How to get URL link on X (Twitter) App

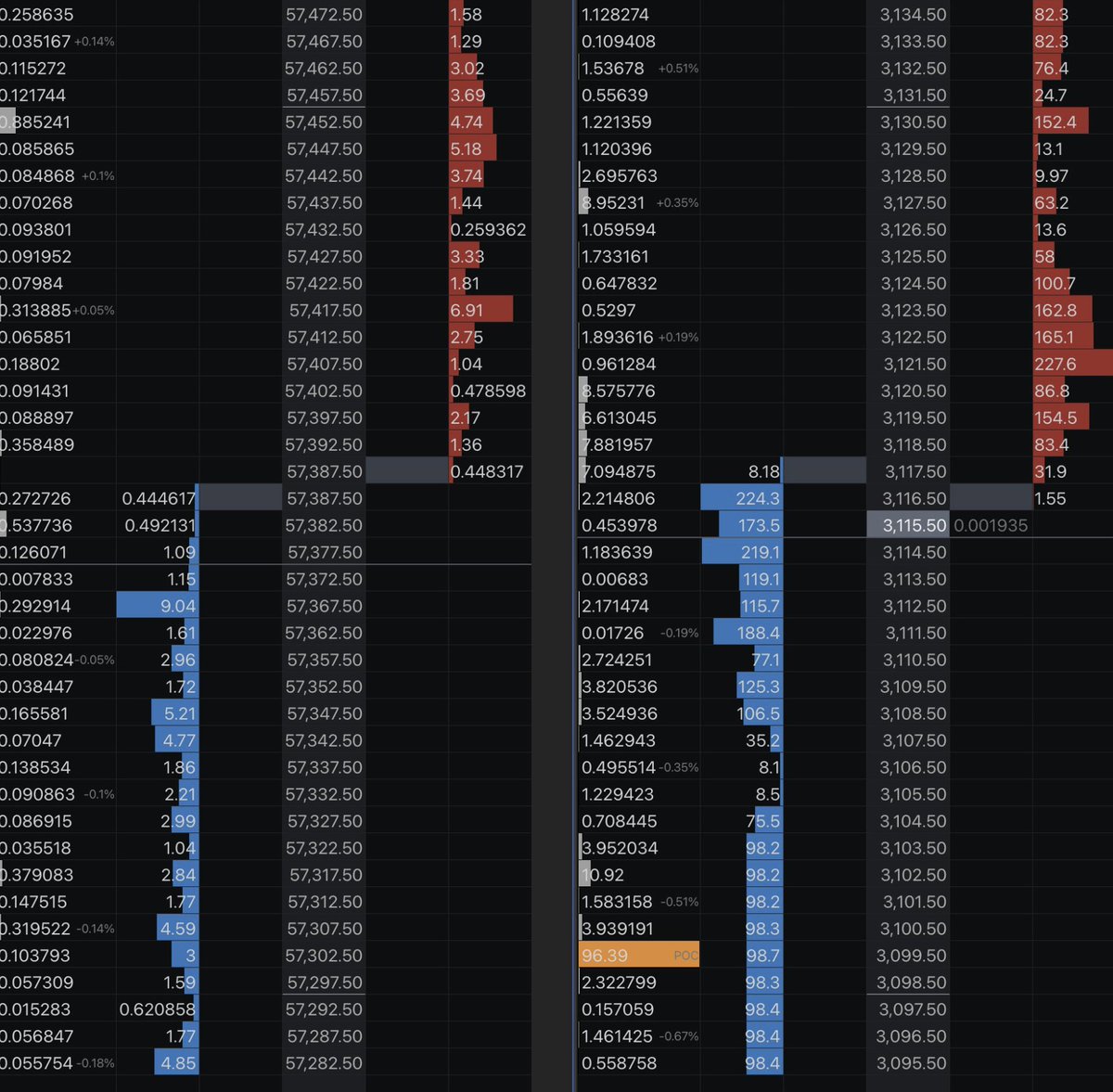

what is order book data

what is order book data

Open Interest Definition

Open Interest Definition

So, what is order flow trading?

So, what is order flow trading?

Commitment of Traders

Commitment of Traders

First, there is absolutely zero magic voodoo manipulation reasoning why prices react from these levels.

First, there is absolutely zero magic voodoo manipulation reasoning why prices react from these levels.

Although liquidity is often associated with stop-losses of other traders, this is false.

Although liquidity is often associated with stop-losses of other traders, this is false.

First of all, the proof of trade, so this is not just a Tradingview R:R tool larping situation.

First of all, the proof of trade, so this is not just a Tradingview R:R tool larping situation.

Before we get into things, this thread is sponsored by @HelixApp_.

Before we get into things, this thread is sponsored by @HelixApp_.

before we get into things, it is important to realise that finding a trade opportunity is just the first part of the puzzle.

before we get into things, it is important to realise that finding a trade opportunity is just the first part of the puzzle.

The last SOL trade shared two days ago

The last SOL trade shared two days agohttps://x.com/abetrade/status/1817941821382688878

First of all, nothing works 100% of the time.

First of all, nothing works 100% of the time.

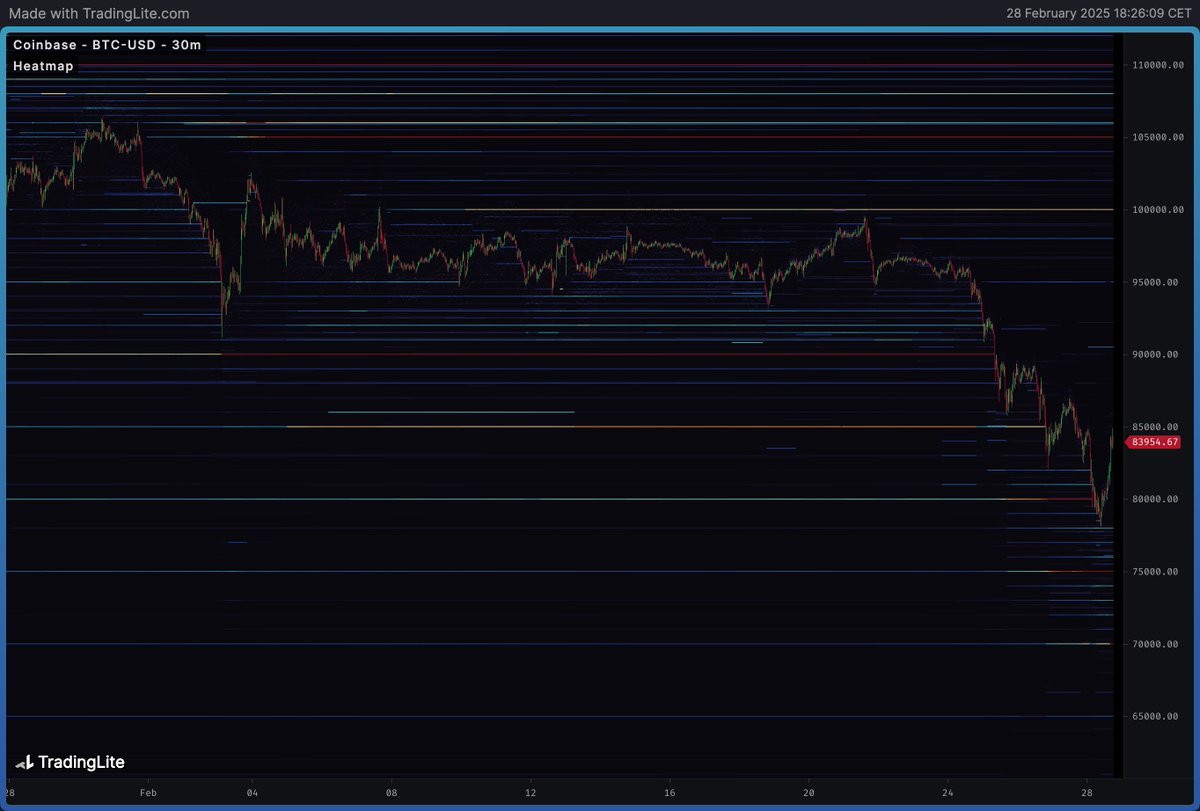

When I am day trading, I do not really care about specific timeframes as I think they are not relevant, and the only important thing for me is where the market is trading in the context of the large composite profile.

When I am day trading, I do not really care about specific timeframes as I think they are not relevant, and the only important thing for me is where the market is trading in the context of the large composite profile.

Before we go into the thread, I had a stab at this almost 2 years ago on my blog, where I broke down all the popular price action concepts and the logic behind them; you can read it for free here.

Before we go into the thread, I had a stab at this almost 2 years ago on my blog, where I broke down all the popular price action concepts and the logic behind them; you can read it for free here.

The platforms we will talk about today will be @laevitas1 and @MobChartCrypto.

The platforms we will talk about today will be @laevitas1 and @MobChartCrypto.

First of all, although these things work more often than not, they rarely work only by themselves.

First of all, although these things work more often than not, they rarely work only by themselves.

Indicator colours the candles based on three conditions.

Indicator colours the candles based on three conditions.