Refreshed obesity competitive landscape

Updated thoughts on this massive market following today's positive SELECT trial readout ($NVO) and Mounjaro sales beat ($LLY):

Updated thoughts on this massive market following today's positive SELECT trial readout ($NVO) and Mounjaro sales beat ($LLY):

Obesity refresher:

• Defined as BMI >30kg/m^2

• >750M patients globally, including ~40% of US adults --> expected to increase to 1B people / ~50% of US adults by 2030

• Linked to 1/5 US adult deaths

However, just ~2% of people (15M) are on anti-obesity medications (AOM)

• Defined as BMI >30kg/m^2

• >750M patients globally, including ~40% of US adults --> expected to increase to 1B people / ~50% of US adults by 2030

• Linked to 1/5 US adult deaths

However, just ~2% of people (15M) are on anti-obesity medications (AOM)

$NVO's SELECT trial was the most meaningful catalyst for this space in 2023 - it measured Wegovy's impact on reducing major adverse CV events (MACE) over a period of up to 5 years

The trial enrolled >17K overweight or obese adults with a history of CV disease & no diabetes

The trial enrolled >17K overweight or obese adults with a history of CV disease & no diabetes

Before today, KOLs considered a ~16% redux in MACE to be clinically meaningful - SELECT delivered a 20% redux

Things to monitor once the full data is released:

(1) Any separation in all-cause mortality

(2) What contributed to MACE redux

(3) Safety

+ readthrough to SURMOUNT-MMO

Things to monitor once the full data is released:

(1) Any separation in all-cause mortality

(2) What contributed to MACE redux

(3) Safety

+ readthrough to SURMOUNT-MMO

Based on these results, we can expect $NVO to file for a label indication expansion for Wegovy

Payors will see added pressure to reimburse these obesity drugs moving forward, given a redux in CV outcomes has massive downstream cost-saving implications

Payors will see added pressure to reimburse these obesity drugs moving forward, given a redux in CV outcomes has massive downstream cost-saving implications

Importantly, SELECT could pave the way to Medicare coverage of AOMs, which has been locked since 2003

Legislative amendments will take time, but this could potentially be a prominent healthcare issue during the 2024 election cycle, alongside the IRA

Legislative amendments will take time, but this could potentially be a prominent healthcare issue during the 2024 election cycle, alongside the IRA

Separately, $LLY reported Q2 results and Mounjaro crushed expectations, with sales coming in >$200M above consensus estimates

Mounjaro is not yet approved for obesity, but off-label usage has been massive ($LLY previously reported ~33% of scripts were diabetes naive patients)

Mounjaro is not yet approved for obesity, but off-label usage has been massive ($LLY previously reported ~33% of scripts were diabetes naive patients)

That off-label usage has been driven by

(1) supply constraints with Wegovy and

(2) unprecedented demand, largely driven by social media (i.e. patient journeys) & pop culture (celebrity usage)

#Mounjaro, #Wegovy & #Ozempic have billions of views across notable platforms

(1) supply constraints with Wegovy and

(2) unprecedented demand, largely driven by social media (i.e. patient journeys) & pop culture (celebrity usage)

#Mounjaro, #Wegovy & #Ozempic have billions of views across notable platforms

Beyond Mounjaro, $LLY's Ph2 asset retatrutide demonstrated BIC efficacy of 24.2% mean weight reduction at 48 weeks (~58 lbs). This is in-line with bariatric surgery

Compare this to Wegovy (~12%) and Mounjaro (~16-22%) and the arms race may be just beginning

Compare this to Wegovy (~12%) and Mounjaro (~16-22%) and the arms race may be just beginning

Results for retatrutide may even be better than advertised, since:

(1) the trial enrolled a larger proportion of men than women, and women tend to lose a higher proportion of weight (~29% vs. ~22%)

(2) patients had yet to reach a plateau by study end, implying more potential

(1) the trial enrolled a larger proportion of men than women, and women tend to lose a higher proportion of weight (~29% vs. ~22%)

(2) patients had yet to reach a plateau by study end, implying more potential

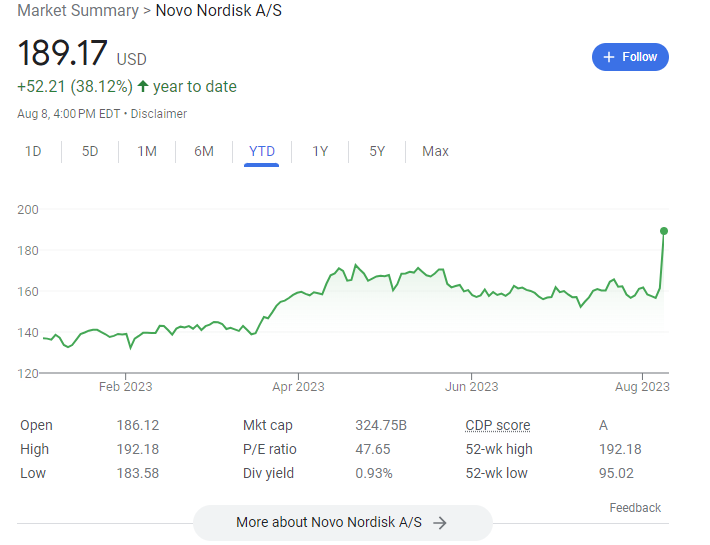

All of this weight loss has translated into massive market share gains for $LLY and $NVO

$LLY is now the world's most valuable pharma company and collectively the two giants are worth >$825B

$LLY is now the world's most valuable pharma company and collectively the two giants are worth >$825B

Other companies are taking notice - as the space gets increasingly crowded, differentiation beyond efficacy & safety will be important:

• Dosing convenience (i.e. less frequent injections or oral)

• Weight loss kinetics (slope of weight loss)

• Data in sub-populations

• Dosing convenience (i.e. less frequent injections or oral)

• Weight loss kinetics (slope of weight loss)

• Data in sub-populations

This analysis has been focused on general (polygenic) obesity, but there is a separate pipeline for various genetically-driven obesities (monogenetic obesity)

One player in this space is $RYTM which launched Imcivree for patients with 3 genetic deficiencies (POMC, PCSK1, LEPR)

One player in this space is $RYTM which launched Imcivree for patients with 3 genetic deficiencies (POMC, PCSK1, LEPR)

That's all - If you enjoyed this, follow me

@andrewpannu for more biotech charts, musings and breakdowns

If you'd like a PDF of the landscape, you can find it here, along with all of my other reports & graphics: andrewpannu.com/downloads/

@andrewpannu for more biotech charts, musings and breakdowns

If you'd like a PDF of the landscape, you can find it here, along with all of my other reports & graphics: andrewpannu.com/downloads/

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter