Billionaire investor Dan Loeb believes studying this one company is worth more than a 2-year MBA.

Surprisingly, it isn’t Amazon, Apple, or Berkshire Hathaway.

As one of the all-time best-performing stocks, it’s delivered 4,500%+ returns over the last 25 years.

Let’s dive in!

Surprisingly, it isn’t Amazon, Apple, or Berkshire Hathaway.

As one of the all-time best-performing stocks, it’s delivered 4,500%+ returns over the last 25 years.

Let’s dive in!

The company is Danaher and the secret to its success is the Danaher Business System (DBS).

In this thread, I’ll give you an overview of Danaher, DBS, and their M&A strategy.

Let’s start with Danaher’s history! $DHR

In this thread, I’ll give you an overview of Danaher, DBS, and their M&A strategy.

Let’s start with Danaher’s history! $DHR

In 1980, brothers Steven and Mitchell Rales founded Equity Group Holdings to acquire undervalued industrial businesses.

They used junk bonds to acquire Mohawk Rubber Company and Master Shield, manufacturers of tires and vinyl goods.

They used junk bonds to acquire Mohawk Rubber Company and Master Shield, manufacturers of tires and vinyl goods.

The Rales brothers acquired a real estate investment trust (REIT) called DMG, Inc. in 1983 for its $130 million tax-loss carryforwards.

They then transferred Master Shield & Mohawk Rubber Company into the REIT to help shelter their profits using the tax credits.

They then transferred Master Shield & Mohawk Rubber Company into the REIT to help shelter their profits using the tax credits.

In 1984, they renamed the company after a river in Montana - Danaher was born! The Celtic root “Dana” means “swift flowing.”

By 1986, Danaher had made 12 more acquisitions using debt. It ended up on the Fortune 500 in just 6 years with $456 million in revenues. Talk about swift!

By 1986, Danaher had made 12 more acquisitions using debt. It ended up on the Fortune 500 in just 6 years with $456 million in revenues. Talk about swift!

Around 1988, the Rales brothers saw early warning signs that the junk bond market was going to crash.

They made 3 important changes that set the stage for Danaher as we know it today:

1. Shifted focus to improving operations (DBS)

2. Reduced debt

3. Moved to Chairman role

They made 3 important changes that set the stage for Danaher as we know it today:

1. Shifted focus to improving operations (DBS)

2. Reduced debt

3. Moved to Chairman role

Danaher’s subsidiary Jacobs Vehicle Systems had been facing quality challenges. To learn from the best in lean manufacturing, their manager went to Japan to shadow Toyota Motor Corporation.

When the manager came back and applied his learnings, the results were outstanding!

When the manager came back and applied his learnings, the results were outstanding!

Danaher applied these lessons to the rest of their businesses, making them one of the first U.S. companies to adopt lean manufacturing.

And so, Danaher Business Systems was born!

And so, Danaher Business Systems was born!

Around this time, the Rales brothers also moved to a chairman role, bringing in George Sherman from Black & Decker as CEO.

Sherman was an engineer who also had an MBA. He was credited with turning around the B&D Power Tools business and helping it grow at 2x the market rate.

Sherman was an engineer who also had an MBA. He was credited with turning around the B&D Power Tools business and helping it grow at 2x the market rate.

Sherman changed Danaher’s acquisition strategy in 2 important ways:

1. Transition to less cyclical, higher organic growth industries

2. Platform M&A strategy: “Making fewer but larger acquisitions… firms with respectable market shares that were underperforming financially”

1. Transition to less cyclical, higher organic growth industries

2. Platform M&A strategy: “Making fewer but larger acquisitions… firms with respectable market shares that were underperforming financially”

The new M&A strategy was to focus on:

1. Large, fragmented markets growing without cyclicality or volatility

2. Niche firms they could acquire for products without their overhead

3. Improvement opportunity via DBS

Simply, “we look for markets of size where we can win”

1. Large, fragmented markets growing without cyclicality or volatility

2. Niche firms they could acquire for products without their overhead

3. Improvement opportunity via DBS

Simply, “we look for markets of size where we can win”

Danaher improved its M&A strategy under Sherman. The strategy was to start with a large platform acquisition when entering a new market.

This could then serve as a center of gravity as they made smaller, bolt-on acquisitions to leverage their economies of scale in distribution.

This could then serve as a center of gravity as they made smaller, bolt-on acquisitions to leverage their economies of scale in distribution.

These small tweaks have led to vastly better outcomes over time. At the heart of Danaher has been the Japanese philosophy of kaizen, or continuous improvement.

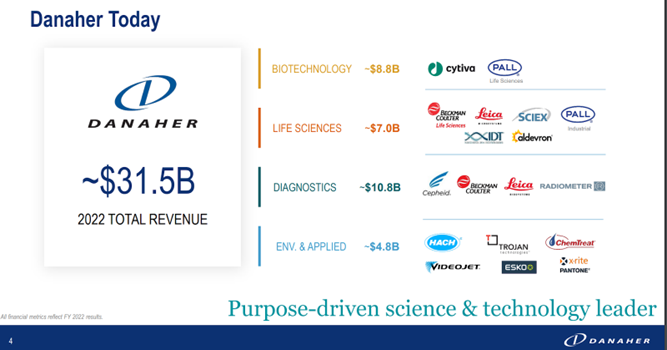

And over the last several decades, Danaher has only gotten stronger and better. It’s now doing $30+ billion in revenues

And over the last several decades, Danaher has only gotten stronger and better. It’s now doing $30+ billion in revenues

The amazing thing is that the Danaher of today looks very different from its start in the industrial sector.

Danaher today is focused solely on Biotech, Life Sciences, and Diagnostics. (They are spinning off their Environmental & Applied Solutions / EAS businesses)

Danaher today is focused solely on Biotech, Life Sciences, and Diagnostics. (They are spinning off their Environmental & Applied Solutions / EAS businesses)

Danaher has meaningfully improved its business quality from a debt-heavy, cyclical industrial company to a more predictable science and technology company.

80%+ of revenues are now recurring thanks to a largely razor/razor-blade business model.

80%+ of revenues are now recurring thanks to a largely razor/razor-blade business model.

Danaher has also significantly improved its growth prospects, as these science & technology end-markets benefit from secular growth.

For example, these industries are set to benefit from the shift toward biologics, cell and gene therapies, and molecular diagnostics.

For example, these industries are set to benefit from the shift toward biologics, cell and gene therapies, and molecular diagnostics.

Along the way, Danaher has refined its M&A strategy. They focus on markets with secular growth + companies with strong market positions + attractive valuations.

They have also evolved the Danaher Business System. DBS now includes not only cost-focused/lean manufacturing tools but also growth and leadership tools.

DBS has turned into a powerful, competitive advantage that allows Danaher to meaningfully improve the operations of the businesses it acquires.

Overall, Danaher is set up well to continue to deliver top-quartile performance through a combination of:

1 Operating in attractive industries

2. Strategic M&A

3. Danaher Business Systems

1 Operating in attractive industries

2. Strategic M&A

3. Danaher Business Systems

Danaher benefits from attractive industry growth. It uses DBS to lower costs and reinvests savings into R&D + S&M to grow.

Cash flow is deployed to acquire undervalued businesses that can be improved with DBS. Rinse & repeat!

Cash flow is deployed to acquire undervalued businesses that can be improved with DBS. Rinse & repeat!

Organic execution + M&A = compounding returns

Danaher has outperformed the S&P 500 by 4,100% over the past 25 years!

Danaher has outperformed the S&P 500 by 4,100% over the past 25 years!

The Rales brothers have built a remarkable business with Danaher and own a combined ~$20 billion stake in the company.

There is so much more to learn from Danaher!

If folks liked this thread, for my next one I’ll do a deep dive on Danaher Business Systems and the key tools that they use to improve their businesses.

If folks liked this thread, for my next one I’ll do a deep dive on Danaher Business Systems and the key tools that they use to improve their businesses.

So if you found this thread helpful, it would mean a lot if you could like and repost the first tweet.

I tweet about investing and entrepreneurship, so follow me for more @skhetpal

I tweet about investing and entrepreneurship, so follow me for more @skhetpal

Sources:

https://t.co/5tjaLXY8Id

https://t.co/rmB52WTakZ

https://t.co/5iMvriaWkmhbs.edu/faculty/Pages/…

filecache.investorroom.com/mr5ir_danaher/…

filecache.investorroom.com/mr5ir_danaher/…

sec.gov/Archives/edgar…

https://t.co/5tjaLXY8Id

https://t.co/rmB52WTakZ

https://t.co/5iMvriaWkmhbs.edu/faculty/Pages/…

filecache.investorroom.com/mr5ir_danaher/…

filecache.investorroom.com/mr5ir_danaher/…

sec.gov/Archives/edgar…

I'm glad you all enjoyed this thread! Thanks for the support.

There's so much more to learn from Danaher. I'm working on the Danaher Business System tools deep dive.

To make sure you don’t miss it:

1. Follow me

2. Click on the bell for notifications

There's so much more to learn from Danaher. I'm working on the Danaher Business System tools deep dive.

To make sure you don’t miss it:

1. Follow me

2. Click on the bell for notifications

• • •

Missing some Tweet in this thread? You can try to

force a refresh