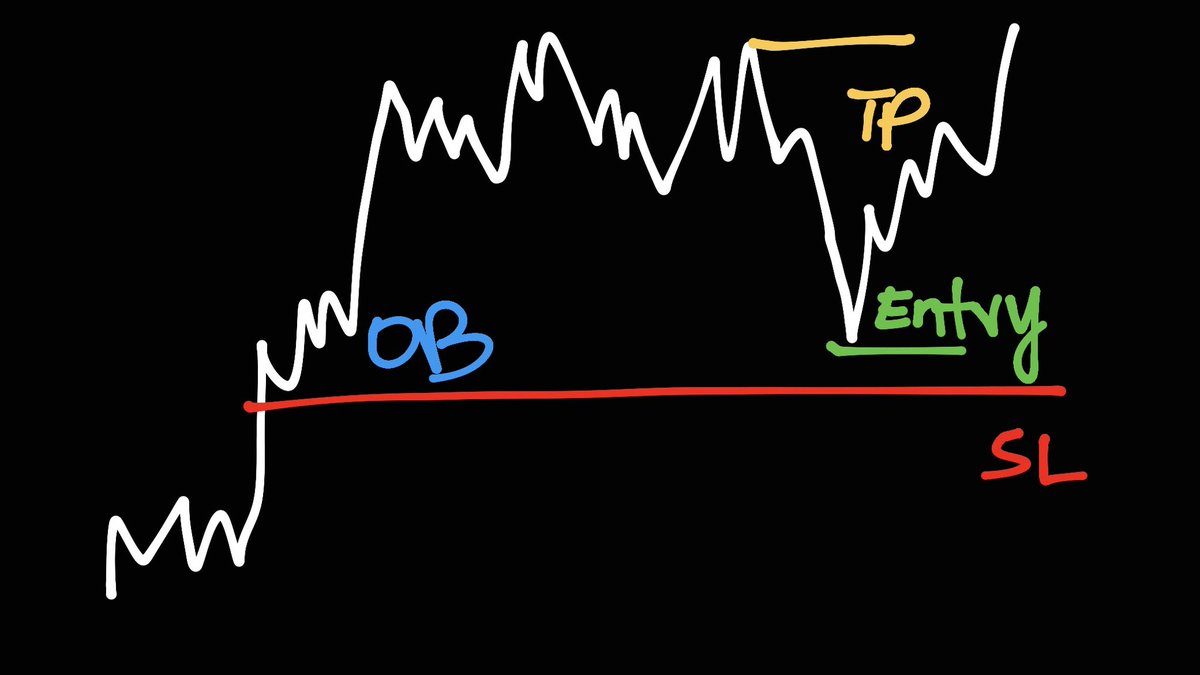

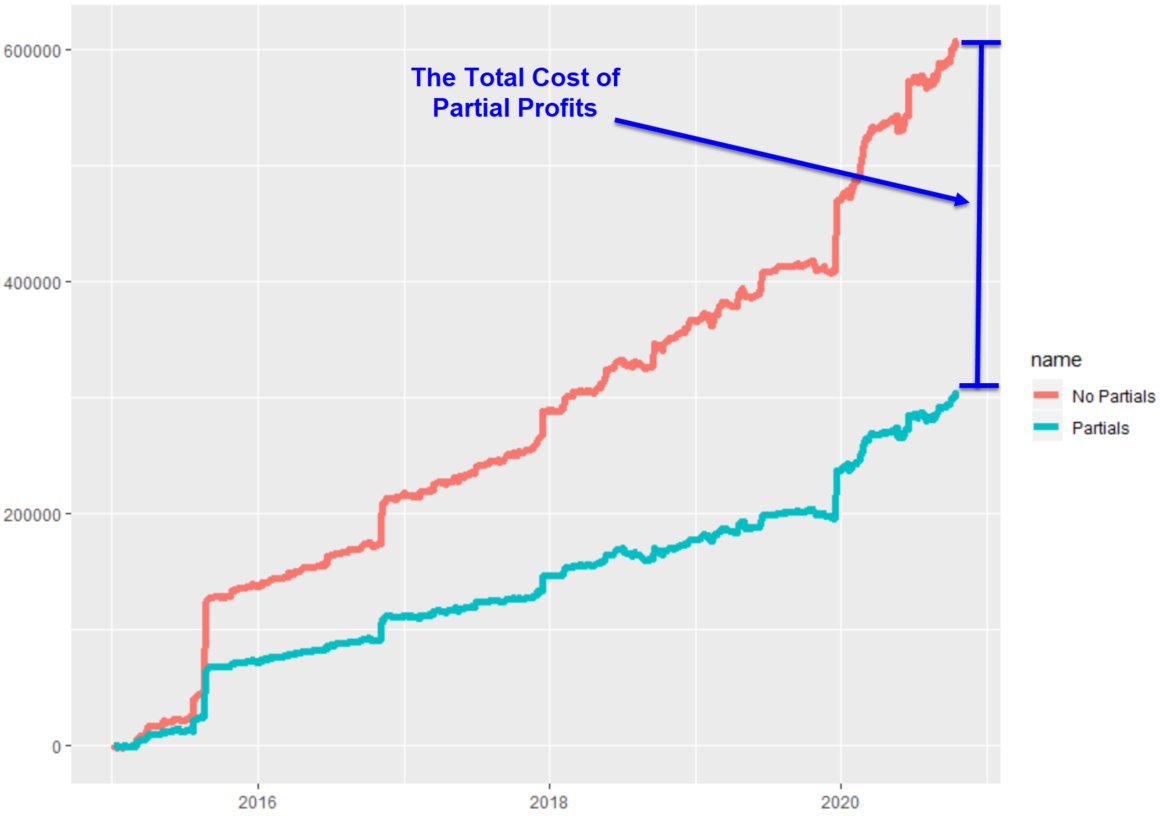

[I stopped taking partial profits]

[I stopped taking partial profits]

1. Range Bound Liquidity:

1. Range Bound Liquidity:

Before going through each entry model, I recommend to watch this video about ranges, order-blocks and supply/demand explained in under 35 minutes!

Before going through each entry model, I recommend to watch this video about ranges, order-blocks and supply/demand explained in under 35 minutes!

1. Technical Analysis does work & you shouldn’t fall prey to people that say it doesn’t. In-fact, TA can help predict news events too like I do for myself before major events like FOMC.

1. Technical Analysis does work & you shouldn’t fall prey to people that say it doesn’t. In-fact, TA can help predict news events too like I do for myself before major events like FOMC.