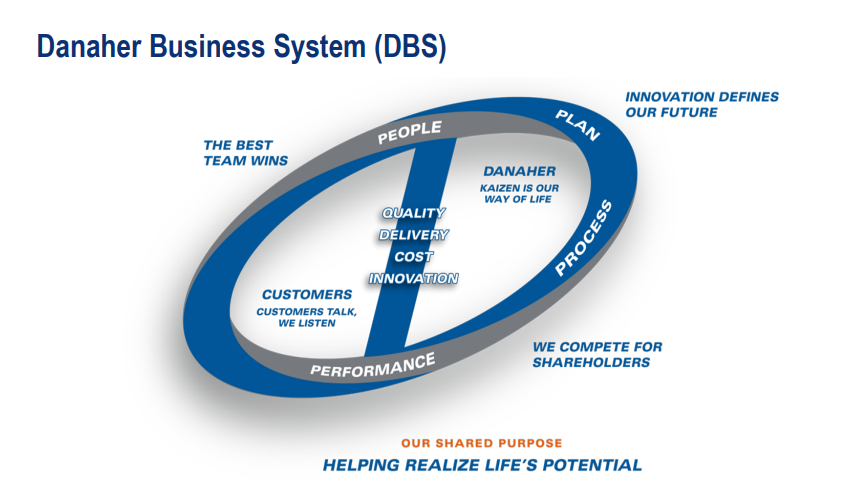

$DHR was the first company I came across that had a “business system” – a structured operating framework used to drive continuous growth & improvement

Many other companies have similar systems in place

Often these have proved to be exceptional businesses

Here’s 10 I've found

Many other companies have similar systems in place

Often these have proved to be exceptional businesses

Here’s 10 I've found

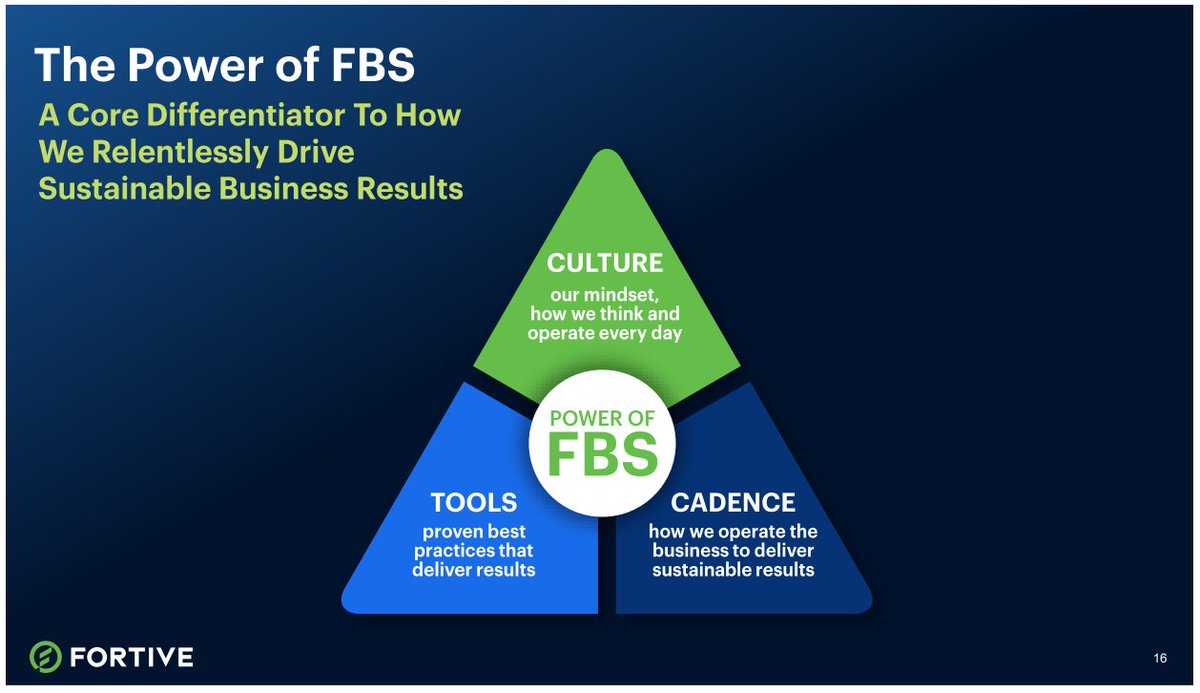

First up is Fortive $FTV

$DHR's framework unsurprisingly extended to its spun-off industrial business, which has a similar system – the “Fortive Business System”

$DHR's framework unsurprisingly extended to its spun-off industrial business, which has a similar system – the “Fortive Business System”

Novanta $NOVT – a ~10x bagger since 2016 – leverages its Novanta Growth System

$NOVT is a mfg of a wide suite of high precision lasers, sensors, robotics, motion control & other subsystem components used in advanced industrial & medical product applications

$NOVT is a mfg of a wide suite of high precision lasers, sensors, robotics, motion control & other subsystem components used in advanced industrial & medical product applications

Lincoln Electric $LECO – a global leader in arc welding equipment, utilizes its six-spoke LBS – Lincoln Business System

Atkore $ATKR – another nearly ~10x bagger since 2016, utilizes its Atkore Business System

$ATKR is a mfg of electrical conduit, fittings, cables and infrastructure, safety and security products which has more than doubled its EBITDA margins since 2016

$ATKR is a mfg of electrical conduit, fittings, cables and infrastructure, safety and security products which has more than doubled its EBITDA margins since 2016

Analytical test instrument, automation and motion control manufacturer AMETEK $AME has its "AMETEK Growth Model" system

Nordson $NDSN, an equipt mfg for industrial adhesives, sealants & coatings, utilizes its NBS Next Growth Framework

SPX Technologies $SPXC – has its “SPX Business Value Model”

$SPXC is a leading supplier of HVAC & detection & measurement products and technologies

$SPXC is a leading supplier of HVAC & detection & measurement products and technologies

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter