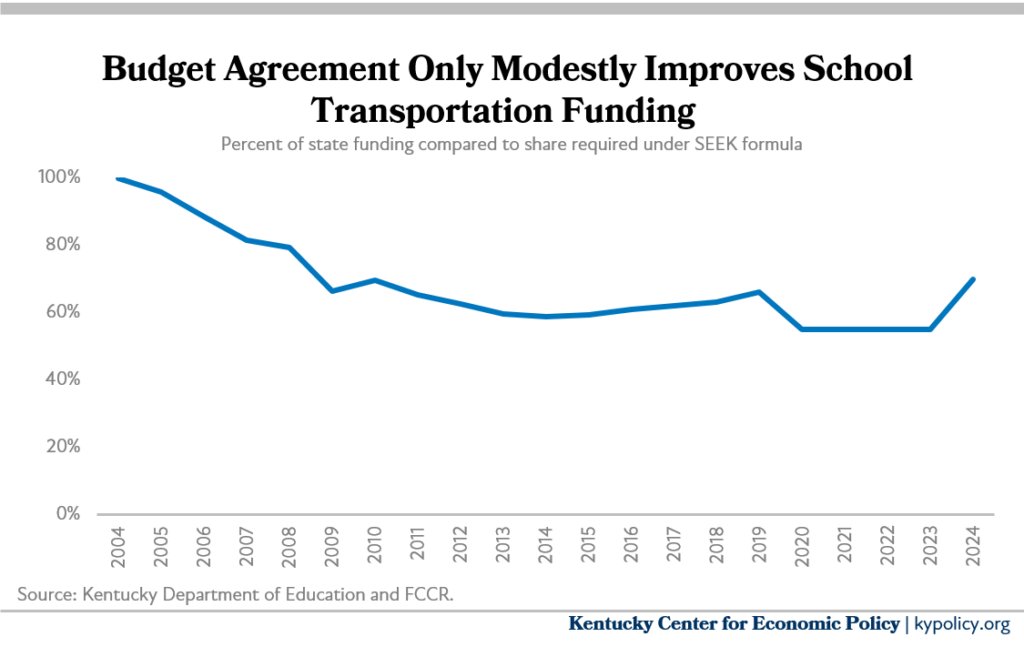

Important to know that paying the full costs of busing kids to & from school is a state responsibility under law. But it's one the legislature has skipped since 2005. Despite billions now in the rainy day fund, the state still pays only 70% of these costs in the current budget.

The numbers in the graph mean this: if the state had been fulfilling its responsibility to fund transportation, JCPS would've had 82% more state dollars over the last three years dedicated specifically to hiring and retaining bus drivers, and 43% more this year.

That would've been especially beneficial because of a severe bus driver shortage. It's difficult to attract drivers when they receive low hourly pay for part-time, part-year work & have to try cobbling together the rest of what it takes to live.

nea.org/nea-today/all-…

nea.org/nea-today/all-…

Districts like Jefferson have bumped pay and incentives to try to attract drivers, but other full-time, year round alternatives for drivers are increasing pay by much more (Hello UPS Teamsters). The lack of state funds puts limits on what districts can do.

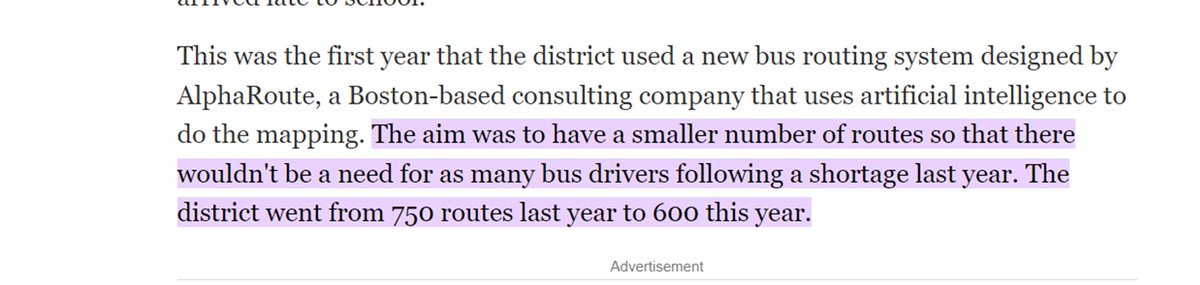

Jefferson Co recently had to revamp its system based on fewer drivers because of the shortage--which led directly to the problems faced last week. https://t.co/oq9pIxZJetcourier-journal.com/story/news/edu…

The baby boomer retirement is shrinking the workforce, making it more important employers improve pay & working conditions if they want to fill shortages. Doing so with bus drivers requires the state to step up with the $ they should already be providing. kypolicy.org/this-one-weird…

• • •

Missing some Tweet in this thread? You can try to

force a refresh