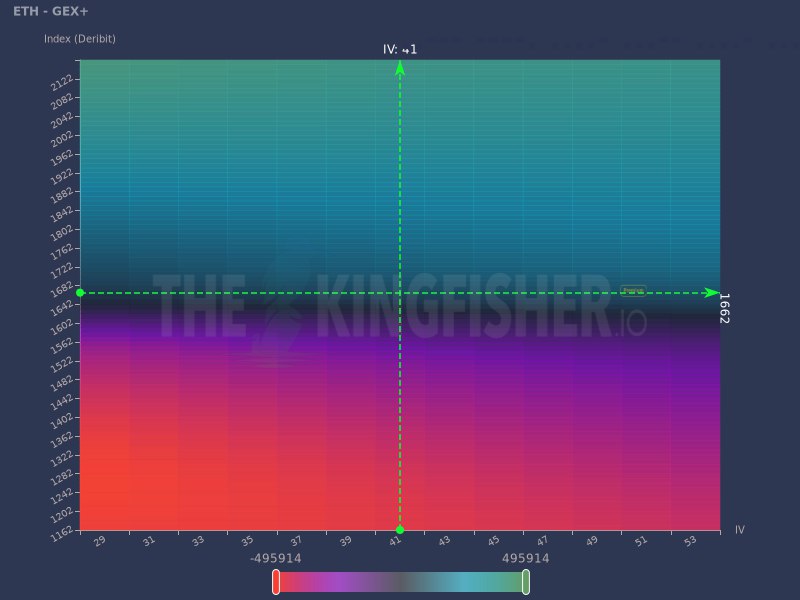

How to read the GEX+ ?

Delta > 0 (blue-green) → dealers tend to trade against price action to stay hedged

Delta < 0 (purple-red) → dealers tend to trade along with price action to stay hedged

Delta = 0 (transparent) → Deltas are hedged, a major shift in price action is coming

Delta > 0 (blue-green) → dealers tend to trade against price action to stay hedged

Delta < 0 (purple-red) → dealers tend to trade along with price action to stay hedged

Delta = 0 (transparent) → Deltas are hedged, a major shift in price action is coming

Also don't forget, 2 days left to enjoy a free #ETH option trade on @Coincall_Global , the latest no-KYC exchange with actually good options and futures liquidity!

https://twitter.com/kingfisher_btc/status/1689294381587529730

$ETH option dealers are currently hedged but some volatility could bring us down pretty quickly

They’ll also be tempering up moves

They’ll also be tempering up moves

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter