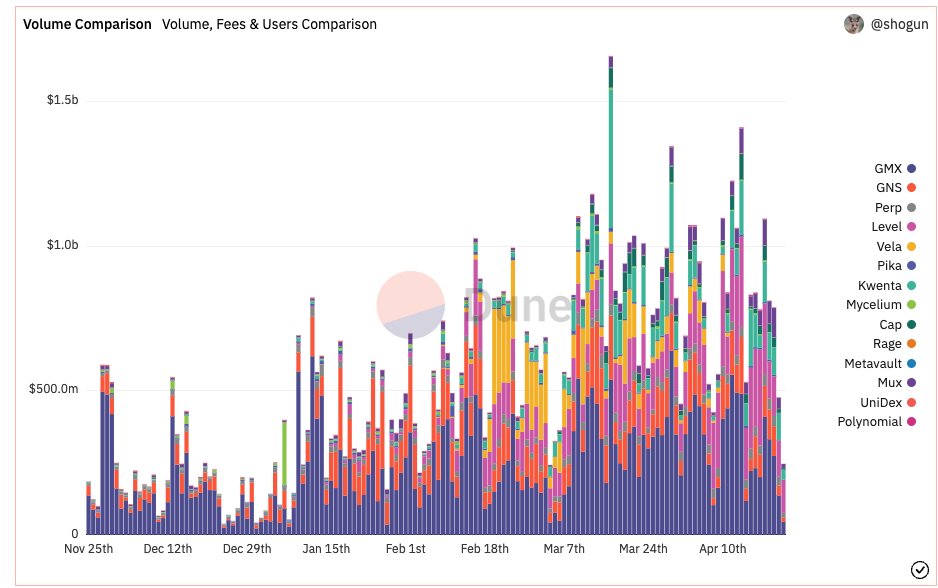

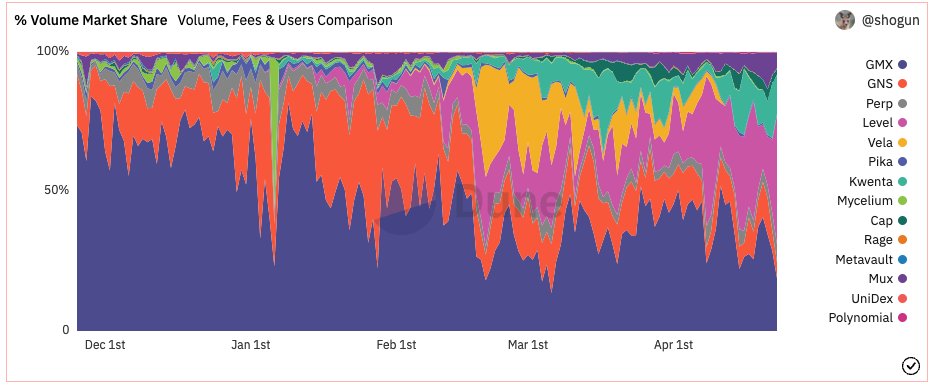

GM(x) frens 🫐❤️ After messing around with @GMX_IO V2 for almost 2 weeks I want to breakdown why I think it is (once again) defining a new gold standard for the DEX perp sector. I start with a breakdown of the liquidity and fee model. Welcome to the beautiful new world of GM.

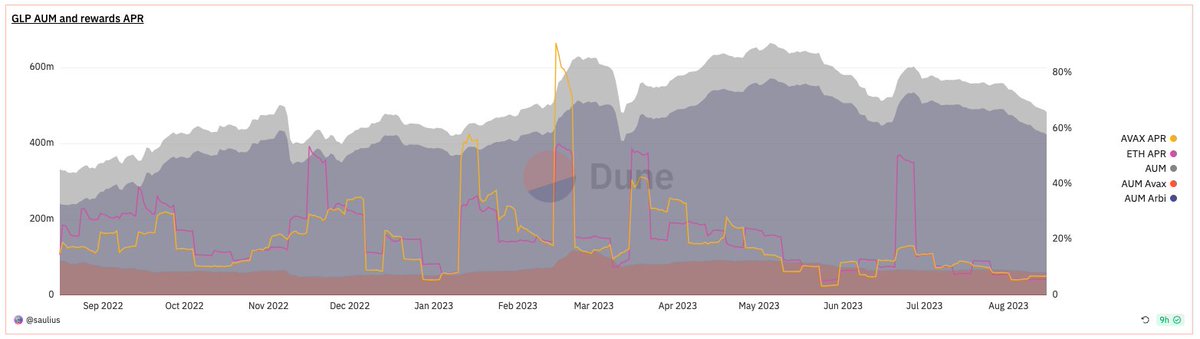

The success of GMX is strongly connected with the liquidity model GLP. At the recent top GLP had a TVL of $576m and undoubtedly started a wave of iterations, protocols building on top of it and utilisations of GLP for defi dapps (@muxprotocol, @Dolomite_io, @rage_trade,...)

GLPs success is strongly connected to its simplicity. It offers muted exposure to BTC/ETH volatility and providing "real yield". It allows for no-price-impact trading, which is interesting for large trading volumes, yielding high fees, paid back to liquidity providers and stakers

Despite its success GLP has a series of limitations:

🫐 Low capital efficiency (volume caps to reduce risk)

🫐 No incentives to balance OI (directional market exposure)

🫐 Limitations of tradable assets (full backing in GLP necessary)

🫐 Comparably high fees for small trades

🫐 Low capital efficiency (volume caps to reduce risk)

🫐 No incentives to balance OI (directional market exposure)

🫐 Limitations of tradable assets (full backing in GLP necessary)

🫐 Comparably high fees for small trades

With V2, GM is introduced as the new liquidity token. GM splits liquidity into isolated pools limiting risk to the respective pools.

Every pool consists of 3 token

🫐 Long backing

🫐 Short backing

🫐 Index

Both native token pools (e.g. ARB-USDC) and synthetic pools are available

Every pool consists of 3 token

🫐 Long backing

🫐 Short backing

🫐 Index

Both native token pools (e.g. ARB-USDC) and synthetic pools are available

Similar to GLP the price of GM is determined by the composition and the price of its backing assets, but I would like to point out some differences and common misunderstandings:

(1) With GLP, fees are collected within one week and distributed in the following week.

(1) With GLP, fees are collected within one week and distributed in the following week.

This opens up to mercenary capital buying into GLP after a strong week, diluting the yield for GLP holders. GM on the other hand is auto-compounding and adds accrued fees directly to the respective GM pool, rewarding liquidity providers immediately.

(2) A common misunderstanding of both GLP and GM is that those LPs can experience impermanent loss (IL). This is neither the case for GLP or GM, since IL is a defined mechanism that only occurs for auto-balancing pools (e.g. UNI V3 pools).

GM pools are not auto-balancing, the asset ratio is independent from the price of its backing assets. Simply put: There is no IL in GM pools. BUT balancing of the pools IS crucial and a key difference to GLP. There are several mechanisms available for that in V2:

(1) Swap impact: When you buy into a lopsided pool with the overrepresented asset you pay a price impact fee, which is collected in a swap impact pool.

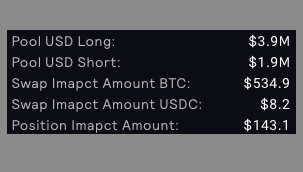

Example: There are $3.9m wBTC and $1.9m USDC in the BTC-USDC pool. The swap impact BTC pool contains $535.

Example: There are $3.9m wBTC and $1.9m USDC in the BTC-USDC pool. The swap impact BTC pool contains $535.

Those funds are proportional distributed when swapping USDC against wBTC via this pool. If you would swap $100k USDC vs wBTC right now, you essentially get paid $91 from the swap price impact pool for doing so (wen integration of V2 pools @1inch, @paraswap,...)

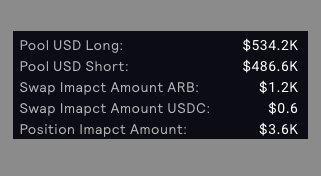

The stronger the lop-side, the higher the positive price impact. Keep in mind that this is a dynamic setup. For example there are now $1.2k in the ARB-USDC swap impact pool, but the pool itself is almost perfectly balanced, the swap impact pool is currently not utilised.

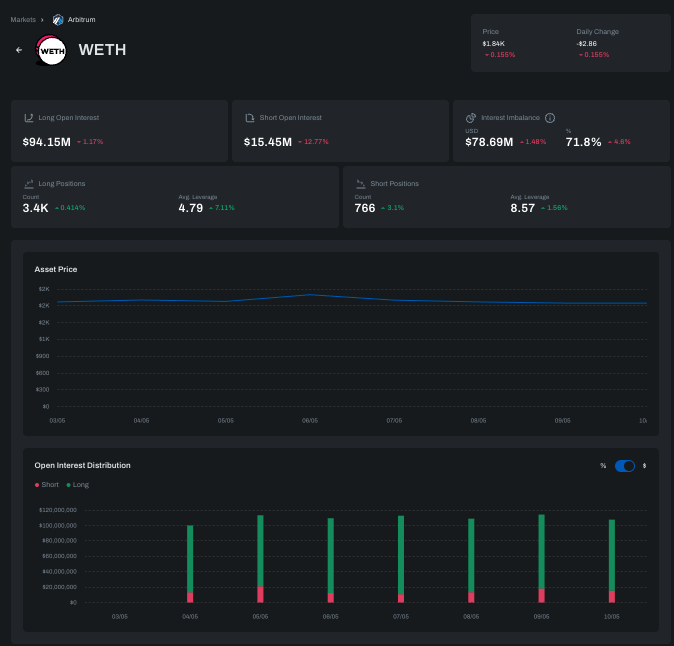

(2) Price impact: Besides the pool balancing there is also balancing of open interest in V2. Balancing of OI is encouraged by price impact on positions. Every time a position on the overrepresented OI side is opened a price impact is deducted from the position.

This fee is collected into a position impact pool.When opening a position on the underrepresented side of OI there is proportional positive price impact on the position.

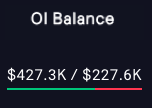

Example: There are $3.6k in the position impact pool for ARB-USDC. OI is lopsided $427k : $228k long : short.

Example: There are $3.6k in the position impact pool for ARB-USDC. OI is lopsided $427k : $228k long : short.

Opening a $150k short position ($30k collateral, 5x leverage), gives a positive price impact of $149. After paying the opening fee the position is still $73in profits before any price movement.

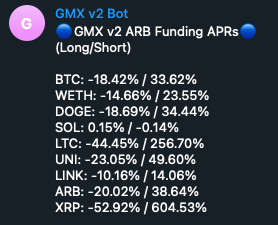

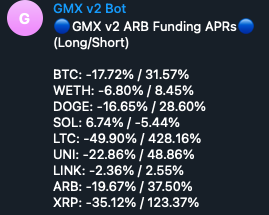

(3) Funding fees: V2 introduces funding fees to additionally support OI balancing. Holding positions on the overrepresented OI side incentivises positions on the underrepresented side. APRs can be quite interesting for market makers to take advantage of.

Example: Check current funding fees for V2 pairs in @SniperMonke01 V2 bot. XRP funding for shorting was high indicating a strong OI misbalance in the first pic. This was incentivising people to open more short positions (second screenshot)

Negative Funding Fees are settled against the collateral automatically and will influence the liquidation price. Positive Funding Fees can be claimed under Claimable Funding after realizing any action on the position.

(4) Borrow fees: The borrow fee applies to all positions leverage trading and is redistributed to GM providers and $GMX stakers. It is currently set to zero if you are holding a position on the side with less OI, additionally favouring OI balancing.

Short breakdown of V2 liquidity and fees

🫐 Isolated GM pools

🫐 No IL

🫐 Higher capital efficiency

🫐 Strong incentives to balancing pools and OI (risk reduction)

🫐 Utilisation of pools for leverage trading but also for swaps

🫐 Isolated GM pools

🫐 No IL

🫐 Higher capital efficiency

🫐 Strong incentives to balancing pools and OI (risk reduction)

🫐 Utilisation of pools for leverage trading but also for swaps

Why is this going to be a game changer now ?

Some thoughts:

🫐 Risk management: Isolated pools allow for superior highly scalable LP risk management

🫐 GM allows to build “custom made GLP”, which again can be automatised by third parties as it was done for GLP

Some thoughts:

🫐 Risk management: Isolated pools allow for superior highly scalable LP risk management

🫐 GM allows to build “custom made GLP”, which again can be automatised by third parties as it was done for GLP

🫐 Fee structure: The fee structure in V2 allows traders to open big positions with essentially positive price impact and zero fees under certain market conditions. This strategy is usually utilised by market makers on centralised exchanges and eventually transferred to Defi

🫐 GMX V2 allows unique combinations of providing liquidity and trade- and swap-arbing, enabling advanced trading strategies, that will eventually be utilised by third parties.

➡️ GMX V2 evolves the simplicity of GLP into a modular toolkit for liquidity providers, traders and third party protocols, putting a major focus on risk management

There are more features in-house for V2, but if you made it until here I think it is fair to call it a day. GN(x)

There are more features in-house for V2, but if you made it until here I think it is fair to call it a day. GN(x)

Tagging frens and chads for visibility:

@Castle__Cap

@DoveyWan

@TheCryptoDog

@CryptoFinally

@0xngmi

@DeFiMann

@tanoeth

@francescoweb3

@crypto_linn

@JiraiyaReal

@LadyofCrypto1

@JamesCliffyz

@rektdiomedes

@coinflipcanada

@Kalcrypto1

@Jonas_ALA

@SniperMonke01

@hansolar21

@Castle__Cap

@DoveyWan

@TheCryptoDog

@CryptoFinally

@0xngmi

@DeFiMann

@tanoeth

@francescoweb3

@crypto_linn

@JiraiyaReal

@LadyofCrypto1

@JamesCliffyz

@rektdiomedes

@coinflipcanada

@Kalcrypto1

@Jonas_ALA

@SniperMonke01

@hansolar21

More awesome people:

@crypto_noodles

@sliux

@JJcycles

@defi_mochi

@defipleb

@0xthade

@realdumbird

@Crypt0_Andrew

@unexployed_

@GBlueberryClub

@resdegen

@gmx_intern

@SquigsCat

@Howth88

Thanks for reading, enjoy your day 🫐❤️

@crypto_noodles

@sliux

@JJcycles

@defi_mochi

@defipleb

@0xthade

@realdumbird

@Crypt0_Andrew

@unexployed_

@GBlueberryClub

@resdegen

@gmx_intern

@SquigsCat

@Howth88

Thanks for reading, enjoy your day 🫐❤️

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter