I am happy to announce that the indicator I worked on with @leviathancrypto is now live on Tradingview and completely free.

Here is a short thread on how to use it.

/cont https://t.co/mBC3KVJtwNtradingview.com/script/lfbSiHI…

Here is a short thread on how to use it.

/cont https://t.co/mBC3KVJtwNtradingview.com/script/lfbSiHI…

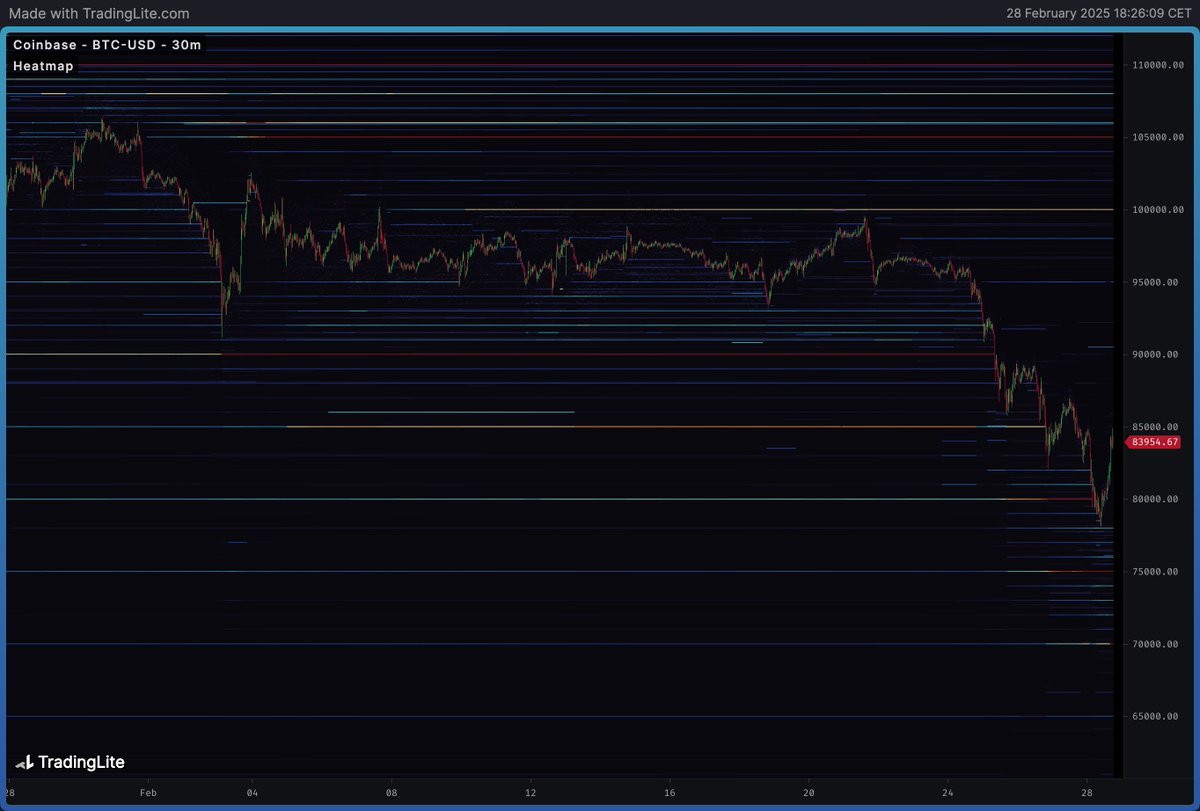

Indicator colours the candles based on three conditions.

High volume, low volume and churn bars.

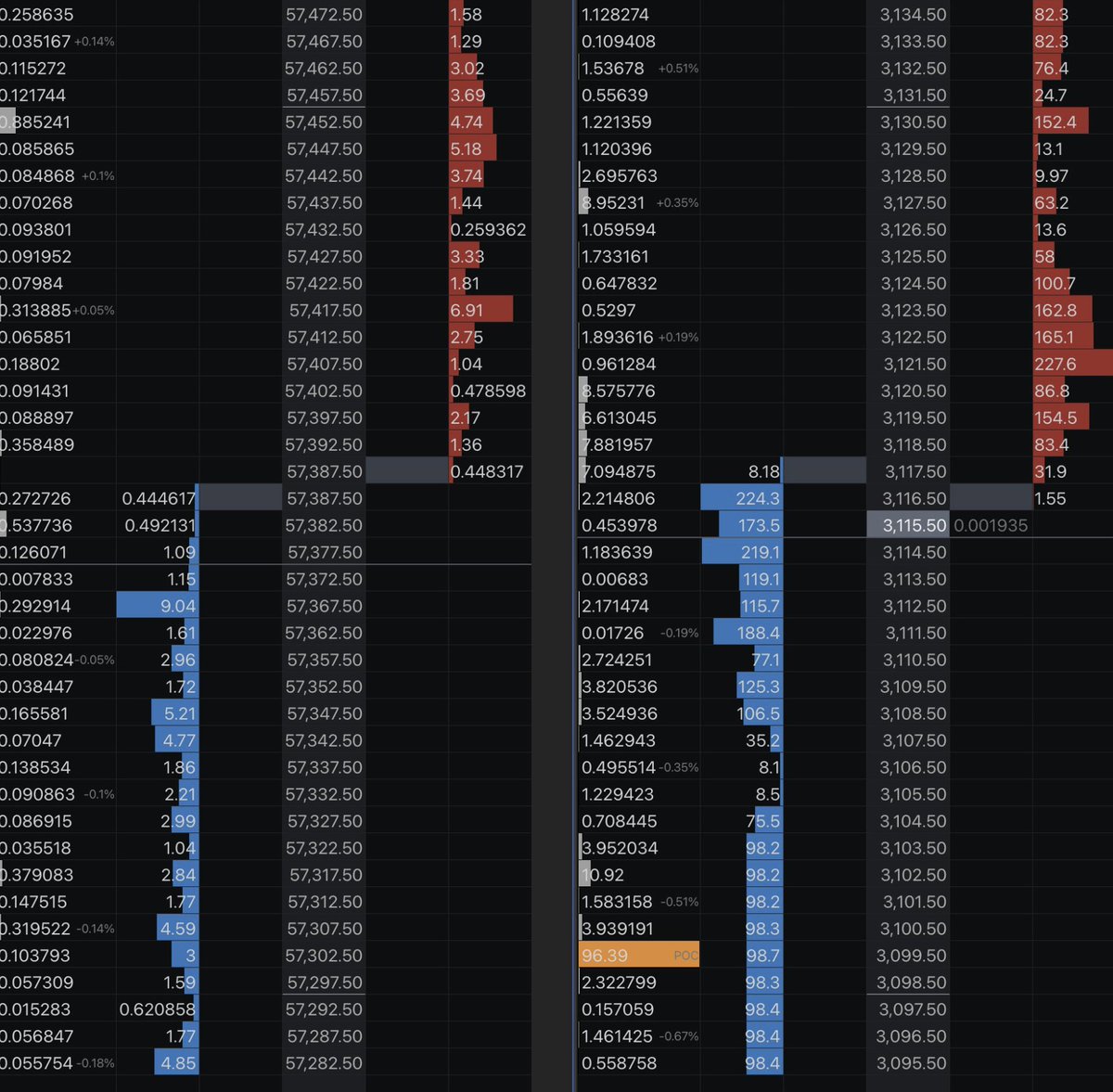

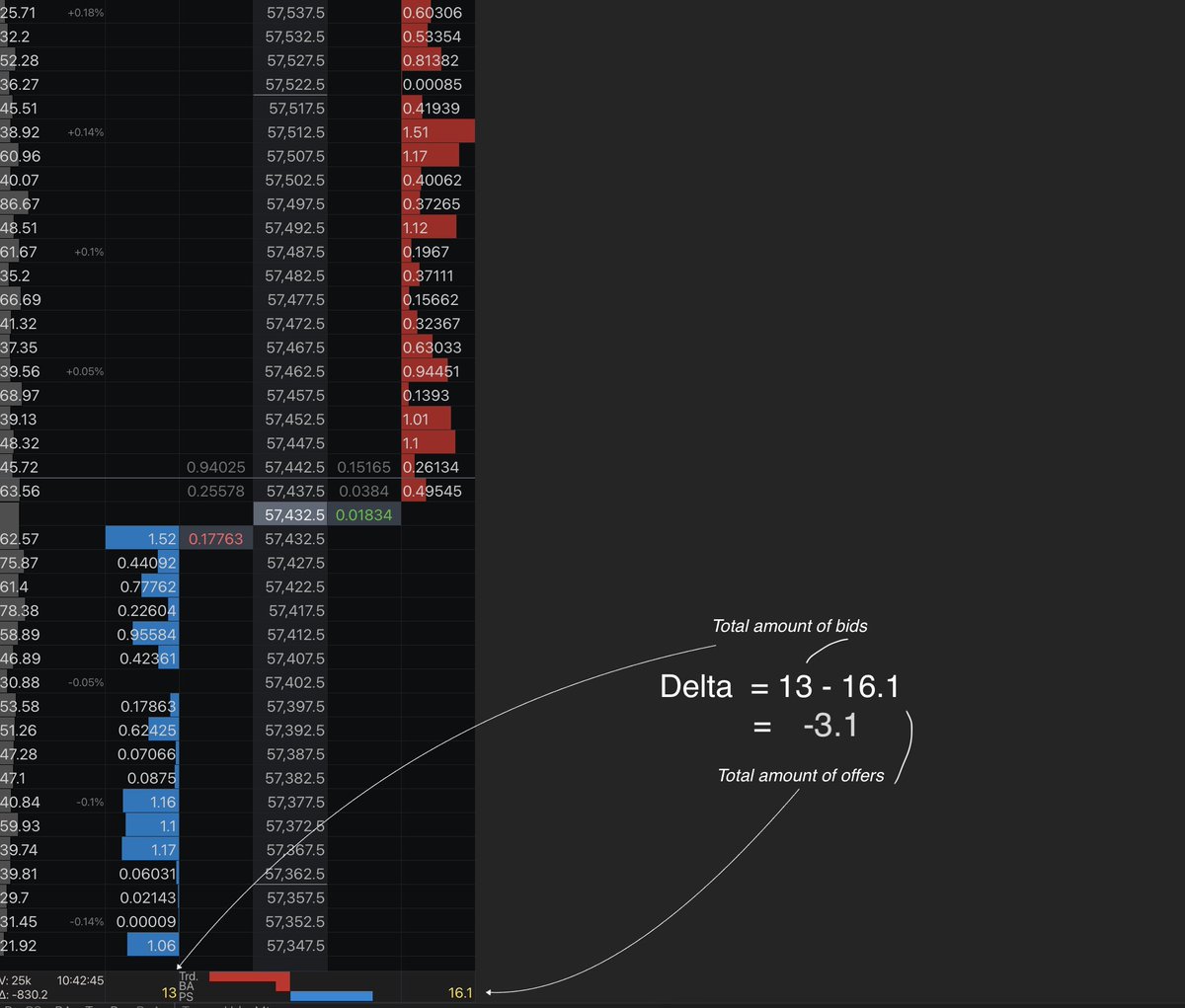

This is a "simplified" orderflow that I have been using for ages.

It is originally inspired b Emini watch https://t.co/ehuTTsb2caemini-watch.com/free-stuff/vol…

High volume, low volume and churn bars.

This is a "simplified" orderflow that I have been using for ages.

It is originally inspired b Emini watch https://t.co/ehuTTsb2caemini-watch.com/free-stuff/vol…

High relative volume tells us a large amount of buying or selling stepping-in wide-body candles.

This is an indication of either end of the move or the start of new trends.

This is an indication of either end of the move or the start of new trends.

High Volume often shows more of a retail participation as people ape in into wide-body candles. Churn bars also show high volume and signal start/end of moves but inside small body candles.

This means there was a more sophisticated execution to avoid large price changes.

This means there was a more sophisticated execution to avoid large price changes.

Low-volume candles tell us there is a lack of participation. These are often the "weak spots" and work great as trade targets.

I published an article while ago that dives deeper into relative volume and you can find it here - tradingriot.com/volume-trading…

Although relative volume is a very useful indicator to have, it is not a standalone trading strategy. If you are interested in how I use it in my trading, you can check out the Tradingriot Bootcamp tradingriot.com/blueprint/trad…

Once again, thanks @leviathancrypto for the collaboration and make sure to check out his long list of indicators.

I use many of them and they are one of the best (and completely free) you will find.

I use many of them and they are one of the best (and completely free) you will find.

• • •

Missing some Tweet in this thread? You can try to

force a refresh