1: You don't need leverage

Margin & options are fun on the way up, but BRUTAL on the way down.

I’ve lost more than 100% on investments before.

Why? Leverage.

Buffett & Munger said it best:

Margin & options are fun on the way up, but BRUTAL on the way down.

I’ve lost more than 100% on investments before.

Why? Leverage.

Buffett & Munger said it best:

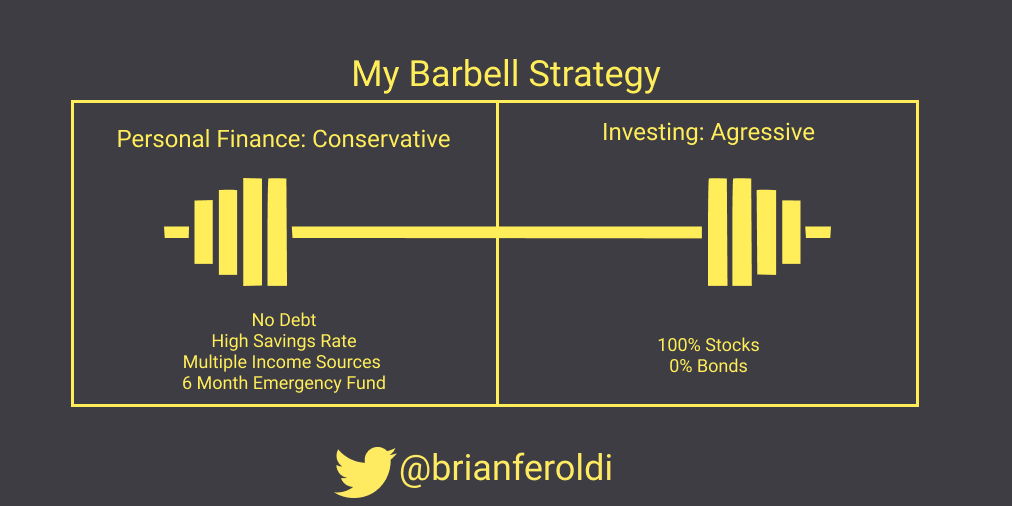

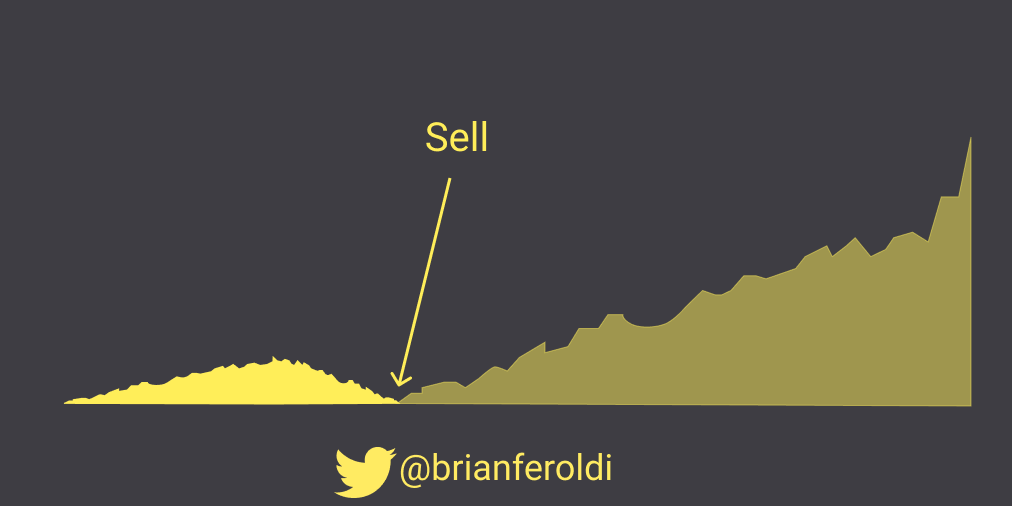

2: Optimize for longevity, not upside

Compound interest is the most powerful wealth-building force that exists.

But it only works if you SURVIVE long enough for it to work.

I used to optimize for upside. Now, I use the barbell method to optimize for longevity.

Compound interest is the most powerful wealth-building force that exists.

But it only works if you SURVIVE long enough for it to work.

I used to optimize for upside. Now, I use the barbell method to optimize for longevity.

3: High conviction does not mean I'm correct

I convinced myself several times that a stock could only go up.

I was right on some. On others, I lost 70% (!!)

Conviction is useful, but just because you think you are right doesn’t mean you are.

Allocate accordingly.

I convinced myself several times that a stock could only go up.

I was right on some. On others, I lost 70% (!!)

Conviction is useful, but just because you think you are right doesn’t mean you are.

Allocate accordingly.

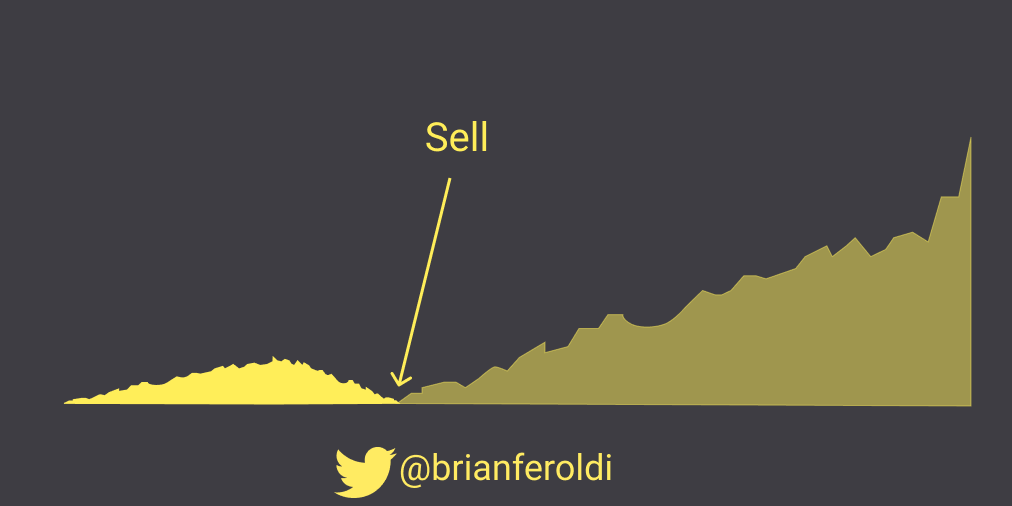

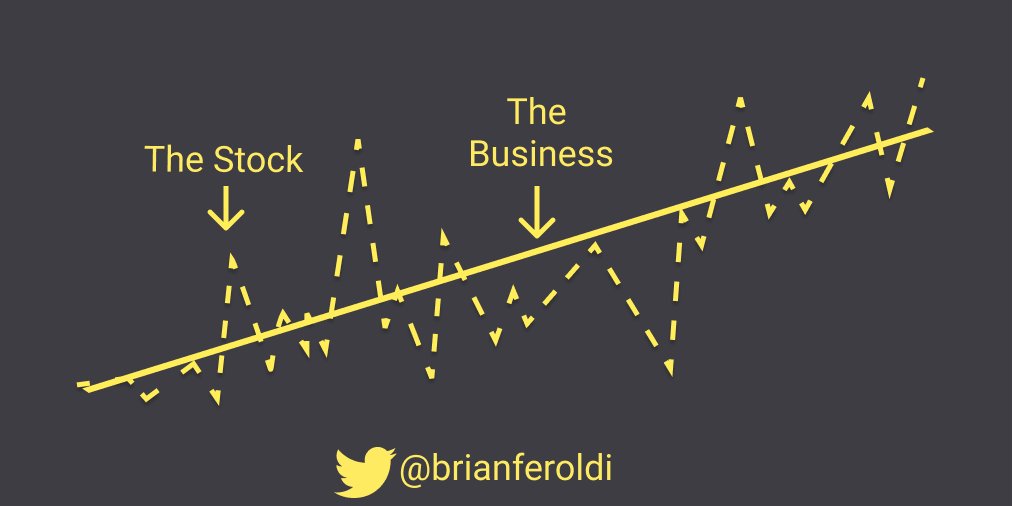

4: Stock prices & business results are 0% correlated in the short-term and 100% correlated in the long-term

I’ve sold future mega-winners because their stocks were down (dumb).

I was watching the stock, not the business.

Now, I do the reverse.

I’ve sold future mega-winners because their stocks were down (dumb).

I was watching the stock, not the business.

Now, I do the reverse.

5: Not having a system

I used to keep everything in my head, which was dumb (and impossible).

I didn't use checklists, journals, or watchlists, which are invaluable free tools.

This caused me to make tons of mistakes.

Now, I have a system:

I used to keep everything in my head, which was dumb (and impossible).

I didn't use checklists, journals, or watchlists, which are invaluable free tools.

This caused me to make tons of mistakes.

Now, I have a system:

6: Not understanding valuation

I passed on high p/e ratio stocks (that went up big).

I bought low p/e ratio stocks (that went down big).

Why? I didn’t understand the business growth cycle.

Now, I know WHICH valuation metrics to use (and WHEN to use them).

I passed on high p/e ratio stocks (that went up big).

I bought low p/e ratio stocks (that went down big).

Why? I didn’t understand the business growth cycle.

Now, I know WHICH valuation metrics to use (and WHEN to use them).

7: Panic selling and panic buying

My emotions have caused me to panic buy hype stocks and panic sell future mega-winners.

It’s easy to say you’ll be greedy when others are fearful, and visa-versa.

It’s damn hard to actually do it.

My emotions have caused me to panic buy hype stocks and panic sell future mega-winners.

It’s easy to say you’ll be greedy when others are fearful, and visa-versa.

It’s damn hard to actually do it.

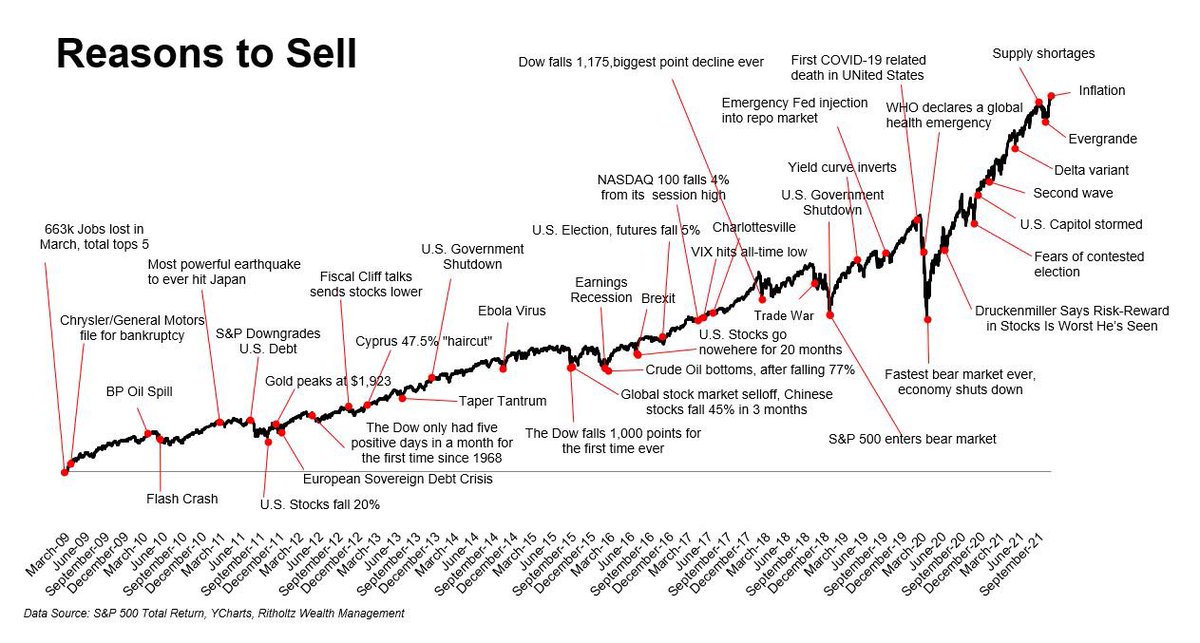

8: I didn't study history

Human nature is remarkably consistent. The same forces that drove markets 100+ years still exist in all of us today.

There’s always a smart-sounded reason to sell.

I didn't understand that. Now, I do.

Human nature is remarkably consistent. The same forces that drove markets 100+ years still exist in all of us today.

There’s always a smart-sounded reason to sell.

I didn't understand that. Now, I do.

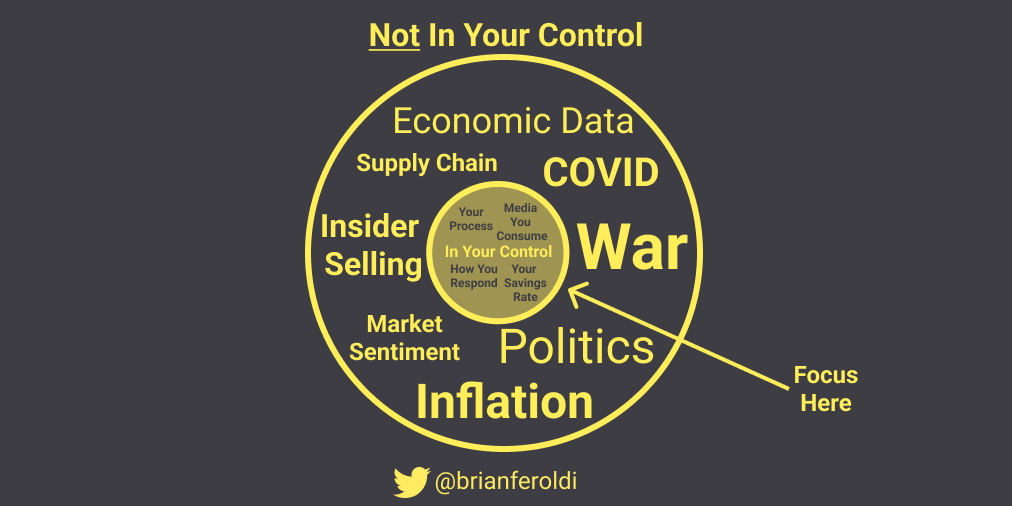

9: I focused on what I can't control

I used to follow stock prices + the news closely, watching for clues to predict the market.

This was time poorly spent. Macro factors matter, but I have no control over them.

I now focus far more on what I can control.

I used to follow stock prices + the news closely, watching for clues to predict the market.

This was time poorly spent. Macro factors matter, but I have no control over them.

I now focus far more on what I can control.

10: Not changing my mind

This one is REALLY hard, but it’s necessary to do well.

Changing your mind is hard. Admitting you're wrong is hard.

But @JeffBezos said it best:

This one is REALLY hard, but it’s necessary to do well.

Changing your mind is hard. Admitting you're wrong is hard.

But @JeffBezos said it best:

I learned all of these lessons the expensive way.

Want to fast-track your learning?

Join me tomorow for my LIVE course, Valuation Explained Simply.

Interested? DM me for a coupon code.

https://t.co/FN0VAheL4Gmaven.com/brian-feroldi/…

Want to fast-track your learning?

Join me tomorow for my LIVE course, Valuation Explained Simply.

Interested? DM me for a coupon code.

https://t.co/FN0VAheL4Gmaven.com/brian-feroldi/…

Last one:

Stay humble yet optimistic.

If you invest, you're going to be wrong. A lot.

Don't beat yourself up. That's just how you get better.

Saving money is hard. Investing is hard. The world is complex.

Invest & stay optimistic anyway.

Stay humble yet optimistic.

If you invest, you're going to be wrong. A lot.

Don't beat yourself up. That's just how you get better.

Saving money is hard. Investing is hard. The world is complex.

Invest & stay optimistic anyway.

Like this thread? Follow me @BrianFeroldi.

I demystify the stock market with daily tweets and weekly threads like this.

To share this thread with your audience, ♻️ retweet the first tweet below.

I demystify the stock market with daily tweets and weekly threads like this.

To share this thread with your audience, ♻️ retweet the first tweet below.

https://twitter.com/61558281/status/1688166448840019969

If you liked this thread, there's a 100% chance you'll like this one, too:

https://twitter.com/BrianFeroldi/status/1677283541984460801?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh