How to get URL link on X (Twitter) App

Bayuk was the US's fourth-largest cigar maker. Their low-priced Phillies and Garcia Y Vega brands earned $3M pre-tax but "had been in decline over the past decade." Bayuk also owned $15M of securities. The board wanted to sell these assets "without paying [capital gains] taxes."

Bayuk was the US's fourth-largest cigar maker. Their low-priced Phillies and Garcia Y Vega brands earned $3M pre-tax but "had been in decline over the past decade." Bayuk also owned $15M of securities. The board wanted to sell these assets "without paying [capital gains] taxes."

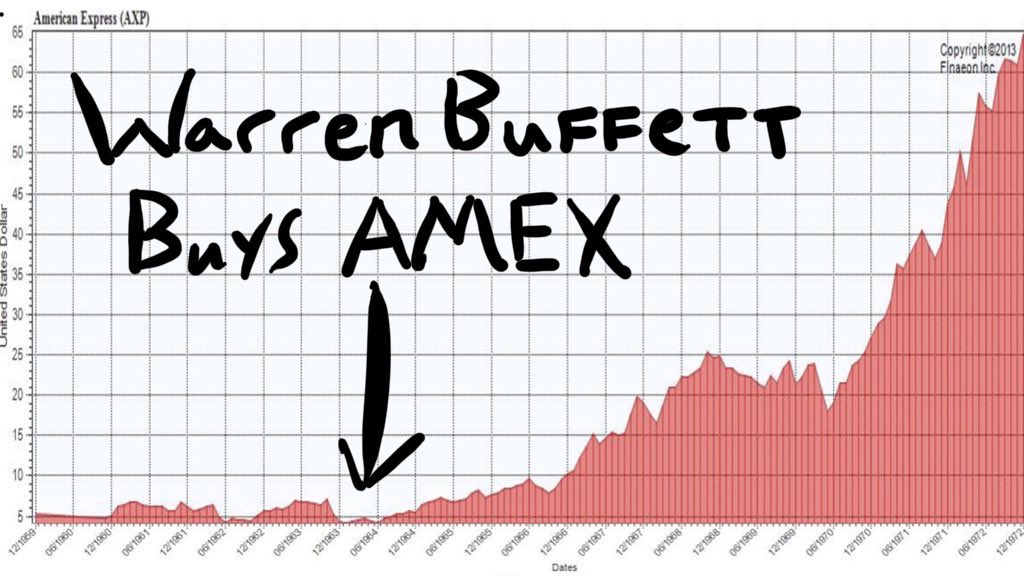

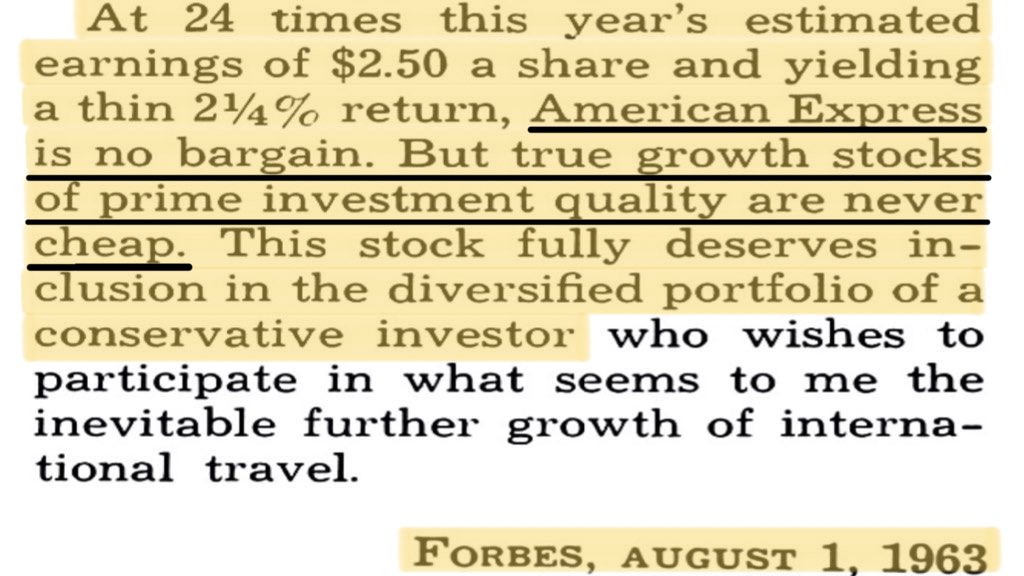

"Things had never looked rosier at AMEX than they did in mid-November 1963." Traveler's checks. Charge cards. Deposits. Earnings. The stock. Everything was "growing by leaps and bounds." AMEX was a "true growth stock of prime investment quality.

"Things had never looked rosier at AMEX than they did in mid-November 1963." Traveler's checks. Charge cards. Deposits. Earnings. The stock. Everything was "growing by leaps and bounds." AMEX was a "true growth stock of prime investment quality.

P&R was "a leading producer of anthracite coal." Anthracite was a dying market that had been "artificially inflated" by a postwar boom. And the boom allowed P&R to do "pretty well from 1946 on" despite management that ran the company "like a fine old nonprofit."

P&R was "a leading producer of anthracite coal." Anthracite was a dying market that had been "artificially inflated" by a postwar boom. And the boom allowed P&R to do "pretty well from 1946 on" despite management that ran the company "like a fine old nonprofit."

NAFI began in 1919 as a stock promotion. The promoters sold shares to “Nebraska and Iowa farmers and small-town merchants who had little idea what it was worth.” These retail investors soon learned their shares were “worthless” and “lost hope ever seeing their money again.”

NAFI began in 1919 as a stock promotion. The promoters sold shares to “Nebraska and Iowa farmers and small-town merchants who had little idea what it was worth.” These retail investors soon learned their shares were “worthless” and “lost hope ever seeing their money again.”

Illinois Central owned 2,900 miles of track between Chicago and New Orleans. The company, which began in 1851 as the first land grant railroad, used its north-south network to transport (a) Midwest coal and grains south and (b) Gulfcoast chemicals north.

Illinois Central owned 2,900 miles of track between Chicago and New Orleans. The company, which began in 1851 as the first land grant railroad, used its north-south network to transport (a) Midwest coal and grains south and (b) Gulfcoast chemicals north.

—April 3, 1984—

—April 3, 1984—

It starts with RJR's CEO—Ross Johnson. By October 1988, Johnson had a solid three-year operating record:

It starts with RJR's CEO—Ross Johnson. By October 1988, Johnson had a solid three-year operating record:

The Bowery fell on hard times back in the seventies when rising interest rates began eroding the bank's balance sheet. There was no looting of Bowery's assets. Just managers who dozed as the cost of deposits kept outstripping the yield on mortgages and government bonds.

The Bowery fell on hard times back in the seventies when rising interest rates began eroding the bank's balance sheet. There was no looting of Bowery's assets. Just managers who dozed as the cost of deposits kept outstripping the yield on mortgages and government bonds.

HJ Stern, the owner of Stern Metals, had a problem. He needed to monetize his Stern equity w/o:

HJ Stern, the owner of Stern Metals, had a problem. He needed to monetize his Stern equity w/o:

Bill Simon, a trader-turned-statesman, left his job as Treasury Secretary in 1977.

Bill Simon, a trader-turned-statesman, left his job as Treasury Secretary in 1977.

CE was Cincinnati's largest newspaper. Scripps, a newspaper chain, bought the paper in 1956. But there was a problem: Cincinnati was one of the last "two-newspaper towns," and Scripps controlled both papers. This led to an antitrust suit and DOJ-imposed sale of CE to Munger.

CE was Cincinnati's largest newspaper. Scripps, a newspaper chain, bought the paper in 1956. But there was a problem: Cincinnati was one of the last "two-newspaper towns," and Scripps controlled both papers. This led to an antitrust suit and DOJ-imposed sale of CE to Munger.

Buffett invested in Bayuk in March 1982. At the time, the company had two assets:

Buffett invested in Bayuk in March 1982. At the time, the company had two assets:

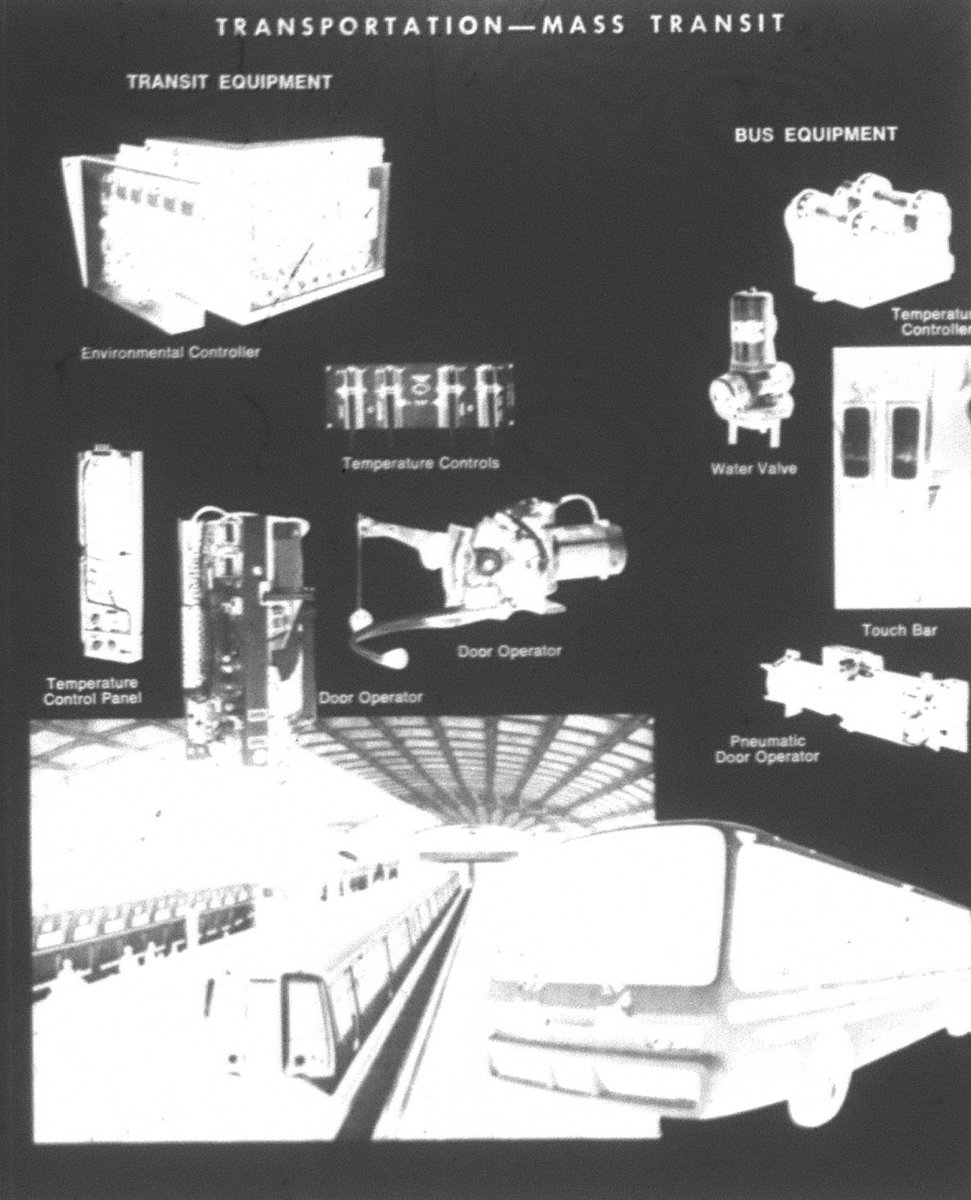

Bear bought Vapor from Singer Corp (sewing). The company had three divisions:

Bear bought Vapor from Singer Corp (sewing). The company had three divisions:

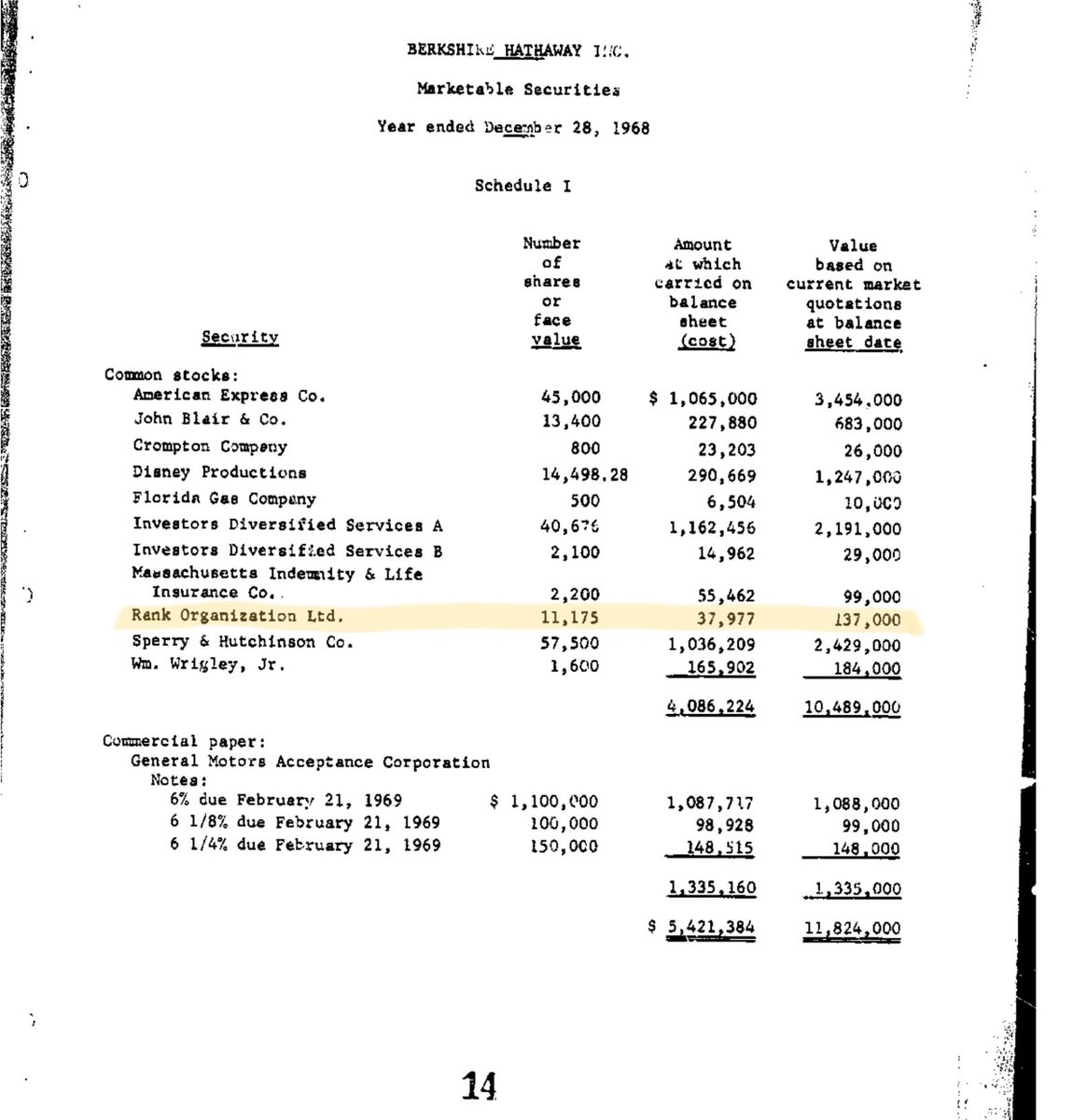

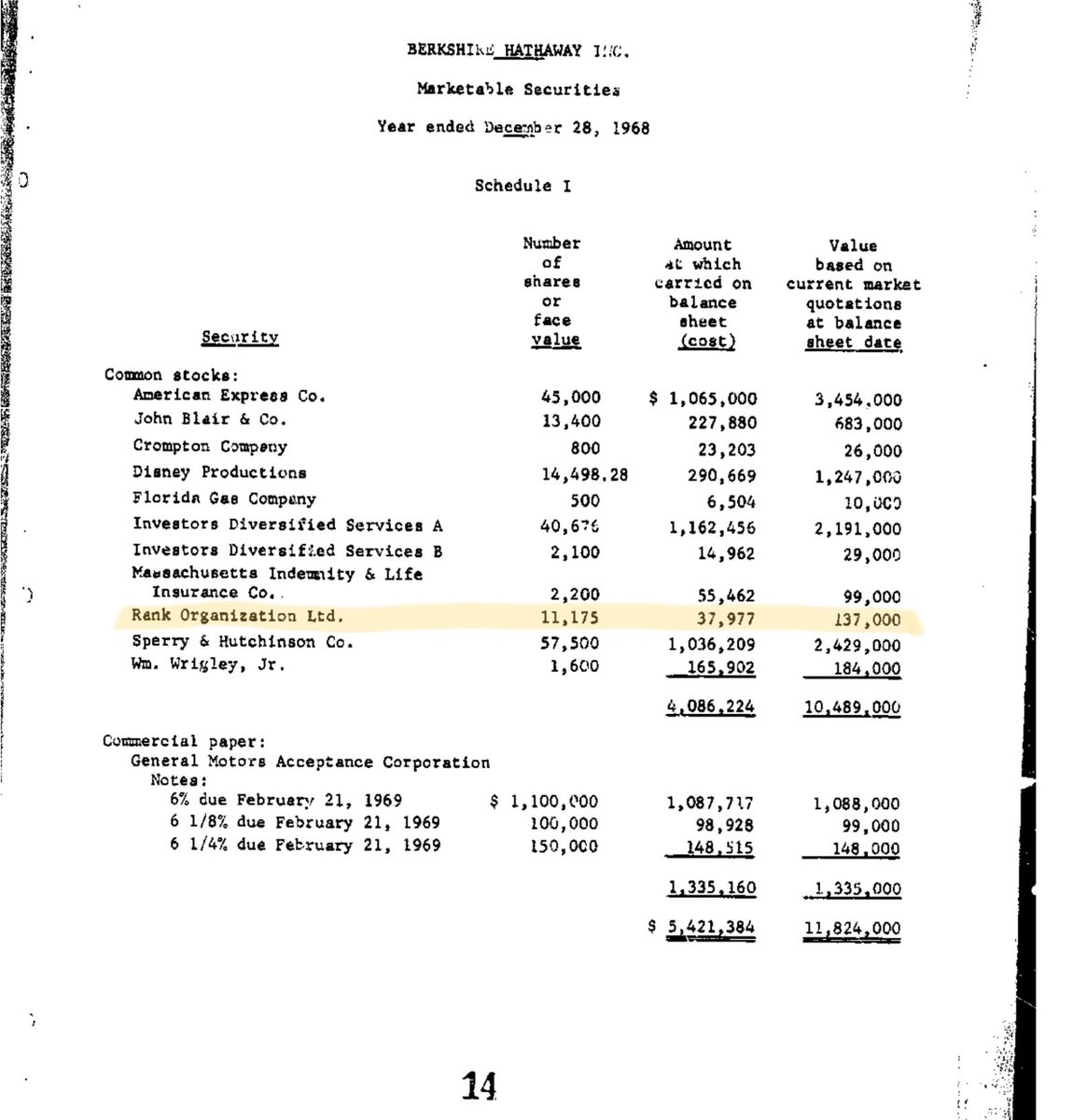

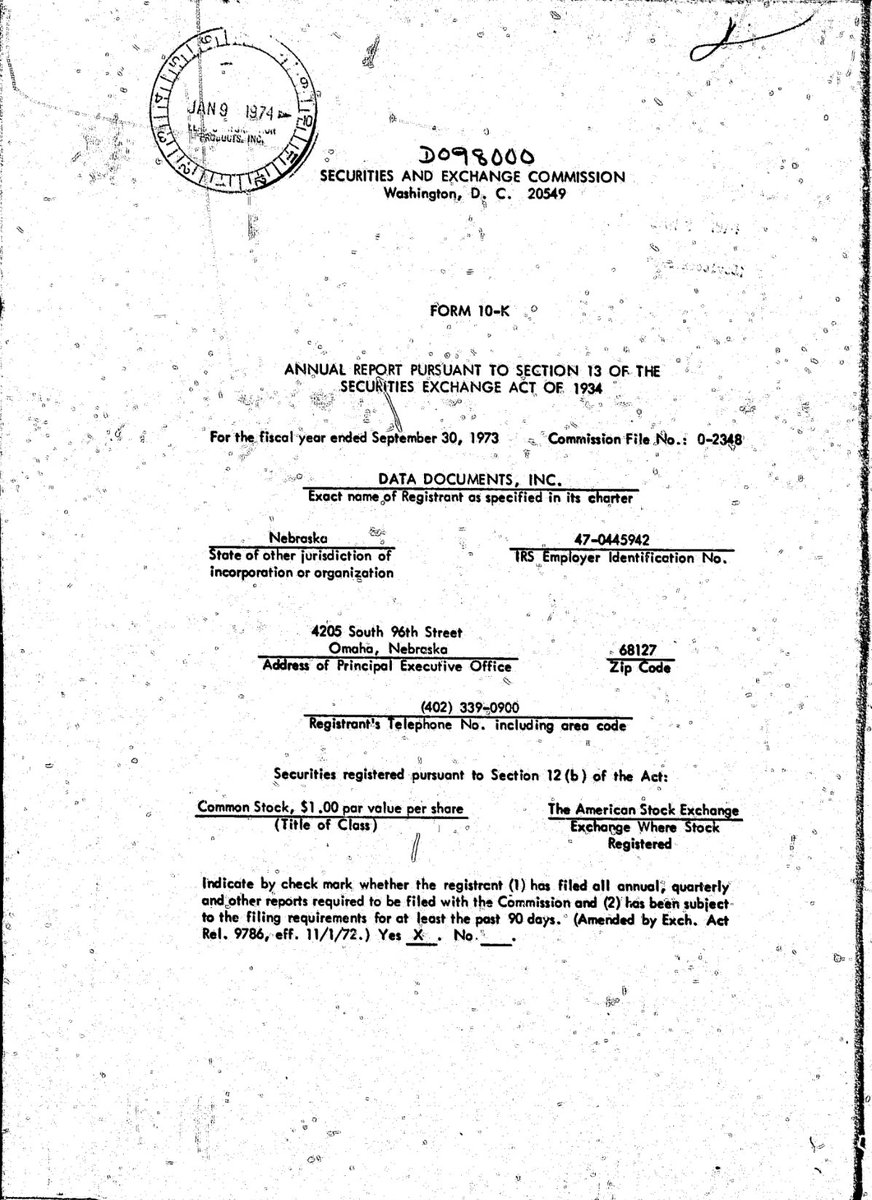

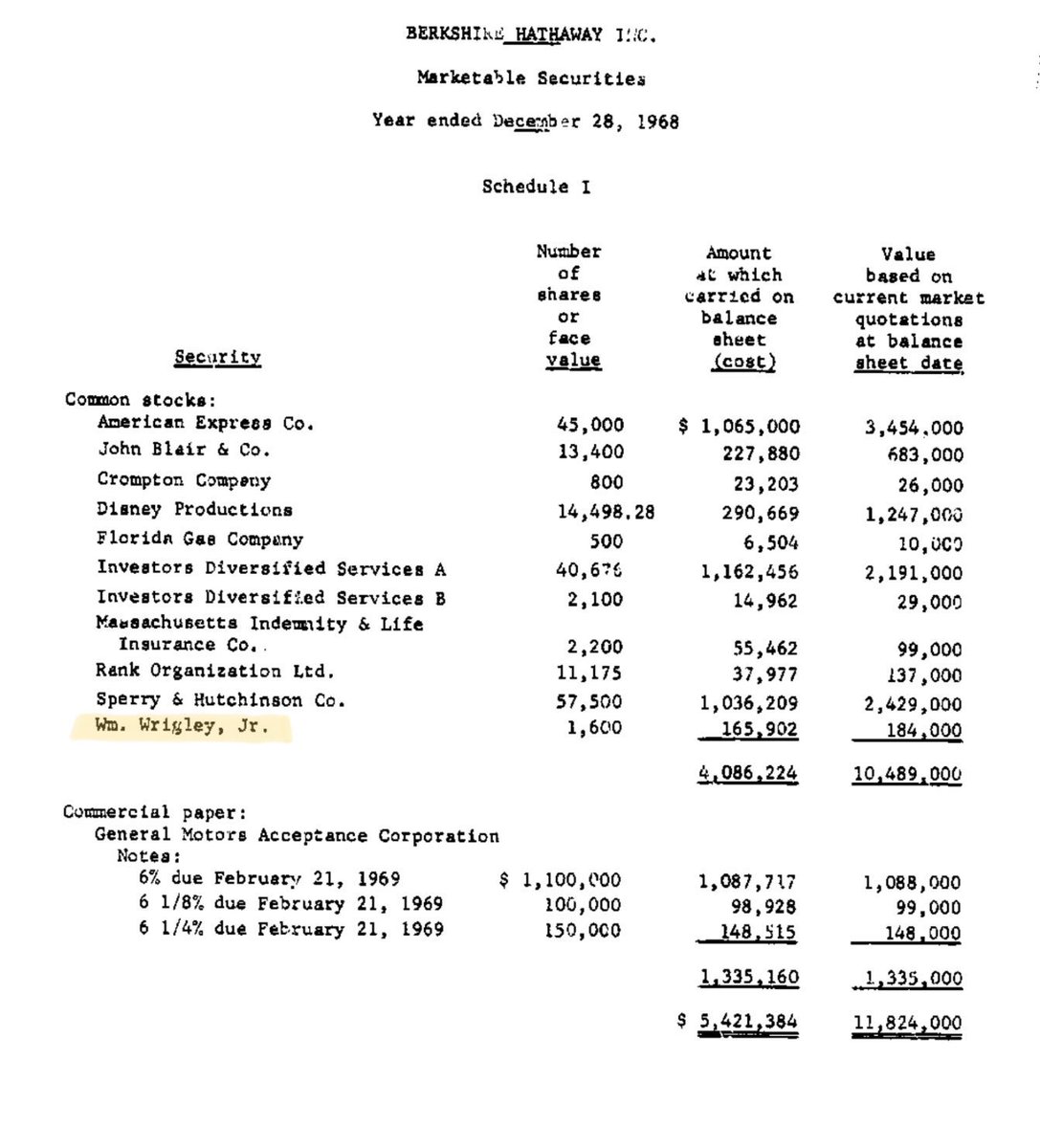

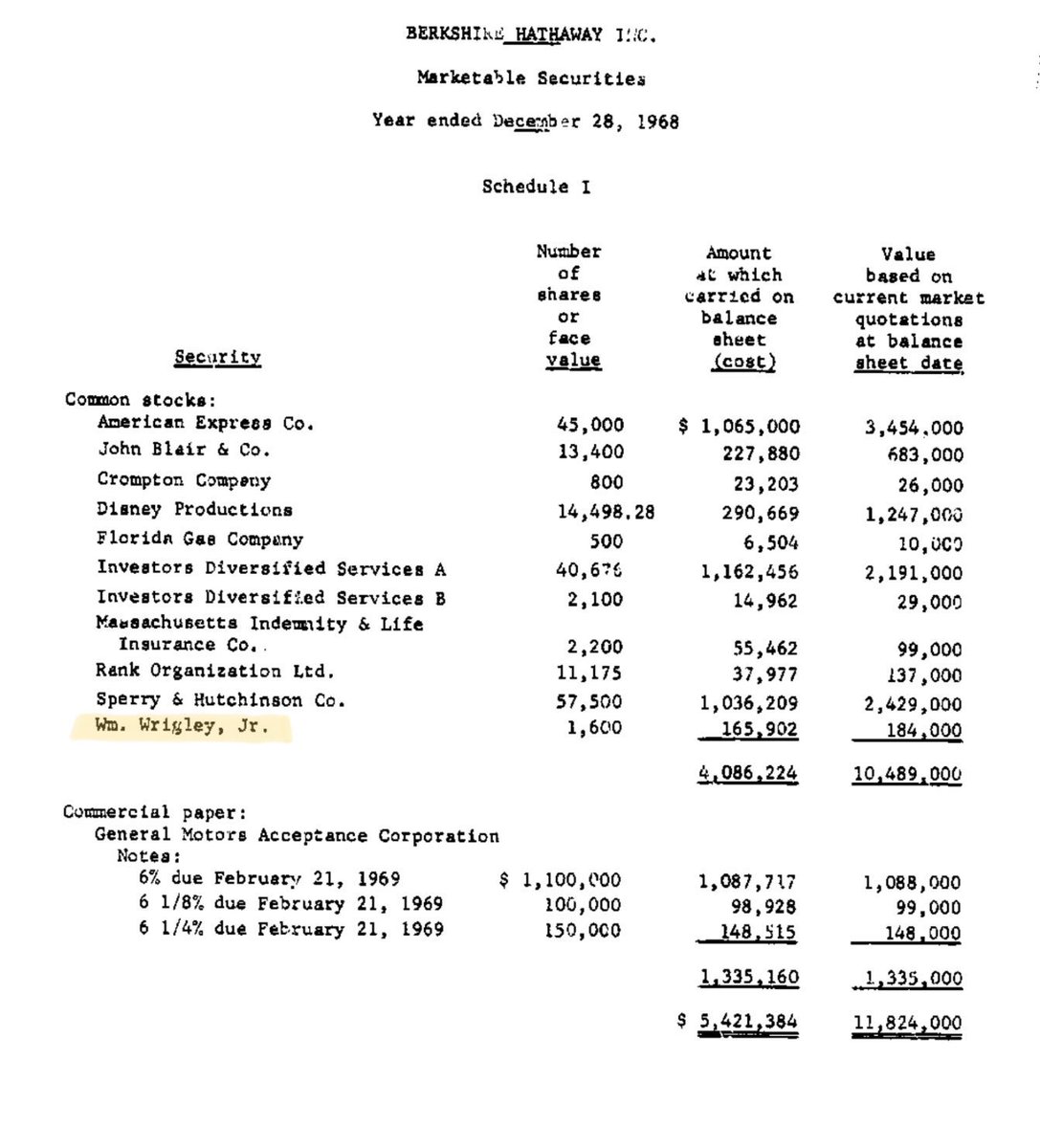

Rank invested $1.7 million into Rank-Xerox. Yet by the time of Berkshire's investment in late 1966, Rank-Xerox:

Rank invested $1.7 million into Rank-Xerox. Yet by the time of Berkshire's investment in late 1966, Rank-Xerox:

Buffett held his investment and remained chairman of the board for over 14 years. Over that time, Data Documents:

Buffett held his investment and remained chairman of the board for over 14 years. Over that time, Data Documents:

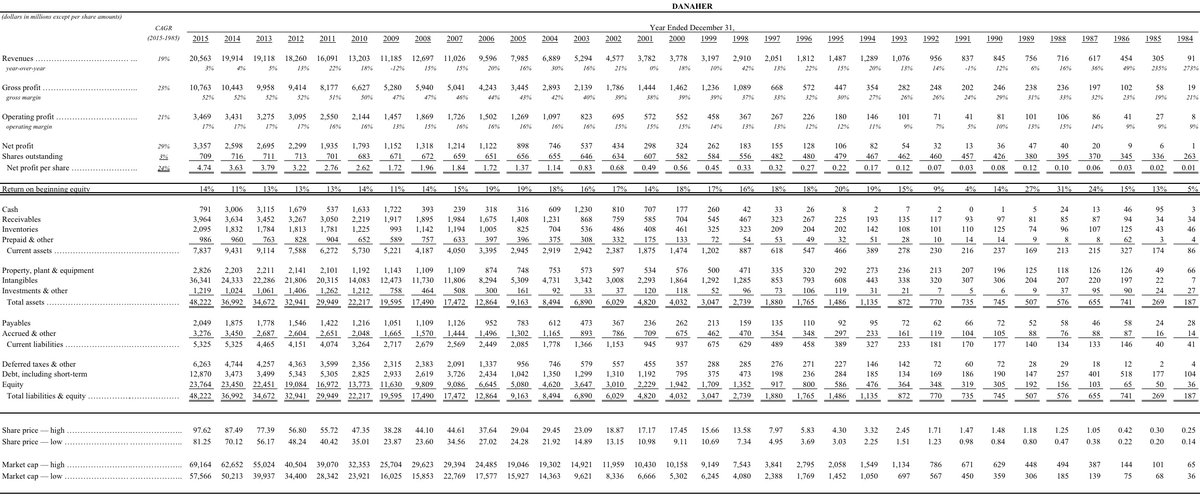

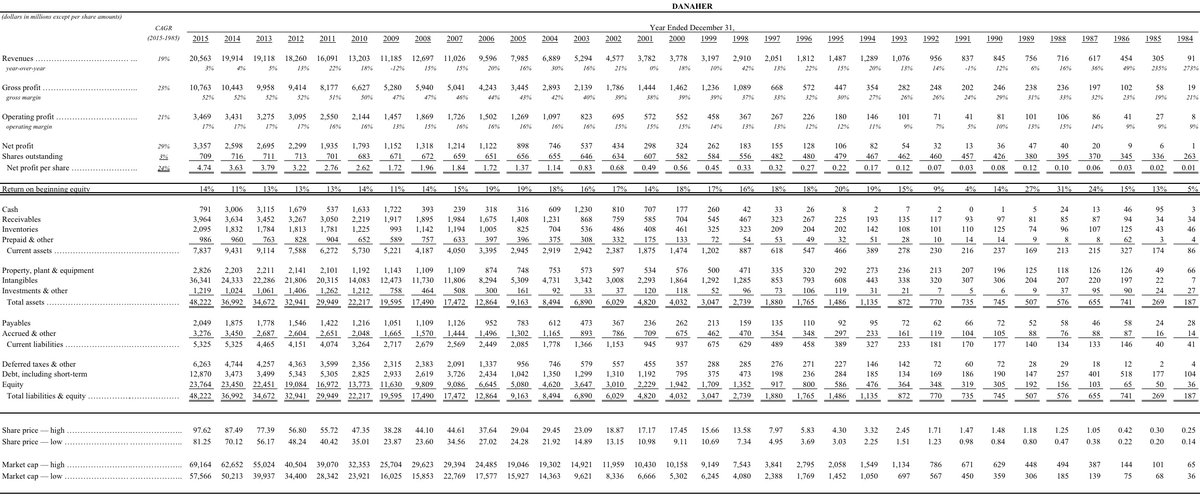

Wrigley's long-term financials:

Wrigley's long-term financials:

In 1979, Steven and Mitchell Rales formed Equity Group Holdings ("EGH").

In 1979, Steven and Mitchell Rales formed Equity Group Holdings ("EGH").