The huge "hedge fund short" 101

Many have published a chart that say "hedge funds have the largest speculative short futures position in history". The data is accurate. It also needs interpretation.

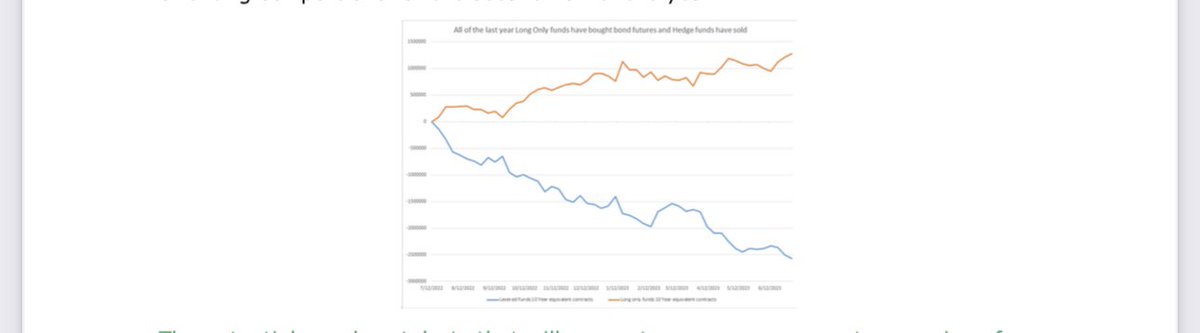

Here's my chart it's a few weeks old but illustrates my point

Many have published a chart that say "hedge funds have the largest speculative short futures position in history". The data is accurate. It also needs interpretation.

Here's my chart it's a few weeks old but illustrates my point

The hedge fund short is someone else's long. That long is institutional investors. It's very big. But that is not the important story. This unlike the ES charts which looked the same and were a choose your fighter Long Only Simps vs Hedge funds (which I got completely wrong)

But fixed income futures positions are quite different. While the long side of the positions are indeed levering up by long only asset managers the short side which is getting so much doomism is more complex

H/T @leadlagreport for this example

H/T @leadlagreport for this example

Why do hedge funds short bond futures

Speculation IS a real thing!

BUT also to hedge out interest rate risk on something they are long in the derivatives or cash market like:

Corporate and High Yield Bonds, Physical Treasury Bonds, Mortgage Bonds, Muni's, Converts, EM debt etc

Speculation IS a real thing!

BUT also to hedge out interest rate risk on something they are long in the derivatives or cash market like:

Corporate and High Yield Bonds, Physical Treasury Bonds, Mortgage Bonds, Muni's, Converts, EM debt etc

For example let's say long only institutions bid up futures to lever up a bet. A hedge fund can buy the correspond US Treasury to that futures contract and take out a spread between the futures and cash markets. It's an arbitrage between the cost of leverage in the futures

Markets and the actual cost of leverage the hedge fund is able to achieve in their funding of the UST long position.

Now. It's possible that the hedge fund is purely speculative or it's possible that they own the bond and are using repo to finance the long and are short the

Now. It's possible that the hedge fund is purely speculative or it's possible that they own the bond and are using repo to finance the long and are short the

Futures. Let's go to the data. As this "historic" futures short has been built. Levered long positions have grown by half a Trillion dollars. Either that should be added to the long position of real money

Or should be subtracted from the short position of hedge funds who are doing the cash and carry arbitrage. I won't show all my data but just say that this is a complex topic and the signal in Fixed Income is pretty weak regarding TFF rates data the doomers are posting

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter