Former hedge fund investor turned entrepreneur. CEO @thetikr. Teach how to invest @super_investing. Post about stocks, entrepreneurship, and life's journey.

8 subscribers

How to get URL link on X (Twitter) App

Andreas grew up in Norway and graduated from the Norwegian Naval Academy where he led a SEAL team. But he wanted more so he moved to the US and got his MBA from Stanford.

Andreas grew up in Norway and graduated from the Norwegian Naval Academy where he led a SEAL team. But he wanted more so he moved to the US and got his MBA from Stanford.

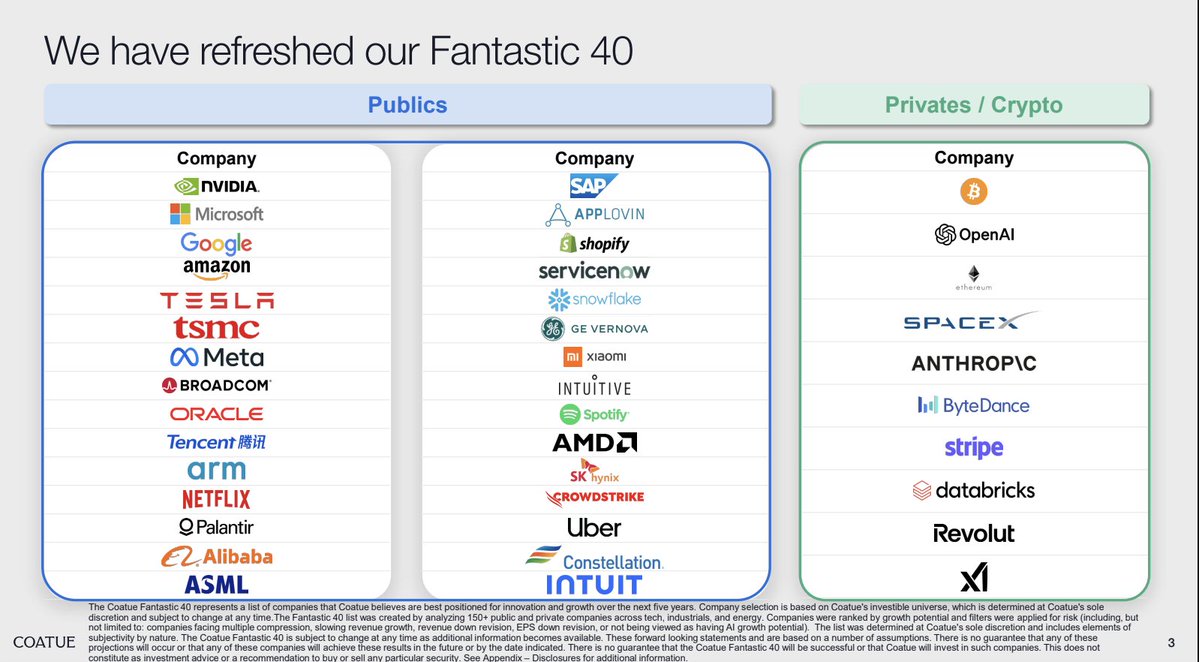

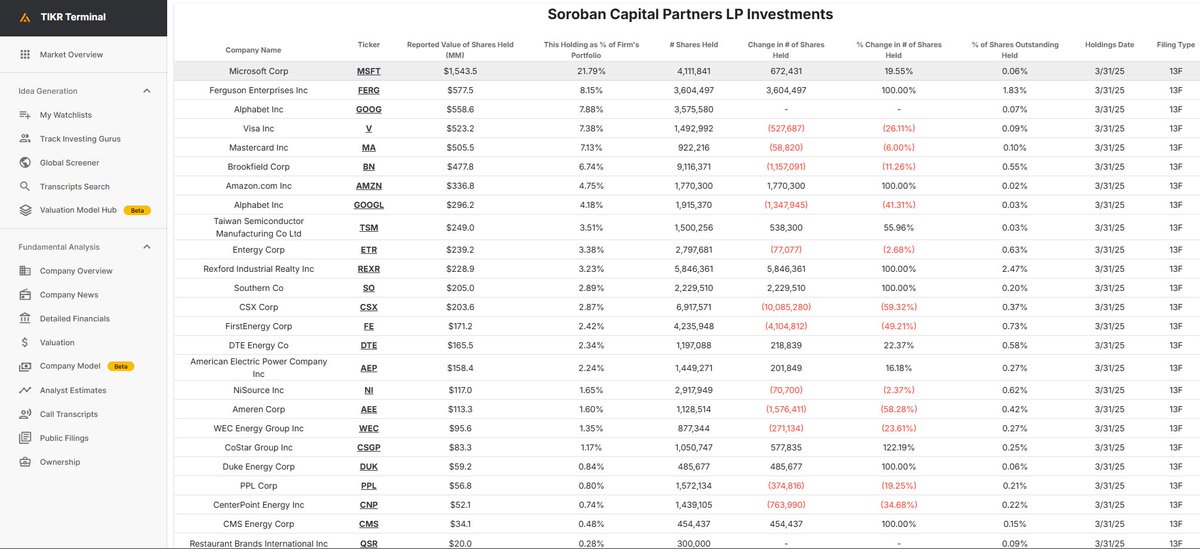

Philippe studied computer science at MIT before joining as a tech analyst at Tiger Management in 1996

Philippe studied computer science at MIT before joining as a tech analyst at Tiger Management in 1996

Eagle Capital's investment philosophy has three core principles:

Eagle Capital's investment philosophy has three core principles:

Karthik joined Tiger Global Management within just months of launch and became a Partner.

Karthik joined Tiger Global Management within just months of launch and became a Partner.

Reece formed his investing philosophy at UCSB, where his professor would hand him S-1 filings every two weeks, teaching him to identify quality businesses before they went public.

Reece formed his investing philosophy at UCSB, where his professor would hand him S-1 filings every two weeks, teaching him to identify quality businesses before they went public.

Nelson Peltz’s story started unconventionally. He dropped out of Wharton to become a ski instructor but ended up driving a delivery truck for his family’s business.

Nelson Peltz’s story started unconventionally. He dropped out of Wharton to become a ski instructor but ended up driving a delivery truck for his family’s business.

Mark Massey got into investing after being inspired by his dad who always talked about stocks around the dinner table.

Mark Massey got into investing after being inspired by his dad who always talked about stocks around the dinner table.

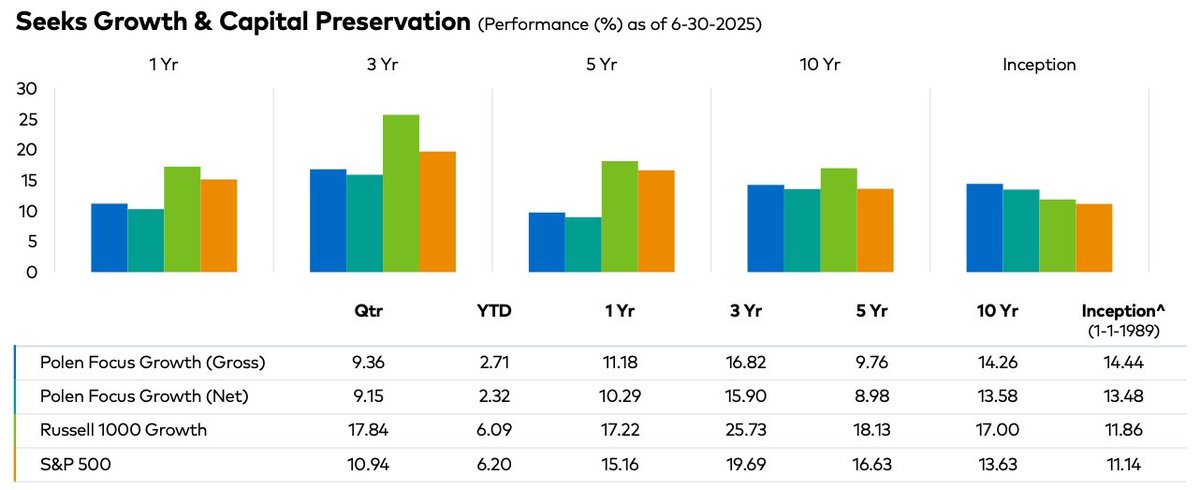

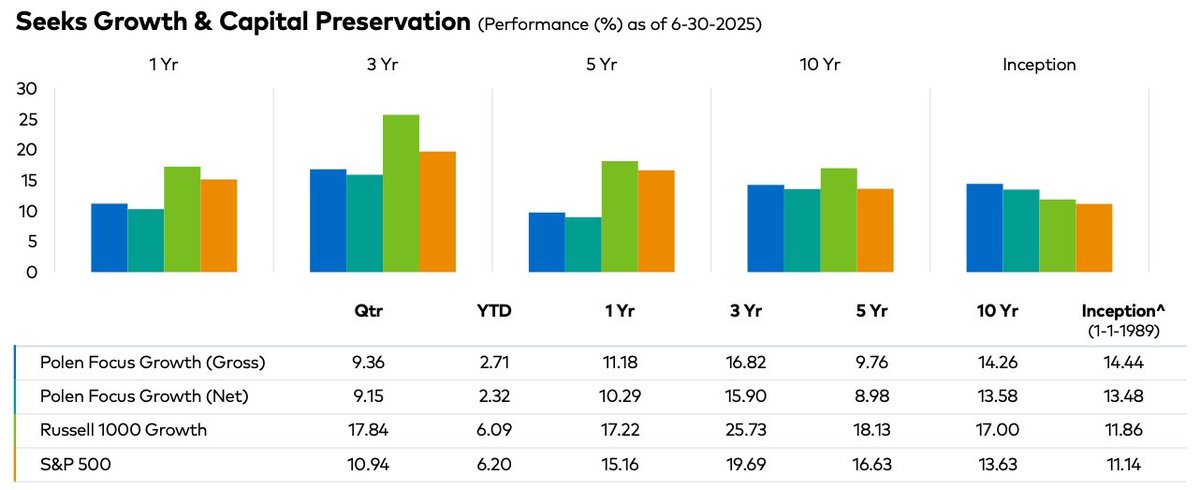

David Polen founded the fund in 1979 and built the firms’ philosophy around investing in 25 of the best businesses globally that in aggregate can grow EPS at 15%+.

David Polen founded the fund in 1979 and built the firms’ philosophy around investing in 25 of the best businesses globally that in aggregate can grow EPS at 15%+.

Roper was founded in 1890 as a home appliance manufacturer.

Roper was founded in 1890 as a home appliance manufacturer.

Born in North Carolina, Julian was a Navy officer turned stockbroker at Kidder Peabody. By 1974 he ran their asset management division, but felt constrained.

Born in North Carolina, Julian was a Navy officer turned stockbroker at Kidder Peabody. By 1974 he ran their asset management division, but felt constrained.

Buffett didn't just flip Moody’s Manuals and scoop up crazy bargains. Obvious quantitative bargains often had issues or were so thinly traded that Buffett had to put out ads to find sellers.

Buffett didn't just flip Moody’s Manuals and scoop up crazy bargains. Obvious quantitative bargains often had issues or were so thinly traded that Buffett had to put out ads to find sellers.

In 1983, Intuit was founded by Scott Cook and Tom Proulx, driven by their vision to create a personal finance program to simplify money management

In 1983, Intuit was founded by Scott Cook and Tom Proulx, driven by their vision to create a personal finance program to simplify money management

The company is Heico $HEI, a serial acquirer in the aerospace industry.

The company is Heico $HEI, a serial acquirer in the aerospace industry.

Wayne dropped out of college after 3 semesters and spent a brief stint in the military before joining a garbage collection service like his successful grandfather.

Wayne dropped out of college after 3 semesters and spent a brief stint in the military before joining a garbage collection service like his successful grandfather.