How to get URL link on X (Twitter) App

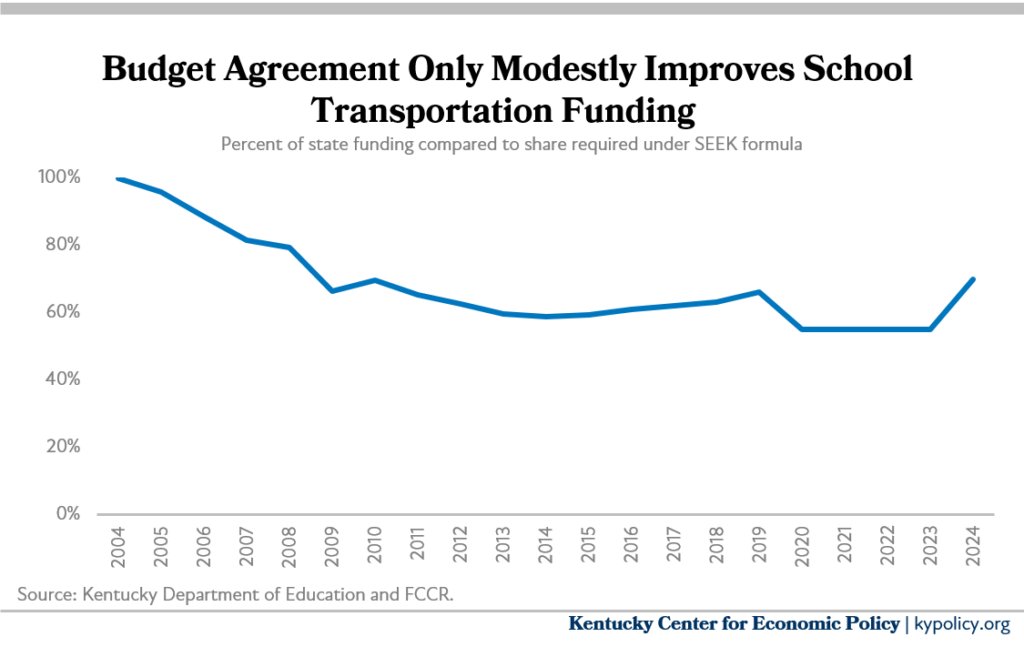

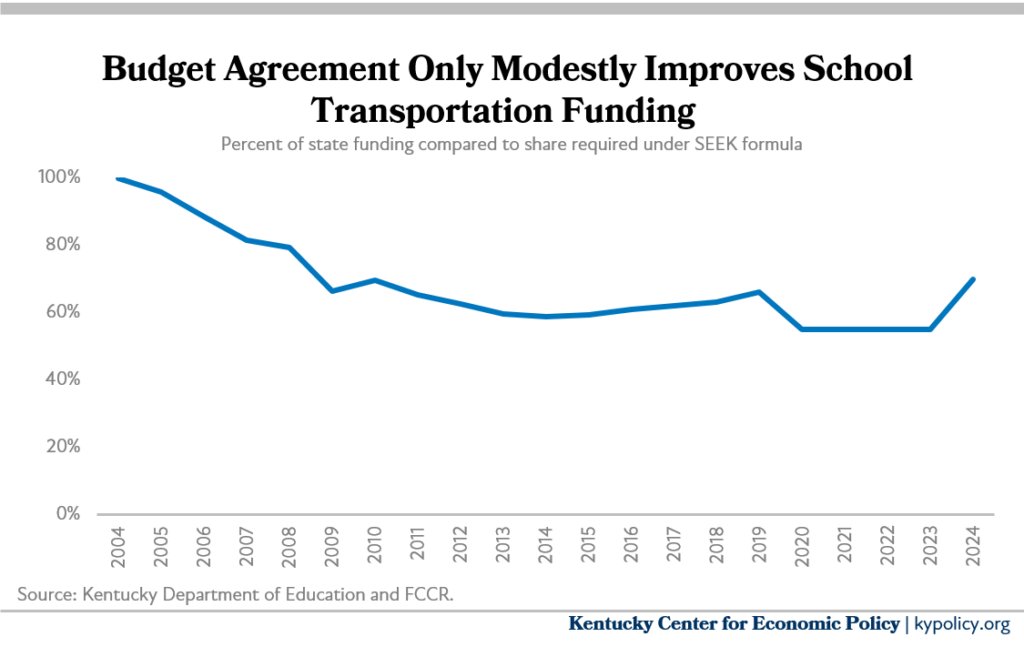

The numbers in the graph mean this: if the state had been fulfilling its responsibility to fund transportation, JCPS would've had 82% more state dollars over the last three years dedicated specifically to hiring and retaining bus drivers, and 43% more this year.

The numbers in the graph mean this: if the state had been fulfilling its responsibility to fund transportation, JCPS would've had 82% more state dollars over the last three years dedicated specifically to hiring and retaining bus drivers, and 43% more this year.

https://twitter.com/joesonka/status/1370742929774551040Similar language was not included in last year's budget which was enacted after the CARES Act passed. The governor used the Coronavirus Relief Fund from that act throughout the rest of the year to shore up the budget, address the public health crisis, and provide aid.