There's a lot of fairly ill-tempered debate among economists about news that should make everyone happy — disinflation without recession. My thought: we should apply Occam's extended razor. When in doubt, go for the simpler story, and rely on standard models 1/

Most econ textbooks offer some version of an aggregate demand-aggregate supply framework that looks like this 2/

For much of 2022 and some way into 2023 many economists were arguing that reducing inflation would require a big reduction in aggregate demand (via Fed hikes) that would lead to large job losses 3/

But what we actually got was a lot of disinflation, even in measures that tried to extract "underlying" inflation excluding volatile components ... 4/

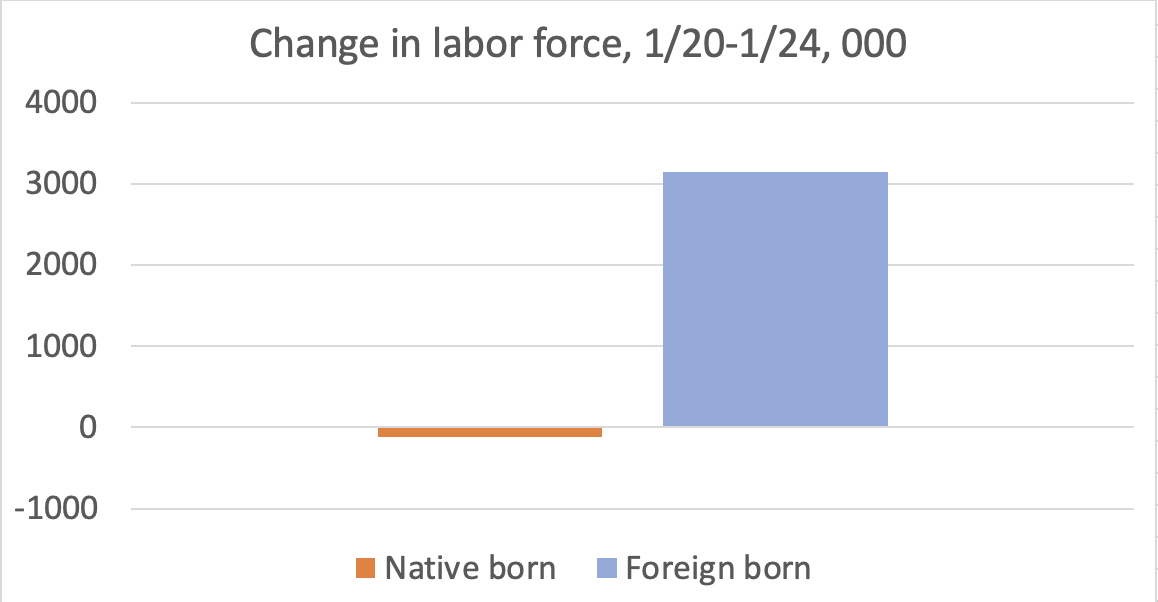

The simplest explanation consistent with the standard model — Occam's extended razor — was and is a rightward shift in aggregate supply 6/

Where might such a shift come from? The obvious answer is the end of Long Transitory, ie recombobulation — the economy sorting out lingering pandemic-related disruptions 7/

We don't know for sure that this is true; when do we ever know that anything in economics is true? But alternative explanations, especially claims that the Fed somehow did this with its mystical power of credibility, feel like attempts to explain away a big forecasting miss 8/

• • •

Missing some Tweet in this thread? You can try to

force a refresh