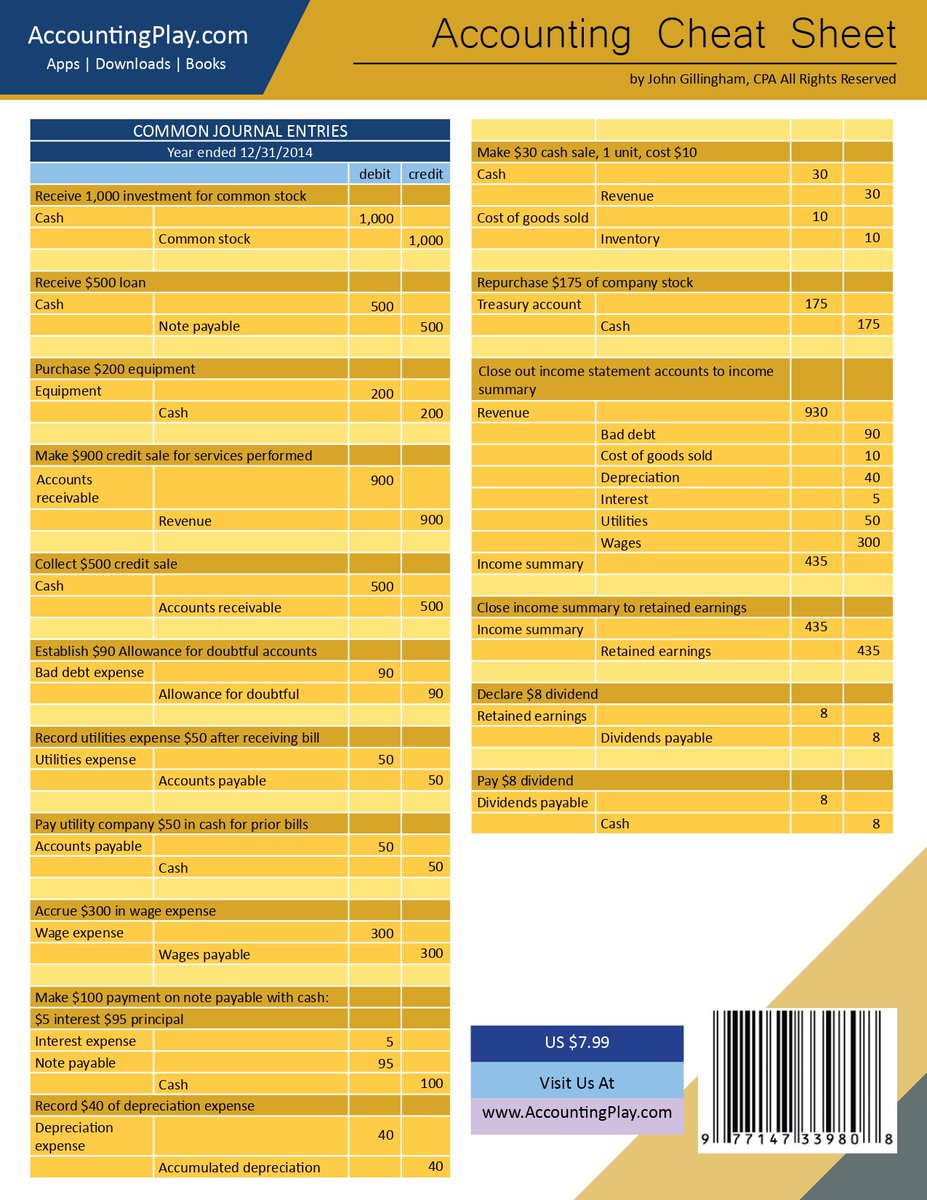

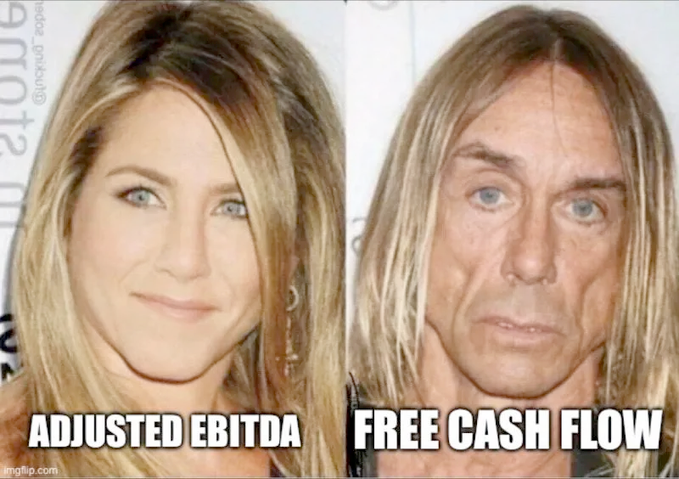

Accounting is the language of business.

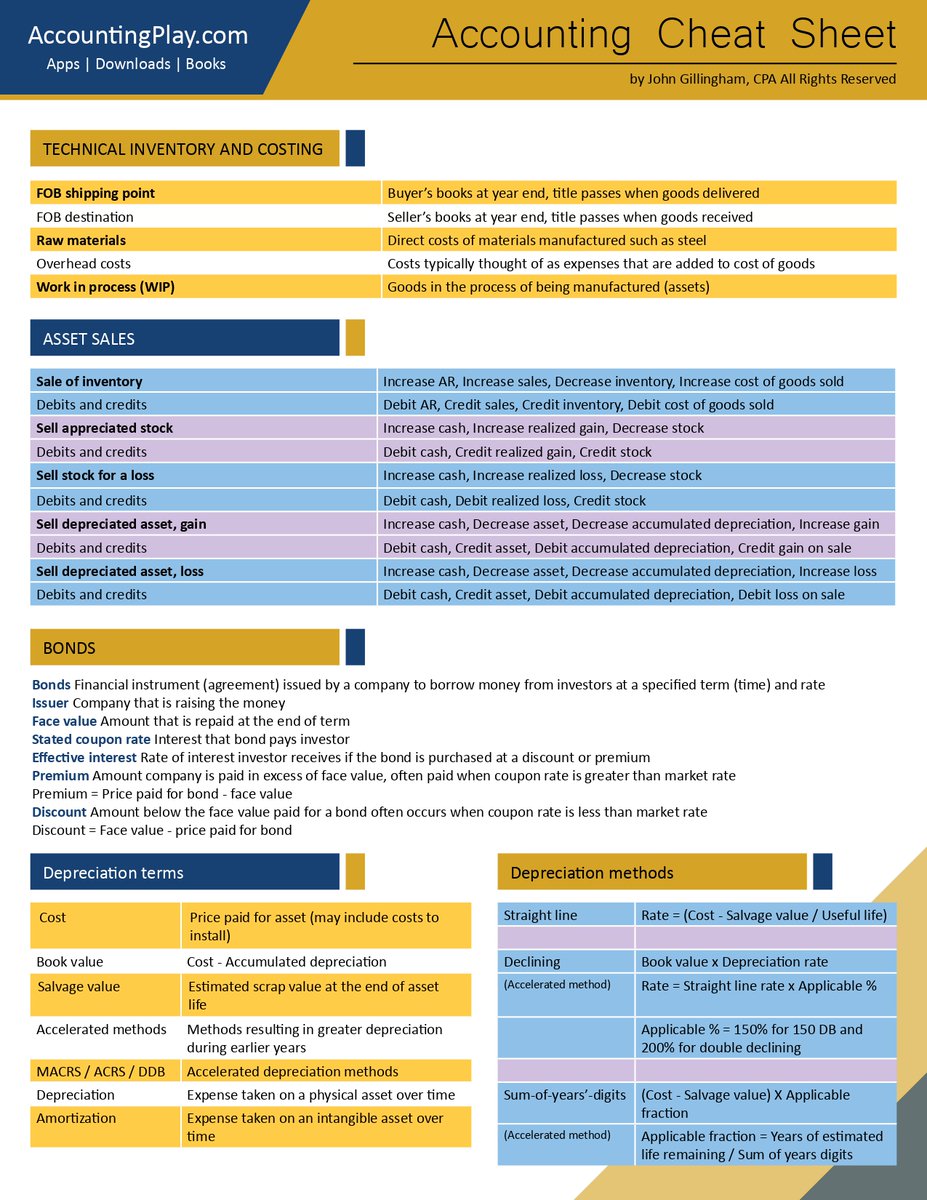

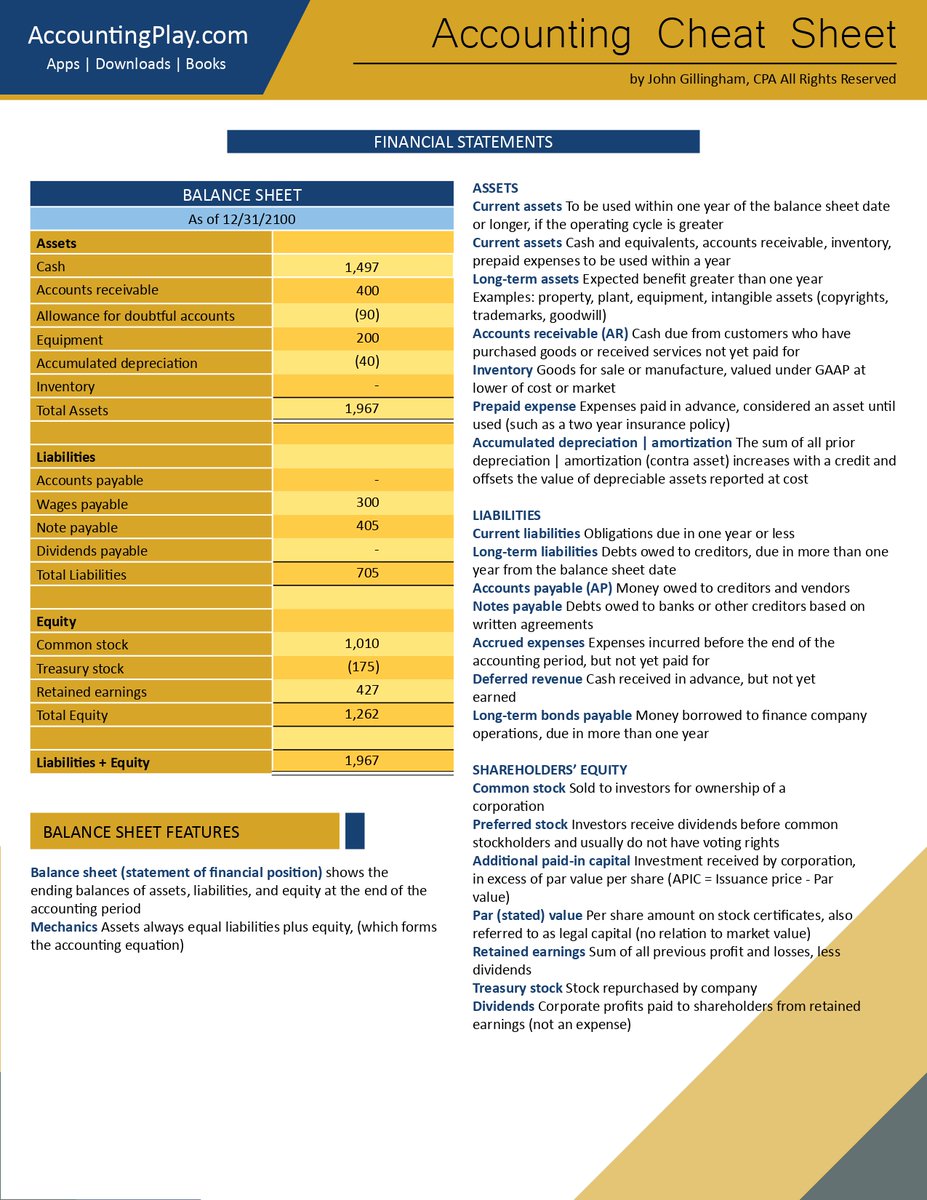

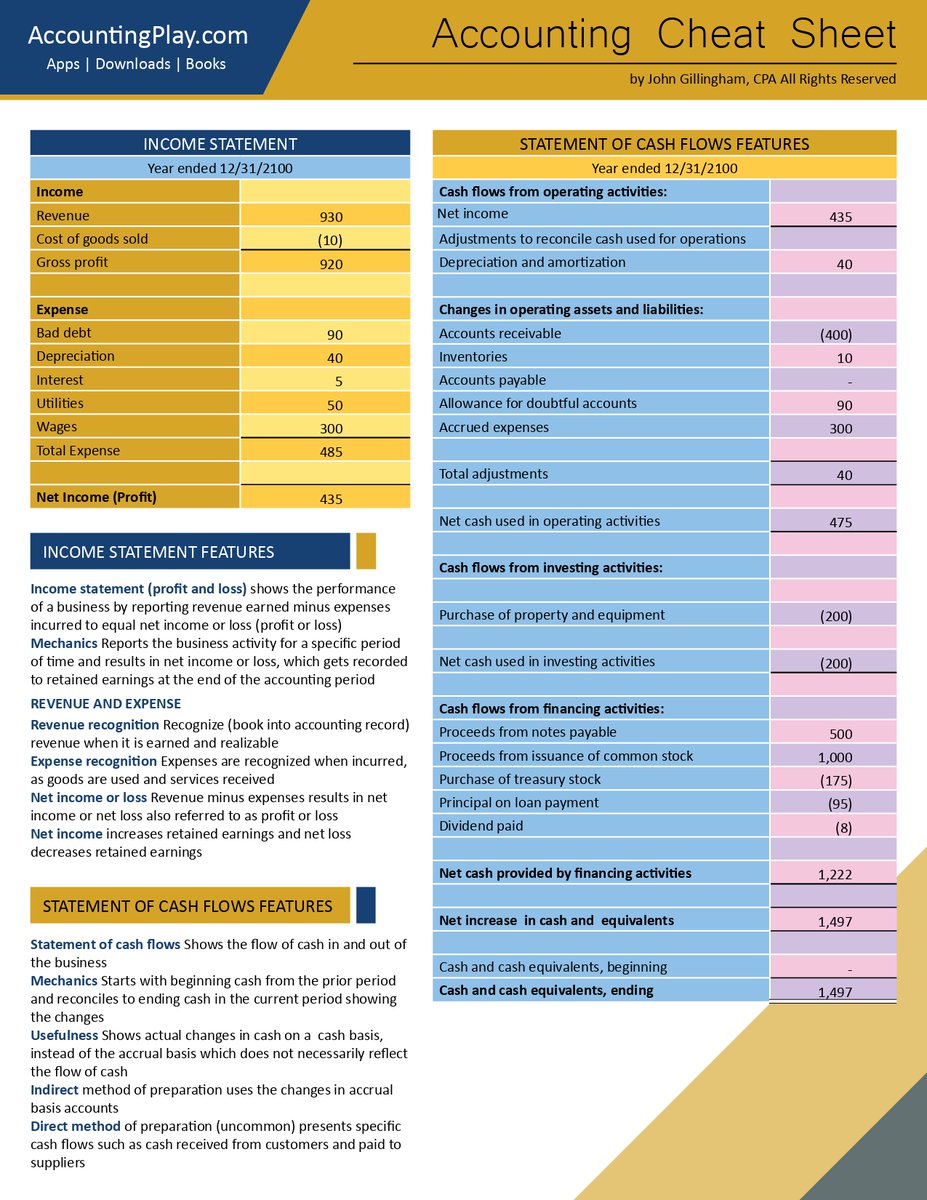

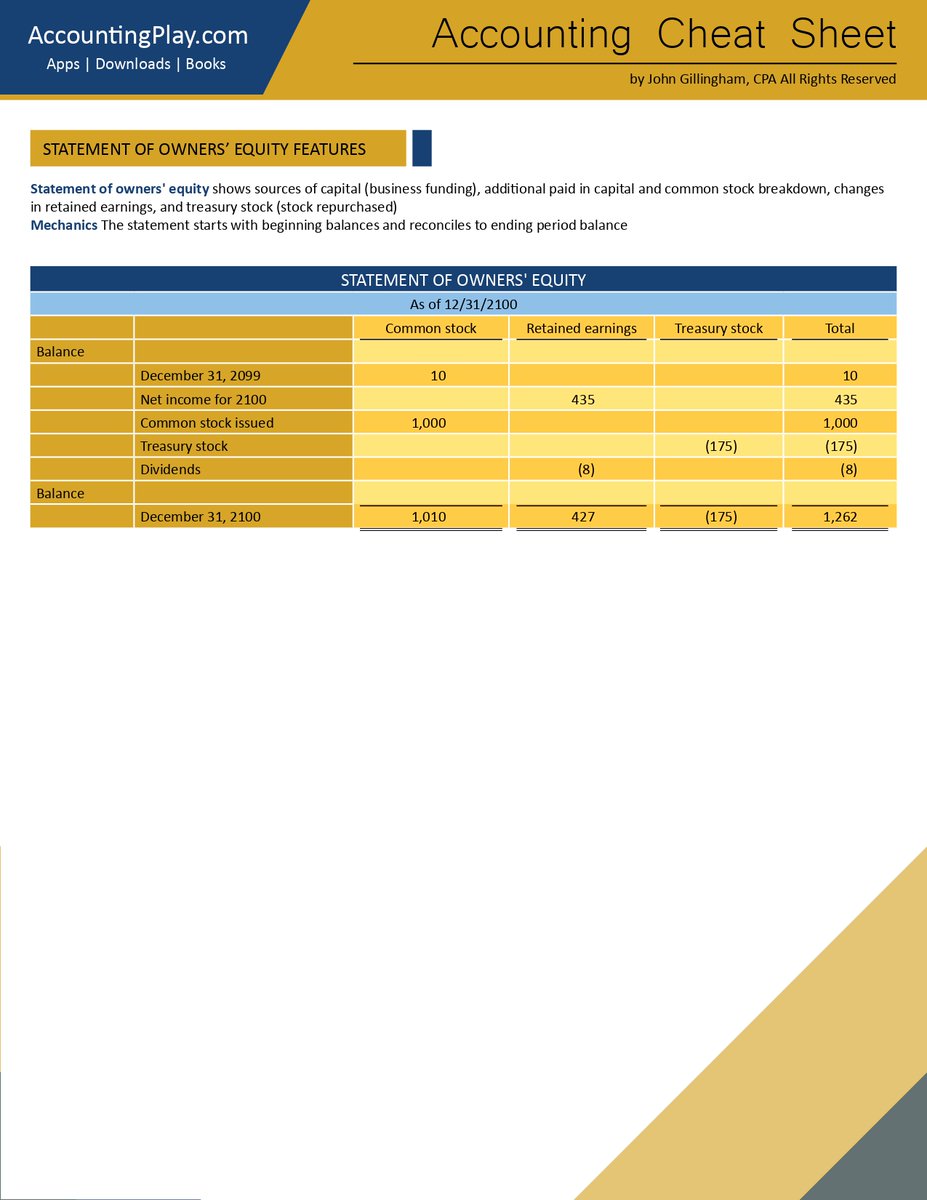

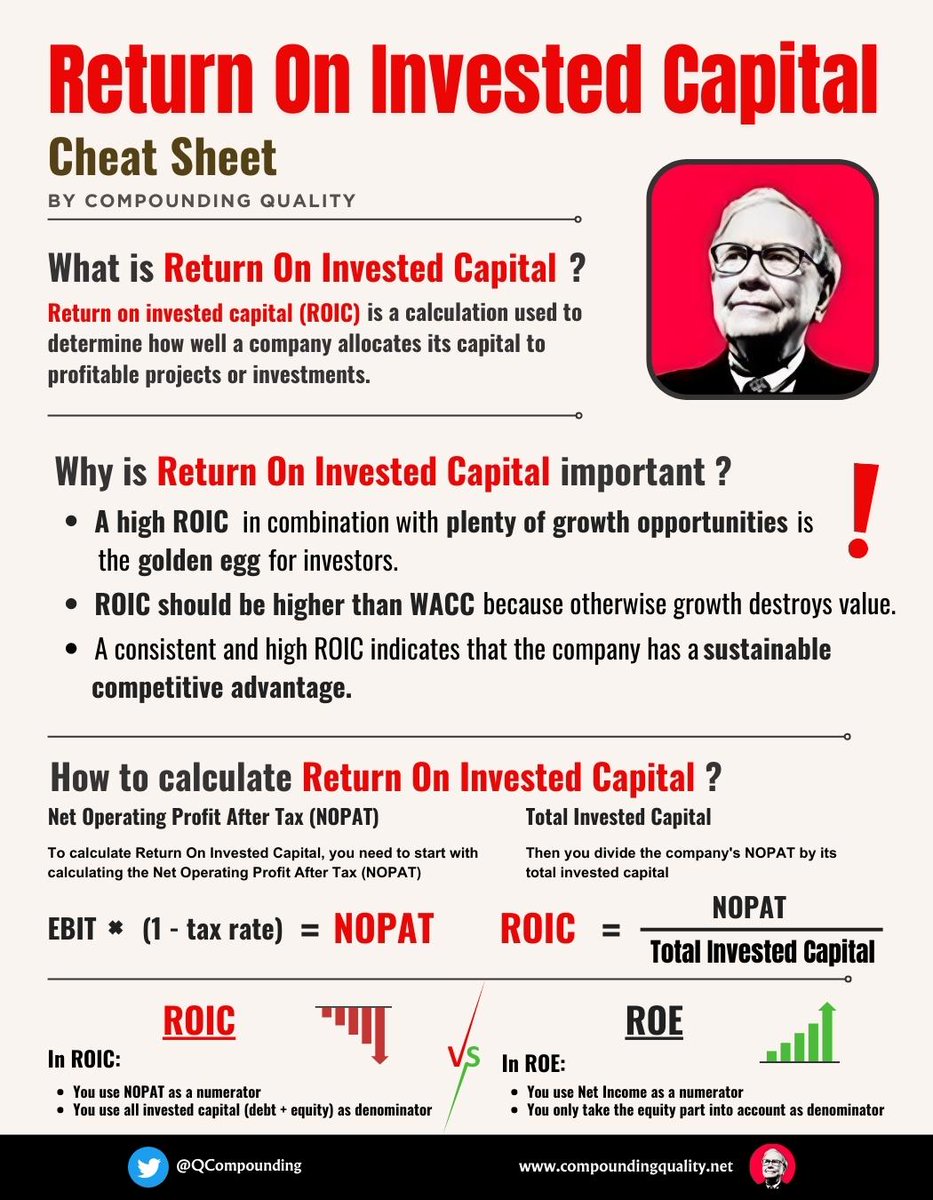

Via this 7-page cheat sheet you learn everything you need to know:

Via this 7-page cheat sheet you learn everything you need to know:

That's it for today.

If you like this, you'll LOVE our free course.

It teaches you how to read Financial Statements like a professional.

Grab it for free here: https://t.co/Xq8OSGltSceepurl.com/h9kw29T

If you like this, you'll LOVE our free course.

It teaches you how to read Financial Statements like a professional.

Grab it for free here: https://t.co/Xq8OSGltSceepurl.com/h9kw29T

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter