My all-time favorite LBO: Conwood

Buffett called it "one of the best businesses I ever saw." Munger called it "the best deal I ever saw." Pritzker bought it and made ~260X.

Here's the story…

Buffett called it "one of the best businesses I ever saw." Munger called it "the best deal I ever saw." Pritzker bought it and made ~260X.

Here's the story…

—April 3, 1984—

Conwood, the US's second-largest smokeless tobacco maker, was 'in play'. Management had scrapped a planned merger. Now Conwood needed a friendly buyer. And they had to find one before a raider made a hostile bid for the company.

The solution: Call Jerry Seslowe.

Conwood, the US's second-largest smokeless tobacco maker, was 'in play'. Management had scrapped a planned merger. Now Conwood needed a friendly buyer. And they had to find one before a raider made a hostile bid for the company.

The solution: Call Jerry Seslowe.

Seslowe, a well-connected accountant-turned-investor, was the GP of Resource Holdings ("RH"). RH ran money for some of the sharpest guys on the planet. It also offered deal advisory services. Conwood hired RH to find a friendly buyer.

One potential buyer: Berkshire Hathaway

One potential buyer: Berkshire Hathaway

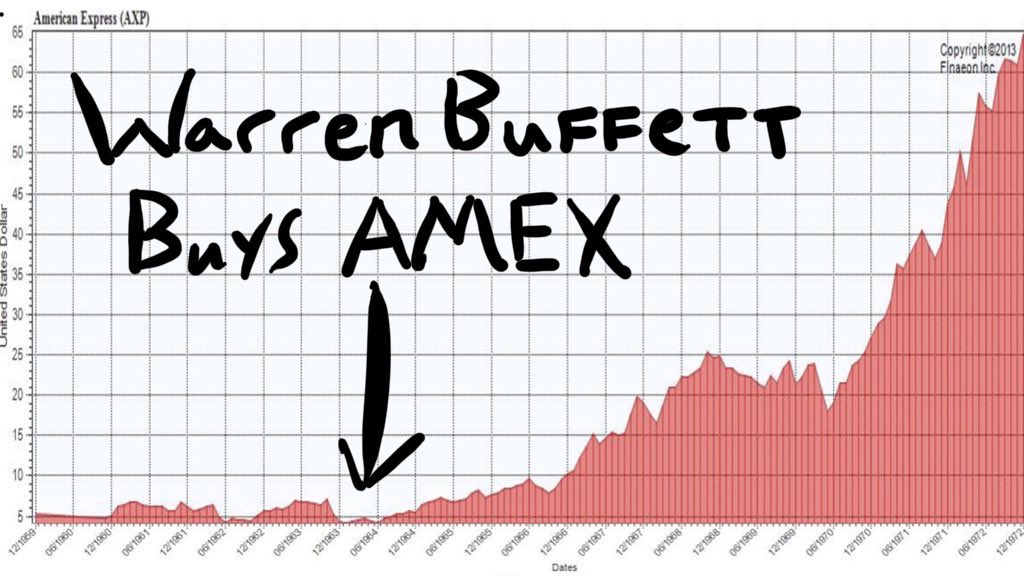

Why Berkshire? Because Buffett and Munger:

- Owned RJ Reynolds stock

- "Knew tobacco and liked it"

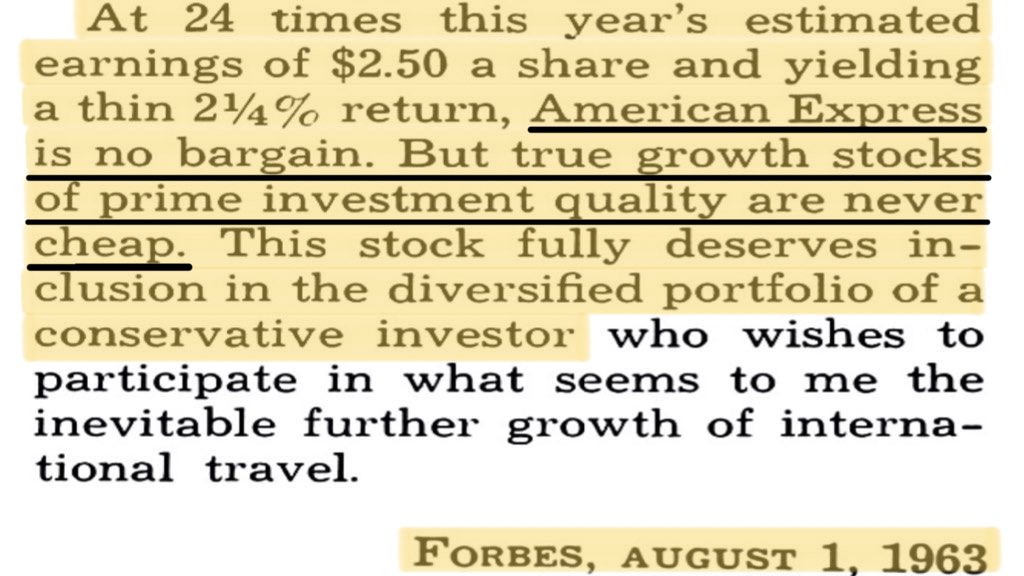

Buffett on tobacco economics:

- "It costs a penny to make."

- "It sells for a dollar."

- "It's addictive."

- "And there's fantastic brand loyalty."

- Owned RJ Reynolds stock

- "Knew tobacco and liked it"

Buffett on tobacco economics:

- "It costs a penny to make."

- "It sells for a dollar."

- "It's addictive."

- "And there's fantastic brand loyalty."

What'd Buffett & Munger think of Conwood?

- WB: "One of the best businesses I've seen.

- CM: "The figures were unbelievable."

Conwood's figures (1972-1984 CAGRs):

- Unit growth: 6%

- Price increases: 9%

- Tobacco revenues: 15%

- Net profit: 17%

Cash conversions: ~100%

- WB: "One of the best businesses I've seen.

- CM: "The figures were unbelievable."

Conwood's figures (1972-1984 CAGRs):

- Unit growth: 6%

- Price increases: 9%

- Tobacco revenues: 15%

- Net profit: 17%

Cash conversions: ~100%

Conwood was, in fact, a near-perfect analog to Buffett & Munger's favorite holding:

See's Candies

CONWOOD VS SEE'S (1972-1984 CAGRs)

- Unit growth: 6% vs 4%

- Price increases: 9% vs 9%

- Revenues: 15% vs 13%

- Net profit: 17% vs 17%

Cash conversions: ~100%

See's Candies

CONWOOD VS SEE'S (1972-1984 CAGRs)

- Unit growth: 6% vs 4%

- Price increases: 9% vs 9%

- Revenues: 15% vs 13%

- Net profit: 17% vs 17%

Cash conversions: ~100%

Why'd Berkshire pass?

Buffett:

"I'm not sure the logic is perfect, but we wouldn't have trouble owning stock in a [tobacco] company. We wouldn't want to manufacture [tobacco]. We might own a retail company that sells [tobacco]…The lines aren't perfect on this sort of thing."

Buffett:

"I'm not sure the logic is perfect, but we wouldn't have trouble owning stock in a [tobacco] company. We wouldn't want to manufacture [tobacco]. We might own a retail company that sells [tobacco]…The lines aren't perfect on this sort of thing."

Enter Jay Pritzker.

Pritzker and Seslowe had history. Seslowe was Pritzker's accountant at Peat Marwick. When Seslowe left Peat, he became Pritzker's deal scout. Pritzker was also a big investor in RH.

Jay got the Conwood pitch.

His reaction: "He snapped it up so fast."

Pritzker and Seslowe had history. Seslowe was Pritzker's accountant at Peat Marwick. When Seslowe left Peat, he became Pritzker's deal scout. Pritzker was also a big investor in RH.

Jay got the Conwood pitch.

His reaction: "He snapped it up so fast."

The purchase price: $350 million (net)

- Consideration: $401 million

- Less net cash: $51 million

= Purchase price: $350 million

Multiples:

- EV/EBIT (LTM): 6.7X

- EV/EBIT (NTM): 6.5x

- Consideration: $401 million

- Less net cash: $51 million

= Purchase price: $350 million

Multiples:

- EV/EBIT (LTM): 6.7X

- EV/EBIT (NTM): 6.5x

Here's how Pritzker financed the deal:

- $120 million term loan

- $210 million debentures

- $20 million equity

= $350 million purchase price

DEBT/EBIT

- LTM: 6.3X

- NTM: 6.1x

EBIT/INTEREST

- LTM (PF): 1.2x

- NTM (A): 1.4x

LTV: 94%

- $120 million term loan

- $210 million debentures

- $20 million equity

= $350 million purchase price

DEBT/EBIT

- LTM: 6.3X

- NTM: 6.1x

EBIT/INTEREST

- LTM (PF): 1.2x

- NTM (A): 1.4x

LTV: 94%

Conwood was the perfect LBO.

Why? Pricing power.

Pricing power allowed Conwood to:

- Grow earnings in the mid-teens.

- Convert ~100% of earnings into cash.

Conwood was also:

- Recession-proof

- Less exposed to litigation

- Retail's highest GMROI SKU

Why? Pricing power.

Pricing power allowed Conwood to:

- Grow earnings in the mid-teens.

- Convert ~100% of earnings into cash.

Conwood was also:

- Recession-proof

- Less exposed to litigation

- Retail's highest GMROI SKU

Just how important was pricing power?

Pritzker top-ticked Conwood's core market: non-moist snuff tobacco. From the purchase date, non-moist snuff unit volume declined at a MSD rate. Yet price increases of 10% a year allowed Pritzker to pay off all the LBO debt within six years.

Pritzker top-ticked Conwood's core market: non-moist snuff tobacco. From the purchase date, non-moist snuff unit volume declined at a MSD rate. Yet price increases of 10% a year allowed Pritzker to pay off all the LBO debt within six years.

How'd the deal turn out?

Conwood continued to…

Raise prices at a HSD rate

…For twenty years.

Then Pritzker sold Conwood for $3.6 billion.

RESULTS

- Purchase (1985): $20 million

- Sale (2005): $3.6 billion

- Dividends (est): $1.5 billion

RETURNS

- TPVI: 260X

- IRR: 49%

Conwood continued to…

Raise prices at a HSD rate

…For twenty years.

Then Pritzker sold Conwood for $3.6 billion.

RESULTS

- Purchase (1985): $20 million

- Sale (2005): $3.6 billion

- Dividends (est): $1.5 billion

RETURNS

- TPVI: 260X

- IRR: 49%

Footnote #1

Pritzker bought Conwood through Dalfort. Dalfort was the NOL shell that emerged from the Braniff bankruptcy. It had $400 million in total tax assets.

Also: Dalfort got 95% of the Conwood equity for a cash outlay of $3 million!

[They borrowed the other $16 million]

Pritzker bought Conwood through Dalfort. Dalfort was the NOL shell that emerged from the Braniff bankruptcy. It had $400 million in total tax assets.

Also: Dalfort got 95% of the Conwood equity for a cash outlay of $3 million!

[They borrowed the other $16 million]

Footnote #4

Conwood owns the "oldest continually used US trademark": Garrett Scotch Snuff. Garrett dates back to 1782.

Conwood owns the "oldest continually used US trademark": Garrett Scotch Snuff. Garrett dates back to 1782.

Want more case studies like this? Let me know by liking or retweeting the post below. I'm also looking for new case study ideas. Know of any great deals or investments? Send me a DM.

https://twitter.com/turtlebay_io/status/1687522191384961024

• • •

Missing some Tweet in this thread? You can try to

force a refresh