Danaher used DBS to build a $200 billion company and generate a 45x return.

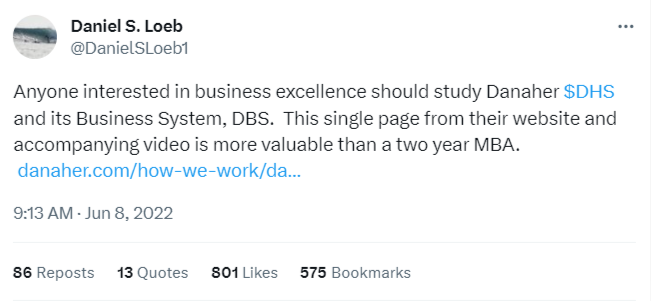

Billionaire investor Dan Loeb believes studying Danaher is worth more than a 2-year MBA.

In this thread, we’ll dive into the actual tools & tactics behind their success - Danaher Business System (DBS):

Billionaire investor Dan Loeb believes studying Danaher is worth more than a 2-year MBA.

In this thread, we’ll dive into the actual tools & tactics behind their success - Danaher Business System (DBS):

Before jumping in, if you haven’t seen my last thread (pinned on my page), I recommend you review it to get an overview of Danaher.

In this thread, we’ll deconstruct the playbooks used to build this $200 billion company.

As far as I know, DBS has never been studied like this!

In this thread, we’ll deconstruct the playbooks used to build this $200 billion company.

As far as I know, DBS has never been studied like this!

We will start with an overview of Danaher Business System. Then we’ll explore the 4 types of DBS tools.

We will next focus on the 4 Ps used to implement DBS. Finally, we’ll see how DBS was implemented to create billions of dollars in value. $DHR

Let’s dive in!

We will next focus on the 4 Ps used to implement DBS. Finally, we’ll see how DBS was implemented to create billions of dollars in value. $DHR

Let’s dive in!

So what is Danaher Business System?

“DBS is who we are and how we do what we do.”

Five core values underpin DBS:

1. Best Team Wins

2. Customers Talk, We Listen

3. Kaizen (Continuous Improvement)

4. Innovation Defines Our Future

5. We Compete for Shareholders

“DBS is who we are and how we do what we do.”

Five core values underpin DBS:

1. Best Team Wins

2. Customers Talk, We Listen

3. Kaizen (Continuous Improvement)

4. Innovation Defines Our Future

5. We Compete for Shareholders

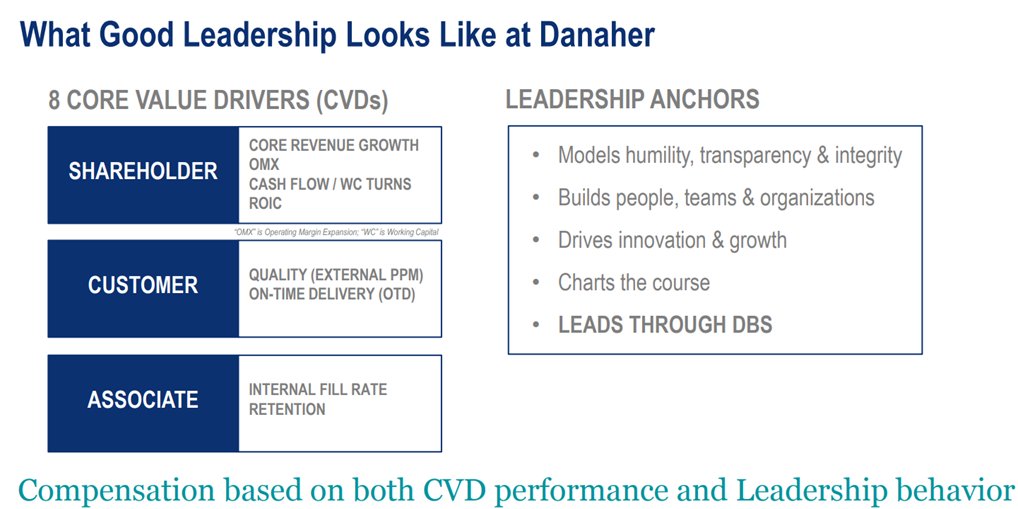

Danaher focuses on 8 Core Value Drivers to measure success across their stakeholders.

DBS drives continued & sustained improvement in:

1. Organic Revenue Growth

2. Operating Margins

3. Cash Flow

4. ROIC

5. Quality

6. On-Time Delivery

7. Internal Fill Rate

8. Employee Retention

DBS drives continued & sustained improvement in:

1. Organic Revenue Growth

2. Operating Margins

3. Cash Flow

4. ROIC

5. Quality

6. On-Time Delivery

7. Internal Fill Rate

8. Employee Retention

DBS has been successful for 2 reasons.

First, the tools are simple + accessible. “Common sense, vigorously applied.”

Second, DBS creates a blameless culture. Problems are framed in terms of process, not people. Everyone collaborates to make things better & faster for customers.

First, the tools are simple + accessible. “Common sense, vigorously applied.”

Second, DBS creates a blameless culture. Problems are framed in terms of process, not people. Everyone collaborates to make things better & faster for customers.

Danaher believes that everything that is important to the customer can be broken down into four main dimensions (in order of importance):

1. Quality

2. Delivery

3. Cost

4. Innovation

They call this the QDCI framework.

1. Quality

2. Delivery

3. Cost

4. Innovation

They call this the QDCI framework.

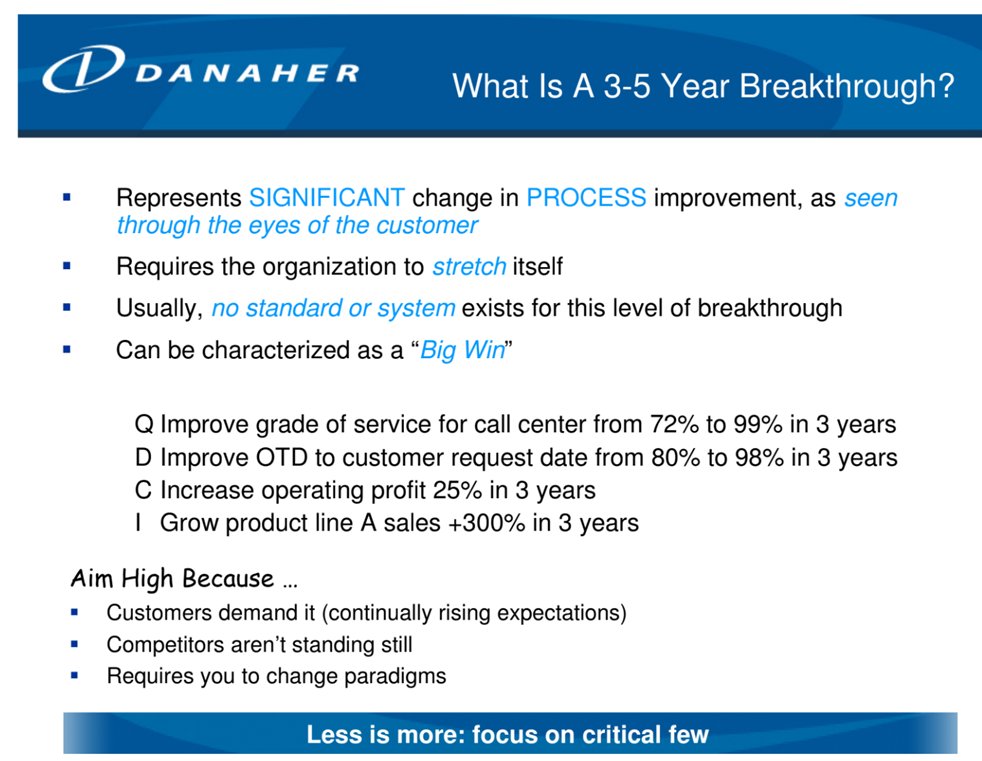

To drive results, Danaher starts with a Strategic Plan which identifies “what game we are playing” & “how we will win”

The 3 - 5 year plan lays out breakthrough goals as:

• Customers demand it

• Competitors don’t stand still

• Drives paradigm shifts when org stretches itself

The 3 - 5 year plan lays out breakthrough goals as:

• Customers demand it

• Competitors don’t stand still

• Drives paradigm shifts when org stretches itself

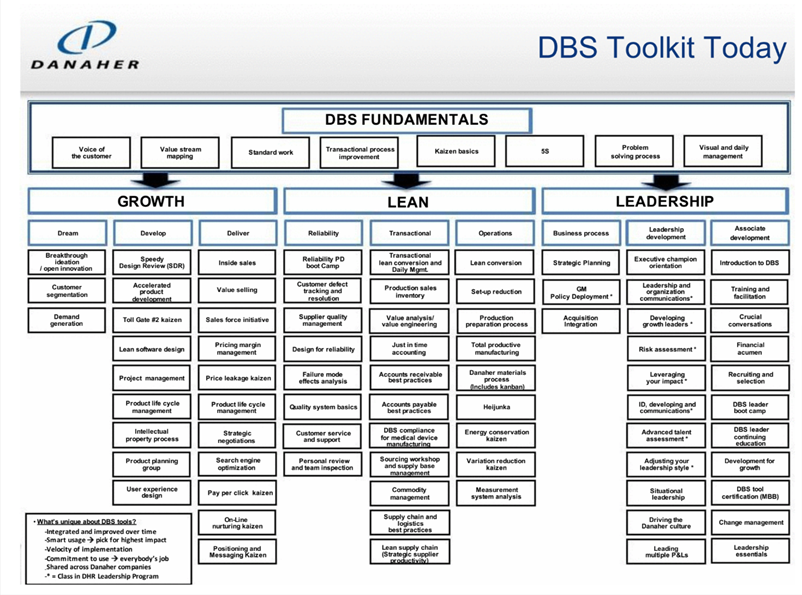

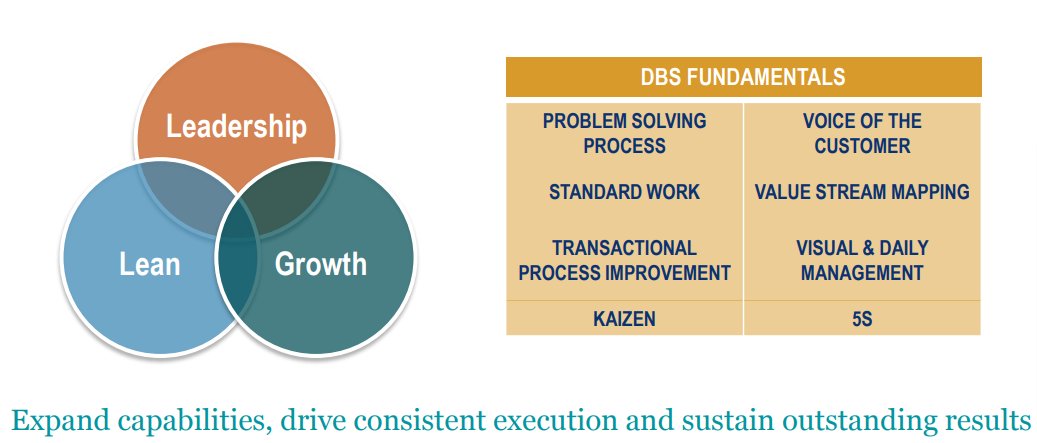

To execute the Plan, Danaher uses DBS which falls into 4 categories (closely aligns with QDCI):

1. Fundamentals: foundational tools

2. Lean: improve quality, delivery, cost

3. Growth: R&D + sales & marketing to drive growth

4. Leadership: develop leaders and associates

1. Fundamentals: foundational tools

2. Lean: improve quality, delivery, cost

3. Growth: R&D + sales & marketing to drive growth

4. Leadership: develop leaders and associates

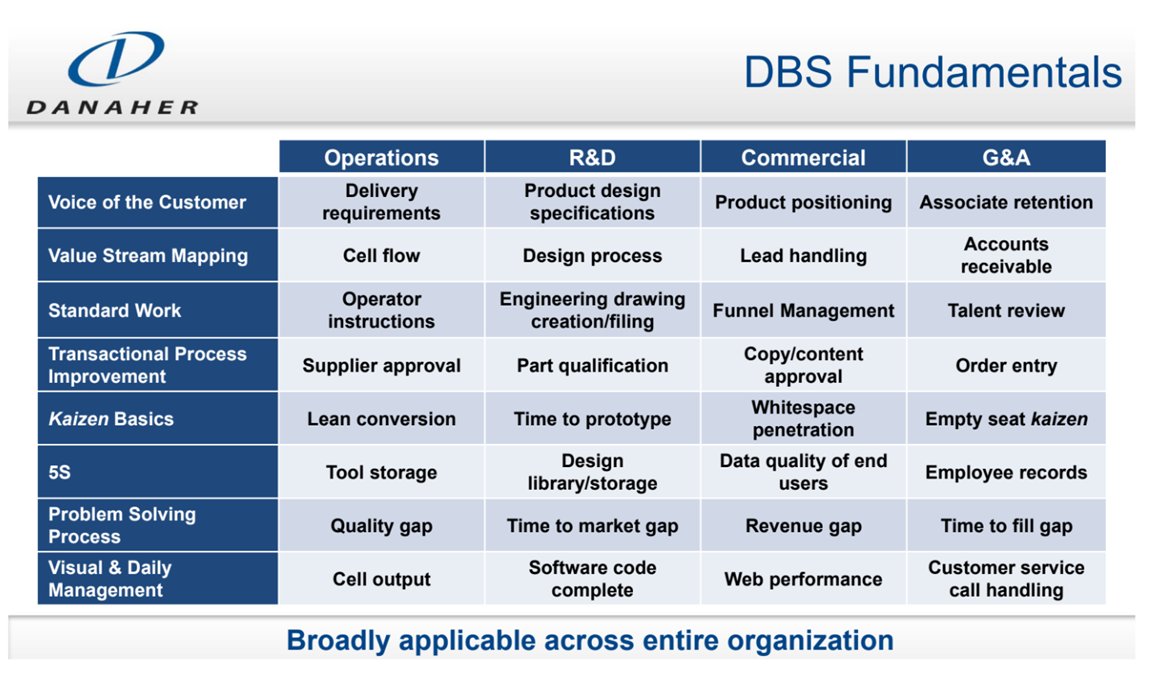

Fundamentals apply to every aspect of the business - operations, R&D, commercial, and G&A.

DBS Fundamentals are learned by everyone:

• Voice of the Customer

• Value Stream Mapping

• Standard Work

• TPI

• Kaizen Basics

• 5S

• Problem Solving Process

• Daily Management

DBS Fundamentals are learned by everyone:

• Voice of the Customer

• Value Stream Mapping

• Standard Work

• TPI

• Kaizen Basics

• 5S

• Problem Solving Process

• Daily Management

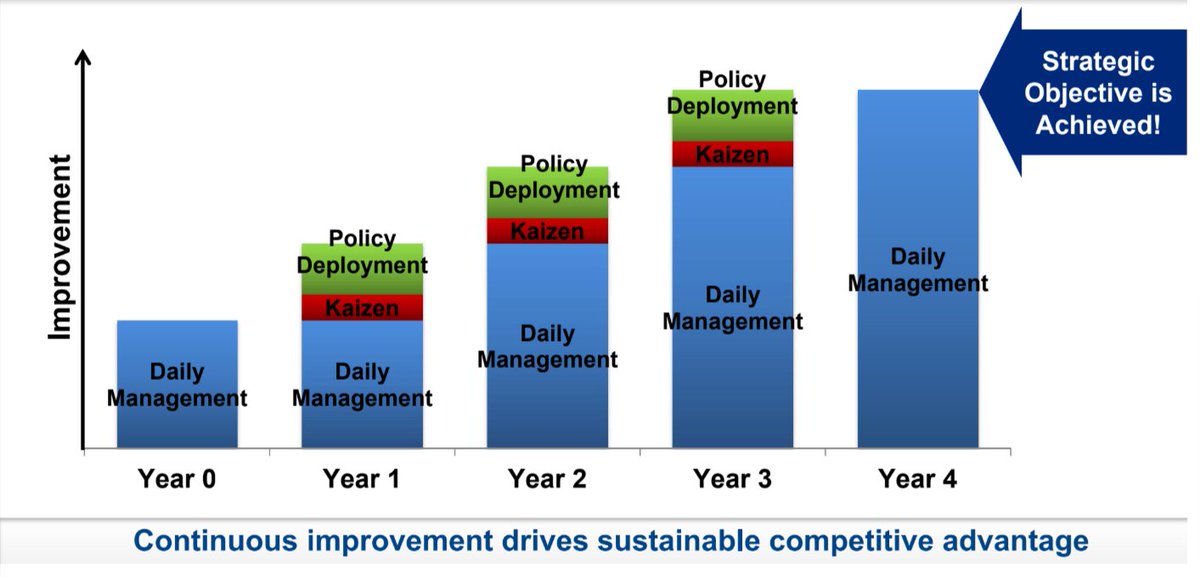

The 3 key Fundamental tools are Policy Deployment (PD) + Daily Management (DM) + Problem Solving Process (PSP). These lay the foundation for all of the other DBS tools.

Danaher uses these three tools together to drive continuous and sustained improvements in the business.

Danaher uses these three tools together to drive continuous and sustained improvements in the business.

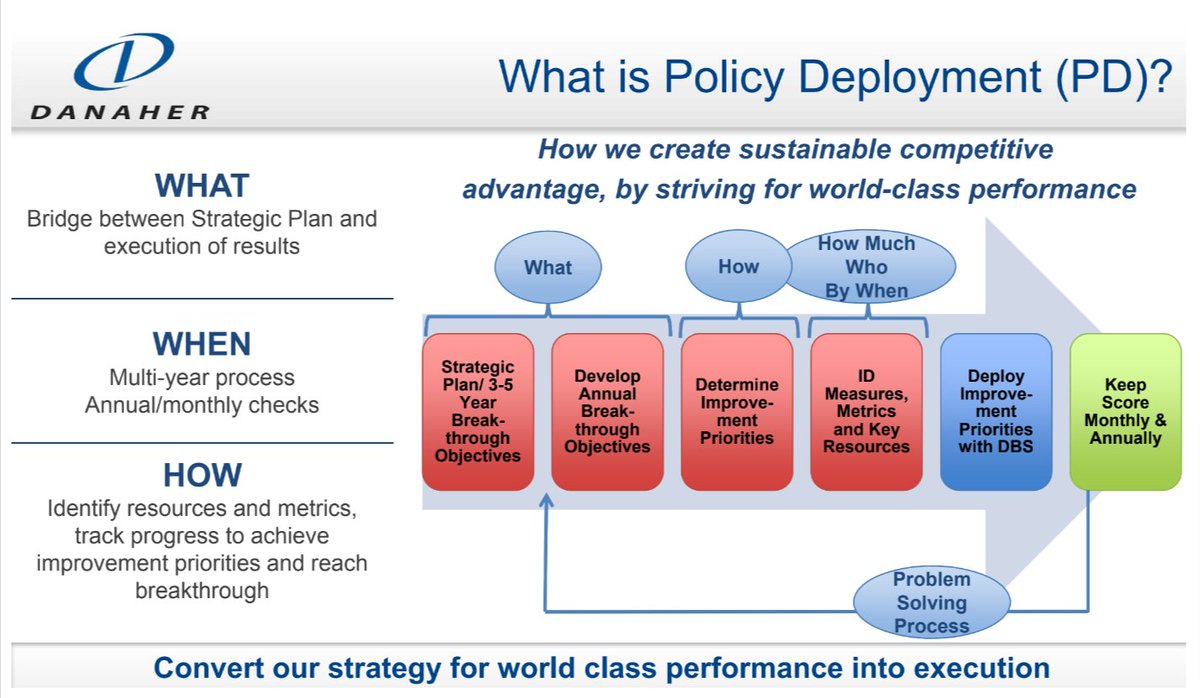

Policy Deployment is the main bridge between the Strategic Plan and execution.

PD breaks down the 3 - 5 Year breakthroughs into more manageable process improvements by year and month.

PD also selects the right DBS tools, aligns resources, and tracks progress to achieve goals.

PD breaks down the 3 - 5 Year breakthroughs into more manageable process improvements by year and month.

PD also selects the right DBS tools, aligns resources, and tracks progress to achieve goals.

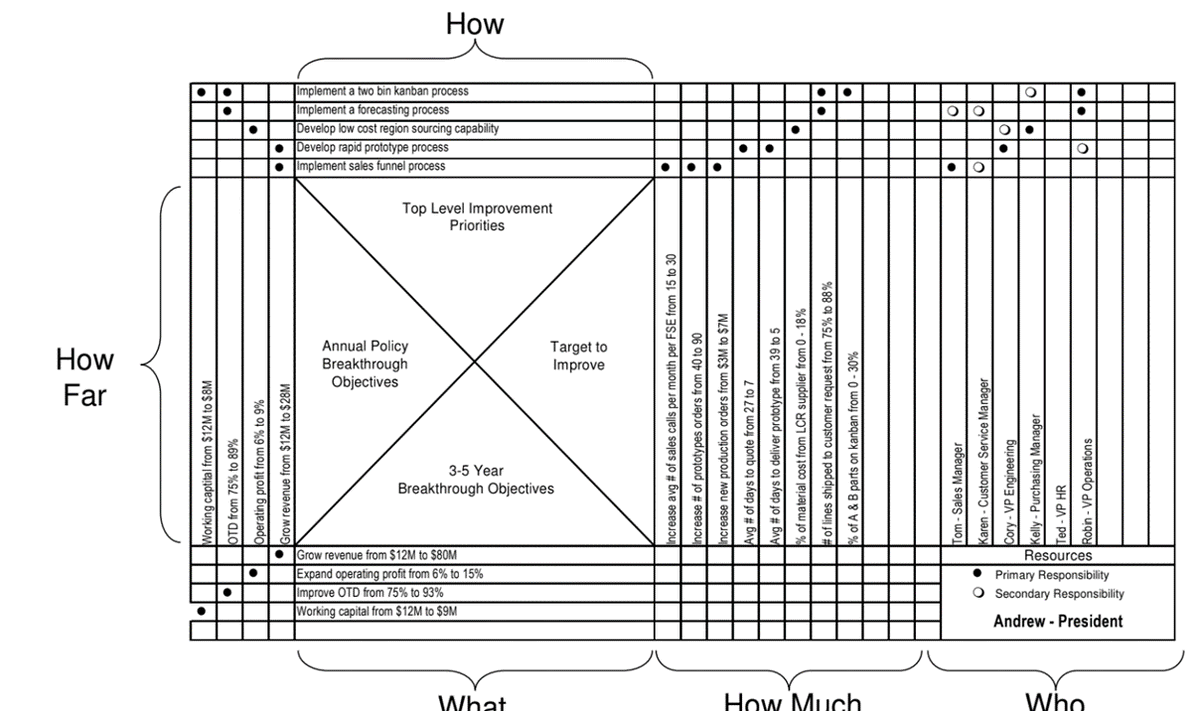

Here is a Policy Deployment Matrix.

Danaher breaks down:

1. What 3 - 5 Year goals are

2. How far to go in year 1

3. How to achieve goals

4. How much to improve

5. Who has responsibility

Danaher’s rule of thumb is 30-50% of 3-5 year goal should be achieved in the first year!

Danaher breaks down:

1. What 3 - 5 Year goals are

2. How far to go in year 1

3. How to achieve goals

4. How much to improve

5. Who has responsibility

Danaher’s rule of thumb is 30-50% of 3-5 year goal should be achieved in the first year!

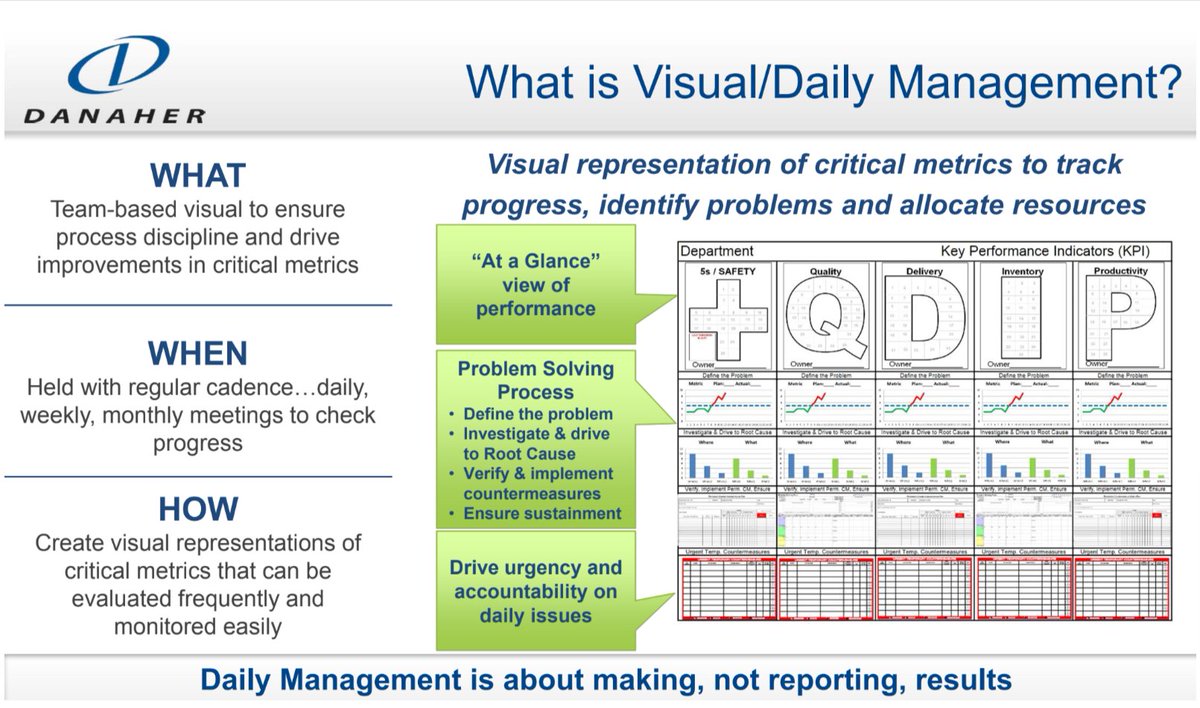

The 2nd key tool is Daily Management (DM).

DM is a visual view of how the team is tracking vs. KPIs. “At a glance view of performance.”

On a daily basis, the team can transparently see if they are tracking to the goals (green) or if they need to course-correct with DBS (red).

DM is a visual view of how the team is tracking vs. KPIs. “At a glance view of performance.”

On a daily basis, the team can transparently see if they are tracking to the goals (green) or if they need to course-correct with DBS (red).

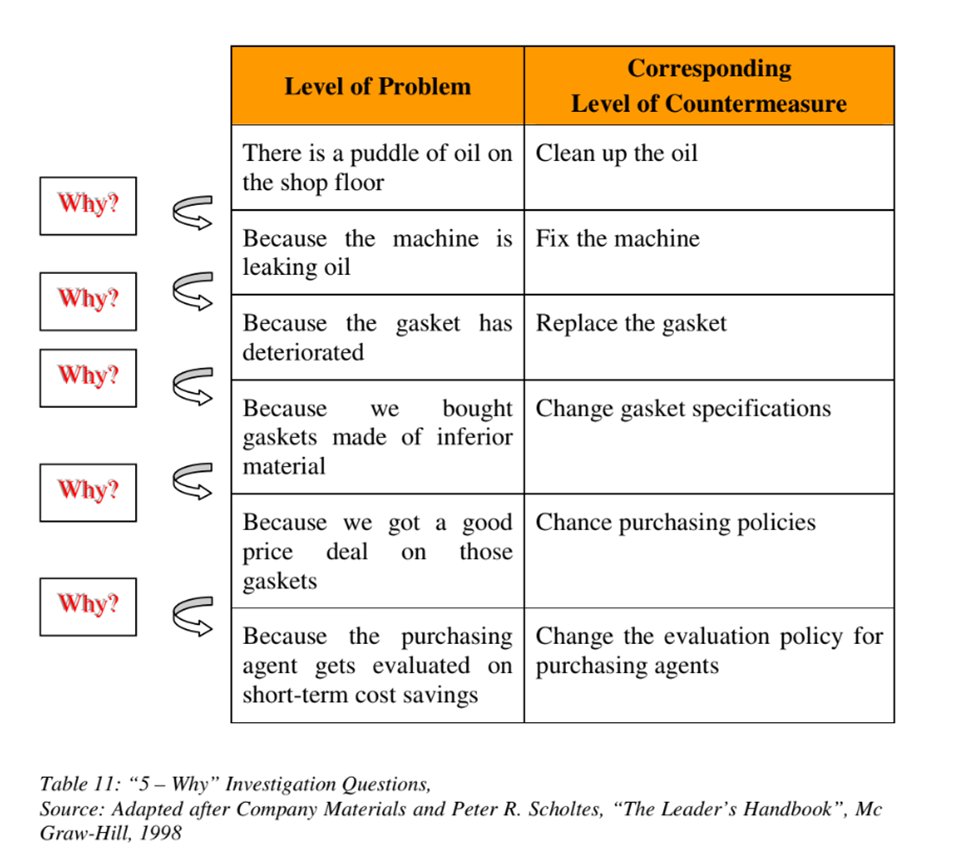

Finally, the Problem Solving Process (PSP) is how Danaher trains all of their employees to:

• Define the problem

• Investigate & drive to the root cause

• Verify & implement countermeasures

• Ensure sustainment

• Define the problem

• Investigate & drive to the root cause

• Verify & implement countermeasures

• Ensure sustainment

Most companies bring in new management & process fads and seemingly drive change, but it never actually sticks. They end up not much better off than where they began.

Danaher aims to sustain their improvements through PD + DM + PSP.

Danaher aims to sustain their improvements through PD + DM + PSP.

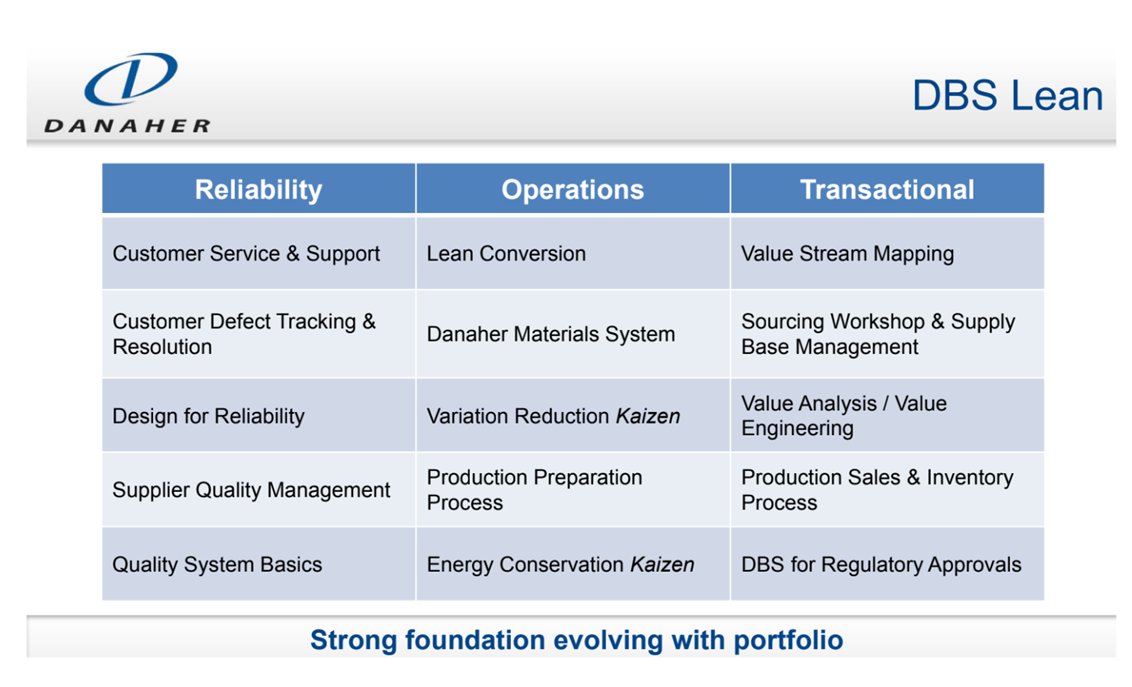

DBS started with just Lean and was modeled after the Toyota Production System. Over the years, Danaher has continually improved DBS.

Lean tools improve Quality, Delivery, and Cost. This is accomplished by focusing on Reliability, Operations, and Transactional processes.

Lean tools improve Quality, Delivery, and Cost. This is accomplished by focusing on Reliability, Operations, and Transactional processes.

One of the key concepts in Lean is that waste should be aggressively and continuously eliminated.

DBS Lean focuses on eliminating 8 forms of waste:

1. Defects

2. Overproduction

3. Waiting

4. Unused talent

5. Transportation

6. Inventory

7. Motion

8. Extra-processing

DBS Lean focuses on eliminating 8 forms of waste:

1. Defects

2. Overproduction

3. Waiting

4. Unused talent

5. Transportation

6. Inventory

7. Motion

8. Extra-processing

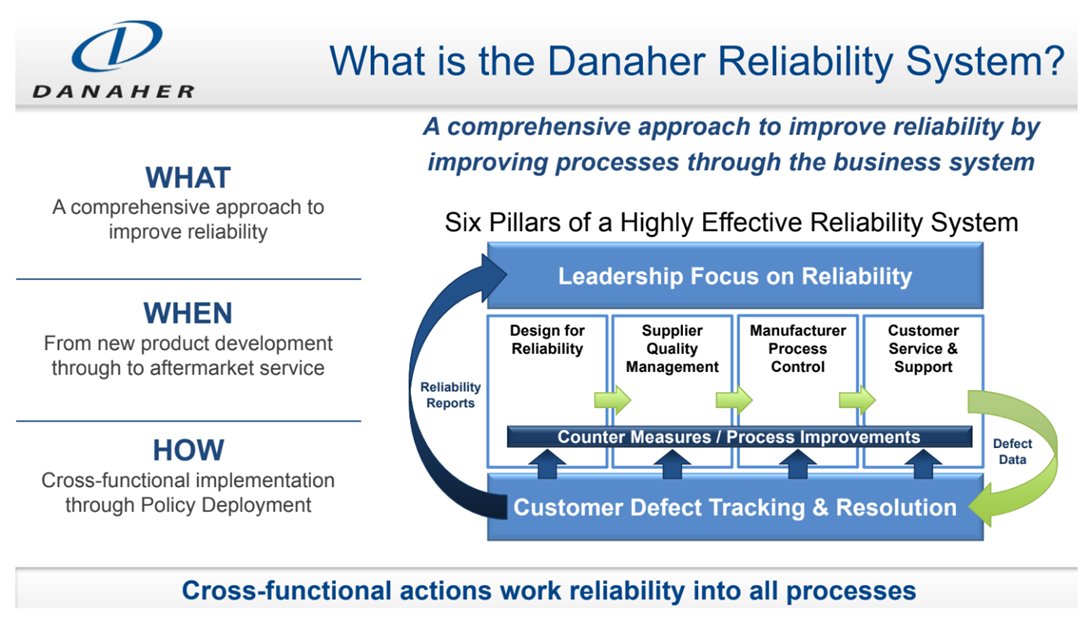

One example of how Danaher accomplishes this is through the Danaher Reliability System.

DRS tracks failures and defects in the field. It then feeds those back in a very logical way into new product development and into manufacturing to make continuous improvements.

DRS tracks failures and defects in the field. It then feeds those back in a very logical way into new product development and into manufacturing to make continuous improvements.

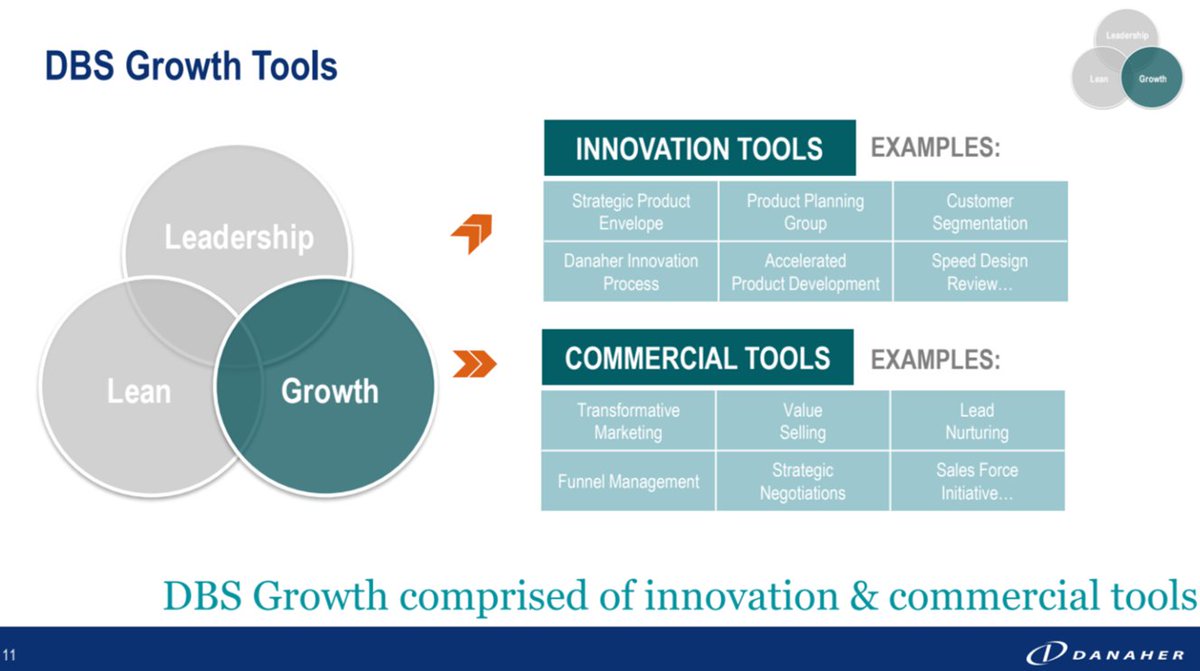

DBS Growth tools focus on driving organic revenue growth.

Growth tools are divided into Innovation (research & development) and Commercial tools (sales & marketing).

Growth tools are divided into Innovation (research & development) and Commercial tools (sales & marketing).

DBS Innovation tools provide a repeatable process for new product development.

Danaher is able to develop market insights and rapidly develop new products to capture market share and drive organic growth.

Danaher is able to develop market insights and rapidly develop new products to capture market share and drive organic growth.

DBS Commercial tools focus on go-to-market strategy. Through integrated sales & marketing, Danaher is able to accelerate organic growth.

Finally, Leadership tools are key to implementing DBS. “Every employee, from the janitor to president, finds ways to improve the way work gets done”

70% of leadership development comes from experience & stretch assignments, 20% from coaching, and 10% from leadership programs.

70% of leadership development comes from experience & stretch assignments, 20% from coaching, and 10% from leadership programs.

Employees tend to stay for the long-term, since there’s a unique opportunity to work in different projects & roles all in one company. 80% of leadership at Danaher is filled internally.

Danaher has also improved its approach to talent identification & development over the years.

Danaher has also improved its approach to talent identification & development over the years.

Danaher has built a unique culture.

"People who think about the whole over themselves do well here—it’s an apolitical environment, no room for ego.

People aren’t afraid of change. But we’re careful it’s not change for its own sake. It’s change for the sake of real improvement"

"People who think about the whole over themselves do well here—it’s an apolitical environment, no room for ego.

People aren’t afraid of change. But we’re careful it’s not change for its own sake. It’s change for the sake of real improvement"

To summarize, Danaher uses the 4P framework to help drive best-in-class results:

1. Great PEOPLE

2. Develop a great strategic PLAN

3. Implement the plan using the DBS PROCESS

4. Great PERFORMANCE retains and attracts great PEOPLE

1. Great PEOPLE

2. Develop a great strategic PLAN

3. Implement the plan using the DBS PROCESS

4. Great PERFORMANCE retains and attracts great PEOPLE

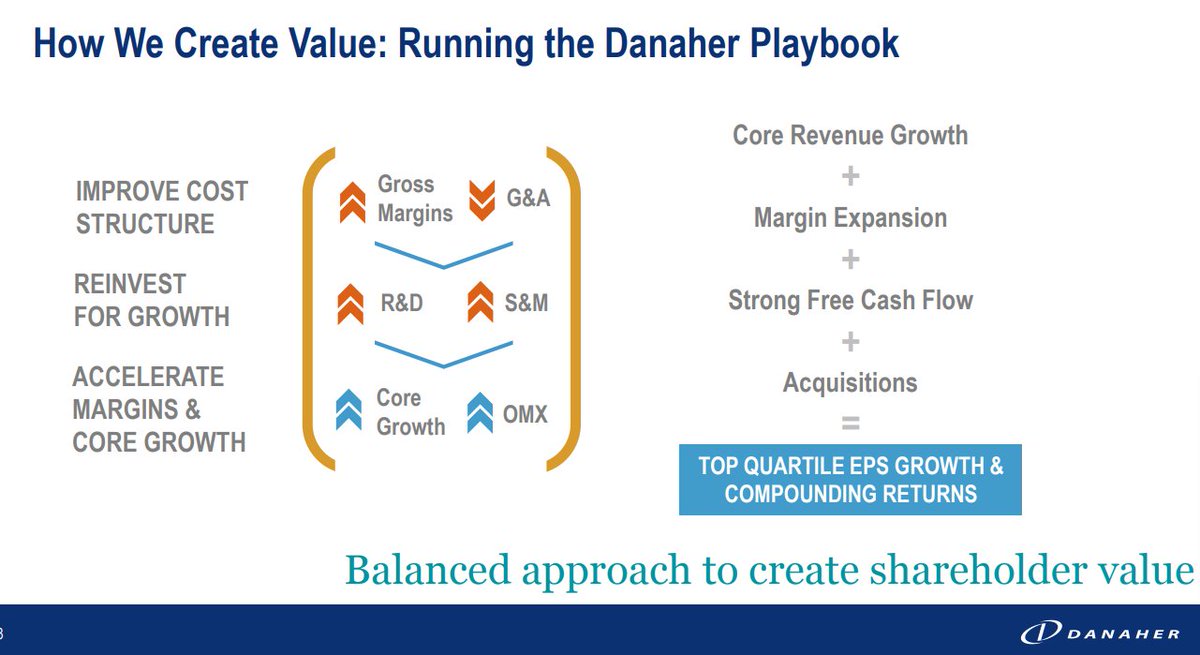

Danaher has built an engine to drive best-in-class results.

Benefits from attractive industry growth. Uses DBS to lower costs and reinvests savings into R&D + S&M to grow.

Cash flow is deployed to acquire undervalued businesses that can be improved with DBS. Rinse & repeat!

Benefits from attractive industry growth. Uses DBS to lower costs and reinvests savings into R&D + S&M to grow.

Cash flow is deployed to acquire undervalued businesses that can be improved with DBS. Rinse & repeat!

That’s all for now. Have questions about Danaher? Feel free to ask in the comments!

I had a lot of fun researching Danaher and spent 100+ hours studying the strategies and tools they used to build this $200 billion company.

I had a lot of fun researching Danaher and spent 100+ hours studying the strategies and tools they used to build this $200 billion company.

So if you found this thread helpful, it would mean a lot if you could like and repost the first post.

I write about investing & entrepreneurship, so follow me for more @skhetpal

I write about investing & entrepreneurship, so follow me for more @skhetpal

• • •

Missing some Tweet in this thread? You can try to

force a refresh