You don't need to pay $1000s to learn to trade.

Do it yourself in 10 days.

Here's 10 powerful trading resources that cost less then $10 🧵

Do it yourself in 10 days.

Here's 10 powerful trading resources that cost less then $10 🧵

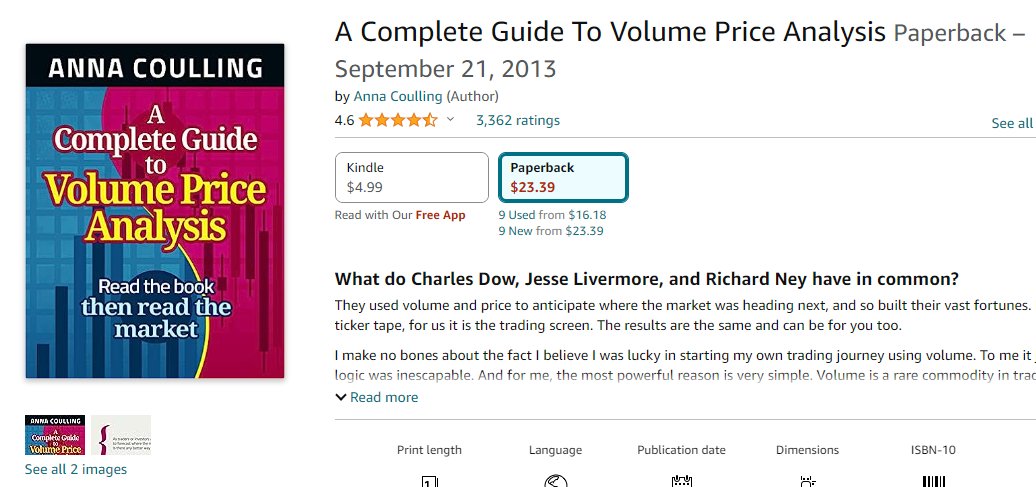

1. Volume Price Analysis by @annacoull

• This is a critical part of technical analysis and no one has written a better book on volume then Anna.

• Every pro-trader must understand how volume relates to price.

Time to study: (3 hours)

• This is a critical part of technical analysis and no one has written a better book on volume then Anna.

• Every pro-trader must understand how volume relates to price.

Time to study: (3 hours)

2. Mark Douglas Seminars

• Mark Douglas wrote 2 books "Trading in the Zone" & "The Disciplined Trader"

• He also did a 4-lessons on Trading Psychology

• Every trader on earth has been taught by Mark Douglas

Time to study: (4.5 hours)

https://t.co/f4Obm1lamV

• Mark Douglas wrote 2 books "Trading in the Zone" & "The Disciplined Trader"

• He also did a 4-lessons on Trading Psychology

• Every trader on earth has been taught by Mark Douglas

Time to study: (4.5 hours)

https://t.co/f4Obm1lamV

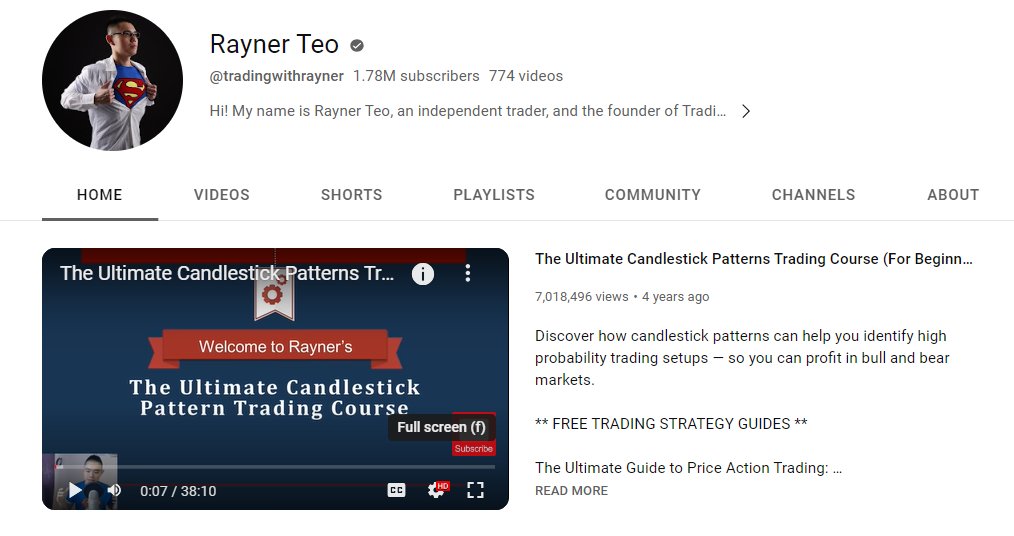

3. Candlestick analysis and technical analysis @Rayner_Teo

• This is probably the best FREE content for your to learn from each day.

• It covers everything you need to read a trading chart like an expert.

Time to study: (6 hours)

• This is probably the best FREE content for your to learn from each day.

• It covers everything you need to read a trading chart like an expert.

Time to study: (6 hours)

4. The Mental Game of Trading by @jaredtendler

• One of the best books to create process for you to manage emotions.

• A lot of your trading mistakes is due to emotional issues you will need to uncover.

Time to study: (4 hours) https://t.co/6bzSJTKHCzjaredtendler.com/books/the-ment…

• One of the best books to create process for you to manage emotions.

• A lot of your trading mistakes is due to emotional issues you will need to uncover.

Time to study: (4 hours) https://t.co/6bzSJTKHCzjaredtendler.com/books/the-ment…

5. This is a FREE class on scalping SPY options done by us!

•

• Comment "Swing" If you are interested in Part 2 for options trading for beginners.

Time to study: (1 hour)vimeo.com/851943170/79c1…

•

• Comment "Swing" If you are interested in Part 2 for options trading for beginners.

Time to study: (1 hour)vimeo.com/851943170/79c1…

6. @thinkorswim Options Trading Tutorial (Lessons).

• TOS is the platform we use and @WebullGlobal so these lessons are great for beginners and intermediate traders.

Time to study: (10 hours)

•

• TOS is the platform we use and @WebullGlobal so these lessons are great for beginners and intermediate traders.

Time to study: (10 hours)

•

@thinkorswim @WebullGlobal 7. This is a great lesson on where to set a stop loss for risk management!

Time to study: (1 hours)

Time to study: (1 hours)

https://twitter.com/1061650783333040129/status/1672696644658429952

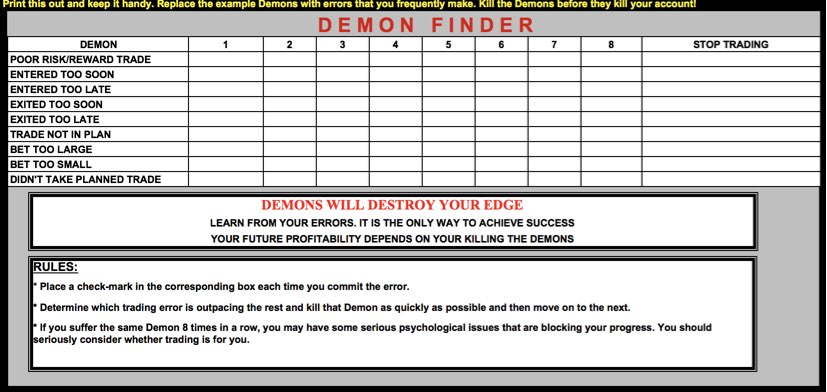

8. Trading mistakes you could be making!

• I'd recreate this for yourself with your personal trading mistakes.

• Then track your mistakes the best way you can.

• This is the only way to get better is to learn from mistakes.

Time to study: (everyday 30 mins)

• I'd recreate this for yourself with your personal trading mistakes.

• Then track your mistakes the best way you can.

• This is the only way to get better is to learn from mistakes.

Time to study: (everyday 30 mins)

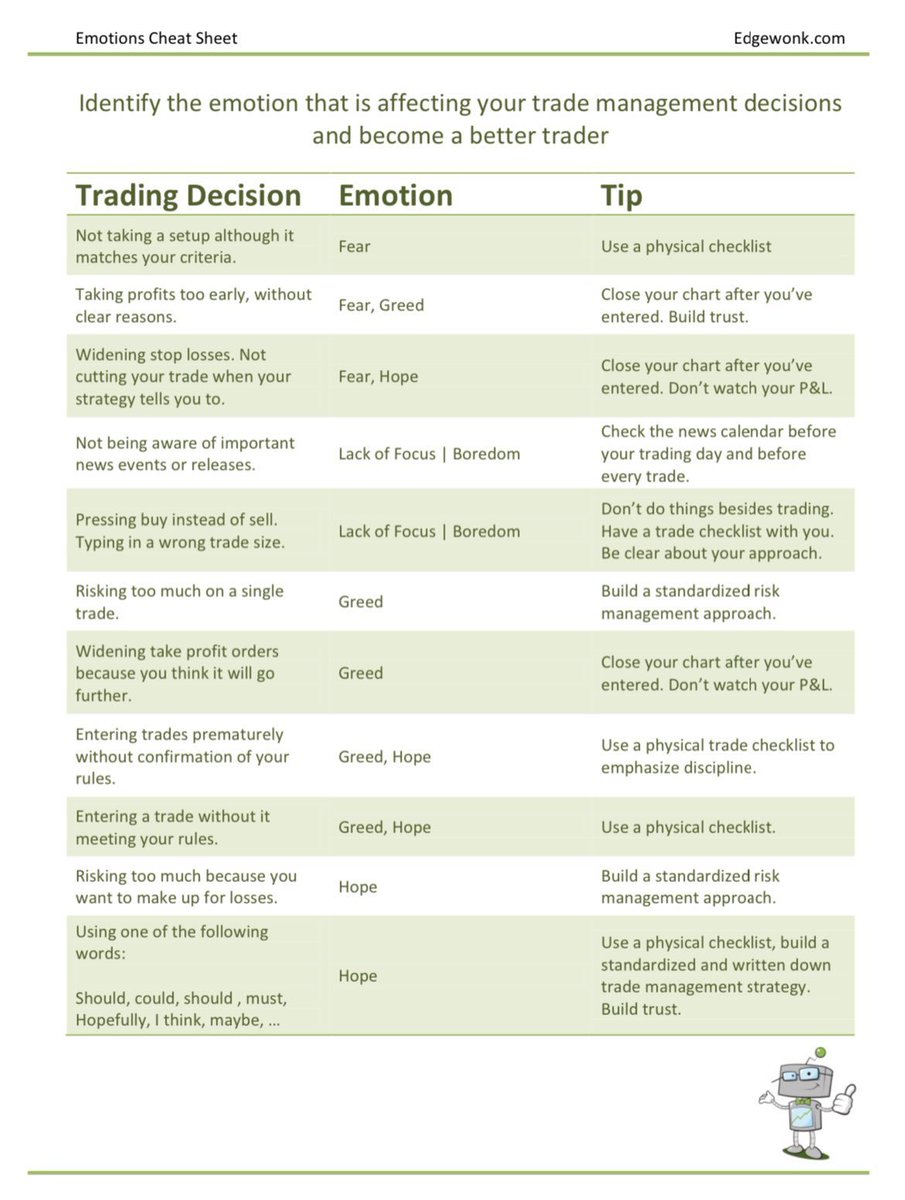

9. @edgewonk

• Take a moment to write down what decisions you are making and why they are making you lose money.

• Then write down how you can improve!

Time to study: (everyday 30 mins)

• Take a moment to write down what decisions you are making and why they are making you lose money.

• Then write down how you can improve!

Time to study: (everyday 30 mins)

10. Risk Management and Mindset is really important

• Take 1 hour to review this lesson.

• Trading isn't about being right or executing trades really.

• Its about knowing what to do when you are in a losing trade.

https://t.co/g8x2UeVFLzvimeo.com/738818718/f14f…

• Take 1 hour to review this lesson.

• Trading isn't about being right or executing trades really.

• Its about knowing what to do when you are in a losing trade.

https://t.co/g8x2UeVFLzvimeo.com/738818718/f14f…

Follow me @SuperLuckeee for more of my trading lessons, analysis and plays.

- RT to share with your audience and help others.

- Make sure you ❤️the post below and BOOKMARK it for reference.

- RT to share with your audience and help others.

- Make sure you ❤️the post below and BOOKMARK it for reference.

https://twitter.com/1061650783333040129/status/1692271766519894289

• • •

Missing some Tweet in this thread? You can try to

force a refresh