this thread will cover the following:

- how I find my favorite liquidity levels

- indicators I use to aid in finding them

- session candles

- daily high/lows

- pivot rays

- preferred timeframes

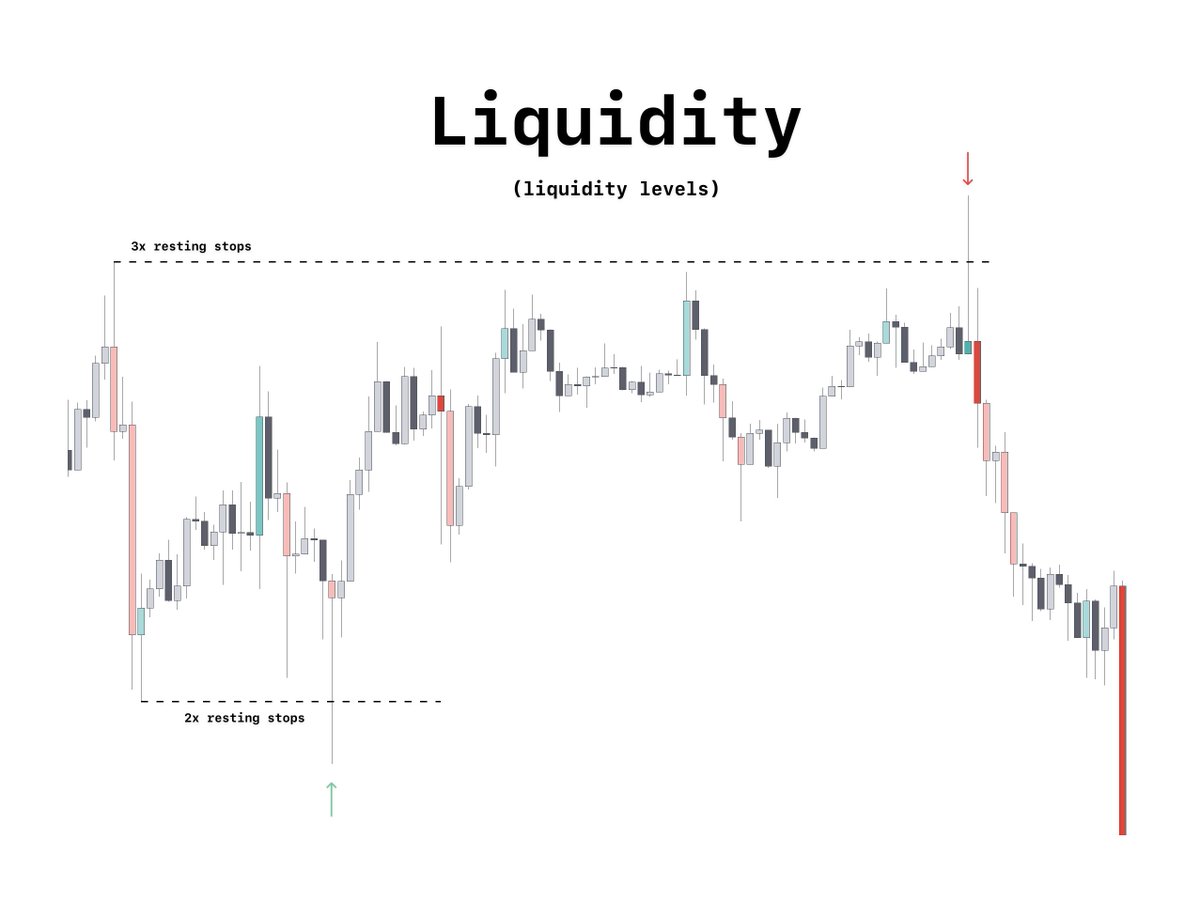

- how I find my favorite liquidity levels

- indicators I use to aid in finding them

- session candles

- daily high/lows

- pivot rays

- preferred timeframes

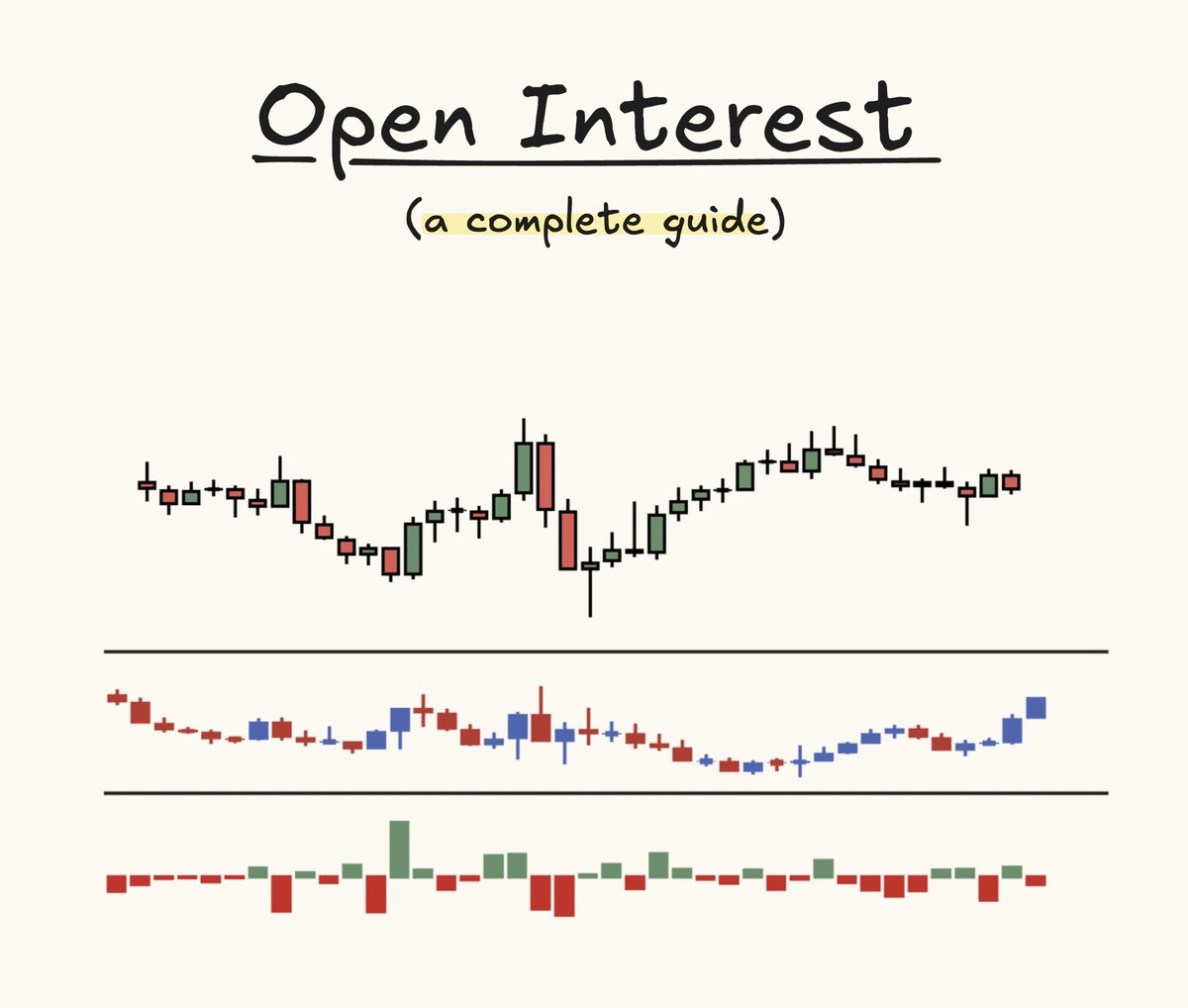

pivot line indicator

a simple indicator I had made to suit my needs in marking out pivot/fractal highs and lows by extending the rays out.

a simple indicator I had made to suit my needs in marking out pivot/fractal highs and lows by extending the rays out.

pivot line indicator (2)

the concept -

look for a series of either higher lows or lower highs on this indicator which do the following:

- remain untapped

- are close together

- have a decent gap after them before the next swing pivot.

the concept -

look for a series of either higher lows or lower highs on this indicator which do the following:

- remain untapped

- are close together

- have a decent gap after them before the next swing pivot.

preferred time frames -

- 5m (scalpers)

- 15m (most used)

- 1h

- 4h

- daily (great M-HTF trades)

- 5m (scalpers)

- 15m (most used)

- 1h

- 4h

- daily (great M-HTF trades)

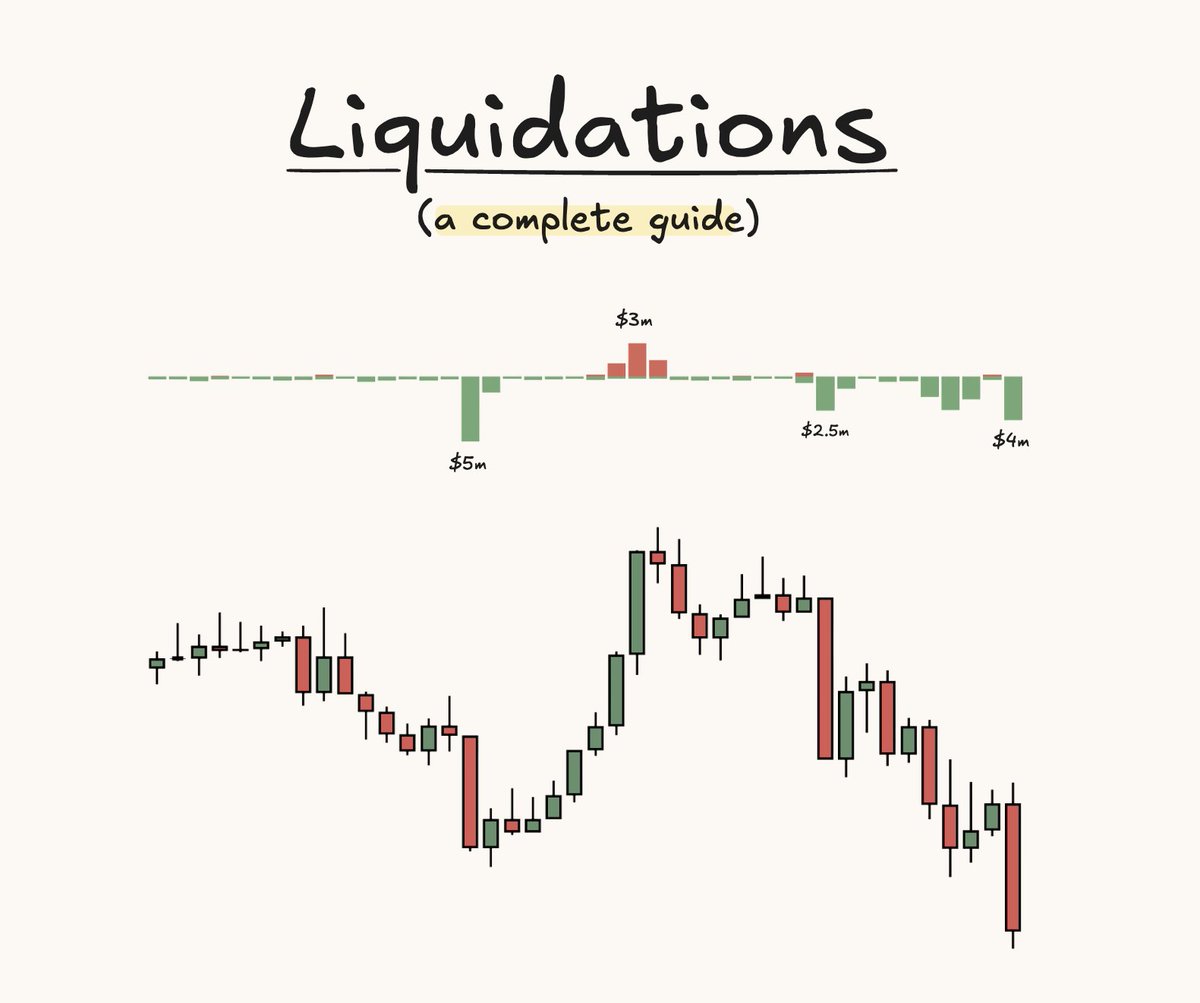

daily highs/lows

note - this does not show swing highs/lows

it shows each individual days daily high & low

I use these in a similar matter to the pivot lines

series of consecutive HLs or LHs followed by a gap

the last one of those consecutive h/ls offers a trade opportunity

note - this does not show swing highs/lows

it shows each individual days daily high & low

I use these in a similar matter to the pivot lines

series of consecutive HLs or LHs followed by a gap

the last one of those consecutive h/ls offers a trade opportunity

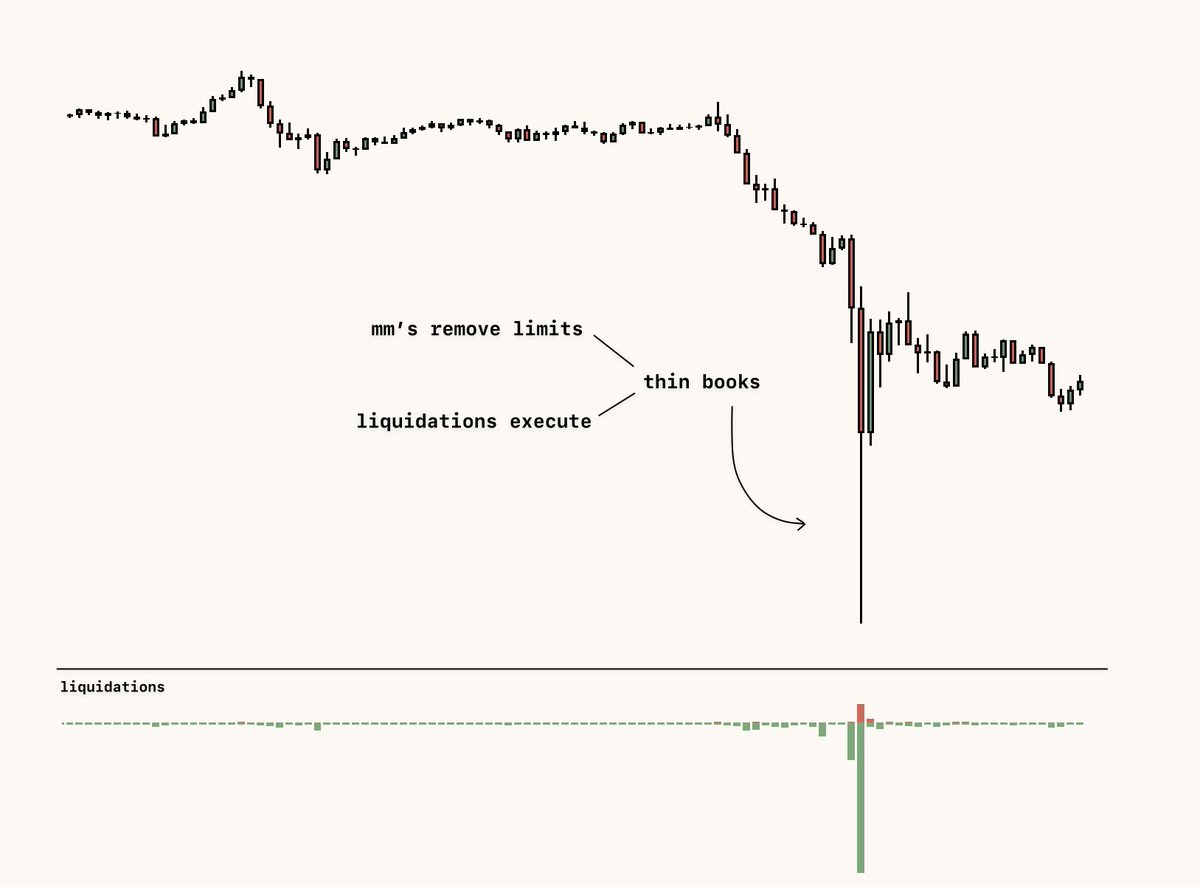

session candles

untested highs/lows from session candles are also really good resting liquidity points.

there is no ray possible for this currently

its the same concept just without visual rays

untested highs/lows from session candles are also really good resting liquidity points.

there is no ray possible for this currently

its the same concept just without visual rays

tpo poor highs/lows

2 blocks or more highs/lows on TPO profiles

- 50 tick on the inverse (BTC/USD) pair

when leaving poor highs/lows behind expect continuation/revisits of those levels

2 blocks or more highs/lows on TPO profiles

- 50 tick on the inverse (BTC/USD) pair

when leaving poor highs/lows behind expect continuation/revisits of those levels

BONUS

to RECEIVE everything

- TPO Chart

- Session candles

- liquidity indicator

option 1 - go through everything I've posted manually and try and find it somehow (you are welcome to do)

option 2 to RECEIVE - Follow, Like and reply to the original tweet of this thread

to RECEIVE everything

- TPO Chart

- Session candles

- liquidity indicator

option 1 - go through everything I've posted manually and try and find it somehow (you are welcome to do)

option 2 to RECEIVE - Follow, Like and reply to the original tweet of this thread

• • •

Missing some Tweet in this thread? You can try to

force a refresh