Three years ago, $SE had a GOLDEN opportunity.

E-Commerce was a nascent business for $SE, but the pandemic made it ENORMOUSLY important.

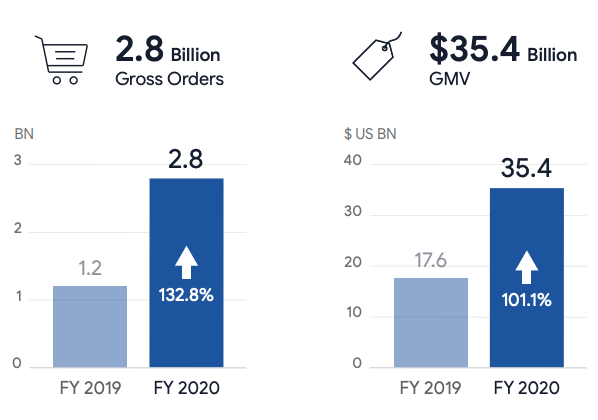

$SE's Shopee (think Amazon) saw orders and GMV more than double.

It had a leading position in SE Asia

E-Commerce was a nascent business for $SE, but the pandemic made it ENORMOUSLY important.

$SE's Shopee (think Amazon) saw orders and GMV more than double.

It had a leading position in SE Asia

The company had secondary offering 2021 bringing cash to $10B +

*IF* it had spent that cash on a SE Asia Fulfillment network, it would have secured its future.

🛑FULL STOP

But it didn't do that

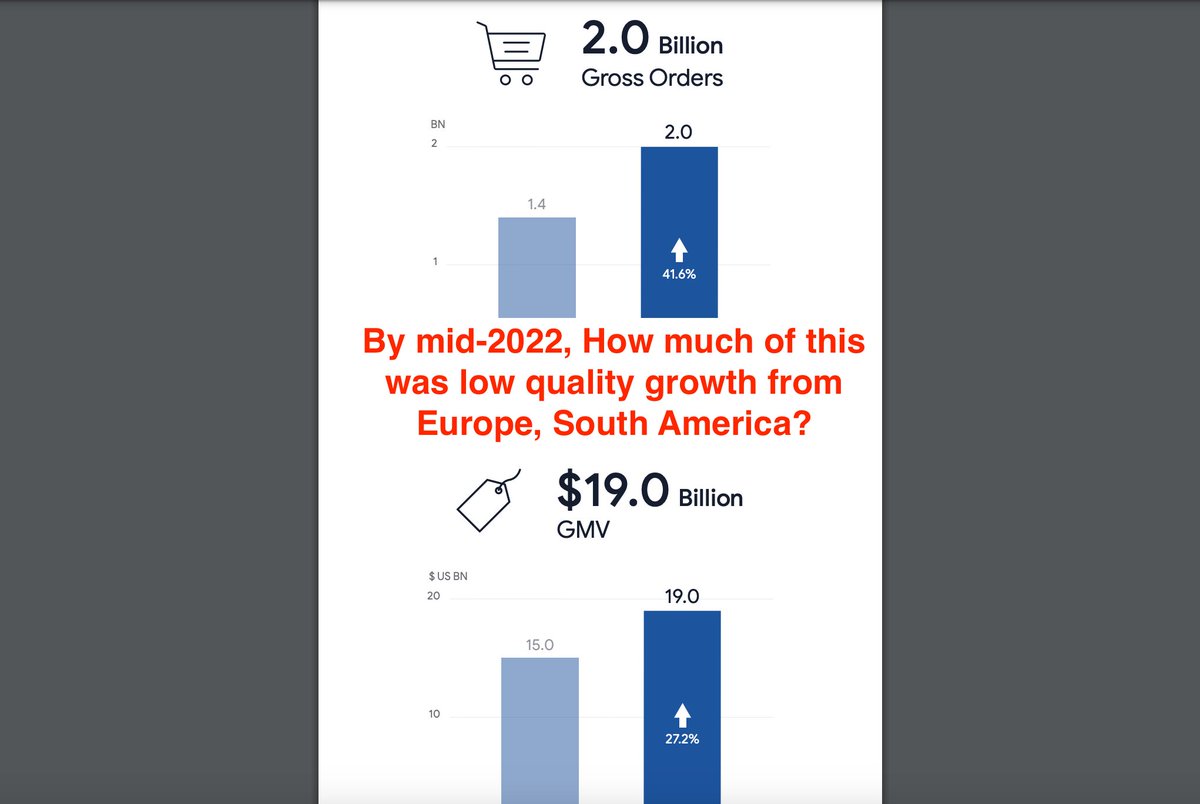

It pursued low-quality growth in Europe, France -- even the US

Terrible decision!

*IF* it had spent that cash on a SE Asia Fulfillment network, it would have secured its future.

🛑FULL STOP

But it didn't do that

It pursued low-quality growth in Europe, France -- even the US

Terrible decision!

These forays grew revenue, but there was NO MOAT surrounding these far-flung businesses.

And meanwhile, by not investing in SE Asia fulfillment, competitors like Lazada and even TikTok were given an opportunity.

Yes, building fulfillment = slower growth. But also SUSTAINABILITY

And meanwhile, by not investing in SE Asia fulfillment, competitors like Lazada and even TikTok were given an opportunity.

Yes, building fulfillment = slower growth. But also SUSTAINABILITY

By end of 2022, Forrest Li realized some problems

🎮 Gaming division saw growth plummet

🏦Cash pile was down to ~$6B

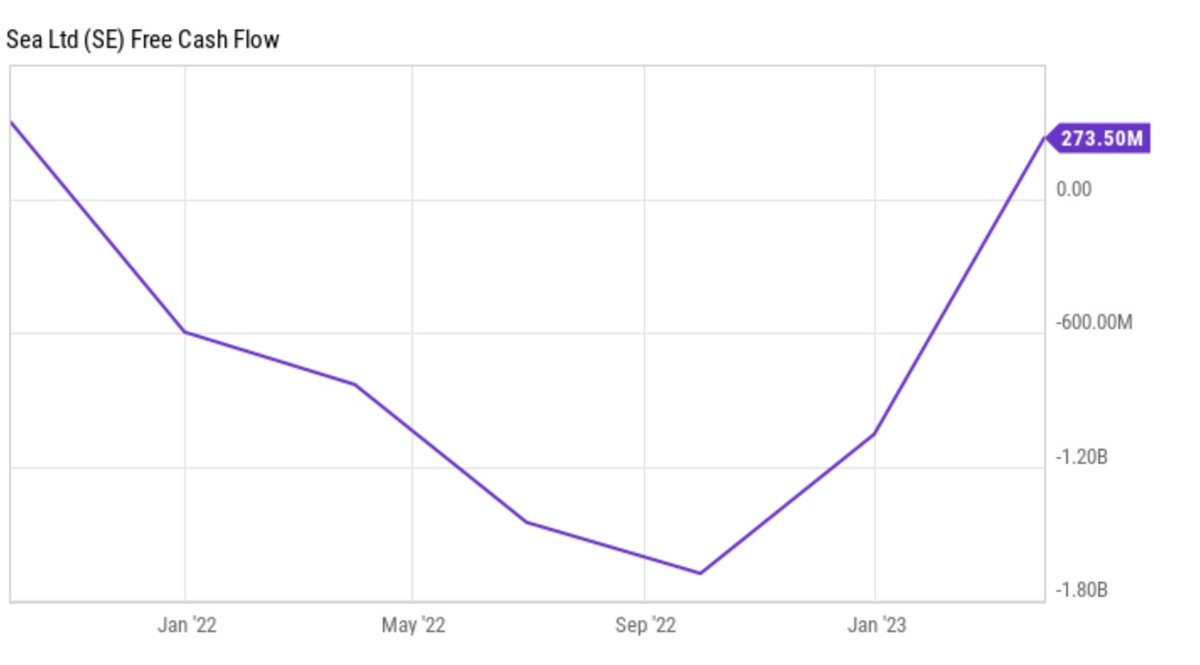

📉 FCF was ~($2 billion)

Low-quality e-commerce revs dried up

Moat around SE Asia ecommerce was weak

But he needed profits fast!

What did he do?

🎮 Gaming division saw growth plummet

🏦Cash pile was down to ~$6B

📉 FCF was ~($2 billion)

Low-quality e-commerce revs dried up

Moat around SE Asia ecommerce was weak

But he needed profits fast!

What did he do?

He pulled off a miracle.

Went from huge FCF losses to gains in just two quarters

HOW?

1️⃣ Slash sales and marketing by ~60%

2️⃣ Increase fees like crazy for Shopee users

It did the trick in the short-run, but may have been a long-term death nell

Went from huge FCF losses to gains in just two quarters

HOW?

1️⃣ Slash sales and marketing by ~60%

2️⃣ Increase fees like crazy for Shopee users

It did the trick in the short-run, but may have been a long-term death nell

Would YOU use Shopee with such price increases?

Since fulfillment wasn't built out, the only moat = brand.

But Li was tarnishing brand

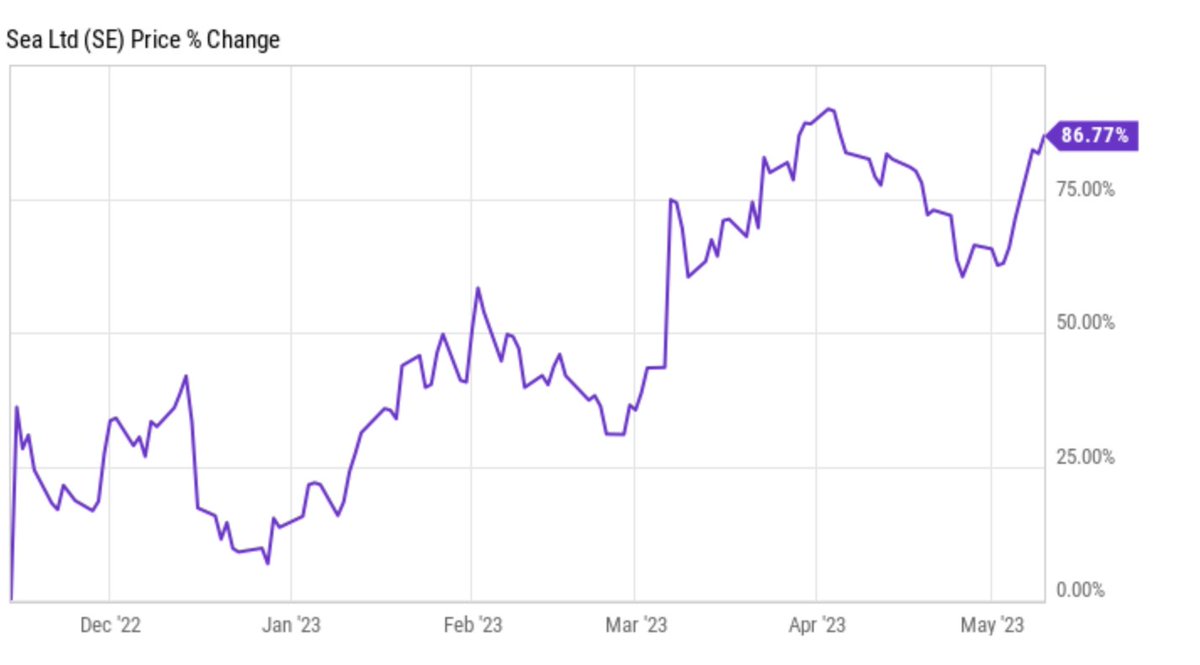

Wall St didn't care, though, it loved the profitability. Shares jumped ~90% in a few months

Since fulfillment wasn't built out, the only moat = brand.

But Li was tarnishing brand

Wall St didn't care, though, it loved the profitability. Shares jumped ~90% in a few months

But if you only satisfy Wall Street -- and not your CUSTOMERS, the chickens will eventually come home to roost.

That's what's happening now.

Core marketplace revs were up 37% -- but that's off price increases.

Gross orders were only up 10%

That's what's happening now.

Core marketplace revs were up 37% -- but that's off price increases.

Gross orders were only up 10%

And NOW Li says he's investing in fulfillment - 3️⃣ years too late

If they pull it off, today's prices look VERY tempting

But I won't be putting a dime in.

$SE squandered of a GOLDEN opportunity due undisciplined sales grabs across the globe.

There are better places for my $$

If they pull it off, today's prices look VERY tempting

But I won't be putting a dime in.

$SE squandered of a GOLDEN opportunity due undisciplined sales grabs across the globe.

There are better places for my $$

If you enjoyed this thread:

1. Follow me @Brian_Stoffel_ for more of these

2. RT the tweet below to share this thread with your audience

1. Follow me @Brian_Stoffel_ for more of these

2. RT the tweet below to share this thread with your audience

https://twitter.com/331913203/status/1691460484007141378

• • •

Missing some Tweet in this thread? You can try to

force a refresh