How to get URL link on X (Twitter) App

The success of GMX is strongly connected with the liquidity model GLP. At the recent top GLP had a TVL of $576m and undoubtedly started a wave of iterations, protocols building on top of it and utilisations of GLP for defi dapps (@muxprotocol, @Dolomite_io, @rage_trade,...)

The success of GMX is strongly connected with the liquidity model GLP. At the recent top GLP had a TVL of $576m and undoubtedly started a wave of iterations, protocols building on top of it and utilisations of GLP for defi dapps (@muxprotocol, @Dolomite_io, @rage_trade,...)

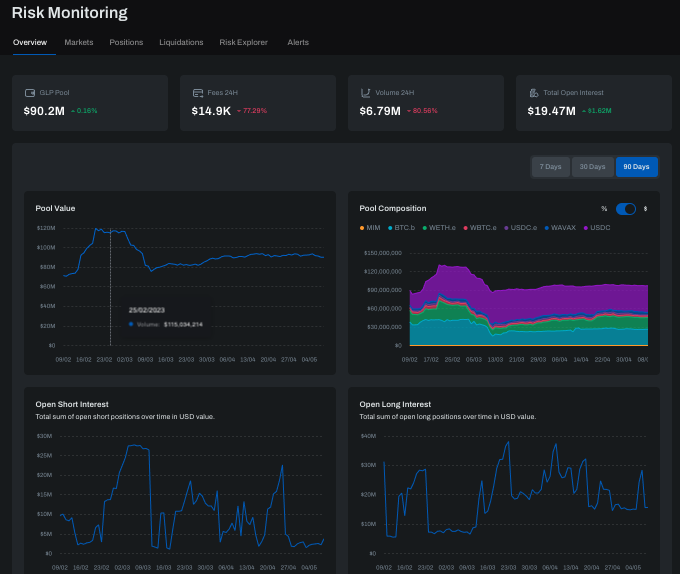

2/7 The dashboard offers a variety of tabs beginning with an overview tab visualising high-level stats of the platform like pool value and composition, open interest and fees. You can toggle between stats for @arbitrum and @avax. Very smooth and professional UI in my opinion.

2/7 The dashboard offers a variety of tabs beginning with an overview tab visualising high-level stats of the platform like pool value and composition, open interest and fees. You can toggle between stats for @arbitrum and @avax. Very smooth and professional UI in my opinion.

2/4

2/4

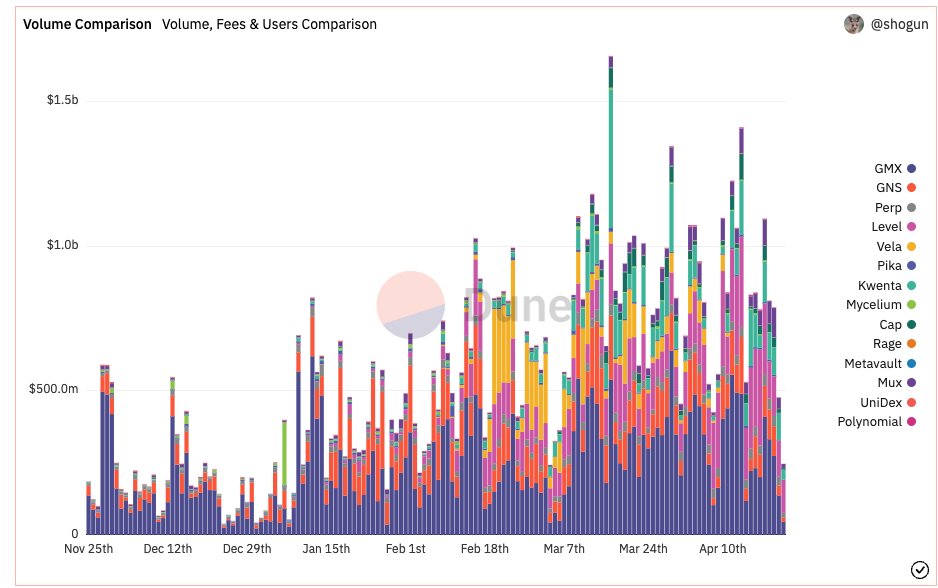

2/13 When looking at trading volume of derivate exchanges on @tokenterminal, you find @GMX_IO, @GainsNetwork_io, @Level__Finance and @muxprotocol among those with high trading volumes in the last 30 days. How do these 4 compare?

2/13 When looking at trading volume of derivate exchanges on @tokenterminal, you find @GMX_IO, @GainsNetwork_io, @Level__Finance and @muxprotocol among those with high trading volumes in the last 30 days. How do these 4 compare?

2/9 The total volume of selected protocols more than doubled on average from Nov/Dec 22 to Feb/March 23. While @GMX_IO was dominating the market in 22, volume got fragmented in 2023. Anyhow, volume on GMX doubled on average as well, showing heavy growth of the overall sector.

2/9 The total volume of selected protocols more than doubled on average from Nov/Dec 22 to Feb/March 23. While @GMX_IO was dominating the market in 22, volume got fragmented in 2023. Anyhow, volume on GMX doubled on average as well, showing heavy growth of the overall sector.

https://twitter.com/Rewkang/status/1616476297844391936?s=20&t=pCdnLJQXcDbOL2369d4jXQ2/9 Currently, @Rewkang has circa $16m of open profits in his trades including positions both on @arbitrum and on @avalancheavax. He withdrew most of his collateral already or the collateral was reduced by fees since most of the trades started at very high leverage close to 50x.

https://twitter.com/napgener/status/1596304990108549120?s=20&t=Ve77jQt1BuzDFDNnu1J7VQ2/10 The address they are talking about is this one: