CONTINUATION OF MARKET PROFILE SERIES- PART 3

MP terminology & Anomalies covered:

Next, there is some value to understanding the DAILY OPEN TYPES and use it to leverage potential opportunities in terms of how the rest of the day might play out. https://t.co/3jCow6Qcim

MP terminology & Anomalies covered:

Next, there is some value to understanding the DAILY OPEN TYPES and use it to leverage potential opportunities in terms of how the rest of the day might play out. https://t.co/3jCow6Qcim

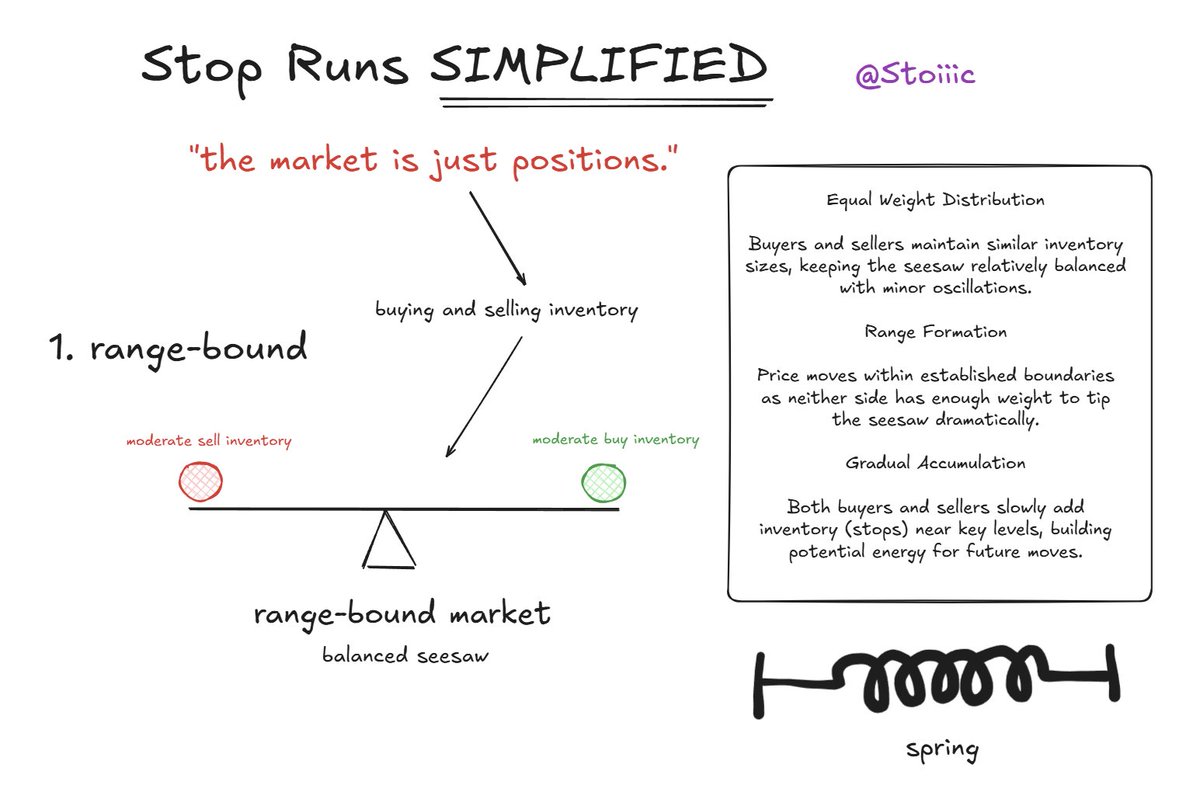

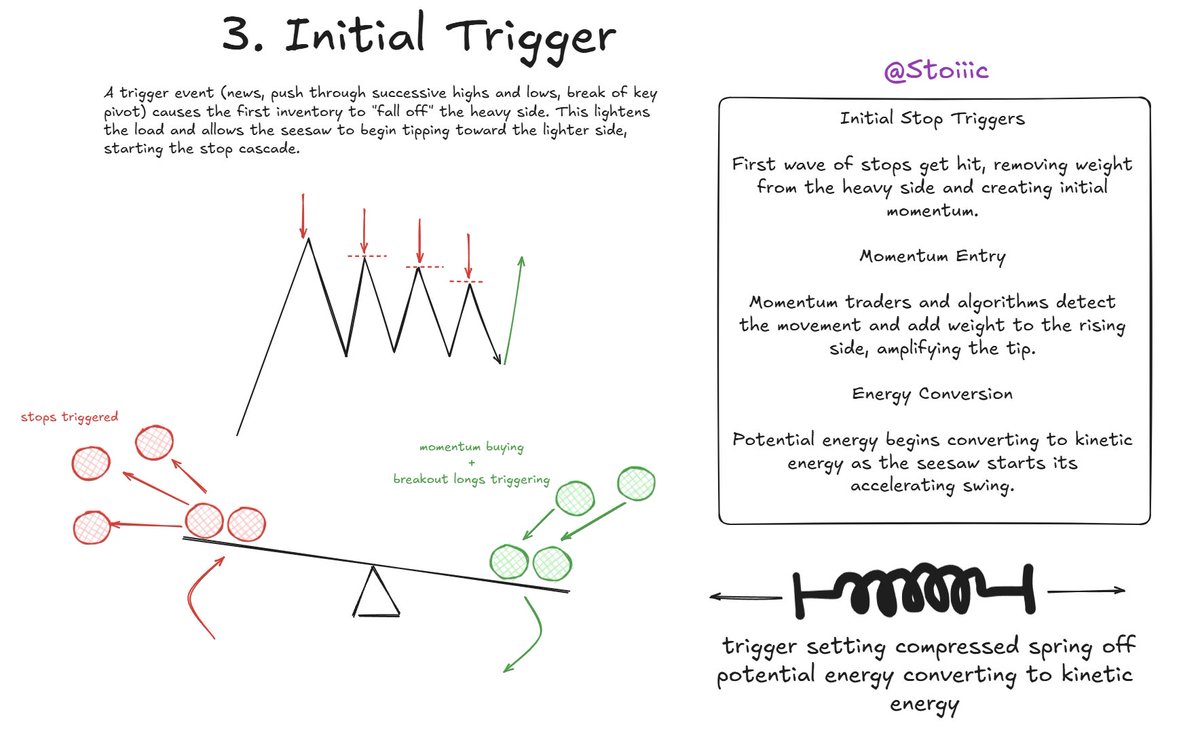

https://twitter.com/Stoiiic/status/1682004952217001985?s=20

DAILY OPEN TYPES:

- Open Drive

- Open Test Drive

- Open Rejection Reverse

- Open Auction

Let's dive in to the characteristics of each daily open type.

- Open Drive

- Open Test Drive

- Open Rejection Reverse

- Open Auction

Let's dive in to the characteristics of each daily open type.

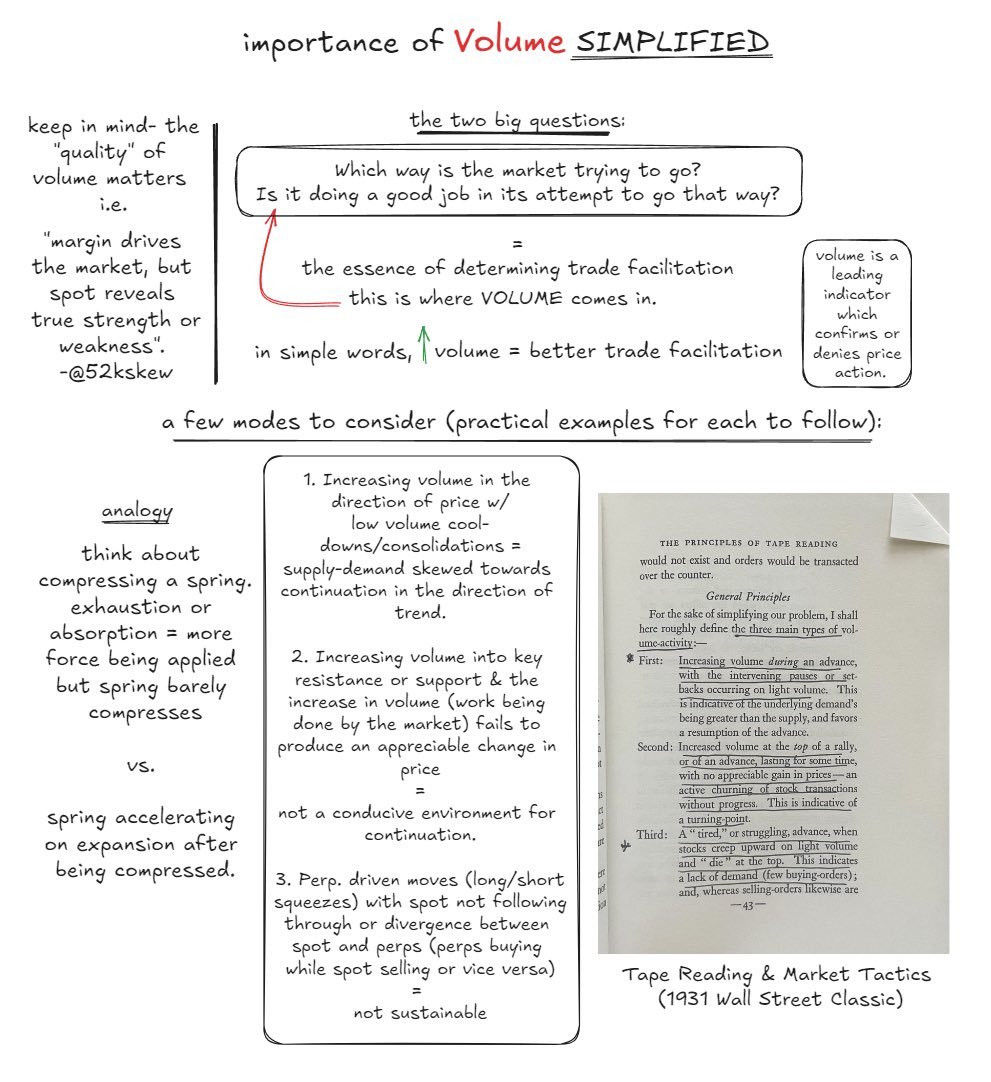

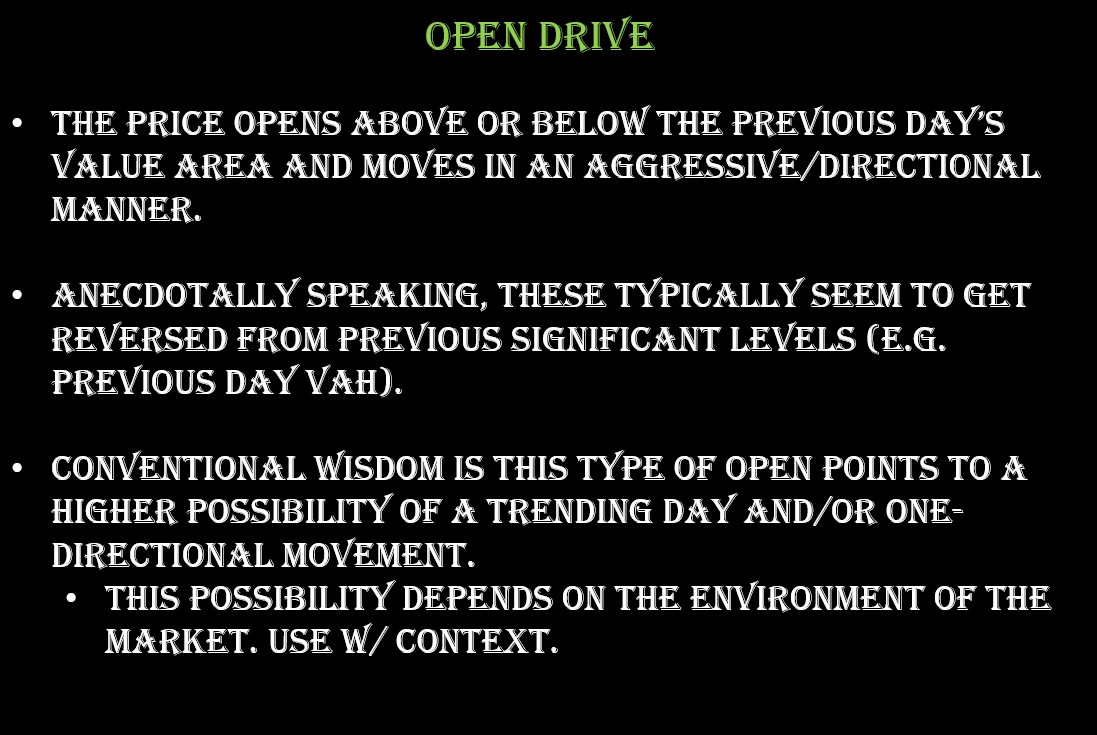

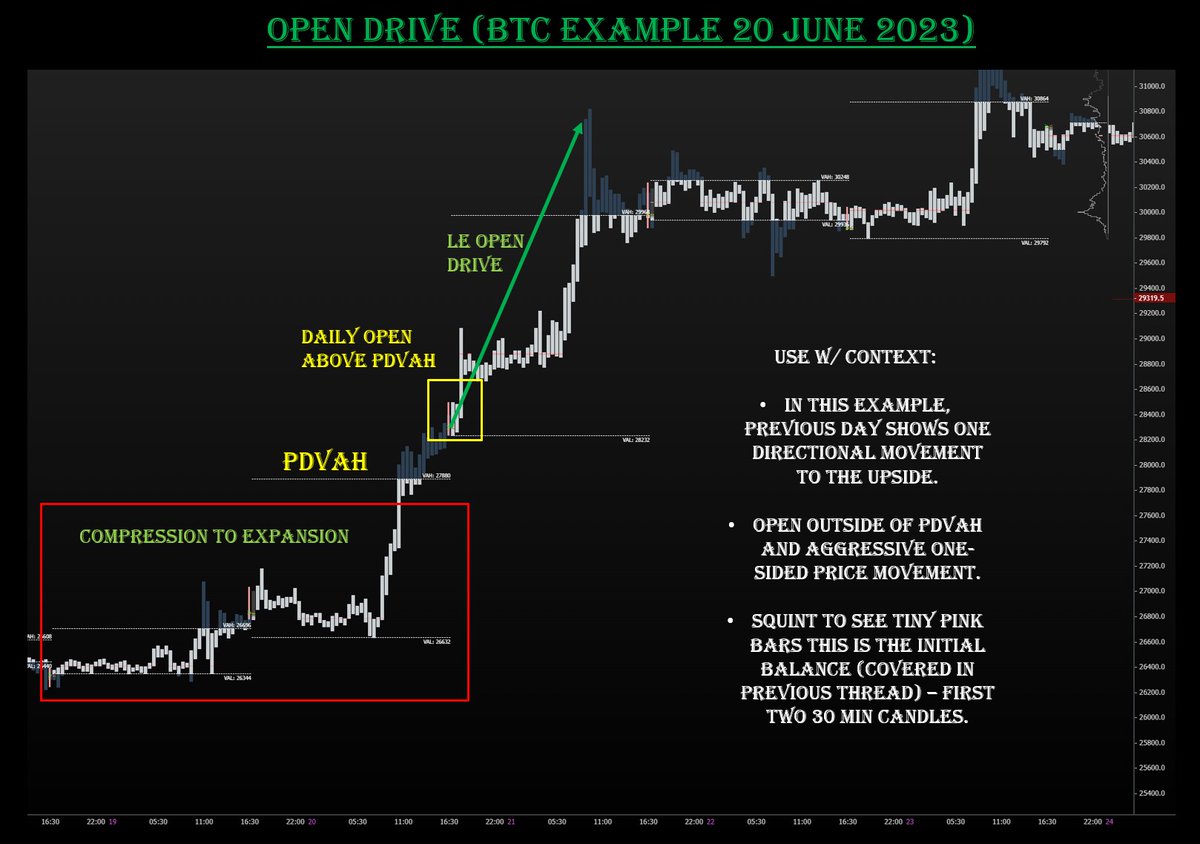

OPEN DRIVE- DETAILS IN IMAGES

Price opens above or below the previous day’s value area and moves in an aggressive/directional manner.

Anecdotally speaking, these typically seem to get reversed from previous significant levels (e.g. previous day VAH). Use w/ context.

Price opens above or below the previous day’s value area and moves in an aggressive/directional manner.

Anecdotally speaking, these typically seem to get reversed from previous significant levels (e.g. previous day VAH). Use w/ context.

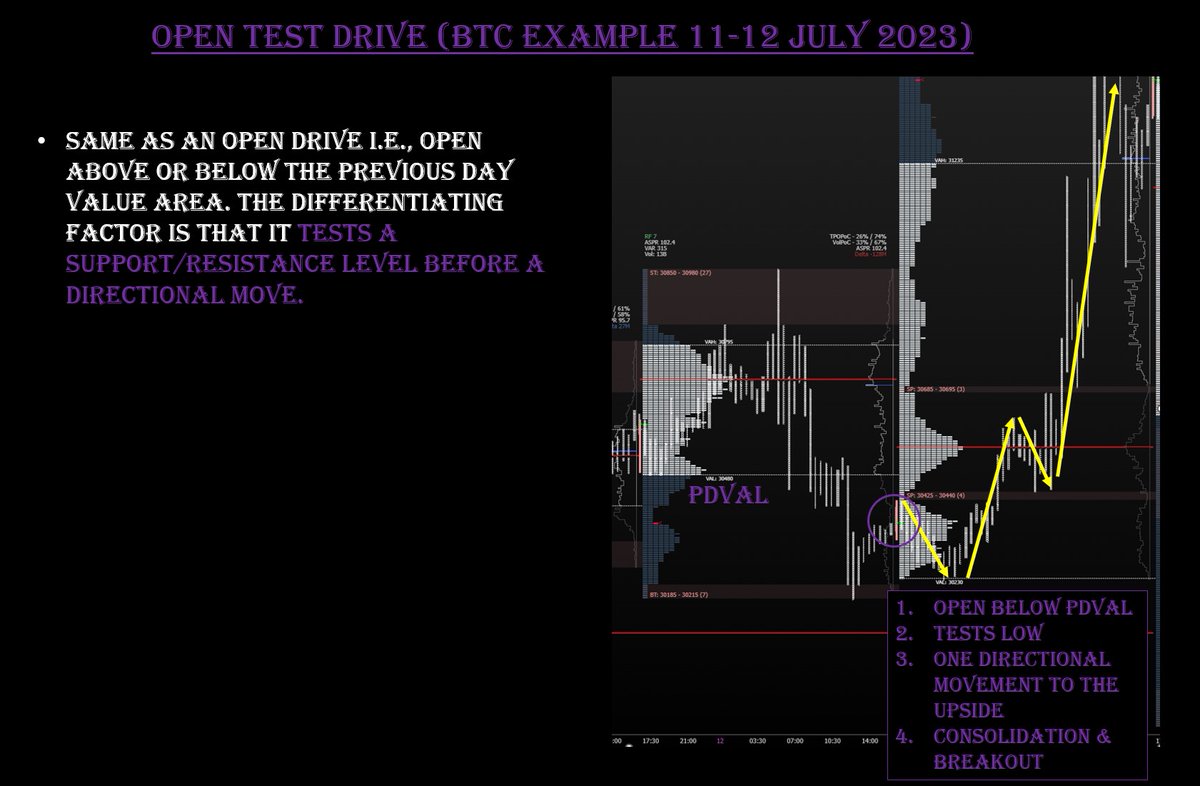

OPEN TEST DRIVE- DETAILS IN IMAGE

Same as an open drive i.e., open above or below the previous day value area. The differentiating factor is that price tests a support/resistance level before reversing for a directional move.

Same as an open drive i.e., open above or below the previous day value area. The differentiating factor is that price tests a support/resistance level before reversing for a directional move.

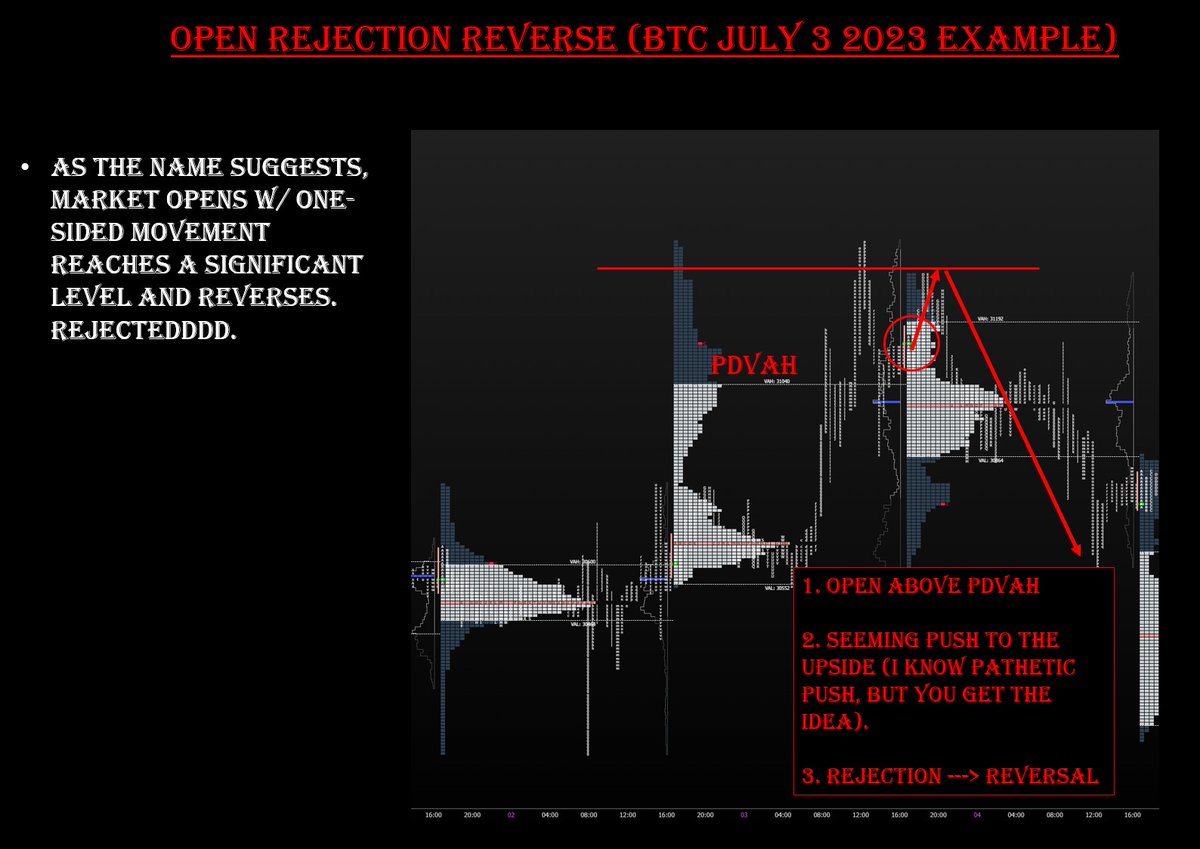

OPEN REJECTION REVERSE - DETAILS IN IMAGE

As the name suggests, market opens w/ one-sided movement reaches a significant level and reverses.

As the name suggests, market opens w/ one-sided movement reaches a significant level and reverses.

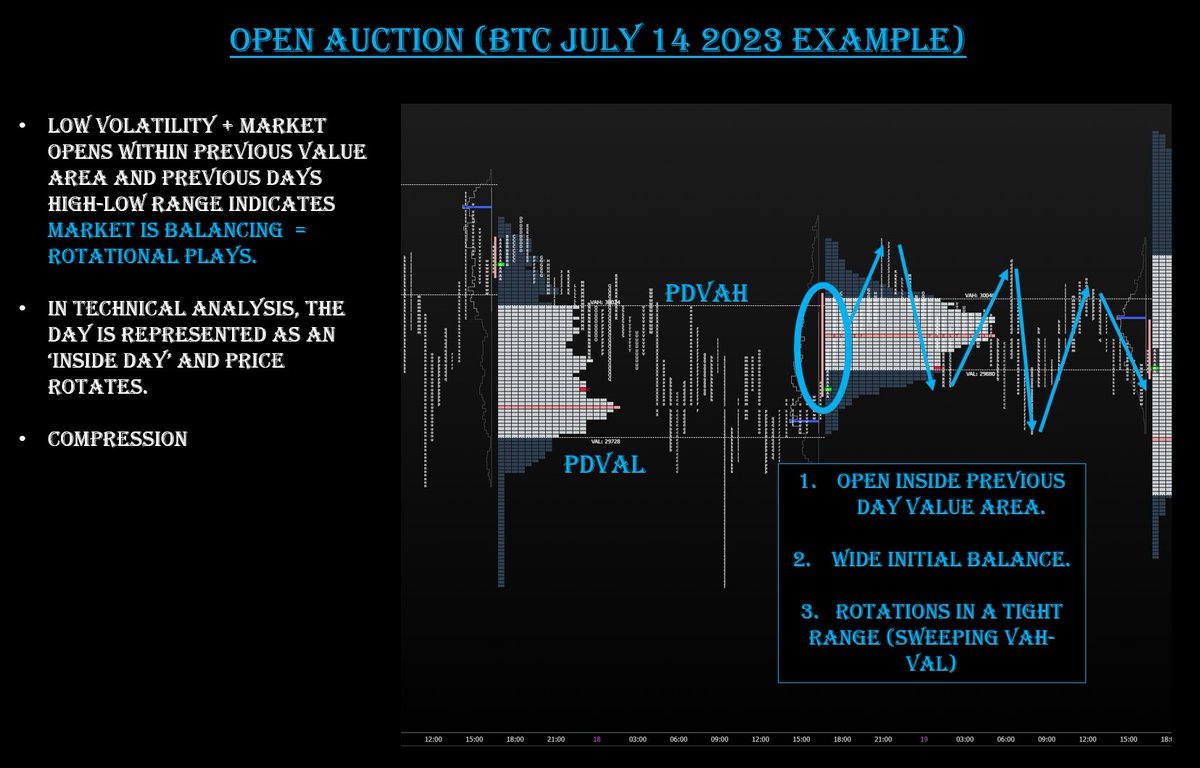

OPEN AUCTION - DETAILS IN IMAGE

Low volatility + market opens within previous value area and previous days high-low range indicates market is balancing = rotational plays. God knows we've been getting a lot of these lately....

Low volatility + market opens within previous value area and previous days high-low range indicates market is balancing = rotational plays. God knows we've been getting a lot of these lately....

Additional Resources-

1. @abetrade -

(TradingRiot has phenomenal free information available if you're interested in learning)

2. https://t.co/ixIMw2eyY7

3. https://t.co/CJDqYFxVQn https://t.co/aK1uHtpYpLtradingriot.com/market-profile/

atas.net/volume-analysi…

marketcalls.in/market-profile…

1. @abetrade -

(TradingRiot has phenomenal free information available if you're interested in learning)

2. https://t.co/ixIMw2eyY7

3. https://t.co/CJDqYFxVQn https://t.co/aK1uHtpYpLtradingriot.com/market-profile/

atas.net/volume-analysi…

marketcalls.in/market-profile…

@abetrade Understanding the daily open types can prove helpful to assign probabilities to how the rest of the day will play out = being able to capitalize on directional or mean-reversion opportunities.

RT to share, LIKE & FOLLOW for more insightful content.

Thank you for the support 🙏

RT to share, LIKE & FOLLOW for more insightful content.

Thank you for the support 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh