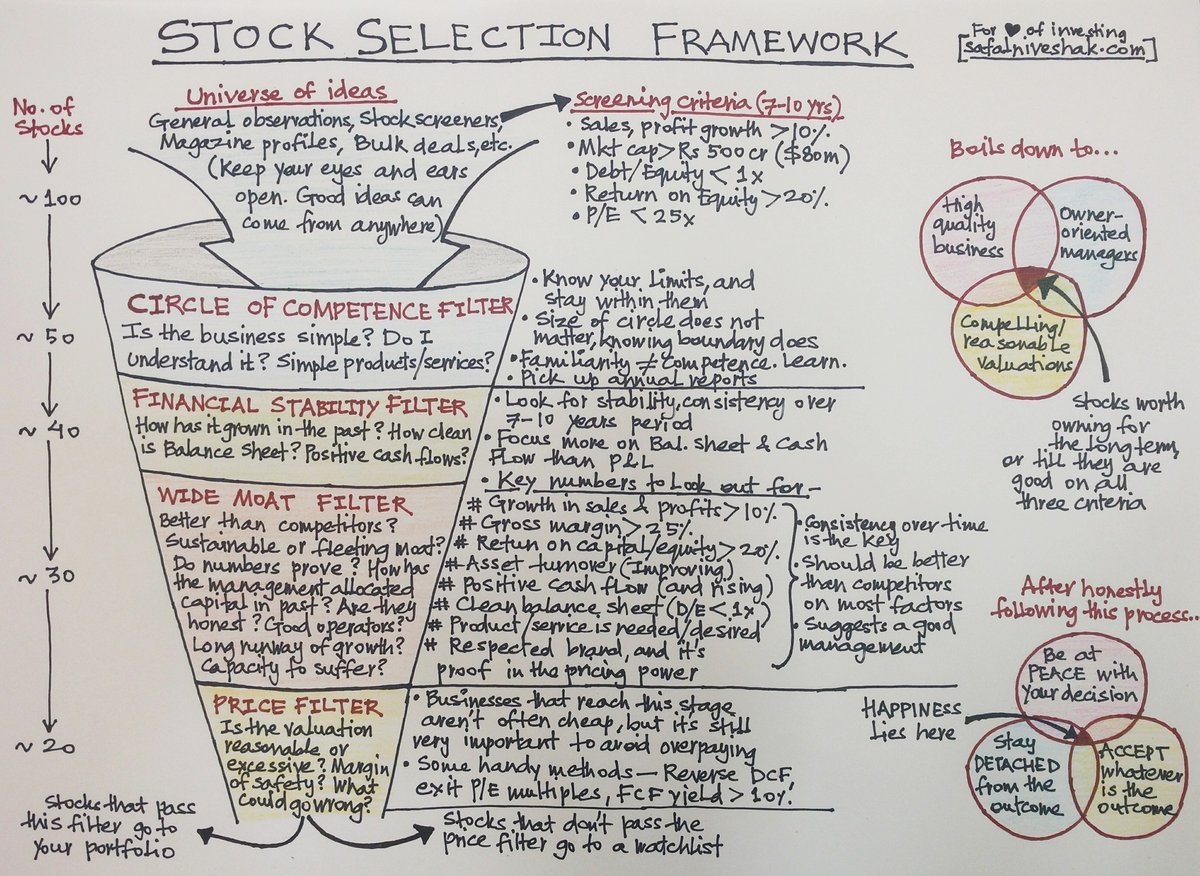

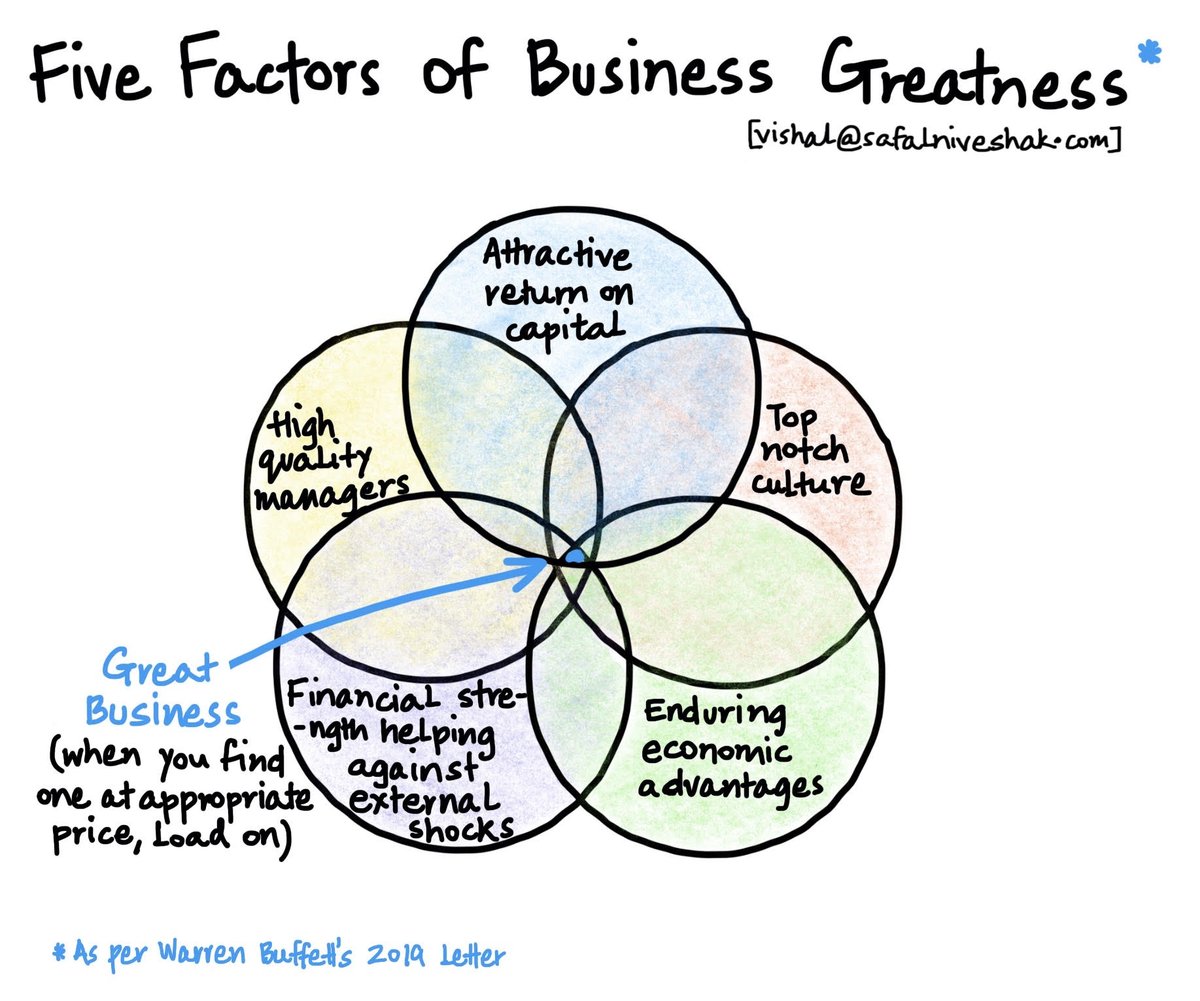

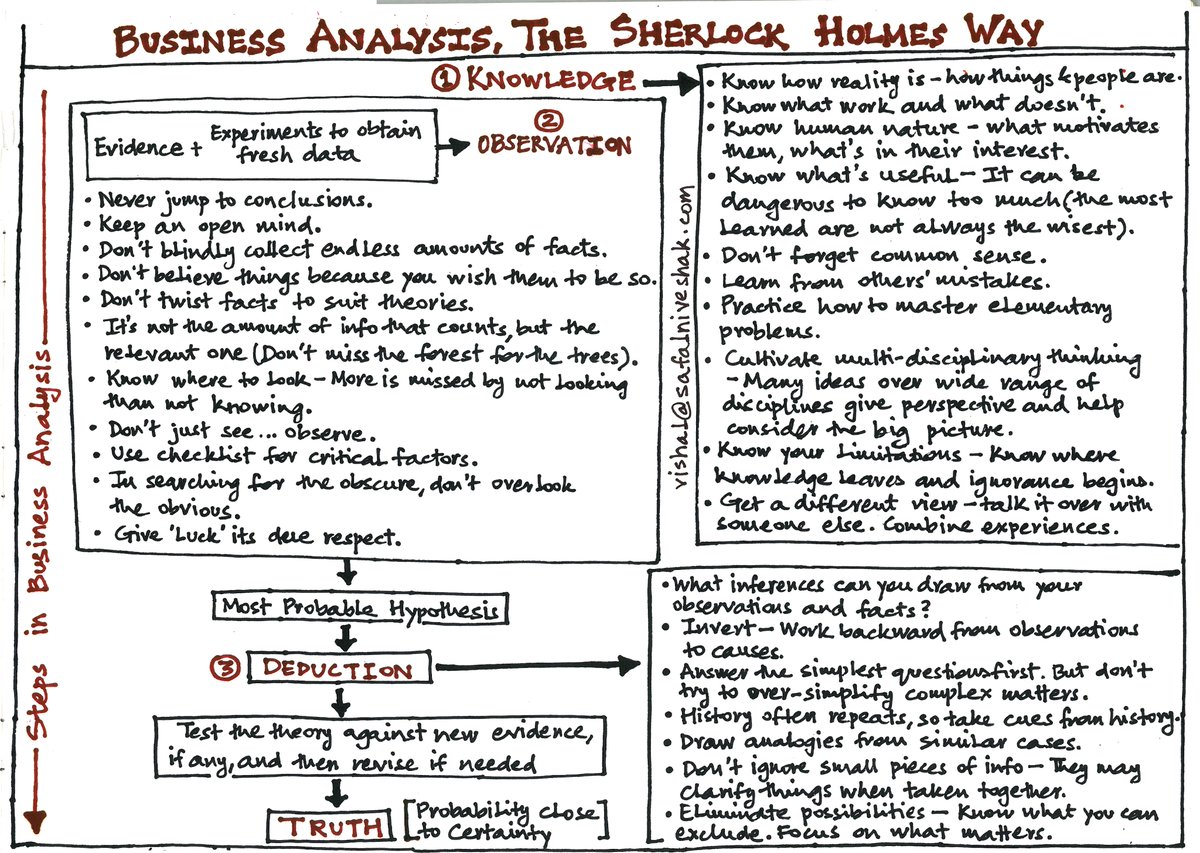

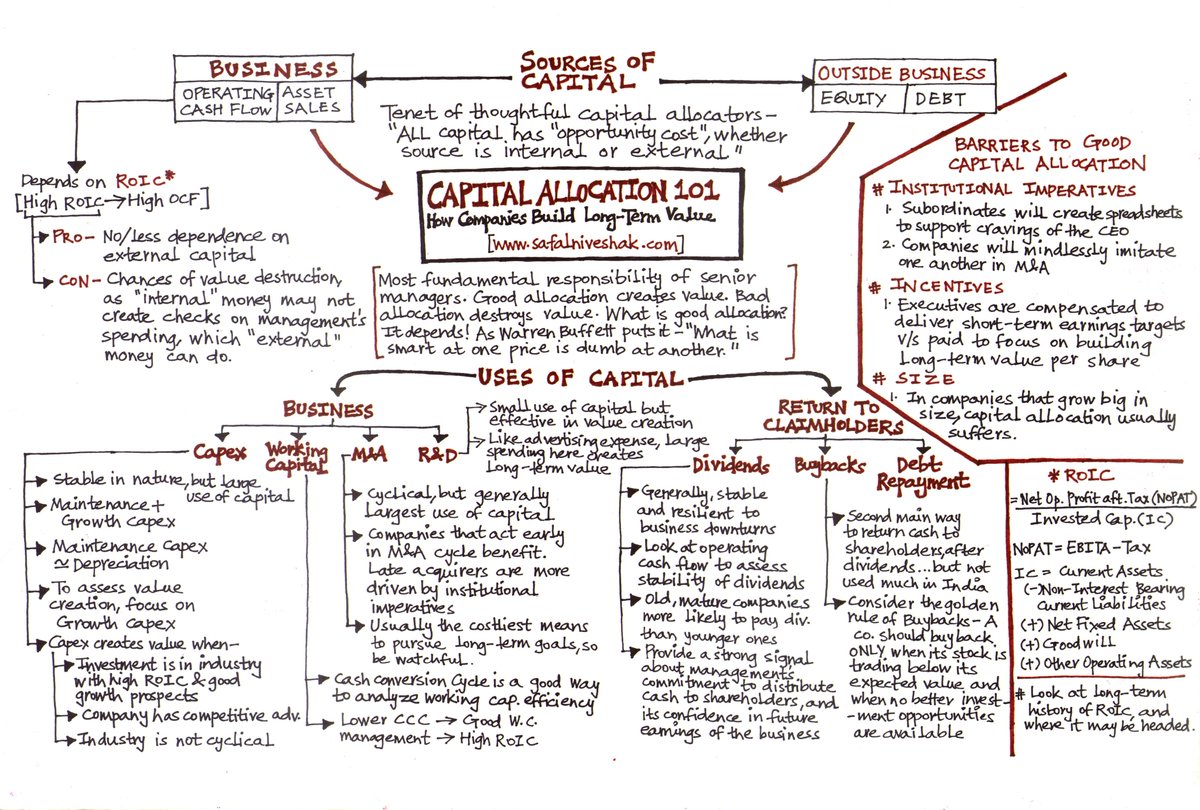

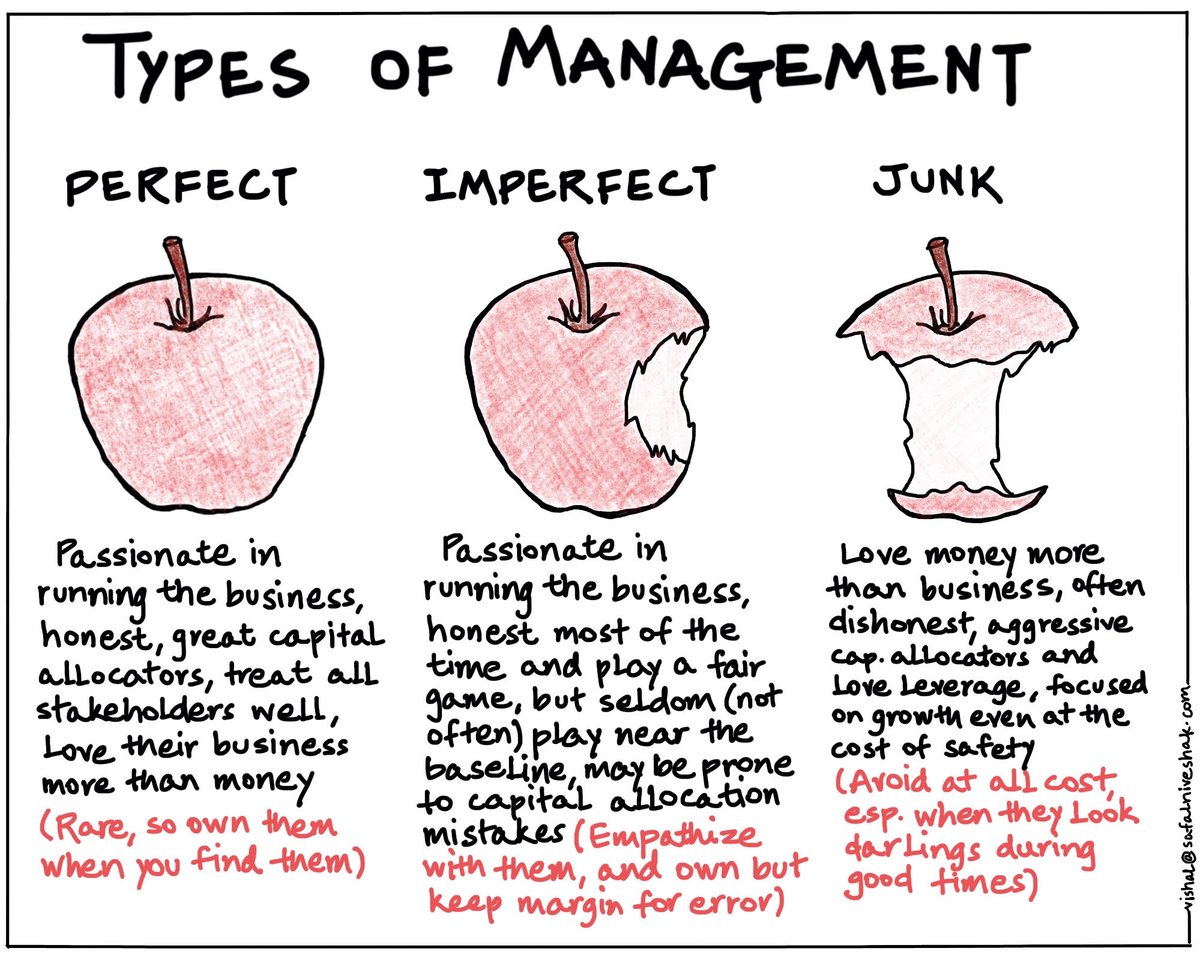

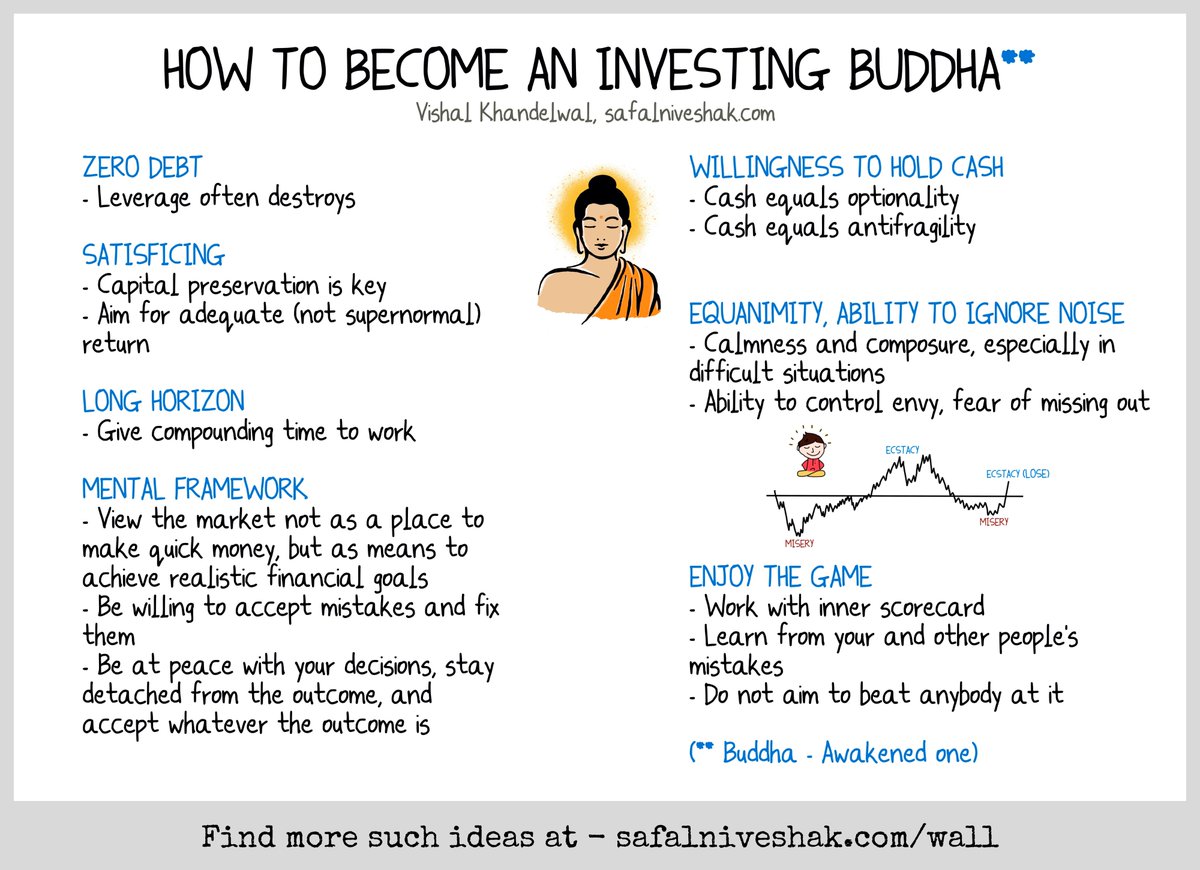

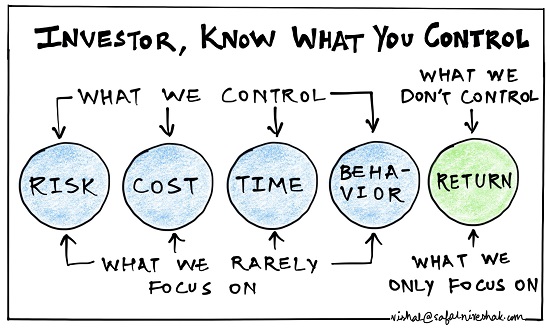

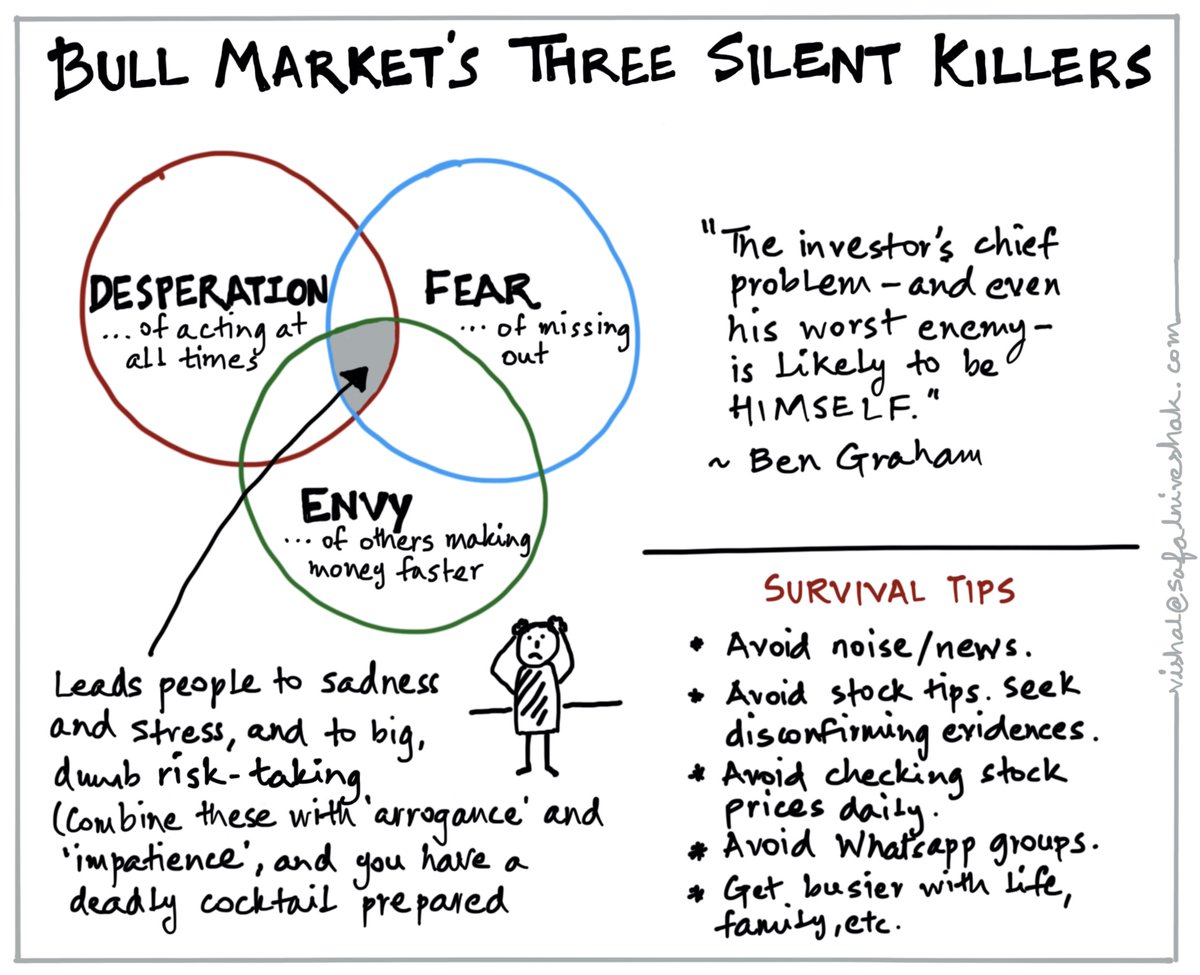

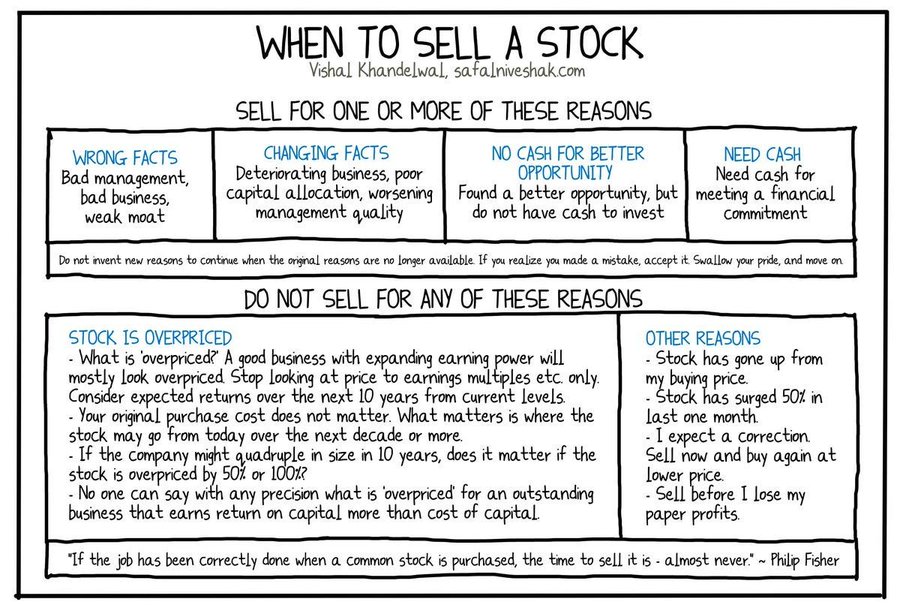

All credit to @safalniveshak for making these great images.

Follow him for more great content!

Follow him for more great content!

If you like investing visuals, you'll love my free ebook:

99 Powerful Financial Lessons - Visualized

Grab a copy of it here:

https://t.co/qYUnxgeI5Vbrianferoldi.ck.page/99

99 Powerful Financial Lessons - Visualized

Grab a copy of it here:

https://t.co/qYUnxgeI5Vbrianferoldi.ck.page/99

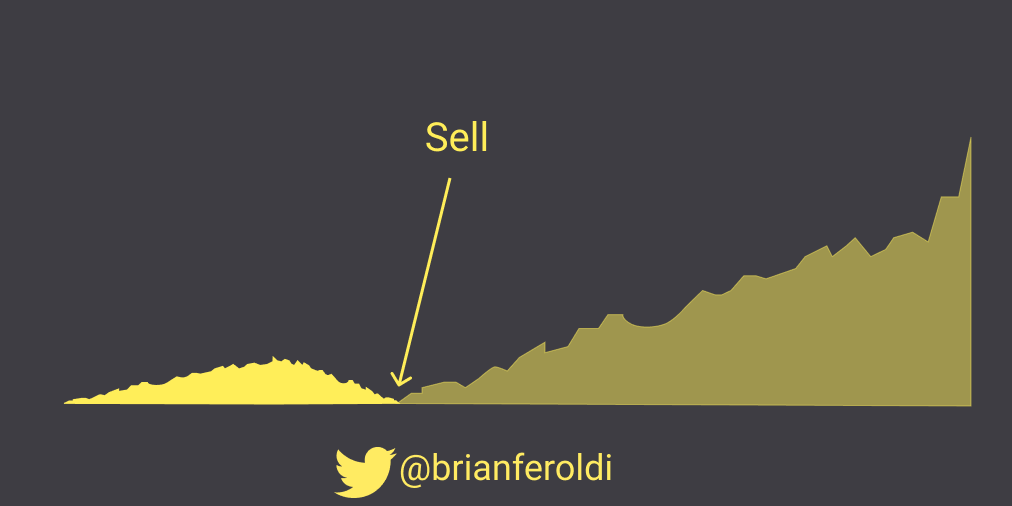

Like this thread? Follow me @BrianFeroldi.

I demystify the stock market with daily tweets and weekly threads like this.

To share this thread with your audience, ♻️ retweet the first tweet below.

I demystify the stock market with daily tweets and weekly threads like this.

To share this thread with your audience, ♻️ retweet the first tweet below.

https://twitter.com/61558281/status/1690699697458122754

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter